Treasuries weigh on investors, plus timing the market, Berkshire's portfolio, and streaming wars

The Sandbox Daily (8.16.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

it’s all about yields, right?

the cost of timing the market

Berkshire Hathaway’s portfolio

streaming wars squeeze more dollars from your pocket

Let’s dig in.

Markets in review

EQUITIES: Dow -0.52% | S&P 500 -0.76% | Nasdaq 100 -1.07% | Russell 2000 -1.28%

FIXED INCOME: Barclays Agg Bond -0.24% | High Yield -0.31% | 2yr UST 4.972% | 10yr UST 4.267%

COMMODITIES: Brent Crude -1.77% to $83.39/barrel. Gold -0.63% to $1,923.0/oz.

BITCOIN: -0.79% to $28,930

US DOLLAR INDEX: +0.25% to 103.463

CBOE EQUITY PUT/CALL RATIO: 0.75

VIX: +1.94% to 16.78

Quote of the day

“To make good returns in the long run, you need to get to the long run because the law of the jungle dictates that survival takes priority over reproduction.”

- Dylan Grice, Calderwood Capital from The Meb Faber Show

Treasury headwinds weigh on markets

The 10-year U.S. Treasury is on the move and has come under renewed pressure, bringing the yield to its highest closing level since 2008.

At 4.26%, the yield is up around 20 basis points since the start of August and by 50 basis points over the past four weeks. Those are big moves for the 10-year Treasury.

This has been driven by both global and U.S. developments.

Upward pressure on yields globally came from the Bank of Japan’s decision to ease its yield-curve control policy earlier than expected. Meanwhile, in the U.S., the Treasury Department announced an increase in bond issuance of ~$1 trillion dollars for both the 3rd and 4th quarters, at the same time resilient macro data from the labor and housing markets alongside renewed dollar strength are other contributing factors.

While some thought the recent backup in yields implied Treasuries were carving out a massive top challenging the cycle highs (bottom panel below), it appears the recent move might be a continuation pattern that will resolve higher in the direction of the underlying trend (top panel below).

Still too early to call one way or the other.

But, if interest rates are going higher from here, we should expect further selling pressure for risk assets, especially in growth and tech stocks, with potential opportunities in more value-oriented groups.

Source: Bianco Research, All Star Charts

The cost of timing the market

We all hear that “time in the market” beats “timing the market.”

Here are some simple numbers from Visual Capitalist that show mistiming the market even by a few days over many years can negatively impact an investor’s returns in a meaningful way.

If you missed the 10 best trading days between January 2003 and December 2022, a $10k investment in the S&P 500 turned into $29.7k — as opposed to $64k if you held.

And the more days you miss – either due to volatility spiking, outright fear of the headlines, or continuing your losses – the results get even worse.

The overly simplistic reason for the divergence in investor returns from investment results – what Carl Richards dubs The Behavior Gap – is because most of the best (and worst) days in the market occur during bear markets and around turns in the cycle.

Reference the graphic above: the 10 best days in recent market history all occurred during the Global Financial Crisis (2008-2009) and the emergence of COVID-19 (2020).

Missing out on days when the S&P 500 is up 6-10% are material.

Source: Visual Capitalist

Berkshire Hathaway’s portfolio

Berkshire Hathaway’s 13F filing for the 2nd quarter disclosed that investing giants Warren Buffett and Charlie Munger continue to manage a concentrated portfolio anchored by Apple (AAPL), were net sellers of equities to the tune of $8 billion over the 3-month period, and started dabbling with new small positions in the homebuilders.

The $348 billion portfolio is centered around Apple, which amounts to 51% of Berkshire’s total portfolio value as of June 30th. Separately, Berkshire Hathaway bought over $800mm in shares of 3 U.S. homebuilders – D.R. Horton (DHI), NVR (NVR) and Lennar (LEN) — all 3 up more than 35% this year.

