The unscientific anecdata supporting the American consumer, plus Brain Rot and the Overton Window

The Sandbox Daily (12.3.2024)

Welcome, Sandbox friends.

We begin today’s newsletter by sharpening our language skills in preparation for your next sitting of the SAT Test.

‘Brain Rot’ is the 2024 Oxford Word of the Year, a modern condition familiar to most of us.

Following a public vote including more than 37,000 people, the slang phrase is defined as the “supposed deterioration of a person’s mental or intellectual state” from consuming excessive amounts of low-quality and low-value digital content. The phrase speaks to the perceived dangers of our virtual lives and how we spend our free time. Spot on, Oxford!

On a related topic, I recently heard someone use the term “Overton Window” on a podcast (can’t remember whom, sorry!), which is defined as the range of ideas/discourse that the public is willing to consider and accept at any given time. Finger snaps to the person who dropped this mid-sentence without the slightest hesitation.

Today’s Daily discusses:

the American consumer is alive and well

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.31% | S&P 500 +0.05% | Dow -0.17% | Russell 2000 -0.73%

FIXED INCOME: Barclays Agg Bond -0.19% | High Yield +0.01% | 2yr UST 4.184% | 10yr UST 4.228%

COMMODITIES: Brent Crude +2.48% to $76.31/barrel. Gold +0.27% to $2,665.6/oz.

BITCOIN: +0.43% to $96,163

US DOLLAR INDEX: -0.12% to 106.319

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: -0.30% to 13.30

Quote of the day

“Great things are done by a series of small things brought together.”

- Vincent Van Gogh

The American consumer is alive and well

From personal conversations to the news reporting cycle and all the numbers in-between, it sure looks like the American consumer is alive and well.

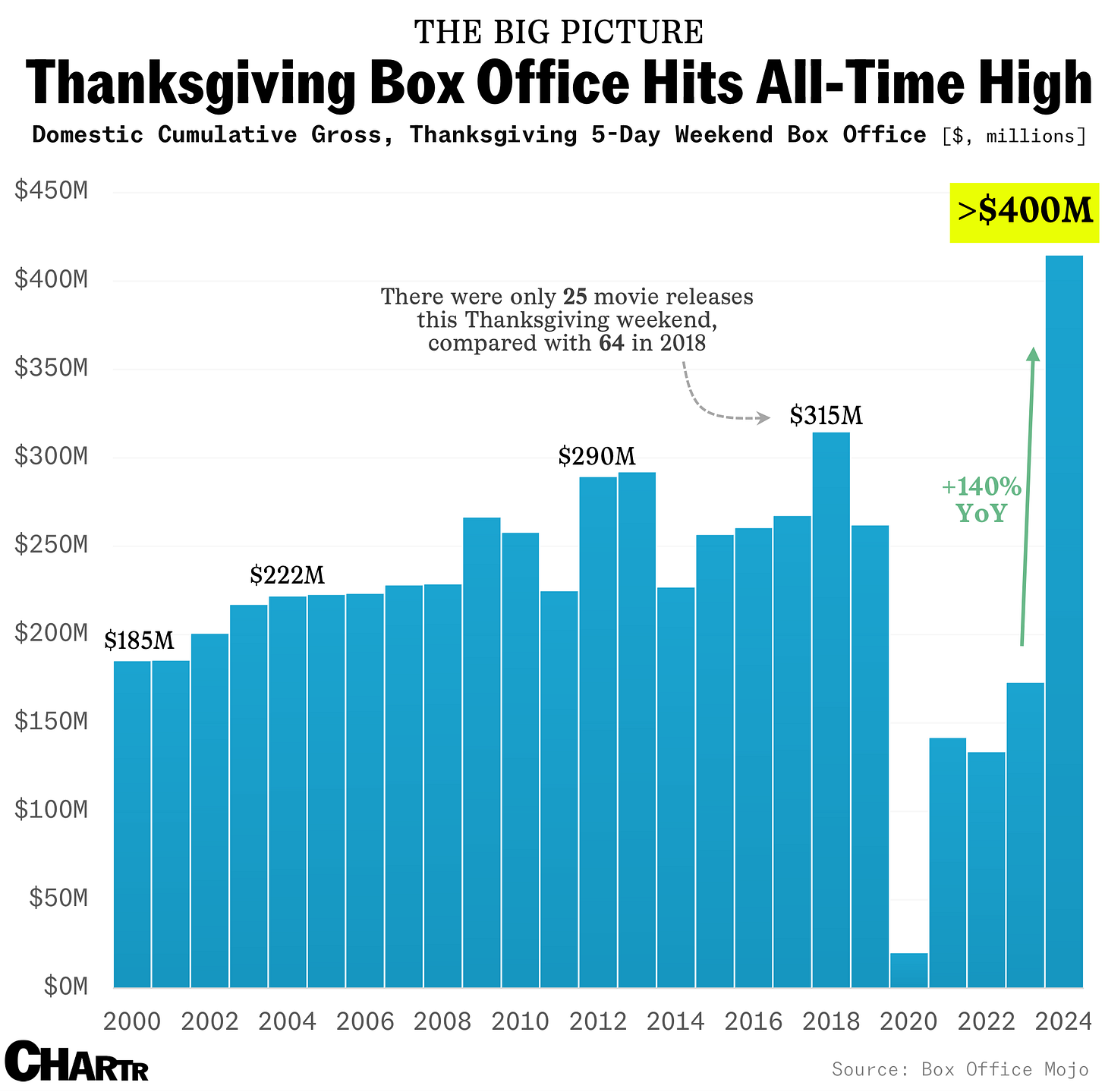

Take last weekend’s box office as exhibit one. Deadline is reporting that the domestic box office grossed roughly $420 million over the Wednesday-to-Sunday Thanksgiving stretch, its highest grossing Turkey day trot in history.

Sure, these numbers were in part due to the success of the Moana 2, Wicked, and Gladiator II trifecta of newly-released motion pictures – but wow these numbers sure buck the trend of the whole movie-theater-is-dead narrative.

For exhibit two, let’s review planes, trains, and automobiles (no, not the movie).

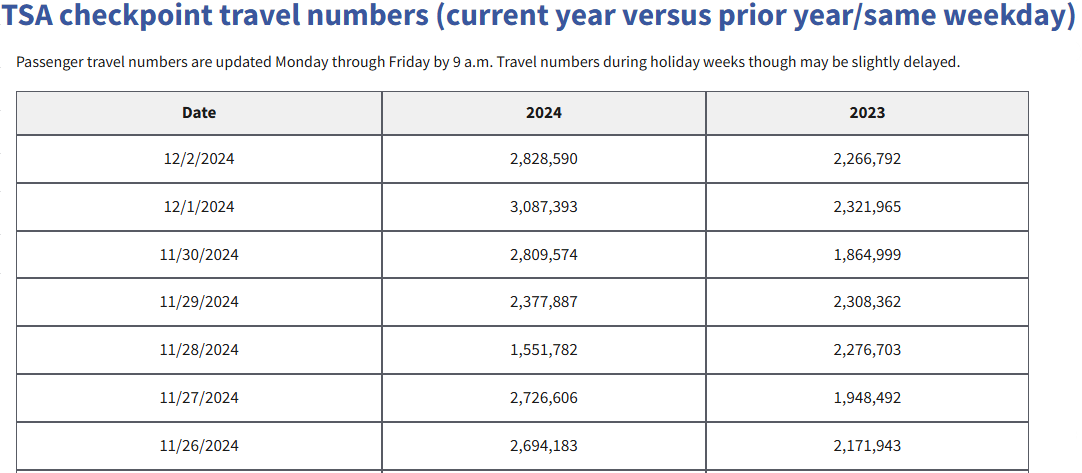

The Transportation Security Administration (TSA) processed 3,087,393 individuals at airports nationwide on Sunday, December 1 – a new all-time record for volume.

The Tuesday 11/26 through Monday 12/2 period also produced a record surge for travel numbers: 18,076,015 in 2024 vs. 15,159,256 in 2023, an astonishing 19% increase.

Here’s TSA Administrator David Pekoske commenting on the trend, saying: “The 10 busiest travel days in TSA’s history have all occurred in 2024, and we anticipate that trend to continue.”

Wow.

