The Sandbox Daily (9.7.2022)

U.S. trade deficit, NAAIM Exposure Index, commodities, and Ether

Welcome, Sandbox friends.

Today’s Daily discusses the narrowing U.S. trade deficit, softer market positioning as demonstrated by the NAAIM Exposure Index, commodities at key technical support, and Ether relative outperformance ahead of the Merge.

Let’s dig in.

EQUITIES: Russell 2000 +2.21% | Nasdaq 100 +2.07% | S&P 500 +1.83% | Dow +1.40%

FIXED INCOME: Barclays Agg Bond +0.72% | High Yield +1.44% | 2yr UST 3.439% | 10yr UST 3.271%

COMMODITIES: Brent Crude -4.76% to $88.32/barrel. Gold +0.94% to $1,711.9/oz.

BITCOIN: +2.74% to $19,257

US DOLLAR INDEX: -0.41% to 109.807

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: -8.44% to 24.64

U.S. trade deficit narrows

The trade deficit narrowed by $10.2 billion in July to $70.6 billion, its fourth consecutive monthly decline and the smallest gap in nine months, although slightly above the consensus of $70.1 billion. Since its record level in March, the monthly deficit has shrunk 33.9%, the biggest four-month decline since May 2009.

Exports grew +0.2% in July from the prior month, helped largely by higher shipments of capital goods like computers and industrial machinery. Spending by foreign visitors, which is counted as a services export, also picked up as Covid travel restrictions eased and more vacationers came to the U.S. Meanwhile, Imports fell -2.9% in July, reflecting declines in American purchases of consumer goods and industrial supplies and perhaps a softening in broader consumer demand.

On a 12-month total basis, the trade deficit still widened slightly to a record $981.6 billion. Nevertheless, the improvement on a monthly basis puts net exports on track for a positive contribution to Q3 real gross domestic product growth from an accounting perspective, as trade deficits subtract from GDP. Following today’s report, the GDPNow Model expects net exports to contribute 1.1% to real GDP growth this quarter, which itself is tracking at a 1.4% annual rate.

Source: Ned Davis Research, Wall Street Journal

NAAIM Exposure Index shows weaker positioning post summer rally

The National Association of Active Investment Managers (NAAIM) Exposure Index moved lower for the 3rd consecutive week to 32.36 from 54.86 in the prior week. The NAAIM report shows the collective professional money manager’s weekly average exposure to equities (scaled from -200% which is leveraged short to +200% which is fully levered long). The index has meaningfully rolled over since mid-August, indicating active investment fund managers are shedding risk and/or adding downside protection. This latest reading is approaching an attractive level where fund managers generally feel more comfortable putting risk back on.

Source: Canaccord Genuity

Commodities under pressure

The Invesco DB Commodity Index Tracking Fund (DBC) closed below its 200-day moving average for the first time since October 2020 and its lowest level in nearly 6 months. This commodity exchange-traded fund tracks 14 of the most heavily traded and important physical commodities around the world – including WTI Crude, Heating Oil, Gasoline, Brent Crude, Gold, Silver, Copper, Wheat, Corn, Soybeans, and more. Commodities have been one of the few asset classes to show absolute and relative strength in a difficult year for markets. The commodities basket is still up 18% year-to-date, but it’s down almost 20% from the June highs, while the uptrend is clearly in jeopardy.

Source: Beat the Bench

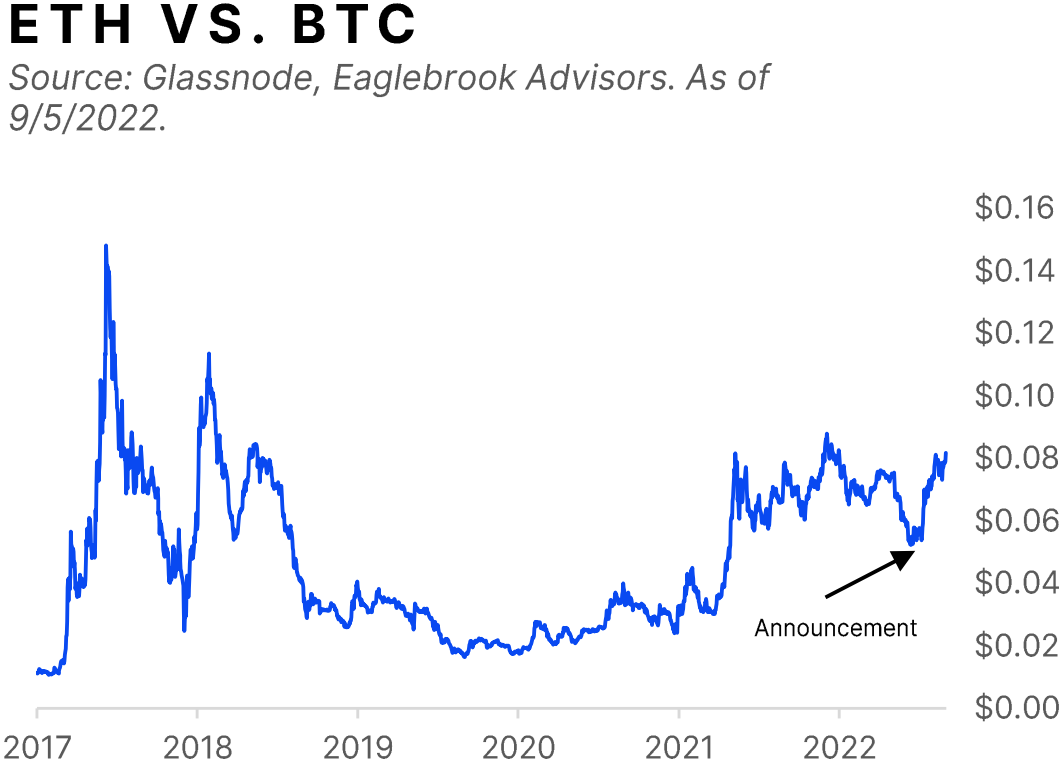

Ether relative outperformance ahead of the Merge

Ether has outperformed bitcoin since early July’s announcement of the September 15th Merge date, with the asset’s relative price (as illustrated by the ETH/BTC “pair”) reaching year-to-date highs of 0.082.

From the digital asset low on June 18th through September 5th, ether has rallied +77.0% while bitcoin has rallied just +12.8%. This decoupling illustrates growing investor interest in “crypto narratives” and use cases for the Ethereum network – this time being Ethereum’s milestone shift from proof-of-work (which relies on crypto miners using tons of computing energy to validate transactions) to proof-of-stake (which uses an algorithmic lottery system to determine validators from a pool of “stakers” who lock up funds to secure the network). Benefits include the 99% reduction in energy use, a ~90% reduction in new issuance, and cash flows in the form of staking rewards. The Merge also brings Ethereum one step closer to greater scalability.

Source: Eaglebrook Advisors, TechCrunch

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.