The Sandbox Daily (9.9.2022)

Bond bear market, investor sentiment, Queen Elizabeth II, air travel, Elvis Presley, and a weekly market recap

Welcome, Sandbox friends.

Today’s Daily discusses the bear market in global bonds, investor sentiment plunging after the summer rally fades, celebrating the life of Queen Elizabeth II by numbers, Labor Day weekend air travel surpasses 2019 levels, this day in history (Elvis Presley), and a brief recap to snapshot the week in markets.

Let’s dig in.

EQUITIES: Nasdaq 100 +2.17% | Russell 2000 +1.95% | S&P 500 +1.53% | Dow +1.19%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield +0.40% | 2yr UST 3.563% | 10yr UST 3.315%

COMMODITIES: Brent Crude +3.56% to $92.32/barrel. Gold +0.48% to $1,727.6/oz.

BITCOIN: +9.69% to $21,210

US DOLLAR INDEX: -0.67% to 108.973

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: -3.47% to 22.79

Bloomberg Global Aggregate Bond Index enters a bear market

It’s not just stocks. A key index tracking global bonds has also reached bear market territory.

The Bloomberg Global Aggregate Bond Index (formerly co-run by Barclays) measures the performance of global investment grade fixed income securities. This index is a widely quoted metric and used by many market participants as a benchmark for global bond performance. The global bond index is now down -20.90% since the beginning of 2021 – truly historic in nature.

Market behavior this year has thrown a wrench in the traditional 60-40 portfolio strategy, with both sides of the portfolio suffering corrections simultaneously. With the Federal Reserve, European Central Bank, Bank of England, and countless other central banks committed to hiking rates in efforts to bring down inflation, it’s likely bonds will continue to weather a difficult storm in the coming months.

Source: Sandbox Financial Partners

Investor sentiment plunges after weakness following the summer rally

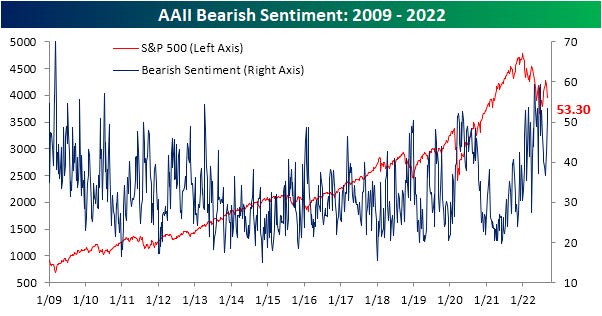

Despite the current 3-day bound in the S&P 500 index, the equity weakness following the summer rally that topped out in mid-August has mean further deterioration in investor sentiment. In the latest update, only 18.1% of responses to the weekly American Association of Individual Investors (AAII) sentiment survey reported as bullish. That marked the third consecutive decline in bulls resulting in the weakest reading since the end of April.

Bearish sentiment in turn has rocketed higher, climbing back above 50% last week and rising further to 53.3% this week. That is the highest level of bearish sentiment since the week of June 23rd and ranks in the top 2.5% of all weeks on record.

Source: Bespoke Investment Group

Operation London Bridge

The death of Queen Elizabeth II marks the beginning of a new era for the United Kingdom in which the Royal monarch passes to King Charles III, and during the 10 days of national mourning, the world lays witness to many well-orchestrated Royal traditions and processions. For now, let’s run through the astonishing numbers behind Queen Elizabeth II.

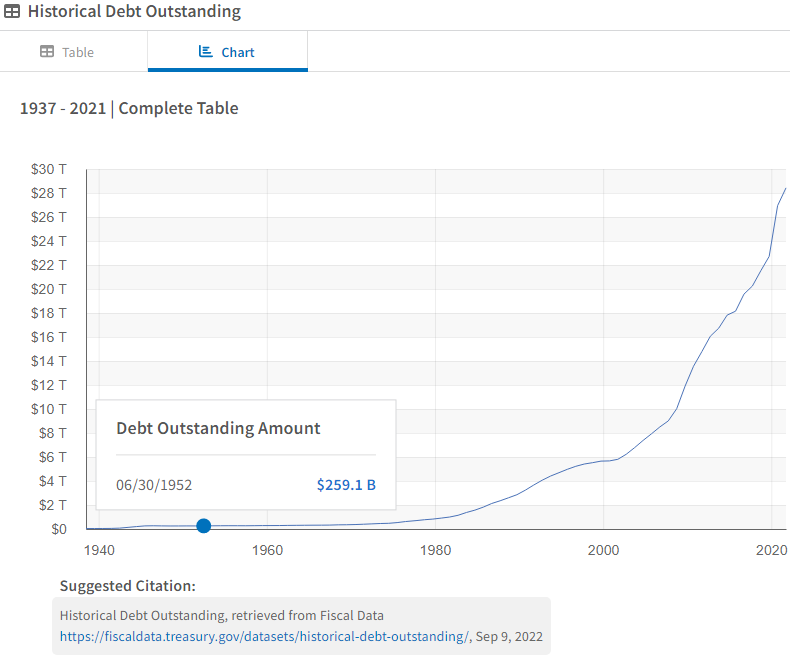

When a 25-year-old Elizabeth first donned the crown in February 1952, Harry Truman was president, Winston Churchill was Prime Minister, Ernest Hemingway released The Old Man and the Sea, Dr. Jonas Salk developed a vaccination against polio, and the United States national debt was $259 billion (today it’s $30.57 trillion).

