This bull market is young, plus breadth improvement, loss aversion, and Retail Sales

The Sandbox Daily (7.16.2024)

Welcome, Sandbox friends.

And say hello to the everything rally !

Today’s Daily discusses:

This bull market is young

breadth improvement is impossible to ignore

Loss Aversion and what it means to stay invested

Retail Sales report defy calls of slowing consumer/economy

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +3.50% | Dow +1.85% | S&P 500 +0.64% | Nasdaq 100 +0.06%

FIXED INCOME: Barclays Agg Bond +0.41% | High Yield +0.38% | 2yr UST 4.424% | 10yr UST 4.161%

COMMODITIES: Brent Crude -1.24% to $83.80/barrel. Gold +1.85% to $2,473.9/oz.

BITCOIN: +2.37% to $65,074

US DOLLAR INDEX: +0.03% to 104.217

CBOE EQUITY PUT/CALL RATIO: 0.52

VIX: +0.53% to 13.19

Quote of the day

“My grandma may not have been a market wizard, but she always told me to ‘make hay while the sun is shining.’ When the opportunity presents itself, go get it. It won’t last forever.”

- Steve Strazza, All Star Charts

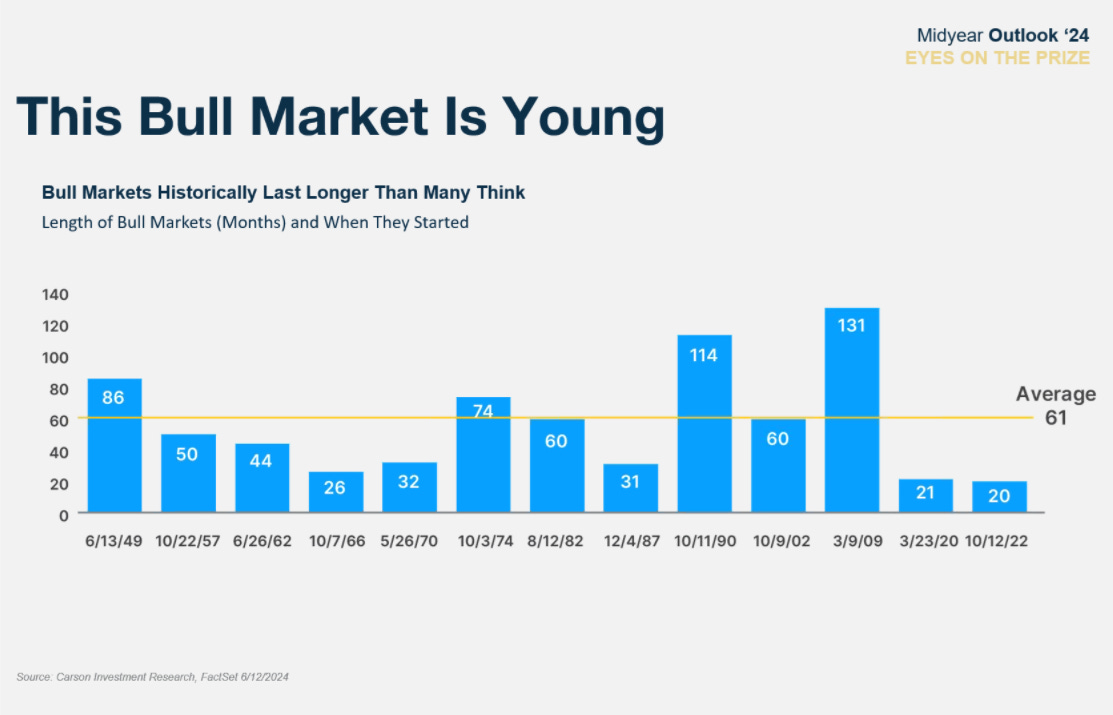

This bull market is young

If the current bull market ended today, it would be the shortest in post-war history!

But, it isn’t and it won’t – as long as earnings are inflecting higher and the U.S. consumer, buoyed by a relatively strong labor market, continue to fundamentally underpin this market.

The past 12 bull markets dating back to World War II have averaged 61 months (~5 years) in duration, so top-calling the market here puts you on the wrong side of history.

Today’s bull market is just 20 months young, with nothing more than a few scratches on its horns.

Source: Sonu Varghese, PhD and Ryan Detrick, CMT

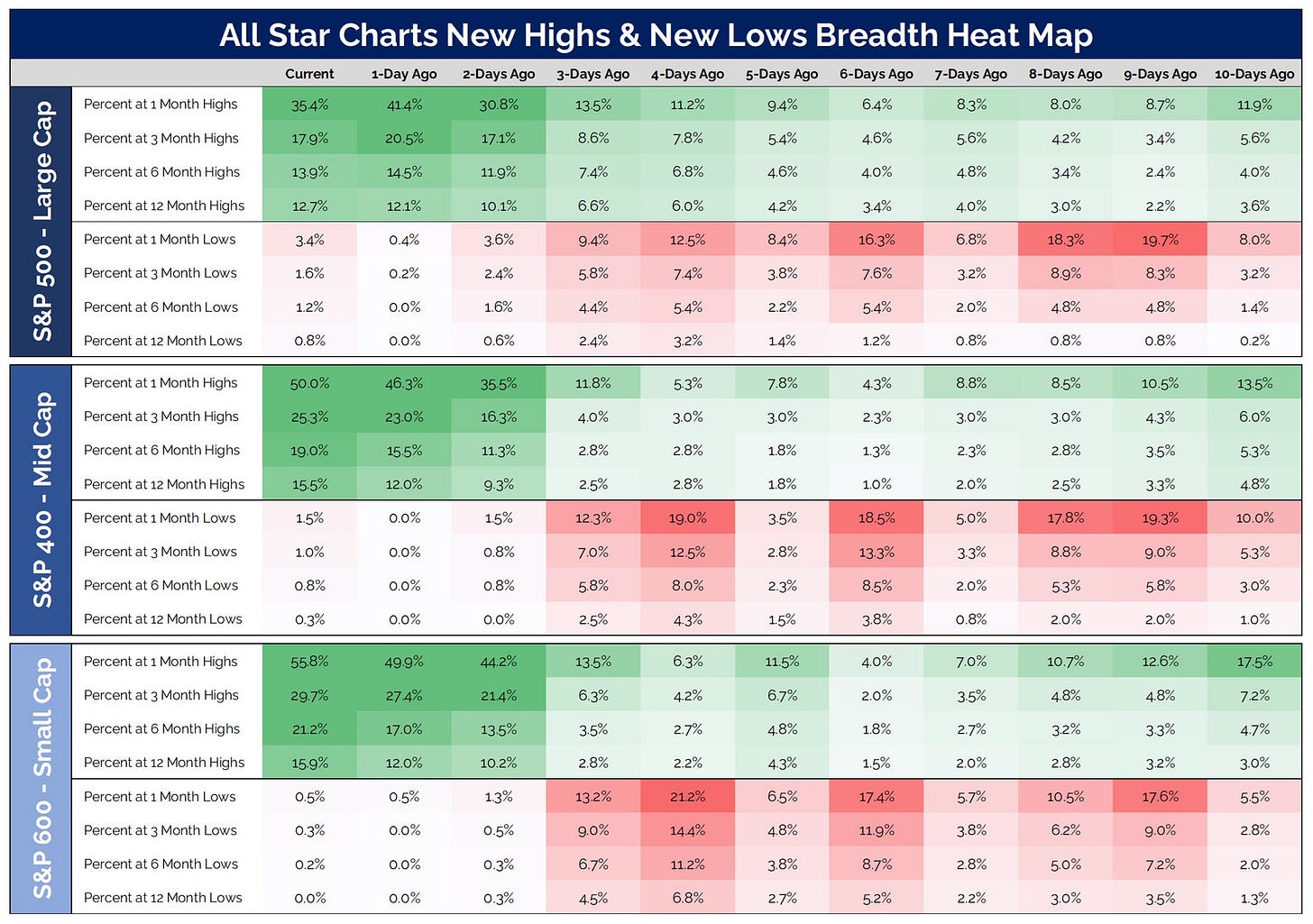

Breadth improvement is impossible to ignore

This market is broadening out before our very eyes.

Looking up and down the cap stock, more and more stocks are advancing higher, while it’s nothing but crickets in the New Lows lists.

The surge in breadth over the past two weeks has many of the bears back in hibernation.

Source: Grant Hawkridge

Loss Aversion and what it means to stay invested

Loss Aversion is a critical behavioral bias that is important for investors to recognize. These are the blind spots that keep investors from reaching their long-term goals.

On its surface, this one might seem obvious: after all, who isn't opposed to losses?

But thinking deeper, especially with the way our brains are wired, losses leave much more of an impression than gains. And those memories stick with us. If you've experienced a significant loss – no matter how long ago – you can probably relate. But gains, on the other hand, leave far less of an impression. We don't spend as much time thinking about all of those years when the stock market delivered 20% or 30% or more.

Meaning – people look at potential losses and potential gains quite differently.

People dislike a $1 loss more than they enjoy a $1 gain. In fact, research shows that it takes a gain of about $2 to mentally offset a loss of just $1.

Investors just really hate losses. Unfortunately, losses are a part of the investing process and trying to avoid them can be costly to your future self.

Staying invested through difficult markets is tough, but the data shows how damaging it is when you decide to get out of the market.

Source: JPMorgan Guide to Retirement

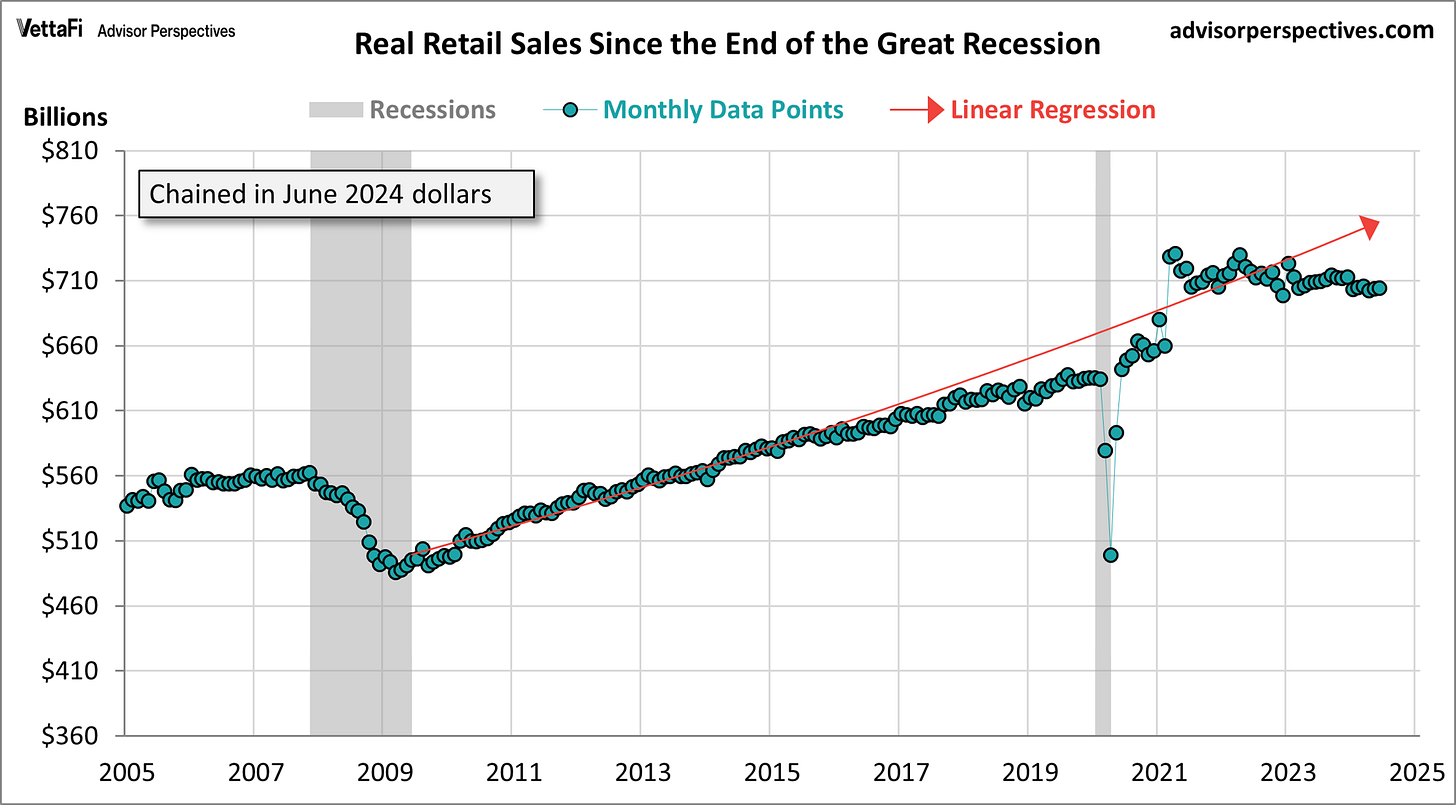

Retail Sales report defy calls of slowing consumer/economy

Retail Sales – an important and closely watched metric that tracks consumer demand for goods – came in stronger than expected for June, albeit flat on the month but above the consensus estimate of -0.3%. Additionally, the prior month was revised higher from +0.1% to +0.3%. Consumer spending remains resilient, despite high interest rates and calls for a “stretched consumer.”

On a smoothed YoY trend basis, Retail Sales is up +2.3% compared to June 2023, about the same as in the prior month and largely range-bound over the past year (excluding the holiday season).

The “Core Control” sales group, which strips out volatile categories such as motor vehicles & parts, building materials, and gasoline — and is included in the formula to determine GDP because it’s a more consistent and reliable reading of the economy — was up +0.9% in June and higher than expectations (+0.2%).

It’s important to remember that a key driver of overall inflation is spending.

While overall Retail Sales are up +2.3% in the last year and sit at record highs unadjusted for inflation, “real” (inflation-adjusted) Retail Sales are down -0.7% in the last year and have remained stagnant for nearly two years after peaking in April 2022.

It’s been 40 years since the U.S. had an inflation problem, so investors should be aware that it can distort the data.

So, what are the takeaways from today’s report?

The booming consumer may be behind us, as we’ve witnessed some softening in consumer spending over the past few months.

Josh Brown believes the consumer isn’t dying, they’re just making more deliberate choices.

This is confirmed by what corporate America has been telling us. For instance, 1st-quarter sales from many large retailers showed little-to-no growth. The consumer is still buying, but they’re just not buying at the same pace as two years ago.

Economic data like Q1 GDP further confirms that personal consumption is slowing.

The recent University of Michigan Consumer Sentiment Survey followed suit as it was much, much weaker than expected.

Compared to earlier in the cycle, Retail Sales growth has moderated as the boost in pandemic-related excess savings has come down, compounding inflation remains an issue, credit usage is rising, and wage growth has eased. Also, we should not discount that irregular post-pandemic consumption behaviors are finally normalizing and consumers no longer have the means or desire to overspend.

But, consumers are not down and out, as continued payrolls growth and low absolute levels of unemployment continue to support income and spending growth, even if it’s at a reduced pace.

Source: Piper Sandler, Ned Davis Research, Bloomberg, Advisor Perspectives, Charlie Bilello

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.