Today's noisy inflation report, plus central bank easing, Presidential debate, August's stock outflows, and remembering 9/11

The Sandbox Daily (9.11.2024)

Welcome, Sandbox friends.

23 years later, we pause to remember the lives lost in the September 11th attacks. We honor the resilience and unity that emerged in the face of adversity. With hope in our hands and optimism in our hearts, today we celebrate the strength that defines our collective spirit in anticipation for a better tomorrow.

Even my 8-year-old son, Hudson – whom we’ve never discussed those tragic events – had these poignant thoughts to share in his classroom today.

Today’s Daily discusses:

noisy inflation data shows path lower remains choppy, protracted

moving closer to net accommodation

a look at the second U.S. presidential debate

August saw the biggest equity fund outflow since 2022

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.17% | S&P 500 +1.07% | Russell 2000 +0.31% | Dow +0.31%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield +0.15% | 2yr UST 3.648% | 10yr UST 3.661%

COMMODITIES: Brent Crude +2.04% to $70.61/barrel. Gold -0.04% to $2,542.1/oz.

BITCOIN: -0.52% to $57,495

US DOLLAR INDEX: +0.10% to 101.732

CBOE EQUITY PUT/CALL RATIO: 0.69

VIX: -7.29% to 17.69

Quote of the day

“Do the best you can until you know better. Then, when you know better, do better.”

- Maya Angelou

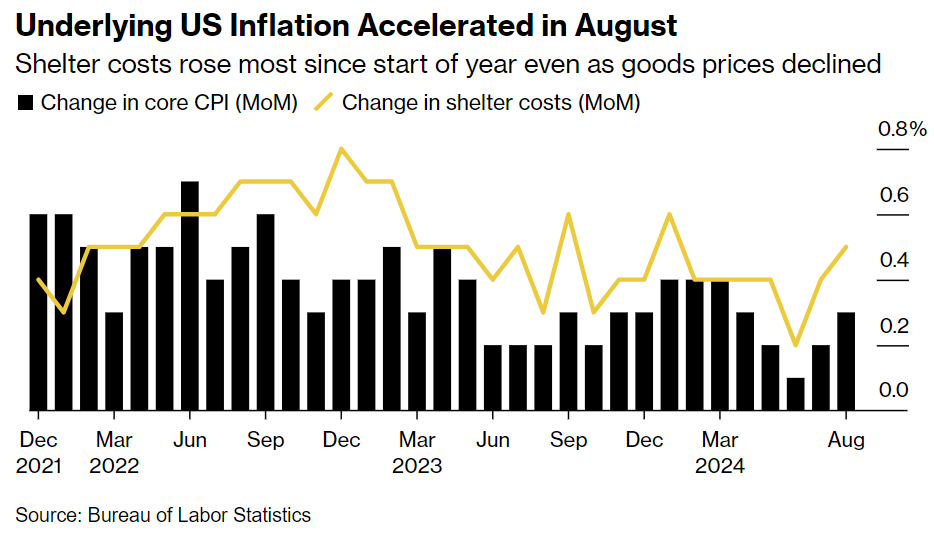

Noisy inflation data shows path lower remains choppy, protracted

The center of attention for this week’s eco data was today’s August Consumer Price Index (CPI) report, and it did not disappoint investors.

Headline CPI inflation rose +0.2% in August, the same as in the previous month and matching the market’s expectations.

The core CPI, which excludes the more volatile food and energy components, rose +0.3%, the most in four months and above expectations of 0.2%.

There was a lot of movement under the surface.

While energy prices (including gasoline) fell for the third time in the past four months, it was shelter (ex-hotels) and transportation services (including airfares and vehicle insurance) that contributed the most to today’s report.

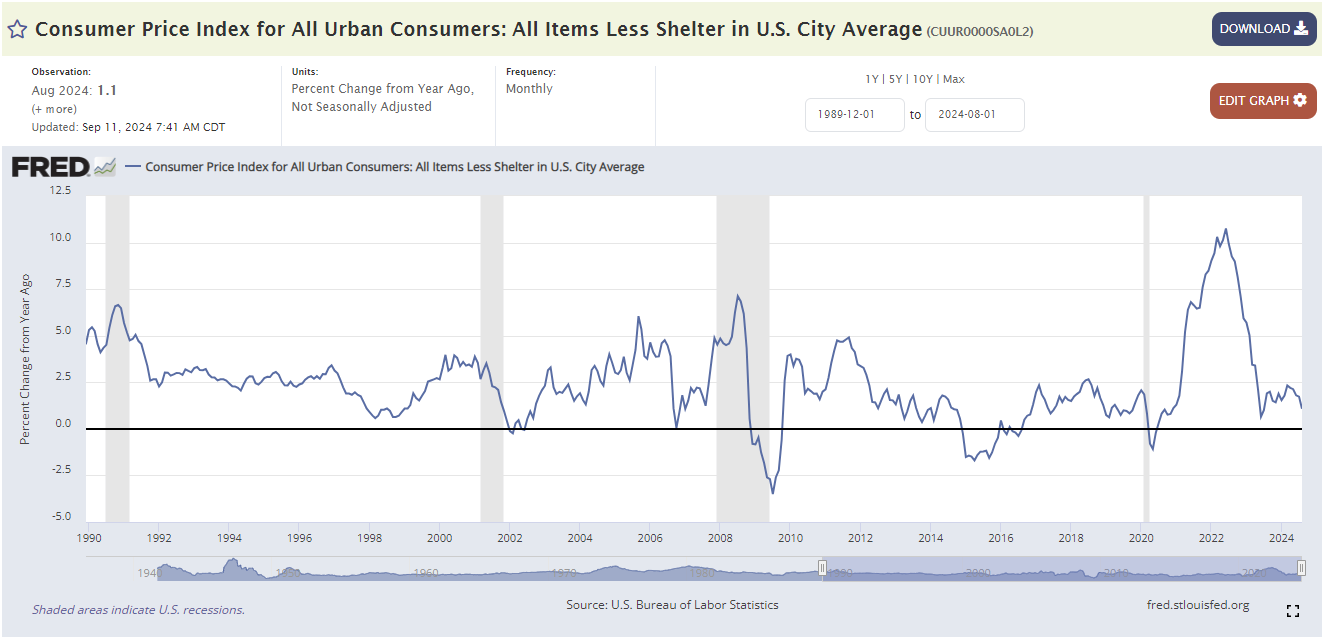

As we’ve stated for over a year, the stickiness in the data continues to largely reside within the Shelter category which accounts for most of the current inflation. The BLS data is very out of step (strong) with what actual rents in the market are doing today (falling/steady).

In other words, if you remove housing, you eliminate any concern over inflation. CPI ex-shelter is up just 1.1% versus this time last year.

On a year-over-year basis, headline CPI fell from 2.9% to 2.5% , while core CPI was steady at 3.2%.

Both are at or near their lowest levels since the spring of 2021.

The bottom line is that underlying price pressures remain sticky, largely attributable to lagging housing data, which means that reaching the Fed’s 2.0% inflation target may take longer. Although the Fed has now shifted its focus from the inflation war to supporting the labor market, inflation trends suggest a slow easing cycle.

I expect the Fed to cut rates by 25 bps at its meeting next week, with the option to do bigger cuts (50 bps each) after the presidential election.

Source: St. Louis Fed, CNBC, Bloomberg

Moving closer to net accommodation

With inflation on a sustainable path to target and downside growth risks edging up, the time for central bank easing is now.

For the Fed, the balance of risks around its dual mandate has shifted considerably in just three months. In June, Fed Chair Powell noted that risks around inflation and labor markets were shifting “into better balance.” At the July meeting, the risks appeared more balanced, with the committee “attentive to both sides of its dual mandate.” By Jackson Hole in August, Powell seemed to nudge the needle a little further with a focus on labor market conditions. Last week’s payroll report shifted the bias fully, as Governor Waller stated explicitly on Friday morning that, at least for him, “I believe that the balance of risks is now weighted more toward downside risks to the FOMC’s maximum-employment mandate.”

Beyond the Fed, other Developed Market Central Banks are already on the move. The Bank of Canada cut 25bp again last week, bringing the policy rate down to 4.25%. This 3rd consecutive cut puts Canada in the lead of the DM easing cycle so far. Up next is the ECB tomorrow (9/12), which is almost certain to slash rates another 25bp and signal a quarterly pace of easing.

In fact, half of the world’s central banks are now in easing cycles, the highest since March 2022.

As shown in the cutout table in the chart above, when more than half of the world’s central banks are in easing cycles, it’s historically been a bullish condition for global equities – with the MSCI All Country World Index (ACWI) averaging 8.38% per year.

Source: Ned Davis Research

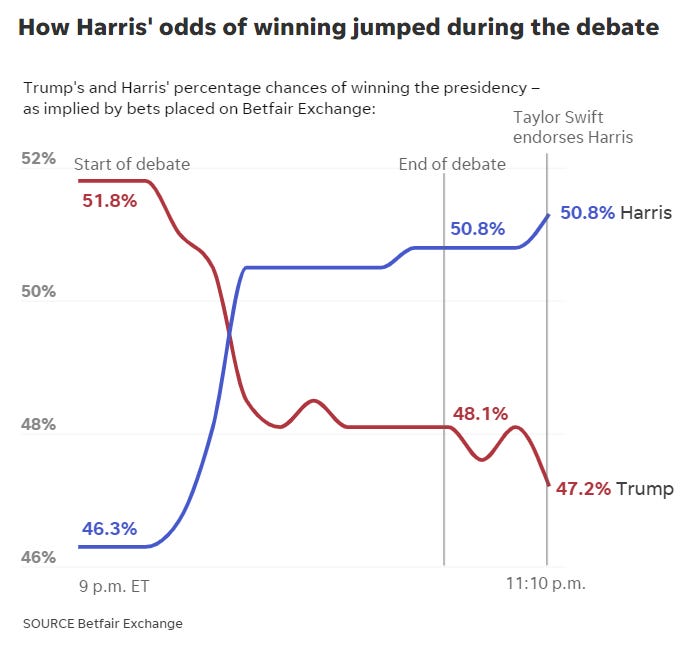

A look at the second U.S. presidential debate

Last night, ABC News hosted the second, and most likely final, presidential debate of this election cycle featuring current Vice President Kamala Harris of the Democrats and former President Donald Trump of the Republicans.

With the candidates virtually tied in the polls, and just 55 days until Election Day, Trump and Harris sought to define their visions for America in front of a national audience and deflect attacks from the other side. This debate had the potential to move the needle in favor of either candidate.

Using key words, the issues top of mind in this debate centered around the economy, immigration, and abortion.

The majority of the focus coming into Tuesday was about how Kamala Harris would handle her first-ever presidential debate against her veteran sparring partner. While former President Trump entered Tuesday with experience debating on the national stage and a history of building his personal brand on television, current Vice President Harris faced the daunting challenge of introducing herself and her yet-to-be-announced policy positions to the American voters. After all, for the Vice President, this was the first time most voters saw her in a Presidential setting.

So, how did Kamala Harris fare?

A CNN flash poll showed 63% of polled watchers said that Democratic presidential nominee Kamala Harris did a better job at arguing her policies and countering her opponent, former President Donald Trump.

And with the debate now behind us, how does the race shape up for each nominee from here?

According to Polymarket, a blockchain-based prediction market, Trump held a 5.5% lead over Harris prior to the debate.

By the end of the Tuesday’s debate, Harris was leading by 2.7% – an 8.2% swing in favor of Harris. That’s a big jump.

As of Wednesday mid-day, the market was back to split odds – with both Kamala Harris and Donald Trump at a 49% chance to win the national election.

The final push by each campaign in the weeks ahead will focus on undecided voters and key battleground states.

Source: Statista, CNN, The Kobeissi Letter, NPR

August saw the biggest equity fund outflow since 2022

The release of equity mutual fund and ETF flows by monthly reporting funds has changed the picture for August entirely.

While initial data by weekly reporting funds saw equity fund inflows for most weeks during August, the monthly reporting equity fund flows were a lot more negative – changing August’s estimate to an outflow of -$55bn globally, using Lipper data of monthly reporting funds. This stands in stark contrast to the picture from weekly reporting funds of net inflows for most weeks.

It makes August 2024 the worst month for equity fund flows since the end of 2022 and portrays a picture of fragility, rather than resilience, in terms of retail investors’ impulse into equities.

Source: J.P. Morgan Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.