Trump trade takes flight: bitcoin, small-caps, rates, and more

The Sandbox Daily (11.6.2024)

Welcome, Sandbox friends.

U.S. markets responded with a resounding blastoff in today’s session following former President Donald Trump’s election victory and potential Republican sweep across Congress.

Happy or not, we are not here to litigate DJT’s policies, former actions, or personal behavior. I keep my personal politics out of these daily e-mails, so instead I’ll focus on some of the significant underlying price action in today’s market.

And, above all, the possibility of a contested election that would have led to uncertainty, protests, and even violence looks to be off the table – and for that, we should all be grateful.

Today’s Daily discusses:

bitcoin finally breaks free

God candle for small-caps

positioning is rather full

volatility collapses

mortgage rates jump after Trump victory

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +5.84% | Dow +3.57% | Nasdaq 100 +2.74% | S&P 500 +2.53%

FIXED INCOME: Barclays Agg Bond -0.78% | High Yield +0.18% | 2yr UST 4.268% | 10yr UST 4.431%

COMMODITIES: Brent Crude -0.52% to $75.14/barrel. Gold -2.92% to $2,669.7/oz.

BITCOIN: +9.26% to $75,951

US DOLLAR INDEX: +1.67% to 105.148

CBOE EQUITY PUT/CALL RATIO: 0.99

VIX: -20.60% to 16.27

Quote of the day

“Every action you take is a vote for the type of person you wish to become.”

- James Clear in Atomic Habits

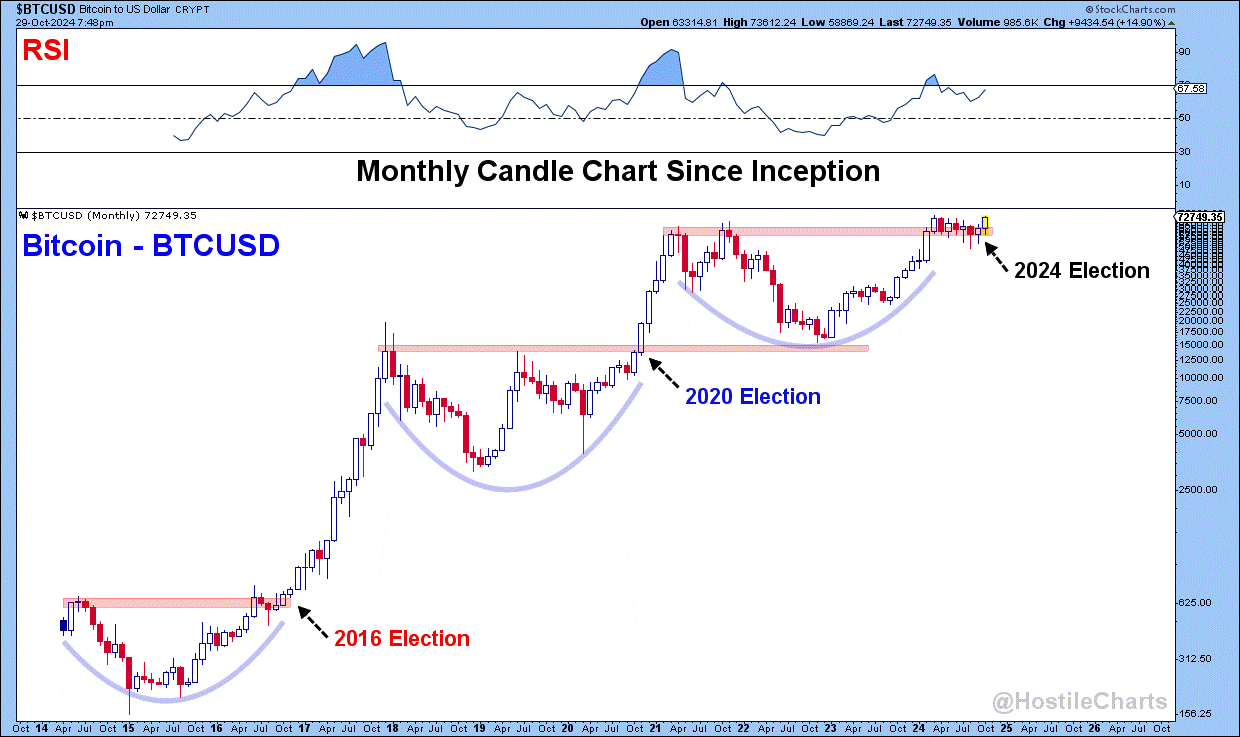

Bitcoin finally breaks free

Bitcoin minted fresh new all-time highs today around ~$76,000 following Donald Trump’s election as 47th president of the United States, after resolving higher through the upper range of its two-year base.

Larry Thompson notes that similar launch patterns occurred following the 2016 election and 2020 election; each of these moves persisted several months with triple-digit rallies.

With crypto back in vogue, retail and institutional investors alike are taking notice.

The iShares Bitcoin Trust ETF (ETF) just experienced its biggest volume day ever.

Near-term catalysts supporting bullish price action would include:

Trump’s favorable regulatory stance on crypto, which may include axing current SEC Chair Gary Gensler from his post

Additional buying support from MicroStrategy, which announced a massive $42B bitcoin acquisition program over the next three years, are additional catalysts supporting bullish price action.

Source: Larry Thompson, CMT CPA, Eric Balchunas

God candle for small-caps

By definition, small-caps are the smallest and least important companies in America, many of which aren’t even profitable.

For much of the last year or two, the perma-bears have been quick to remind the rest of us that small-caps were a reason not to believe in this bull market. Even though certain sectors within small-caps were doing well (i.e. Industrials), the index itself was struggling to push new all-time highs because the Russell 2000 is loaded up with interest rate-sensitive groups like Regional Banks and Biotech stocks.

Small-caps have lagged for much of the recovery cycle since the October 2022 bottom, one of the last few corners of the equity market that had yet to reclaim its prior cycle highs.

Well, no more.

Today, these small-caps were bid up aggressively, rising +5.8% in today’s session.

Today’s chart is what the crypto enthusiasts call a God Candle, which is the largest candle on a trading chart. You don’t want to miss these.

Often created by unforeseen events, a God Candle indicates a sudden and significant price movement.

A +5.8% surge in small-caps surely qualifies as a sudden and significant move that no investor wants to miss.

Source: YCharts

Positioning is rather full

With a Trump victory in hand, investor assumptions are that financial markets could broadly relive the 2016 experience.

While equities showed a knee-jerk bounce in the general direction of the existing underlying trend, the bigger question becomes the sustainability of the upmove, which may likely depend on the magnitude of the bond yields response, as well as other considerations like trade policies, taxes, and fiscal balances.

Crucially, the investor positioning is markedly different currently vs Nov 2016, at highs now vs subdued then

Source: J.P. Morgan Markets

Volatility collapsed

Look at this reset in volatility – wow !!!

This is one of the largest declines of the last few decades, dropping 20% on the day.

A massive compression in volatility is an “additional post-election tailwind for equities” notes Sonu Varghese.

Over the last thirty years, a four-point drop in VIX often means more gains lie ahead.

Source: Barchart, Sonu Varghese Ph.D.

Mortgage rates jump after Trump victory

Following today’s big move in yields, the average mortgage rate on the 30-year fixed loan inched higher by nine basis points this morning to 7.13%, the highest rate since early July 1.

Remember, the recent low was 6.11% back on September 11.

Mortgage rates loosely rise and fall in tandem with the yield on the 10-year U.S. Treasury note, which surged in today’s market session.

Bond yields are rising because investors expect Trump’s proposed fiscal policies to widen the federal deficit and reverse progress on inflation.

To put these rate moves in perspective, if you were buying the median priced home back in early September with a 30-year fixed rate and 20% down payment, the monthly mortgage payment is now $216 more than it was two months ago.

“We should expect more volatility in the housing market in the near term,” Lisa Sturtevant, Chief Economist at Bright MLS, said in a statement.

Source: Mortgage News Daily

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: