Trade Wars 2025: welcome to Trump 47

The Sandbox Daily (2.12.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

trade wars under Trump 47

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.12% | S&P 500 -0.27% | Dow -0.50% | Russell 2000 -0.87%

FIXED INCOME: Barclays Agg Bond -0.52% | High Yield -0.21% | 2yr UST 4.361% | 10yr UST 4.631%

COMMODITIES: Brent Crude -2.52% to $75.06/barrel. Gold -0.27% to $2,924.5/oz.

BITCOIN: +2.23% to $97,501

US DOLLAR INDEX: -0.01% to 107.957

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: -0.81% to 15.89

Quote of the day

“But as for you, be strong and do not give up, for your work will be rewarded.”

- 2 Chronicles 15:8 (NIV)

Trade wars under Trump 47

In the fast-evolving landscape of global trade, the dynamics between the United States and its key trading partners are undergoing significant shifts.

The United States, Canada, and Mexico have agreed to push the tariff deadline out by 30 days, though the fate of China and the European Union tariffs remains more tenuous and unclear.

The administration’s tariff plans under Trump 47 mark a distinct break – albeit its second act – from decades of U.S. trade policy, which long has generally favored lower tariffs and fewer restrictions on the movement of goods and services across international borders.

At present, the effective tariff rate on all U.S. imports remains historically low at ~2.4%, despite starting closer to ~1.8% before the first set of tariffs were imposed under Trump 45 in 2018.

If proposed across-the-board tariffs are implemented, the effective U.S. tariff rate would rise.

Considerably.

The average rate would be the highest in nearly 100 years.

Though the general trend globally has been toward lower tariff rates, some nations still impose relatively high import taxes – particularly countries in Africa, a few across Southeast Asia, Iran, and the Caribbean.

Notice these high-tariff regions and countries are not developed economies averaging 3% annualized GDP economic growth like the U.S.

This speaks to Trump’s obsession to leverage tariffs from a position of strength as a means for negotiation. Tariffs are just a means to impose border control, prevent the influx of illegal drugs, and to raise government revenue.

Here’s Joseph Politano:

“Trump’s tariff plans would also be out of step with policy in all of the world’s prosperous high-income nations—most countries with effective tariff rates near the levels he is proposing are pariah oil producers or struggling low-income agricultural economies. No strong major global economy functions with tariffs that high because the consequences would simply be so overwhelmingly negative.”

Given the broad-based application of tariffs without an exclusion tag, the tariff cost to consumers will likely be a multiple of what it was previously under Trump 45. This suggests the first trade war is not a good guide for assessing the downstream impact under Trump 47.

Keep in mind that tariffs are a regressive tax ultimately borne by consumers to the benefit of domestic producers. The already pressured low-end consumer and increasingly at-risk middle class – already reeling from inflation stacking over the last few years – would face further challenges, which does not bode well for economic growth.

It’s also worth noting the U.S. consumer in 2025 would be more vulnerable to higher costs from rising tariffs than in 2018, which saw an offset from tax cuts via the 2017 Tax Cuts and Jobs Act (TCJA).

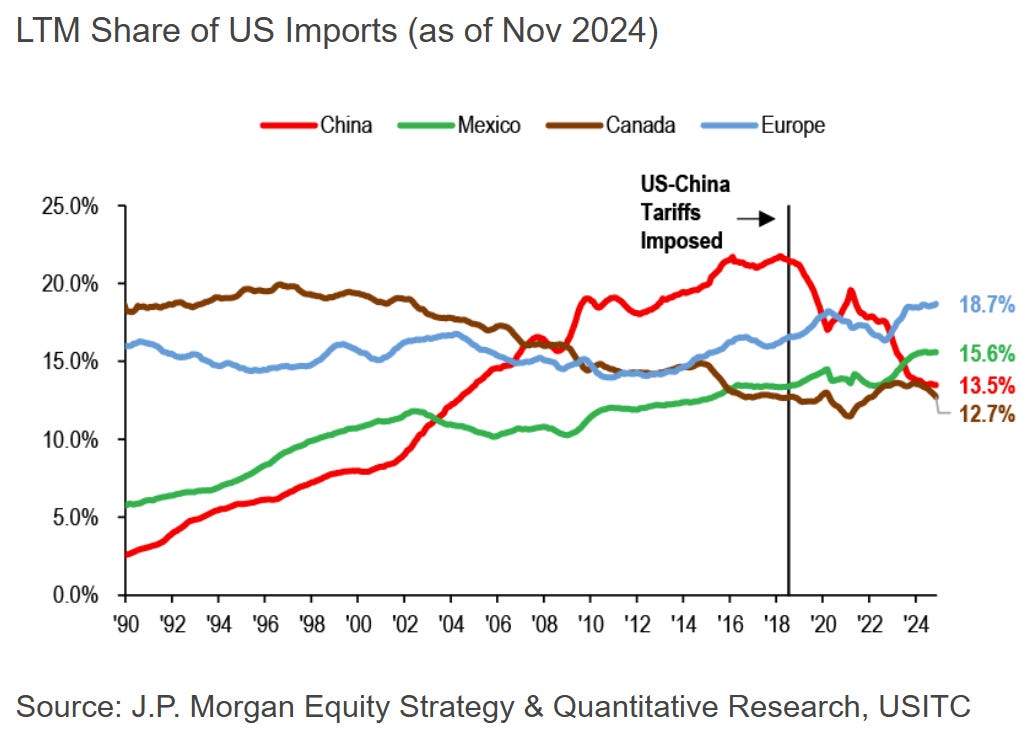

On the positive side, many U.S. companies have diversified exposure away from China since Trump 45. And yet, a more aggressive trade stance with Mexico-Canada-Europe will offset that greater diversification benefit.

While trade and tariffs are important for the global economy, history shows that their effects on financial markets are often overstated. Instead, investors should continue to focus on their long-term financial goals and not overreact to short-term headlines.

Blanket duties on all imports seems highly unlikely from a probabilistic view, even though tariffs on specific goods and/or trading partners will unfold in the coming weeks and months.

Trade partners will retaliate with tariffs of their own, exacerbating the negative shock to global trade.

This makes tariff policy a material risk to global growth in 2025, albeit one that should not destabilize the economic expansion we’ve experienced since the Covid-19 global reopening.

Sources: J.P. Morgan, Joseph Politano, World Trade Organization, PEW Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: