The worst month for stocks is here

The Sandbox Daily (9.4.2025)

Welcome, Sandbox friends.

Quick publisher’s note before we begin today.

I’m heading west next week to Huntington Beach, CA for my 4th Future Proof Festival. This conference brings together the brightest minds across wealth management to tackle the most important themes and ideas shaping our industry. I’m thrilled to be speaking on a panel alongside Ben Carlson, Douglas Boneparth, and Callie Cox. Come say hi if you are attending! As an administrative aside, The Sandbox Daily will be off the majority of next week due to time constraints.

Today’s Daily discusses:

the worst month for stocks is here

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.26% | Nasdaq 100 +0.93% | S&P 500 +0.83% | Dow +0.77%

FIXED INCOME: Barclays Agg Bond +0.40% | High Yield +0.27% | 2yr UST 3.592% | 10yr UST 4.168%

COMMODITIES: Brent Crude -1.17% to $66.81/barrel. Gold -0.84% to $3,605.1/oz.

BITCOIN: -1.71% to $110,232

US DOLLAR INDEX: +0.15% to 98.294

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: -6.42% to 15.30

Quote of the day

“After you have practiced for a while, you will realize that it is not possible to make rapid, extraordinary progress. Even though you try very hard, the progress you make is always little by little. Just to be sincere and make our full effort in each moment is enough.”

- Shunryu Suzuki

Historically challenging seasonality for stocks

September is a lot of things. It’s the time of year associated with back-to-school events, the Harvest Moon and start of fall with the autumn equinox, and of course football.

For markets?

The worst month historically for stocks. Ouch.

When looking across the last century, September is recognized as the worst month of the year for stocks. Not my opinion, facts.

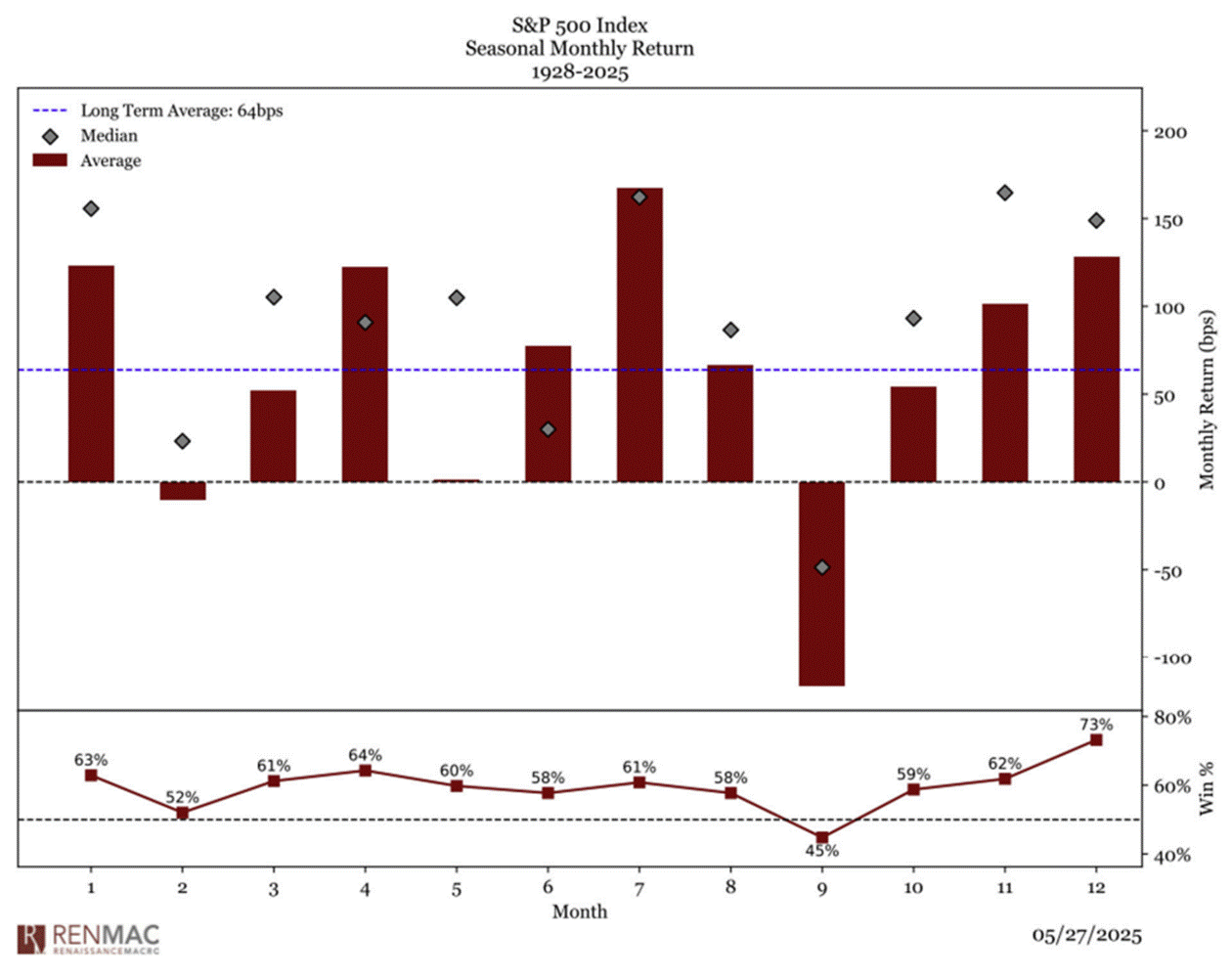

Looking at the chart below, the big red bar going south of the x-axis is your average monthly return for September.

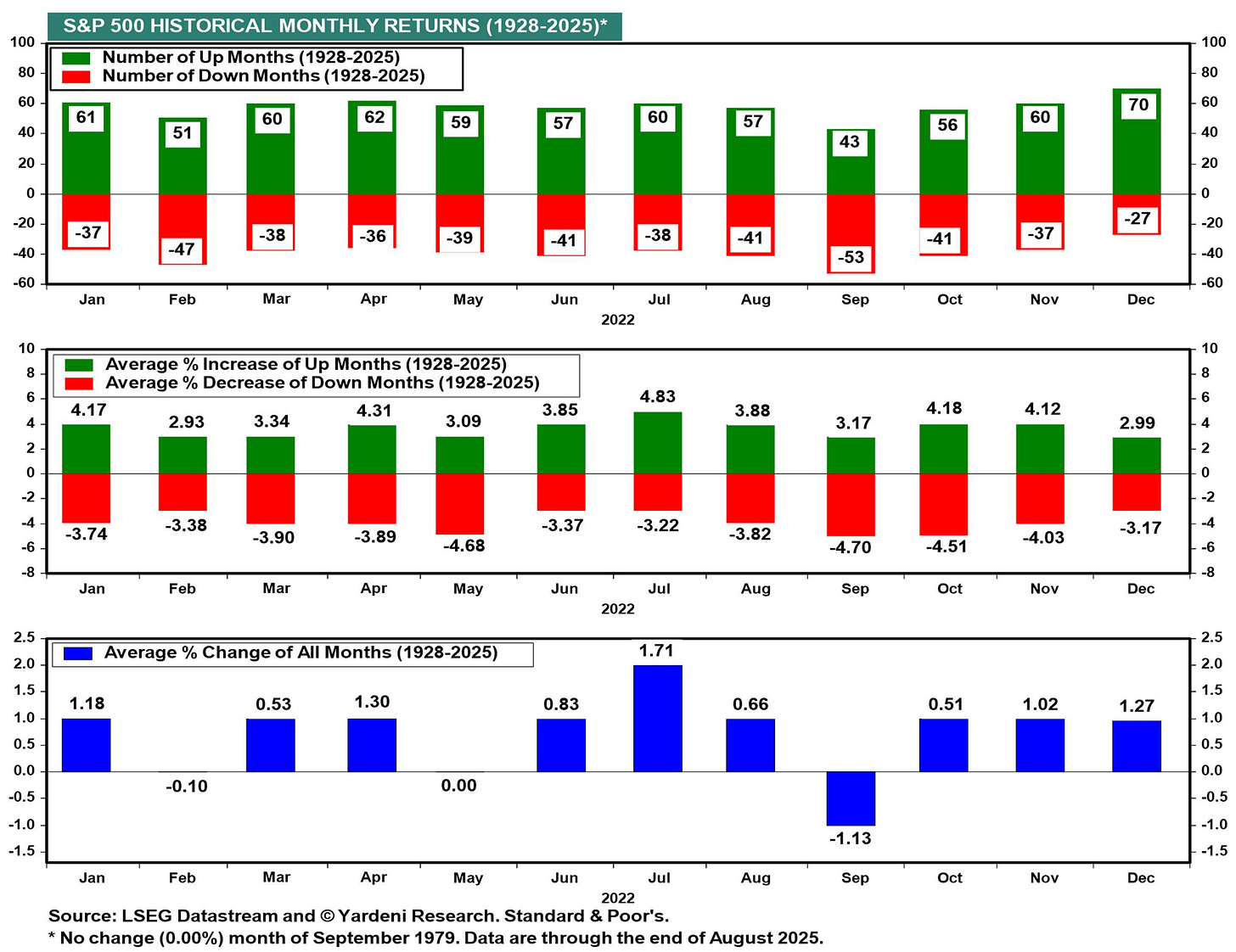

Since 1928, the S&P 500’s average September result has been a fall of -1.13% - just one of two months with negative average returns.

September is also the only month over the past 97 years – dating back prior to its 1950s expansion to 500 stocks – in which the index has declined on more occasions (53) than it's risen (43). That’s good for just a 45% win ratio.

There are plenty of reasons for caution this year. In the background, we are confronted with risks across a wide spectrum.

A federal appeals court ruled against Trump’s tariffs and found the President exceeded presidential authority, a big setback with an unknown future.

Congress is tasked with committing to a long-term funding solution and preventing a government shutdown by September 30.

We must consider structural market dynamics like mutual funds which tend to end their fiscal years in September and purge their holdings to harvest losses for a last-minute cleanup.

Rising global bond yields, waning upward momentum, elevated U.S. stock market valuations, and labor market weakness fill out the coffers.

These next few weeks are crucial to Wall Street. This week’s flurry of jobs reports, a key inflation reading, the Fed’s interest-rate decision and a major expiration of options are coming up.

And yet, on the other side of the ledger, there are many reasons for optimism in which the intermediate outlook for stocks skews positive.

Healthy corporate earnings, impending rate cuts, AI investment, and horrible sentiment/positioning readings are just a few of the forces underpinning the bull camp.

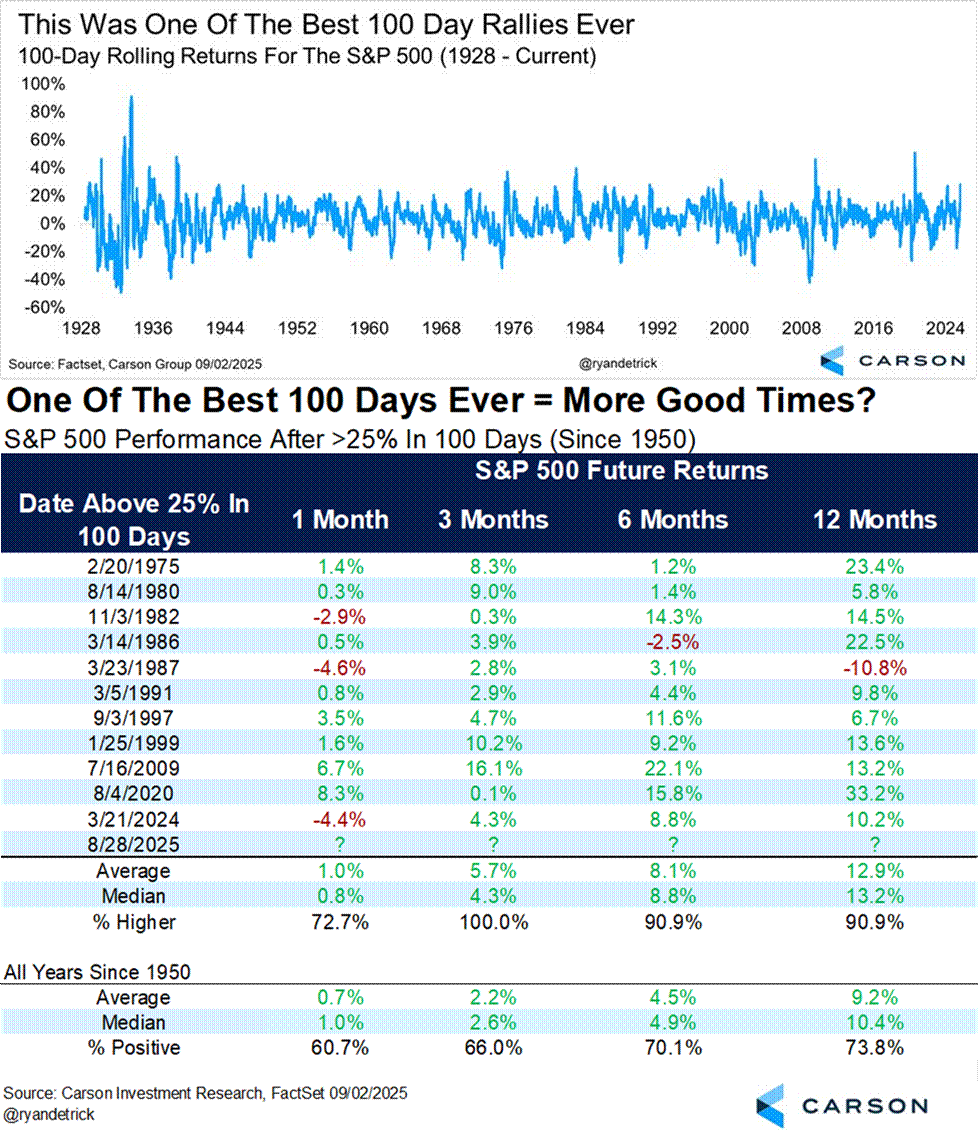

Consider we just finished (on September 2) the 100th trading day since the April 8 tariff crash market low with a return of 28%, just the 12th time in the last 70+ years that the S&P 500 has rallied more than 25% in a 100-trading day period.

That tells me the market is strong.

And looking ahead? When the S&P 500 gains 25% over 100 trading days as it just did, modern history shows that the S&P 500 has been higher every instance after three months, and 10 of 11 times after one year.

Could we be due for some consolidation? Sure. But that doesn’t mean a crash is around the corner either.

Bottom line?

Making one-month market calls on stocks is an inauspicious endeavor, a fallible game that doesn’t need to be played.

And beware of consensus calls such as September seasonal headwinds. As Jeff deGraaf of RenMac eloquently stated in his morning note today: “In this business, predictions are over-rated, but the mismatch between expectations and probable outcomes are underrated.”

I agree.

Instead of worrying about seasonal market patterns, focus on your executing your plan, and as always, stay on target.

Sources: Renaissance Macro Research, Lance Roberts, Yardeni Research, Bespoke Investment Group, Ryan Detrick CMT

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)