Top 20 investment mistakes, plus year-end tax planning updates, unemployment, and defense

The Sandbox Daily (11.13.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

top 20 most common investment mistakes

year-end tax planning updates

worry about the rise in the unemployment rate?

defense that costs a lot

Let’s dig in.

Markets in review

EQUITIES: Dow +0.16% | Russell 2000 +0.01% | S&P 500 -0.08% | Nasdaq 100 -0.30%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield -0.09% | 2yr UST 5.033% | 10yr UST 4.638%

COMMODITIES: Brent Crude +1.60% to $82.73/barrel. Gold +0.65% to $1,950.20/oz.

BITCOIN: -1.93% to $36,432

US DOLLAR INDEX: -0.18% to 105.669

CBOE EQUITY PUT/CALL RATIO: 1.03

VIX: +4.16% to 14.76

Quote of the day

“Unless you buy a stock at the exact bottom (which is next to impossible), you will be down at some point after you make every investment. Your success entirely depends on how dispassionate you are towards short term stock price fluctuations. Behavior matters.”

- Joel Greenblatt

Top 20 most common investment mistakes

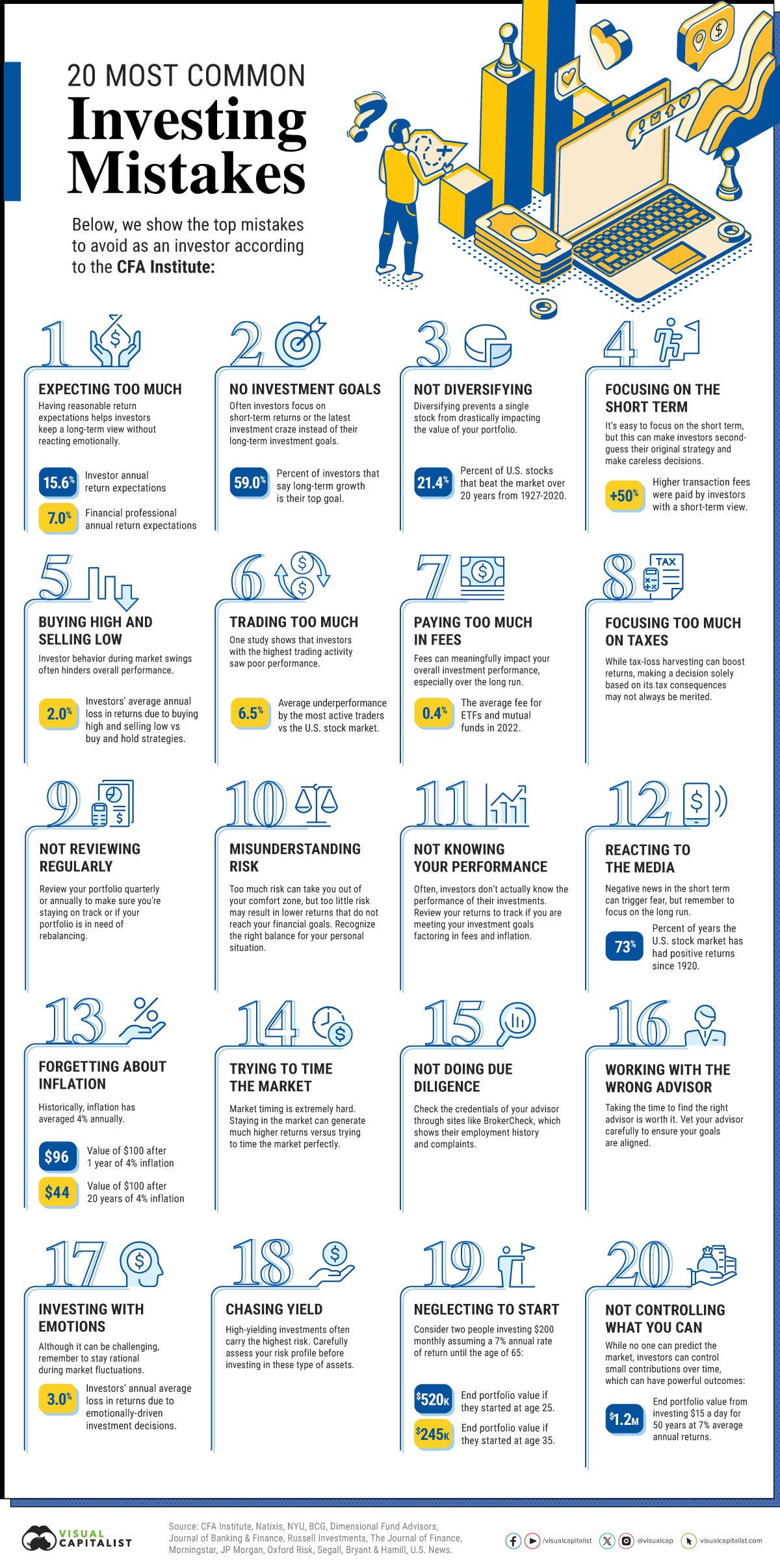

The CFA Institute recently released a white paper highlighting the top 20 most common mistakes that investors make.

The discipline of Behavioral Finance attempts to understand and explain observed investor and market behaviors – including the many mistakes we all make.

This differs from Traditional Finance, which is based on hypotheses about how investors and markets should behave. In other words, Behavioral Finance differs from Traditional Finance in that it focuses on how investors and markets behave in reality rather than in theory.

An understanding of these behavioral biases – often emotional or cognitive in nature – provides insight into how they may influence individuals’ perceptions and investment decisions, and more importantly, that we recognize them and overcome.

Source: CFA Institute, Visual Capitalist

Year-end tax planning: IRS updates for 2024

The Internal Revenue Service announced its annual inflation adjustments for the 2024 tax year.

The thresholds and standard deduction for each tax bracket are up 5.4%, the 2nd largest adjustment in the last three decades after last year’s 7.1% hike. The adjustments are meant to keep inflation from hiking taxes.

But remember, your effective tax rate will be lower than your stated top rate. That is because the 1st slice of income is taxed at 10%, the next slice at 12%, then 22%, and so on.

Your effective tax rate is essentially a blended rate. See below for the numbers.

The standard deduction rises to $14,600 for individuals in tax year 2024, up from $13,850 for this year. For married couples, it is $29,200 for 2024, up from $27,700.

The majority of filers save money by taking the standard deduction instead of itemizing deductions, including deductions for charitable donations and medical expenses.

Elsewhere, retirement and disability benefits will increase by 3.2%, per the Social Security Administration announcement.

Lastly, retirement contribution limits are increasing for 2024 as well.

The contribution limit for 401(k)s and similar workplace plans is $23,000, up $500 from 2023, while the contribution limit for individual retirement accounts (IRAs) also increases by $500 to $7,000.

Source: CNBC, Axios, Social Security Administration, Internal Revenue Service

Worry about the rise in the unemployment rate?

The unemployment rate increased to 3.9% in October and is now 0.33% above its April trough on a 3-month average basis.

Once this 3-month rate of change eclipses a ~1.5% increase in the unemployment rate, we have witnessed a concurrent recession each time since 1950.

One reason not to expect the recent uptick to presage an upward trend in the unemployment rate is job openings, if you assign weight to them.

The broader set of labor market data suggests that job growth is likely to remain strong. Job openings remain well above their 2019 levels in virtually every industry (lower left panel), while both the layoff rate and initial claims remain low historically low, albeit rising (lower right panel).

Source: Goldman Sachs Global Investment Research

Defense that costs a lot

The Fiscal Responsibility Act, signed into law in June 2023, increases the defense spending limit from $858 billion to $886 billion in fiscal year 2023.

The FY2024 budget request allocates a record $145 billion in research, development, test, and evaluation. This is the largest request ever and may suggest that the U.S. is focusing more on next-generation technologies.

The global aerospace and defense market is estimated to reach $855.62 billion in 2023 and grow to an estimated $1,076.50 billion by 2027.

Source: First Trust

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.