Treasury rates, plus S&P 500 time horizons, flight disruptions, and the week in review

The Sandbox Daily (1.13.2023)

Welcome, Sandbox friends.

Jason Voorhees wishes everyone a happy Friday, the 13th!

Today’s Daily discusses the weakness in Treasury yields, the percentage of positive returns for the S&P 500 over various time horizons, flight disruptions, and a brief recap to snapshot the week in markets.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.71% | Russell 2000 +0.58% | S&P 500 +0.40% | Dow +0.33%

FIXED INCOME: Barclays Agg Bond -0.37% | High Yield +0.56% | 2yr UST 4.224% | 10yr UST 3.498%

COMMODITIES: Brent Crude +1.81% to $85.43/barrel. Gold +1.04% to $1,921.7/oz.

BITCOIN: +10.67% to $20,786

US DOLLAR INDEX: -0.06% to 102.180

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: -2.55% to 18.35

Are rising rates in the rearview?

After the U.S. Dollar Index (DXY) broke down late last year, the question was whether yields would follow.

Fast forward a few months, and the answer is yes. Yesterday, the five-year U.S. Treasury yield undercut its June pivot high.

This breakdown to fresh four-month lows trails a parabolic trendline violation similar to that of the Dollar index. If yields continue to fall, we can expect further strength from long-duration assets such as bonds and growth stocks.

On the other hand, if yields hook higher, it could dampen the recent rally in long-duration assets. But as long as yields do not accelerate higher, many risk assets will likely continue to repair last year’s damage.

Source: All Star Charts

Time horizon

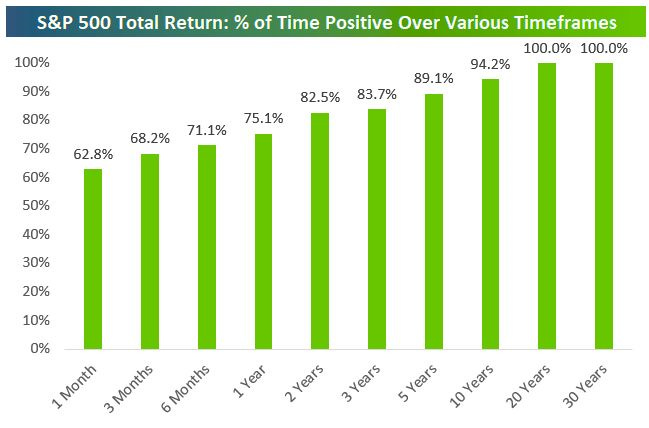

In the stock market, time pays.

Since 1928, the S&P 500 generated a positive total return more than 89% of the time over all five-year periods. Those are pretty good odds, if you buy and hold.

When you extend the timeframe to 20 years, you’ll see that there’s never been a period where the S&P 500 didn’t generate a positive return.

Source: Bespoke Investment Group

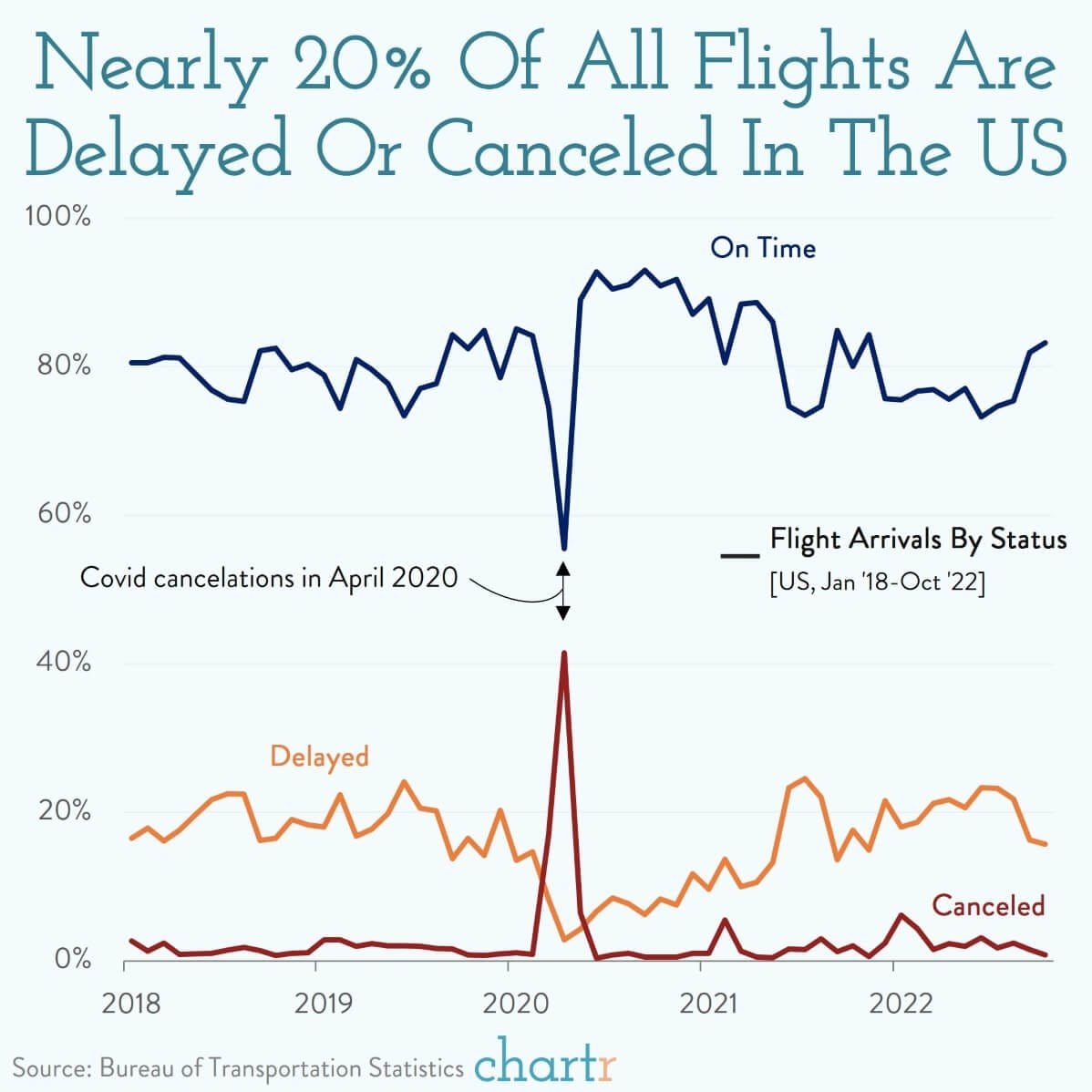

Flight disruptions

An FAA tech meltdown from a corrupt database file earlier this week sent air travel into chaos, with 10,000+ flights delayed or canceled. This comes after the Southwest Airlines debacle around the holidays in which the airlines has now said its holiday flight cancellation bonanza will shave as much as $825 million off its earnings, giving it a loss for the 4th quarter.

These headlines highlight the outdated tech that plagues the aviation industry to this day. Disruptions, as anyone who’s anxiously studied a departure board will tell you, are hardly an uncommon experience. Since 2018, just under 20% of all arrivals in the U.S. are delayed or canceled.

Source: Chartr

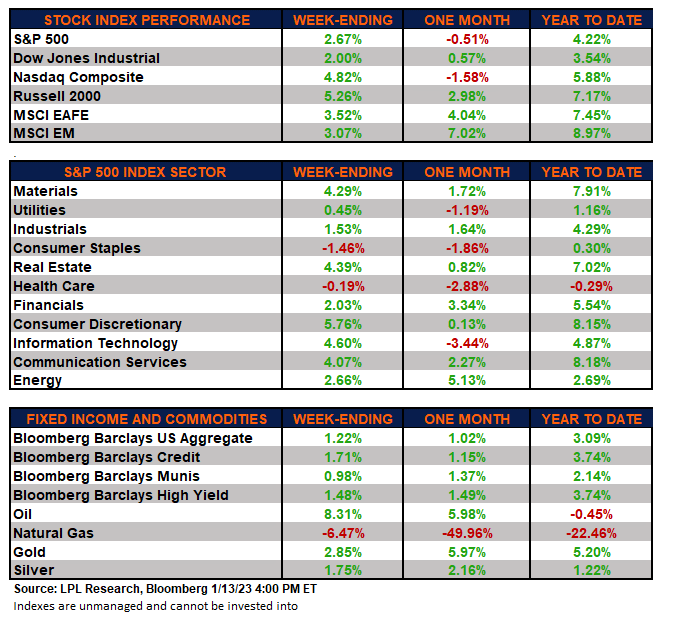

The week in review

Stocks: The major markets finished higher for the 2nd straight week given an improving December inflation report. December’s report gave market participants Goldilocks-type data that they wanted to help ease concerns about an overly aggressive Fed. 4th quarter earnings season begins today with the street consensus for S&P 500 earnings to decline -4.1% YoY in Q4, the first contraction since Q3 of 2020.

Bonds: The Bloomberg Aggregate Bond Index finished the week higher as yields declined on the latest evidence of easing price pressures. In addition, high-yield corporate bonds, as tracked by the Bloomberg High Yield index, finished the week higher, following their equity counterparts.

Commodities: Both oil and natural gas prices finished the week mixed. Oil moved higher given an improving economic backdrop in China. European natural gas prices continue to fall, reaching prices below levels last seen since before the Russia-Ukraine conflict. The major metals, including gold, silver, and copper finished the week higher.

Source: Dwyer Strategy, LPL Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.