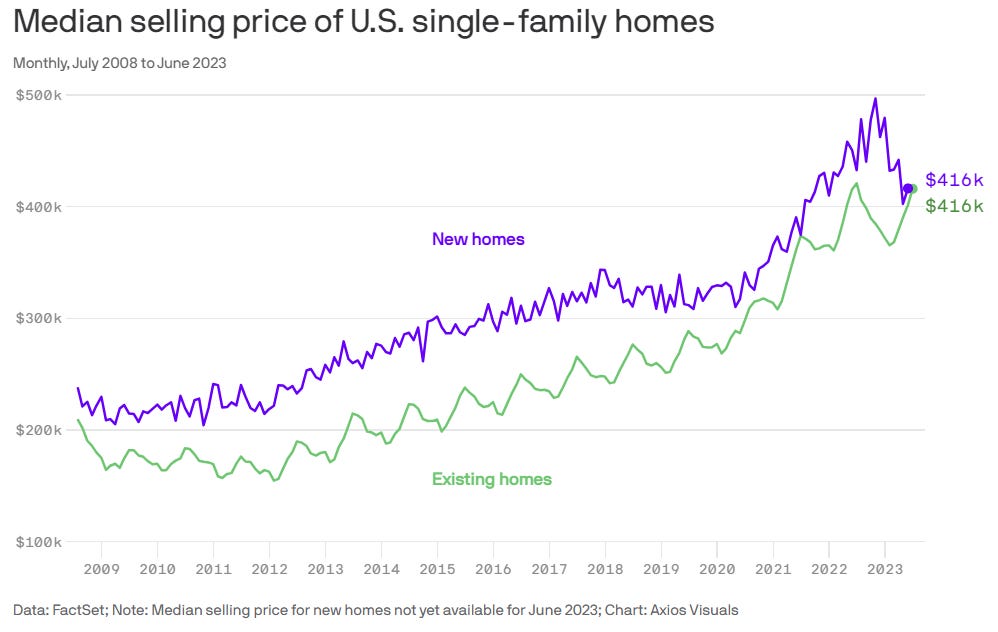

The new purchases in the homebuilders coincide with a demand surge for new homes as high-interest rates (hitting 7.24% this week) continue to prevent current homeowners from selling. Meanwhile, existing homes are in such low supply that the median price of an existing home is nearly the same as a new home.

Elsewhere, Uncle Warren maintains his conviction in energy, increasing Berkshire’s investment in Occidental Petroleum (OXY) by 5%. Berkshire now owns more than a quarter of the Occidental’s common shares outstanding and has regulatory approval to purchase up to 50%, despite publicly stating he has no intention of purchasing the oil and gas exploration firm.

Berkshire is an active buyer of OXY shares when the stock price trades below $60, a level it fell below much of the 2nd quarter. Here are Berkshire’s OXY purchases through May month-end:

Source: Axios, Kiplinger, All Star Charts

Streaming wars squeeze more dollars from your pocket

Most well-known streaming video services, including Netflix, Disney Plus, Hulu, Peacock and YouTube TV, have announced price increases in the past few months. Some are also cracking down on sharing passwords.

Welcome to the modern day streaming wars.

The price gap between watching with and without ads is becoming hard to ignore.

The cheapest monthly subscription to Netflix without commercials now costs $15.49 in the United States. Netflix is killing a $9.99 option. But if you’re okay sitting through commercials, you’ll pay $6.99 per month.

Disney said last week that it’s raising the monthly price of Hulu without commercials to $17.99 from $14.99 starting in October. But the cost of the subscription option with commercials is staying at $7.99 a month in the United States.

And on and on and on…

Behind the scenes, a combination of rising interest rates, labor strikes, and increased competition is prompting major studios to re-strategize. As the era of cheap debt that once fueled streaming content draws to a close and pressure from investors mounts, companies are adapting by increasing subscription fees, cracking down on password sharing, and introducing more ads.

This comes when for the first time ever, the market share of traditional TV (broadcast + cable) has fallen below 50% – while streaming captured a record 38.7%.

How many households are now spending more on their streaming services than their bundled cable package?

Source: The Washington Post, Nielsen

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.