Transitioning from tariffs/geopolitics to corporate earnings, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (6.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

transitioning from tariffs, geopolitics to corporate earnings

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +1.00% | S&P 500 +0.52% | Nasdaq 100 +0.39% | Russell 2000 +0.02%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -0.05% | 2yr UST 3.748% | 10yr UST 4.277%

COMMODITIES: Brent Crude -0.46% to $67.42/barrel. Gold -1.86% to $3,285.6/oz.

BITCOIN: -0.65% to $107,105

US DOLLAR INDEX: +0.14% to 97.286

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: -1.63% to 16.32

Quote of the day

“If you get on the wrong train, get off at the nearest station. The longer it takes you to get off, the more expensive the return trip will be.”

- Japanese Proverb

Transitioning from tariff uncertainty and geopolitical strains to corporate earnings

As we cross the midpoint of 2025, the overall resilience that equity markets have displayed in the first two quarters of the year has been nothing short of impressive.

The turbulent backdrop of tariff uncertainties, geopolitical tensions, a U.S. debt downgrade, porous sentiment, and mounting national debt concerns have been a stiff headwind for investors. The incoming economic data has been anything but consistent, if not outright deteriorating.

And yet, the S&P 500 index notched a new all-time high today, just four months after its prior all-time high on February 19 with a roughly 20% drawdown sandwiched between.

It’s easy to understand why investors might feel conflicted today.

Looking forward to the second half of the year, investors have many reasons to be optimistic.

The technical setup remains constructive with many charts showing the potential for breakouts, while sentiment and positioning remain accommodative to a FOMO catch-up trade. Further easing is expected from Fed Chair Jerome Powell. Policy uncertainty is falling which gives CEOs better visibility and confidence on a go-forward basis.

But, over the long run, nothing matters more to stock prices than earnings.

As Tony Dwyer likes to say – over time, the market correlates to the direction of earnings (EPS) and EPS is driven by the path of economic activity.

Q1 earnings season was strong with a 79% beat rate and year-on-year growth at +13%.

Strong quarter, to be sure, but fearful investors wrote off the results because the world was looking ahead to the trade uncertainty as Liberation Day unfolded.

With Q2 earnings season just a few weeks away, we will get our first glimpse of the tariff fallout on corporate performance.

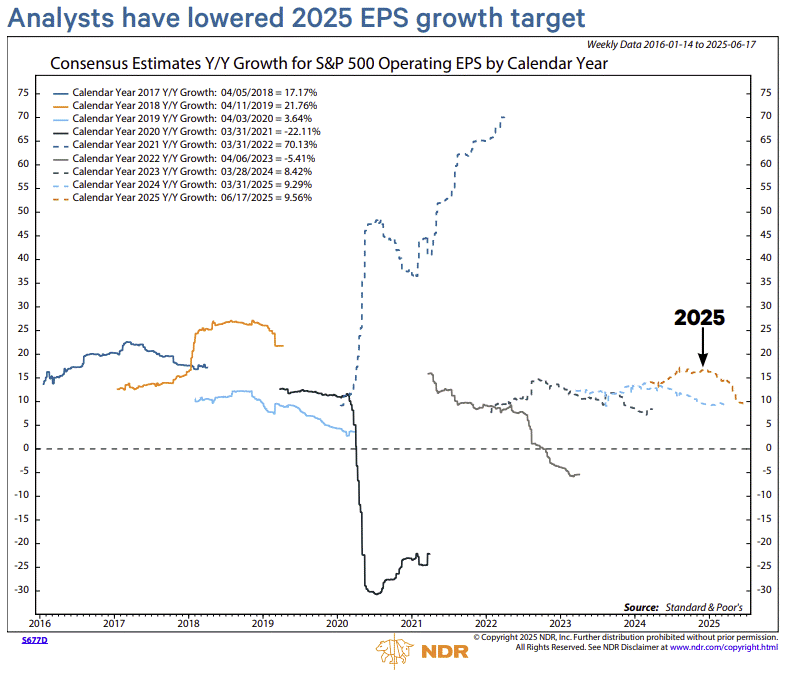

Per FactSet, consensus estimates imply that S&P 500 earnings growth will be +5.0% in Q2, which sounds healthy until you consider expectations were +9.4% on March 31. In other words, earnings estimates have been cut in half over the last three months.

The market will be relying on Tech and the Mag 7 to shoulder the burden once again. While the S&P 493 is expected to see acceleration from -0.6% to +7.4% in EQP growth, that pales in comparison to the size and performance of the tech stalwarts at +36.1%.

The issue for many centers on Q3 and Q4 earnings, with analysts expecting +7.3% and +6.4%, respectively.

Second-half estimates appear especially vulnerable to further cuts considering the potential for tariffs to hit profit margins. Many investors would like to see further revisions lower.

For calendar year 2025, EPS growth is expected to land around 9.0-9.5% – an impressive measure against the economic backdrop.

Often the case, management commentary will assume an elevated role in the upcoming reporting period, with many focused on the impact from tariffs and any discussions around hiring trends and layoffs.

Ultimately, the avoidance of an economic recession, increasing confidence in an earnings reacceleration in 2026, and insurance cuts by the Fed later this year should drive continued U.S. equity gains during the next twelve months.

Sources: FactSet, Ned Davis Research, Goldman Sachs Global Investment Research

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The Big Picture – All Time Highs Are Bullish (Barry Ritholtz)

Lyrics of Livin’ – Campfires and Bonfires (Matthew McConaughey)

The Joint Account – How To Know When You Need Help (Heather Boneparth)

Of Dollars and Data – What’s Better Than U.S. Bonds for Downside Protection? (Nick Maggiulli)

All Star Charts – The Boundaries We Set And Break (Sean McLaughlin)

Podcasts

Scott Galloway – The Collapse of American Trust with Sam Harris (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Mindhunter – Holt McCallany, Jonathan Groff (Netflix, IMDB, YouTube)

Music

Ed Sheeran – Sapphire (Spotify, Apple Music, YouTube)

Books

Sahil Bloom – The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life (Amazon)

Fun

Lex Fridman and ThePrimeagen – Working Hard vs. Working Smart (Instagram, YouTube)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)