The yen carry trade is spooking the market

The Sandbox Daily (12.17.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the yen carry trade is spooking the market

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.47% | Russell 2000 -1.07% | S&P 500 -1.16% | Nasdaq 100 -1.93%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield -0.12% | 2yr UST 3.489% | 10yr UST 4.157%

COMMODITIES: Brent Crude +2.87% to $60.61/barrel. Gold +1.07% to $4,378.6/oz.

BITCOIN: -2.06% to $85,798

US DOLLAR INDEX: +0.26% to 98.401

CBOE TOTAL PUT/CALL RATIO: 0.94

VIX: +6.92% to 17.62

Quote of the day

“Stop being patient and start asking yourself, how do I accomplish my 10-year plan in 6 months? You will probably fail but you will be a lot further ahead of the person who simply accepted it was going to take 10 years.”

- Elon Musk

The yen carry trade is spooking the market

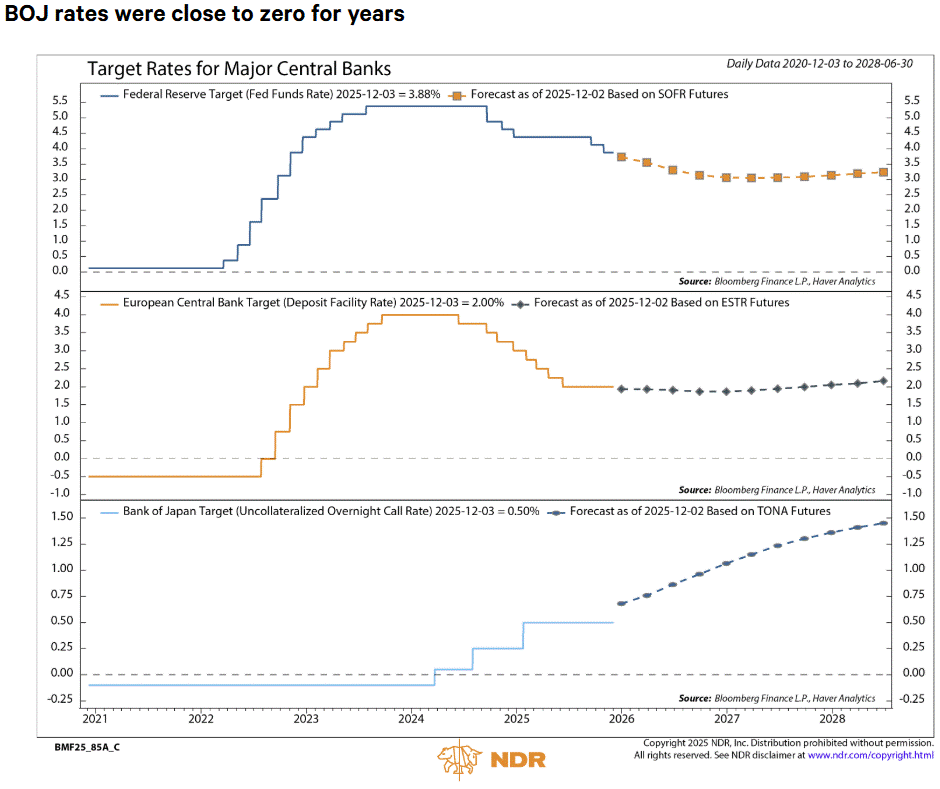

The Bank of Japan is set to raise interest rates on Friday from 0.50% to 0.75% – a three-decade high – and has signaled to keep raising borrowing costs into 2026.

While a hike still keeps its policy rate low by global standards, it’s another landmark step in Governor Ueda’s efforts to normalize monetary policy in a country long accustomed to unconventional easing and zero-bound interest rates.

Why does this matter to you?

Traders like to borrow in cheap funding markets (Japan), then invest in higher yielding instruments around the globe – like, say for instance, the U.S. tech trade – to increase leverage and maximize trading profits.

For years, the funding currency of choice among global traders has been the Japanese yen. That’s because money was essentially free with borrowing costs close to zero and ample liquidity.

Moreover, the yen depreciated rapidly and significantly following the pandemic.

Traders had the best of both worlds – borrow in yen at near zero interest rates and pay back the loan in even cheaper yen!

That dynamic began to slowly change in March 2024 when the BOJ ended its negative interest rate policy (NIRP) and yield curve control (YCC) and started scaling back on quantitative easing (QE).

Since then, yields have been marching higher and hitting new highs across the curve.

Money is no longer free and that is putting a lid on speculation and excessive risk-taking.

This week’s selling pressure in U.S. markets mirrors what has happened after previous BOJ hikes – like March 2024, July 2024, and January 2025 – when liquidity assets like Bitcoin dropped between 20-30% on each occasion.

Against this backdrop, investors see a troubling pattern and are bracing for more volatility.

Source: Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Really clear breakdown of the carry trade unwind mechanics. The double benefit traders had—borrowing at zero rates AND repaying in a depreciating yen—was unsustainable once the BOJ started normalizing. That March-to-now yield curve shift is forcing leverage down across the board. Makes me wonder how many levered positions are still hiding in the system waiting for another unwind trigger.

You may want to reconsider quoting such a polarising and divisive person in the future.