The stock market is complicated, plus record U.S. household net worth, value investing dead?, and major book announcements

The Sandbox Daily (6.11.2024)

Welcome, Sandbox friends.

Big day for book announcements: 1) Josh Brown, CEO of Ritholtz Wealth Management and CNBC contributor, is releasing You Weren’t Supposed to See That on September 3, while 2) Anthony Pompliano, blogger and bitcoin maximalist, is releasing How to Live an Extraordinary Life on September 24. Both have been pre-ordered to Annapolis, MD!!

Looking ahead to tomorrow, we get May inflation data at 8:30am, and then a Fed policy announcement and updated Dot Plot at 2pm. The impact could be huge – stay tuned!

Today’s Daily discusses:

the stock market is complicated

consumers love the stock market, home prices, and 5% on their deposits

what to make of value investing

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.71% | S&P 500 +0.27% | Dow -0.31% | Russell 2000 -0.36%

FIXED INCOME: Barclays Agg Bond +0.34% | High Yield +0.13% | 2yr UST 4.832% | 10yr UST 4.402%

COMMODITIES: Brent Crude +0.18% to $81.78/barrel. Gold +0.27% to $2,333.3/oz.

BITCOIN: -3.37% to $67,246

US DOLLAR INDEX: +0.12% to 105.273

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +0.86% to 12.85

Quote of the day

“We can have faith in the future only if we have faith in ourselves.”

- John F. Kennedy

Yes, it’s complicated

The stock market is complicated, complex, difficult to predict, and full of diverging information and opinions.

For example, you might find a straightforward data set – like the one below – that shows roughly 2/3rds of stocks remain in long-term uptrends. The current reading of 64.1% is historically high and bullish.

As you can see in the bottom cutout table, the S&P 500 averages an ~11.50% gain on a 12-month forward basis when the majority of stocks – in this case, Ned Davis Research defines that as more than 61.0% of index constituents trading above their 200-DMA – find themselves in uptrends. Pretty straightforward, right? Most stocks going up is a healthy breadth gauge and its more likely than not the index follows suit.

Contrast that data to the following tweet below from Liz Ann Sonders, using data from Bespoke Investment Group.

When dividing the S&P 500 index into deciles by market cap, we find the only decile that’s positive in Q2 is the one containing the 50 largest stocks. Keep in mind the S&P 500 is higher by more than 2% this quarter.

This means all other nine deciles containing the 450 smallest stocks are down on average this quarter. So much for a healthy market.

The uncomfortable truth is the market is full of these divergences. In fact, there’s thousands and thousands of these conflicting data points that sit at odds with one another. Sometimes it’s dizzying to try to make sense of it all.

This is why using a weight-of-the-evidence approach, which is more art than science, is often most suitable for investors.

Source: Ned Davis Research, Liz Ann Sonders

Consumers love the stock market, home prices, and 5% on their deposits

U.S. household wealth reached a fresh record to kick off 2024, powered by another jump in the value of Americans’ stock holdings and buoyed by strong home prices.

Last week’s report from the Federal Reserve showed household net worth climbed higher by $5.1 trillion, or 3.3%, in the first quarter to $160.8 trillion.

The value of equity holdings increased by ~$3.8 trillion, while real estate rose by ~$900 billion to a record high.

As a percent of GDP, net worth increased in Q1, but remains below the peak in 2021.

Net worth includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) net of liabilities (mortgages, credit, etc.).

Source: Federal Reserve, Barron’s, Calculated Risk, Josh Brown

What to make of value investing

In recent years, there’s been a growing chorus of investors that Value investing is either broken or dead. While there has been a lot of ink spilled on this topic, and how the rise of passive investing and changing market structure has ruined this popular investment strategy, a recent Piper Sandler white paper points to a different conclusion.

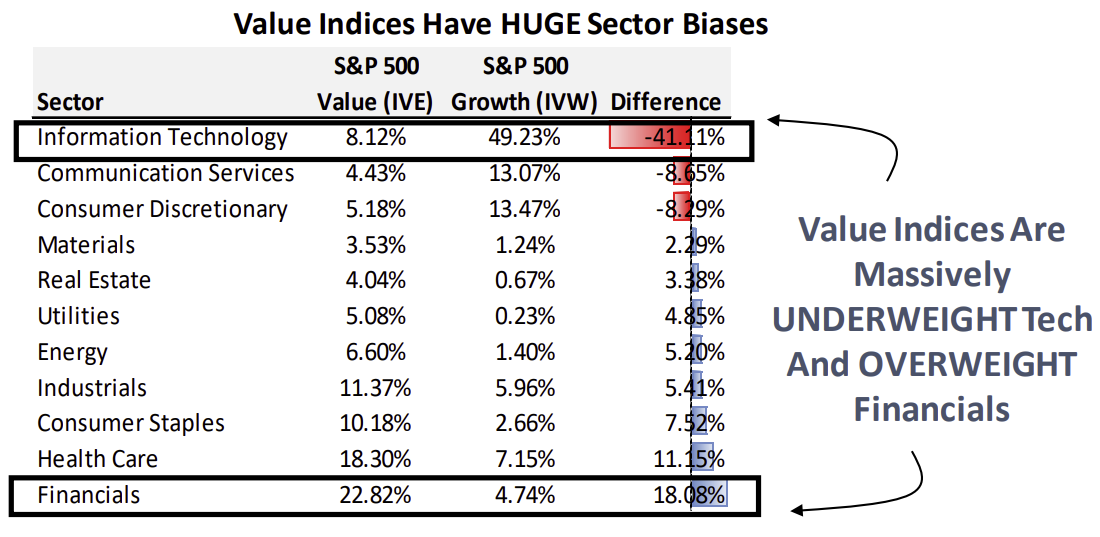

Value indices have been underperforming Growth indices consistently for nearly two decades now. Much of this underperformance can be explained by the huge sector biases in the Value indices.

In particular, the Value index is massively underexposed to Tech and overexposed to Financials.

In fact, a chart showing the relative performance of Value to Growth looks JUST like the relative performance of Financials to Tech.

We also know the cheaper sectors tend to be less profitable and more cyclically sensitive.

Cheaper sectors tend to be consistently cheaper over time with lower growth rates.

While sector biases have been the primary detriment to Value indices in recent decades, the Value factors emphasized in the indices are a secondary issue.

The S&P Value index uses EPS Yield, Book Yield and Sales Yield for its Value Ranking system. Book Yield and Sales Yield are two of the lowest quality, riskiest(and worst performing) value factors.

Source: Piper Sandler, MarketWatch, Business Insider, Institutional Investor

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.