The Sandbox Daily (9.8.2022)

European Central Bank, earnings season, mortgage rates, Goldman Sachs' interest rate forecast update, and Queen Elizabeth II

Welcome, Sandbox friends.

Today’s Daily discusses the European Central Bank’s historic rate hike today, two takeaways from 2nd quarter earnings season, soaring mortgage rates, Goldman Sachs ups their interest rate hiking forecasts, and remembering Queen Elizabeth II (1926-2022).

Let’s dig in.

EQUITIES: Russell 2000 +0.81% | S&P 500 +0.66% | Dow +0.61% | Nasdaq 100 +0.50%

FIXED INCOME: Barclays Agg Bond -0.32% | High Yield +0.44% | 2yr UST 3.512% | 10yr UST 3.325%

COMMODITIES: Brent Crude +0.33% to $88.61/barrel. Gold +0.44% to $1,719.4/oz.

BITCOIN: +0.91% to $19,369

US DOLLAR INDEX: -0.15% to 109.674

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: -4.18% to 23.61

European Central Bank hikes their deposit rate by 75 bps

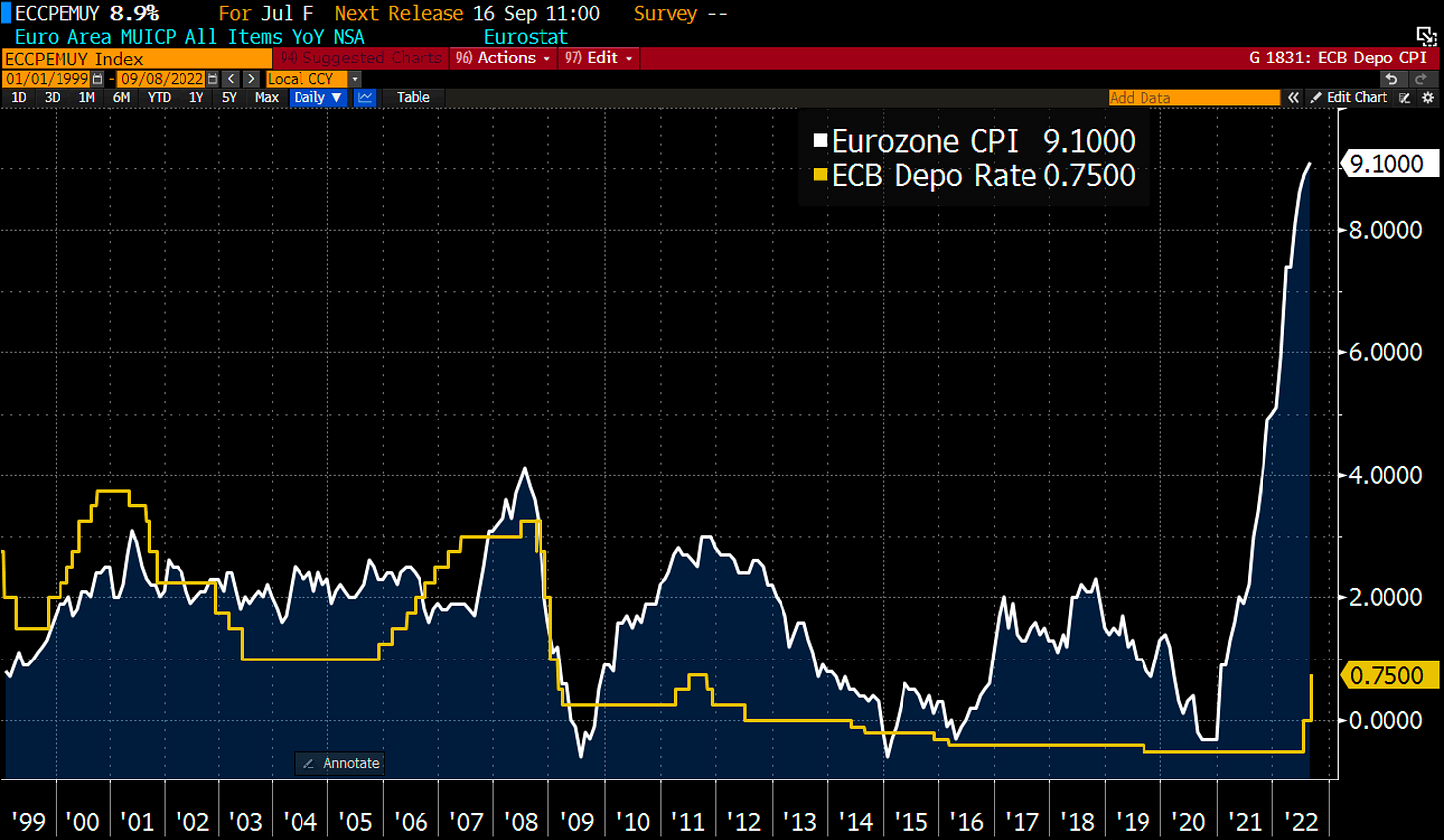

The European Central Bank (ECB) hiked its target deposit rate by the largest amount in its history, a jumbo-sized 75 basis points, and ECB President Christine Lagarde hinted it could do the same again as part of several future moves to escalate the central bank’s attack against rampant inflation. Even with a far weaker growth outlook and price increases primarily driven by supply-side factors, policy makers remained steadfast by bringing their target deposit rate up to 0.75% from 0.0% – following a 0.50% rise in July.

The decision comes as Euro-zone borrowing costs rapidly exit sub-zero policy conditions in efforts to combat the overshoot in inflationary pressures, most recently measured at 9.1% in August.

The ECB raised its outlook for consumer prices this year and the following two, while slashing its forecast for economic expansion in 2023. Rising borrowing costs will likely increase the risk of a slide into recession for Europe’s currency union, which is wrestling with surging energy costs and sagging confidence among households and businesses, driven by the war in neighboring Ukraine.

Higher rates may offer some support to the euro, whose slide below parity with the dollar has made imports, particularly of commodities, more expensive and aggravating inflation. The euro to US dollar exchange rate is currently 0.989, down 12.7% in 2022 alone and well below it’s 20 year average of 1.201.

It’s difficult to overstate how momentous this shift in Euro-zone policy is after years of experimental negative interest rates that led to more than $17.7 trillion of bonds globally yielding less than 0%. Today, the tally is a mere $2.1 trillion.

Source: Bloomberg, Sandbox Financial Partners

Two takeaways from Q2 earnings season

With 96% of the S&P 500 companies having reported its 2nd quarter earnings, two trends emerge that have real implications for the future of equity markets – the risk to operating earnings’ estimates is to the downside and corporate operating margins will remain under great pressure.

Despite 78.4% of companies beating estimates this recent quarter, consensus earnings estimates for calendar year 2022 have been dropping. Since the start of Q2 earnings season, Q3 consensus estimates have fallen by $3.41, or -5.8%, and Q4 consensus has been cut by $2.62, or -3.4%. While a good start to see negative earnings revisions more closely reflect reality, the economic backdrop has not improved materially in the past few months – namely higher interest rates, supply chain bottlenecks, worker shortages, and rising input and labor costs – leading one to question if enough downside in Q3 and Q4 estimates has been baked into market expectations.

Another key takeaway from earnings season is that corporate operating margins will remain under pressure. During high inflationary periods, margin pressures (bottom-line measure) tend to be a bigger issue than sales growth (top-line). Wages are the largest input cost for most companies. For much of the pandemic, inflation has been rising faster than wages, meaning that in aggregate companies have been able to pass higher costs along to their customers. A counterintuitive consequence of the potential decline in inflation in the coming months is that the inflation rate could fall below wage growth, putting downward pressure on profit margins in 2H22 and beyond.

Source: Ned Davis Research

Mortgage rates are soaring

Mortgage rates in the United States climbed for the 3rd week in a row, reaching the highest level since 2008 and squeezing affordability as the housing market continues to slowdown. The average for a 30-year fixed-rate loan increased to 5.89%, up from 5.66% last week, nearly double the rate it was at the beginning of 2022, Freddie Mac said in its weekly statement. “Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy to combat elevated inflation. Not only are mortgage rates rising but the dispersion of rates has increased, suggesting that borrowers can meaningfully benefit from shopping around for a better rate,” stated Sam Khater, Freddie Mac’s chief economist.

Source: Freddie Mac

Goldman Sachs raises its Fed forecast to include 150 bps more in rate increases

Goldman Sachs is raising their Federal Reserve interest rate forecast to include a 75bps rate hike in September (vs. 50bps previously) and a 50bps hike in November (vs. 25bps previously), while maintaining the 25bps hike in December. All told, this would take the Fed Funds Rate to 3.75-4.00% by the end of 2022. The Fed Funds Rate was 0.00% on the lower bound of the target range to begin 2022.

At the July Federal Open Markets Committee (FOMC) meeting, Chairman Jerome Powell laid out a case for slowing the pace of tightening. Since then, the data has on net come in roughly as expected or even a bit more supportive than expected of the case for slowing down. But Fed officials have sounded resoundingly hawkish of late and have seemed to imply that progress toward taming inflation has not been as uniform or as rapid as they would like – see the table below with key recent quotes from various regional Federal Reserve Presidents. And today, the Wall Street Journal reported that the FOMC “appears to be on a path to raise interest rates by another 0.75% this month,” a likely hint from the Fed leadership that a 75bps hike is coming at the September meeting. Accordingly, Goldman Sachs now thinks the FOMC will delay its plan to slow down.

Source: Jan Hatzius, Goldman Sachs

Queen Elizabeth II (1926-2022)

Queen Elizabeth II, who passed today at the age of 96 after the longest reign in British history, will be mourned around the globe as one of the last monarchs born to a classic age of European royalty, when kings and queens wielded genuine political power.

Elizabeth's death comes seven months after she marked the 70th anniversary of her accession to the throne, yet another milestone achievement in the remarkable life of a queen who, though reluctantly thrust into the spotlight at the tender age of 25, won almost universal praise for her steadfast dedication to duty.

Rest in peace.

Source: CNN

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.