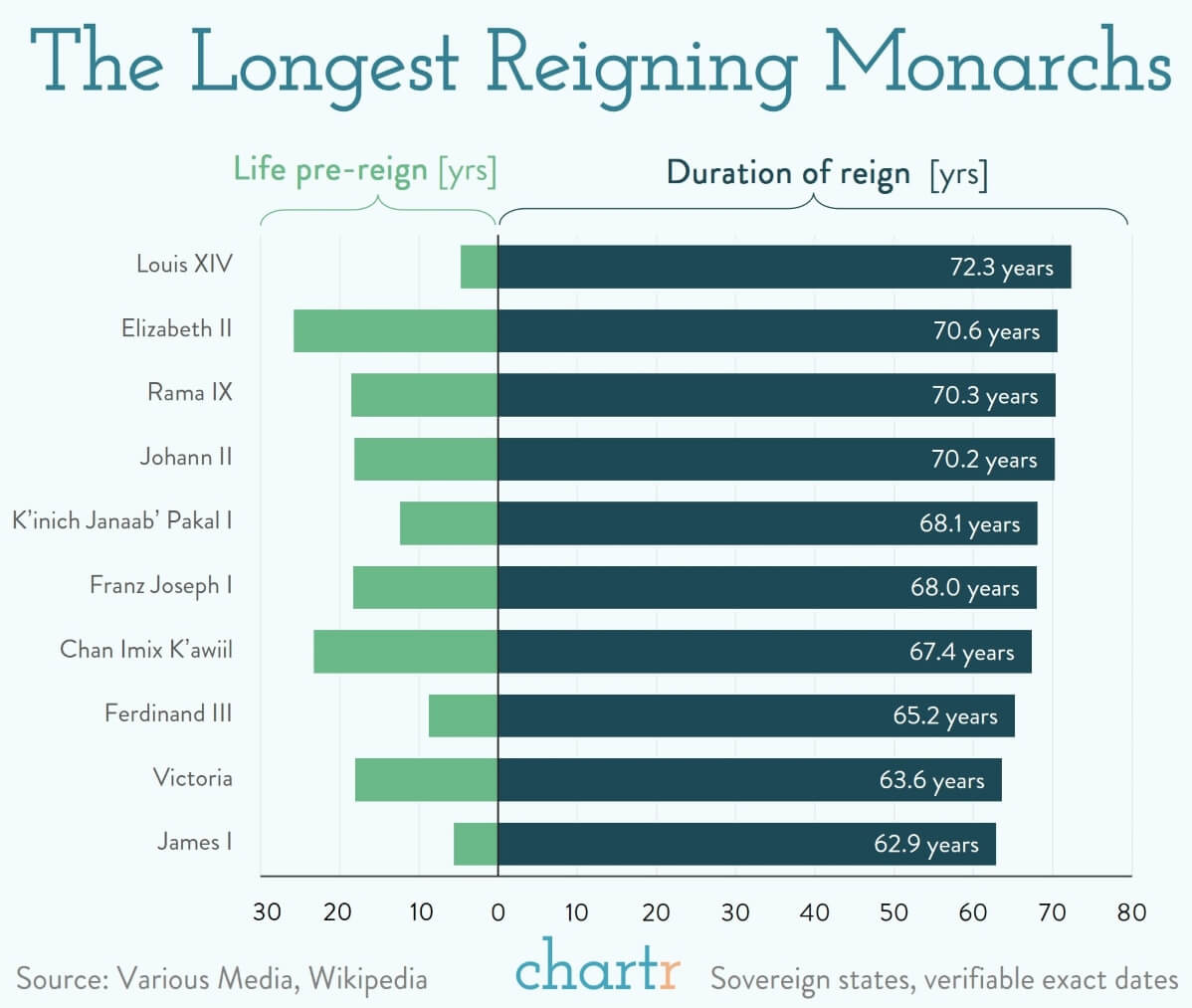

The Queen's passing comes just 7 months after she celebrated her Platinum Jubilee, marking 70 years on the throne, and just 2 days after appointing the new Prime Minister, Liz Truss. During her 25,782 days as monarch, The Queen ruled during the span of 15 U.K. Prime Ministers, 14 U.S. presidents, and nearly 30% of American history, providing a stabilizing force during geopolitical upheaval and scandals in the royal family. ~80% of all people currently living in the U.K. were born after Elizabeth became queen. Her 70-year reign was the 2nd longest of any monarch in history, only behind that of Louis XIV of France who was just 4 years old when he ascended to the throne.

Source: Chartr, Treasury.gov

Labor Day weekend air travel surpasses 2019 levels

Air travel is back. The U.S. Transportation Security Administration (TSA) screened more passengers over Labor Day weekend in 2022 than the same weekend in 2019, suggesting travel demand is finally getting back on track – and reaching a pre-pandemic cruising altitude.

The Labor Day statistics from the TSA come as the industry experienced a relatively calm holiday weekend. Unlike previous long weekends like Memorial Day and the Fourth of July, which saw thousands of flight disruptions, Labor Day only had 642 cancellations to, within, or out of the US, per FlightAware data.

Source: U.S. Transportation Security Administration

This day in history

On September 9, 1956, The King of Rock and Roll appeared on “The Ed Sullivan Show.” With 60 million viewers – or 82.6% of TV viewers at the time – tuning into the live performance, the appearance garnered the show’s best ratings in two years and became the most-watched TV broadcast of the 1950s. At the time of taping, his first album, Elvis Presley had already debuted and Heartbreak Hotel was a hit single, but he wasn’t quite yet “The King.” Presley, then 21, performed Don’t Be Cruel, Little Richard’s Ready Teddy, Hound Dog, and Love Me Tender – and viewers got a full head-to-toe look at the singer despite production fears of “vulgar” hip-shaking gyrations.

Source: HISTORY

The week in review

Stocks: Markets finished higher, reversing three weeks of declines for the major market indexes. Oversold conditions can be seen as the major reason for this week’s bounce as bulls in the September 7th American Association of Individual Investors (AAII) survey fell to just over 18% from 21.9%. This marks the 25th lowest reading in the survey’s history. Inflation is on the forefront of investors’ minds as next Tuesday’s CPI report will provide market participants an indication on how much the Federal Reserve (Fed) could hike rates at this month’s FOMC meeting.

Bonds: The Bloomberg Aggregate Bond Index finished the week lower as inflation and the Fed’s hawkish stance remains the major themes in the bond markets this year. High-yield corporate bonds, as tracked by the Bloomberg High Yield index, performed well mirroring their equity counterparts. Despite the hawkish rhetoric by global central bankers, credit market spreads were generally lower (prices higher). At 470 basis points (4.7%) over Treasuries, high yield credit spreads are currently in the 57th percentile since 2001 (the higher the percent ranking, the more attractive the valuation). Given the higher yields broadly in the Treasury market, the high yield index (Bloomberg Corporate High Yield) is currently yielding 8.4%, which ranks in the 86th percentile relative to history (2001).

Commodities: Amid continued energy supply concerns in Europe from the Eastern European conflict, natural gas finished breakeven for the week. West Texas Intermediate crude oil plunged to a seven-month low this week as U.S. gasoline prices declined approximately 25% from their June peak. The metals mostly had a positive week as global demand concerns remain. Copper, which has declined 20% this year on fears of a recession, could be showing improved prospects as Bloomberg reports that Chinese copper imports are higher.

Source: LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.