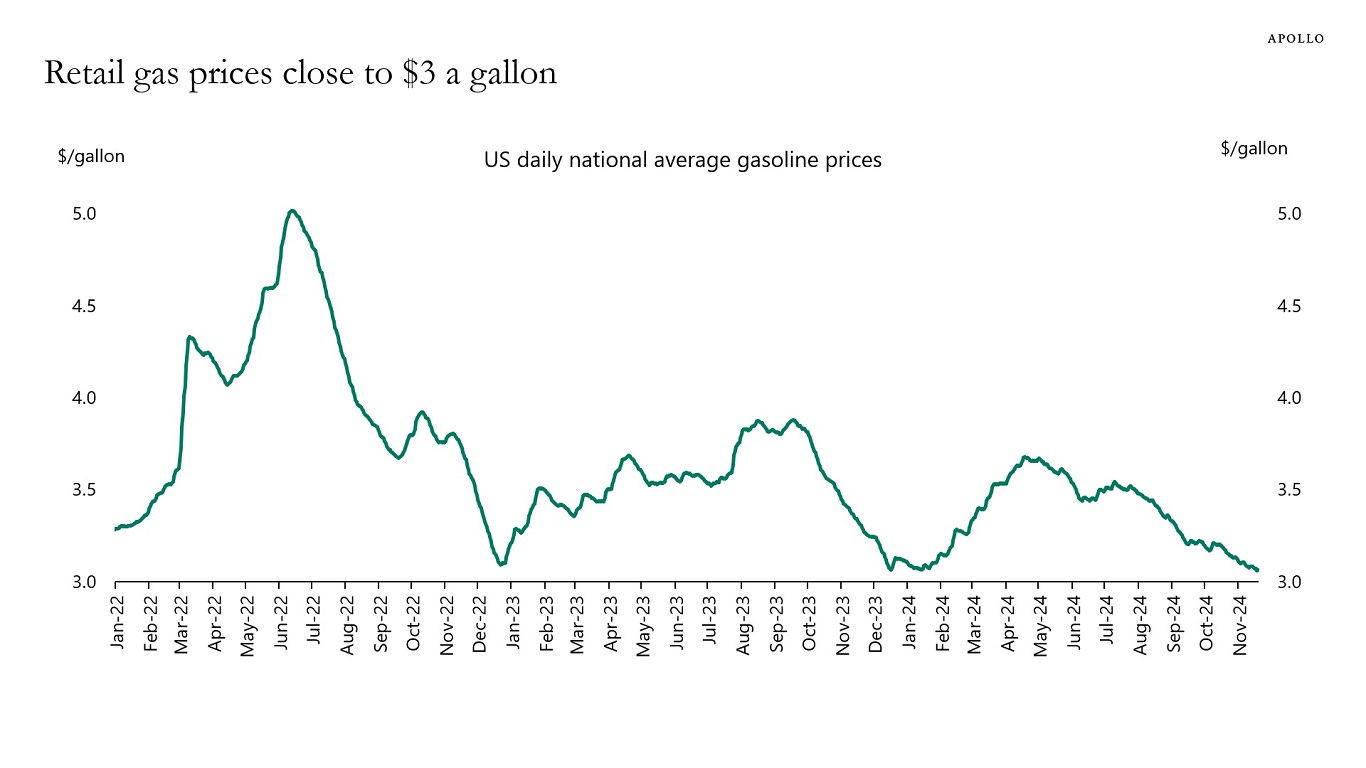

It sure helps the consumer when we’re at a three-year low in gasoline prices.

What about retail spending patterns, which we’ll view for exhibit three. After all, Thanksgiving weekend and the Black Friday/Cyber Monday/Giving Tuesday gauntlet are the lifeblood for many consumer-facing businesses that rely so heavily on the holiday stretch to save their year.

While physical shopping experiences continue to dwindle and concede market share amid the shift to online and delivery options, there was no denying the consumer from swiping their card this year.

Per Mastercard, spending on Black Friday was stronger than expected, further underscoring consumer strength.

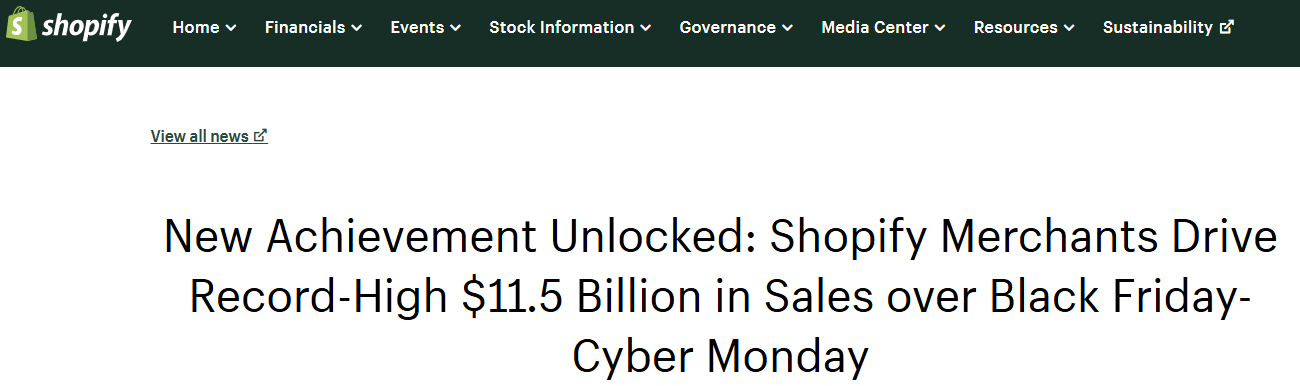

Shopify reported similar strength for its merchants, citing a record $11.5 billion in sales during the Black Friday-through-Cyber Monday weekend, marking a 24% increase from last year.

We know several cyclical tailwinds have been drivers of this economy:

lower interest-rate sensitivity from homeowners and businesses not as sensitive to interest rate hikes from termed out debt at very low levels

strong demand drivers coming from fiscal policy (CHIPS Act, Inflation Reduction Act, Infrastructure Act), excess savings, immigration, and easing financial conditions

robust AI spending from corporate America

But, U.S. households are also a key part underpinning the economic strength that continues to confound many economists and investors alike. The anecdata above shows this. Then, when we consider several years of household wealth gains, higher money market rates, low unemployment, and modest defaults, well…

It continues to paint a portrait that the largest and most important economy to the global setting remains at above-trend growth, showing that not all is lost here in 2024.

Source: Chartr, Deadline, Wall Street Journal, AP News, Torsten Slok, Mastercard, Investopedia

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: