To win Super Bowl LIX, coaches preach winning all three phases. Investors should take note.

The Sandbox Daily (2.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Super Bowl LIX

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -0.95% | Dow -0.99% | Russell 2000 -1.19% | Nasdaq 100 -1.30%

FIXED INCOME: Barclays Agg Bond -0.32% | High Yield -0.31% | 2yr UST 4.289% | 10yr UST 4.489%

COMMODITIES: Brent Crude +0.40% to $74.59/barrel. Gold +0.36% to $2,887.1/oz.

BITCOIN: -0.79% to $96,133

US DOLLAR INDEX: +0.35% to 108.067

CBOE TOTAL PUT/CALL RATIO: 0.80

VIX: +6.71% to 16.54

Quote of the day

“Strive not to be a success but rather to be of value.”

- Albert Einstein

Super Bowl LIX

In the lead up to the Super Bowl this Sunday, the attention of football fans will naturally focus on each team’s offense and defense, but very little (if any) about their special teams.

In a similar fashion, while stocks and bonds routinely dominate financial market commentary, much less is said of uncorrelated strategies.

This makes intuitive sense.

Patrick Mahomes (Nvidia) and Saquon Barkley (U.S. Treasuries) sell tickets, merchandise, and television viewership; Harrison Butker (lean hog futures) doesn’t.

And yet, just as special teams can come up with game-changing plays on the field, diversifying assets can have a meaningful impact on a stock-bond portfolio.

Football is a game of three phases, and coaches stress the importance of winning each. Investing is no different.

Consider the following three scenarios.

FIELD GOALS: If the offense has trouble scoring touchdowns in the red zone, they often “settle” for a field goal and pocket the three points. While the seven points of a touchdown are preferrable, field goals can add up and make the difference in tight games.

PORTFOLIO EQUIVALENT: The performance of commodities, alternatives, and macro strategies may lag that of equities in roaring bull markets, but the compounded returns of these funds can add up over a full market cycle. More importantly, these differentiating asset classes serve an underappreciated, yet important role in making the road more palatable for investors.

Here’s Josh Brown from The Challenge: “I don’t care how 'optimized' our models are or how much math we have behind them – if we can’t keep our clients in them, what’s the difference? A fantastic portfolio that our clients can’t stick to is worthless, we may as well be throwing darts at ETFs.

FIELD POSITION: A successful punt that pins the other team deep in their own territory – à la a fair catch at the opponent’s 5- or 10-yard line (instead of the 20-yard line for a touchback) – increases the distance that the offense must move across the field to reach the end zone. Simply put, make the opposing team go the distance to score.

PORTFOLIO EQUIVALENT: The potentially positive (or less negative) returns of uncorrelated strategies during down markets can provide dry powder for investors to buy stocks or bonds at lower prices when they rebalance their portfolios, bringing them closer to their investment objectives.

KICKOFF RETURN: It doesn’t happen every game, but returning a punt or kickoff for a touchdown is one of the most impactful and momentum-shifting plays that special teams can make as it puts points on the board.

PORTFOLIO EQUIVALENT: In a kickoff return, success depends on a well-coordinated scheme where blockers work together to create running lanes, shielding the returner from defenders. Some blockers take on direct engagements, while others set up second-level protection, ensuring that the returner has multiple paths to exploit. No single player guarantees success – it's the combination of different roles working in sync that improves the chances of a big return.

Just as blockers and returners don’t all move in the same way, investments that react differently to market conditions help stabilize returns. One strategy may provide stability during volatility, another may capitalize on momentum, and another may exploit inefficiencies. Together, they create a resilient portfolio, much like a well-designed kickoff return play maximizes the chances of a successful return.

Sources: ESPN

Weekend sprinkles

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

OptimistiCallie – The Stories We Tell (Callie Cox)

Can I Retire Yet? – How Do You Manage Risk (David Champion)

Kyla’s Newsletter – FAFOnomics: How Chaos Became America’s Economic Strategy (Kyla Scanlon)

The Intelligent Investor - What You Should Do About the Stock Market’s Giant Problem (Jason Zweig)

Podcasts

The Compound feat. Nick Colas and Jessica Rabe of DataTrek Research – Four Rules for Negative Market catalysts (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Anthony Jeselnik – Bones and All (IMDB, YouTube)

September 5 – Peter Sarsgaard, John Magaro (IMDB, YouTube)

Music

Morgan Wallen – I’m the Problem (Spotify, Apple Music, YouTube)

Books

Matthew McConaughey - Greenlights (Amazon)

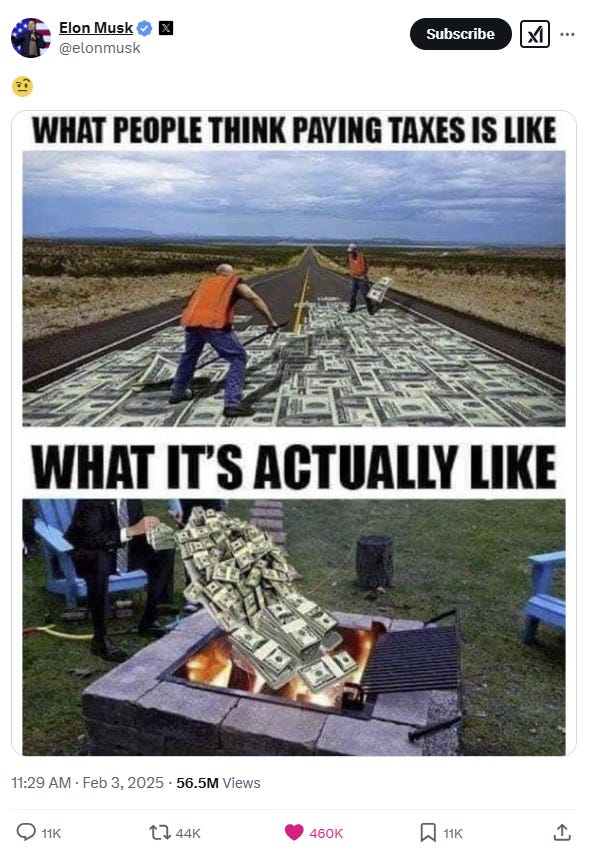

Tweets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: