Trump revives push to scrap quarterly earnings reports

The Sandbox Daily (9.15.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Trump entertains notion to scrap quarterly earnings reports

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.84% | S&P 500 +0.47% | Russell 2000 +0.34% | Dow +0.11%

FIXED INCOME: Barclays Agg Bond +0.17% | High Yield +0.28% | 2yr UST 3.539% | 10yr UST 4.038%

COMMODITIES: Brent Crude +0.70% to $67.48/barrel. Gold +0.91% to $3,719.9/oz.

BITCOIN: -0.35% to $115,328

US DOLLAR INDEX: -0.23% to 97.321

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: +6.30% to 15.69

Quote of the day

“Don't let the sun go down without saying thank you to someone, and without admitting to yourself that absolutely no one gets this far alone.”

- Stephen King

Trump entertains notion to scrap quarterly earnings reports

Legendary investor Warren Buffett values receiving quarterly reports from public companies to better understand their financial performance, however he’s long remained critical of management’s authority to provide forward projections and earnings guidance.

In fact, back in 2018, Buffett co-authored an op-ed in the Wall Street Journal alongside JPMorgan Chase CEO Jamie Dimon that argued management’s capacity to provide quarterly forecasts is bad practice because it encourages companies to focus on short-term performance rather than the long-term health of the business.

This “pressure” can lead to negative outcomes and harm long-term decision-making because Wall Street is more focused on the here and now.

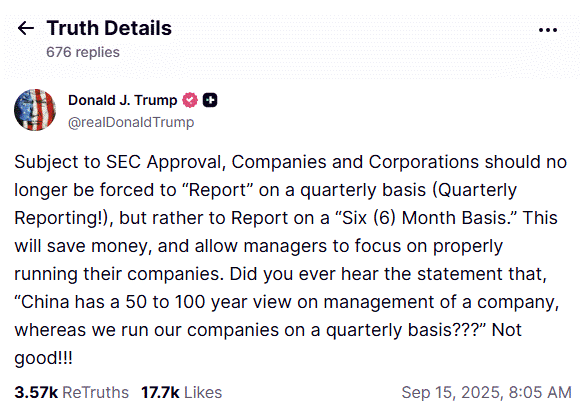

This morning, President Trump reprised this same discussion with a Truth Social post calling for the SEC to change the customary reporting period to six months in what would be a major shift for corporate America.

The SEC currently requires publicly traded U.S. corporations to report their financial statements every 90 days, a policy that’s been in place since 1970.

If that changes, what are some of the adjustments or consequences that would result?

Here are 10 things to consider:

Longer waiting periods would mean less transparency and greater market volatility, theoretically making U.S. stocks less attractive. One reason often cited for why U.S. stocks trade at a premium to equities elsewhere is due to more stringent reporting requirements. The investor is better suited having more information than less, as well as more frequent information than less. Six months also opens the door for leakage of information, which further undermines market confidence and weighs on valuations.

Public companies would produce better capital allocation decisions because management can keep their eye on long-term value creation and less on financial engineering focused on meeting quarterly projections. As Buffett and Dimon wrote: “In our experience, quarterly earnings guidance often leads to an unhealthy focus on short-term profits at the expense of long-term strategy, growth and sustainability.”

Investors would adapt just fine. Changes in market structure occur all the time: evolution of electronic trading, closing the open-outcry trading pits, shortened trade settlement to T+1, asset tokenization, moving off from the Bretton Woods gold system in the United States, etc etc.

Trump’s proposal would be more in line with practices in the United Kingdom, the European Union, and Hong Kong, where companies are required to file semiannually but can issue quarterly reports if they choose. As such, there is established precedent for these more elongated reporting windows.

Reduce gamesmanship by forcing invested capital to adopt longer time horizons. Scores of businesses run on multi-year cycles, including heavy manufacturing, software, airplanes, construction, etc. Shareholders would be less focused on a company “making the quarter” and more focused on the intermediate and long-term trajectory of the business.

A decrease in transparency goes against the grain of progress we’ve seen elsewhere over time. We see and hear from Fed governors and presidents on a seemingly daily basis. Meanwhile, the SEC has adopted a number of policies over the years such as Form 4 (changes in beneficial ownership of a company’s stock by insiders) or an 8-K filing (corporate material events must be disclosed within four business days) that serve to protect investors and provide greater disclosure.

Online brokerage platforms like Robinhood would suffer. Trading volume greatly increases over the two-day period just prior to an earnings announcement as well as two-days following the report. Lower trading volume hurts Robinhood because a significant portion of its revenue comes from transaction-based activities, most notably payment for order flow (PFOF) from market makers. A decrease in trading activity directly reduces the amount of money online brokerages earn from these transactions.

Sell side analysts also suffer. The hamster wheel of madness from updating financials each quarter and management guiding the street about X, Y, and Z would create a greater onus on the banks to sharpen their pencils and do the work. We could see a wedge grow between a stock’s expectations and its actual results.

Too much information has diminished the effect of the actual information itself. We live in a world where updates and notifications compete for every minute of our attention. We should at least remain open-minded to the conversation of exploring what’s the appropriate time frame for updates.

It’s unclear if sustained policy/regulatory energy well be dedicated to implementing a change that no one is asking for. This conversation revives itself every few years but flames out rather quickly. I’d expect the same result in 2025.

Source: Truth Social

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)