Tracking a key bull market indicator, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (8.8.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

tracking a key bull market indicator

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.95% | S&P 500 +0.78% | Dow +0.47% | Russell 2000 +0.17%

FIXED INCOME: Barclays Agg Bond -0.19% | High Yield +0.01% | 2yr UST 3.762% | 10yr UST 4.285%

COMMODITIES: Brent Crude -0.32% to $66.22/barrel. Gold -0.03% to $3,452.6/oz.

BITCOIN: -0.71% to $116,525

US DOLLAR INDEX: -0.12% to 98.281

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: -8.57% to 15.15

Quote of the day

“The only real mistake is the one from which we learn nothing.”

- Henry Ford

Tracking a key bull market indicator

At any given moment in time, one of the most important things we must do as investors is to first identify the type of environment we’re in.

From there, we build strategies based on the highest probability outcomes to either make money or protect capital.

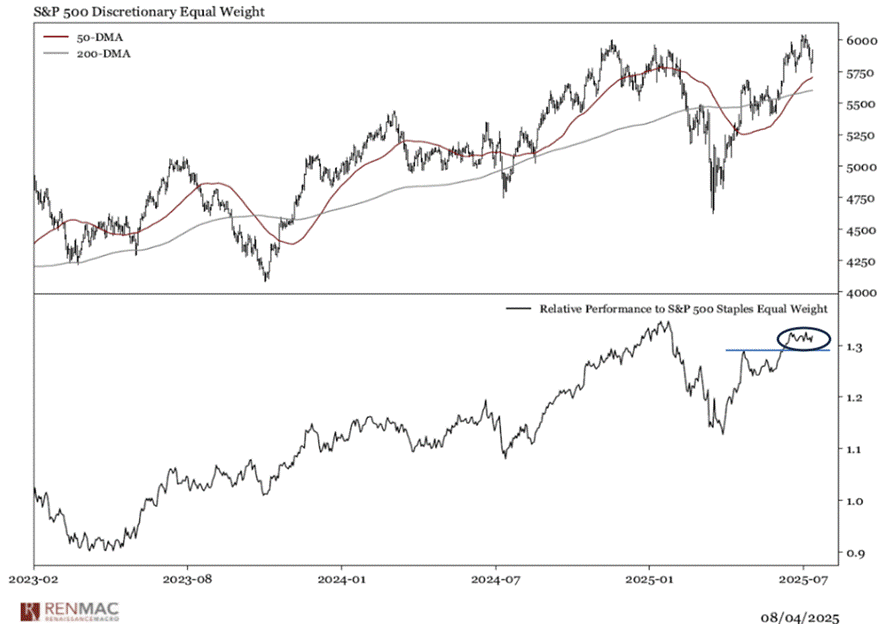

One key relationship to take the market’s temperature – either offense or defense – is the ratio between consumer discretionary stocks (XLY) and consumer staples (XLP), a relationship with an excellent track record at identifying turning points in the overall market.

A leading indicator, if you will.

Discretionary is the offense, Staples are the defense.

Looking at the relative relationship between these groups says a lot about positioning and risk appetite.

And when we look at this particular discretionary-to-staples ratio, I always prefer the equal-weight measures as opposed to market-cap values because consumer discretionary (XLY) is so top heavy. 40% of this basket is Amazon and Tesla, so it masks much of the signal we hope to gain from the broader universe. – the other 60%.

After collapsing during the 1st half around the Liberation Day announcement, this ratio has been steadily repairing itself since the April lows, pushing up against prior highs and threatening an upside breakout, which would confirm the next leg of this bull market.

The tactical trend from the spring is up, while the primary underlying trend for the cycle is also up.

A decisive break higher from this coiling pattern will be a major win for the bulls, and that is the type of environment we want to lean into risk and make money.

Source: Renaissance Macro Research

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Can I Retire Yet? – When Enough is Good Enough (David Champion)

TrendLabs – $350 Billion Lost. CEO Gone. Perfect Time to Buy? (JC Parets)

Collaborative Fund – Very Bad Advice (Morgan Housel)

Carson Group – The Economy is Currently Being Held Up by AI (Sonu Varghese)

Josh Brown – Free advice. Take it or ignore it. (Josh Brown)

Podcasts

Anthony Scaramucci and Scott Galloway with Dan Harris – Can Young Men Find Happiness (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Accountant 2 – Tina Fey, Steve Carell, Will Forte (IMDB, YouTube, Apple TV)

Music

MOLIY, Silent Addy, Sean Paul – Shake It To The Max (Spotify, Apple Music, YouTube)

Books

Nick Maggiulli – The Wealth Ladder: Proven Strategies for Every Step of Your Financial Life (Amazon)

Fun

Gary Owen – Drink Order (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Yes..it is one of the many offense/defense ratio indicators…good collection of potpourris in the end