Two key issues that will define the 2026 midterms

The Sandbox Daily (1.8.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

voter concerns ahead of 2026 midterms

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.11% | Dow +0.55% | S&P 500 +0.01% | Nasdaq 100 -0.57%

FIXED INCOME: Barclays Agg Bond -0.18% | High Yield +0.07% | 2yr UST 3.492% | 10yr UST 4.183%

COMMODITIES: Brent Crude +3.74% to $62.97/barrel. Gold +0.52% to $4,485.9/oz.

BITCOIN: -0.04% to $90,964

US DOLLAR INDEX: +0.25% to 98.927

CBOE TOTAL PUT/CALL RATIO: 0.96

VIX: +0.46% to 15.45

Quote of the day

“Sometimes failure is merely chasing you off the wrong road and onto the right one.”

- Paul Tudor Jones

Why housing and healthcare will define the 2026 midterms

The affordability crisis plaguing many Americans will become a key political debate in 2026 as the midterm election cycle approaches later this year, with housing and health care key concerns among voters.

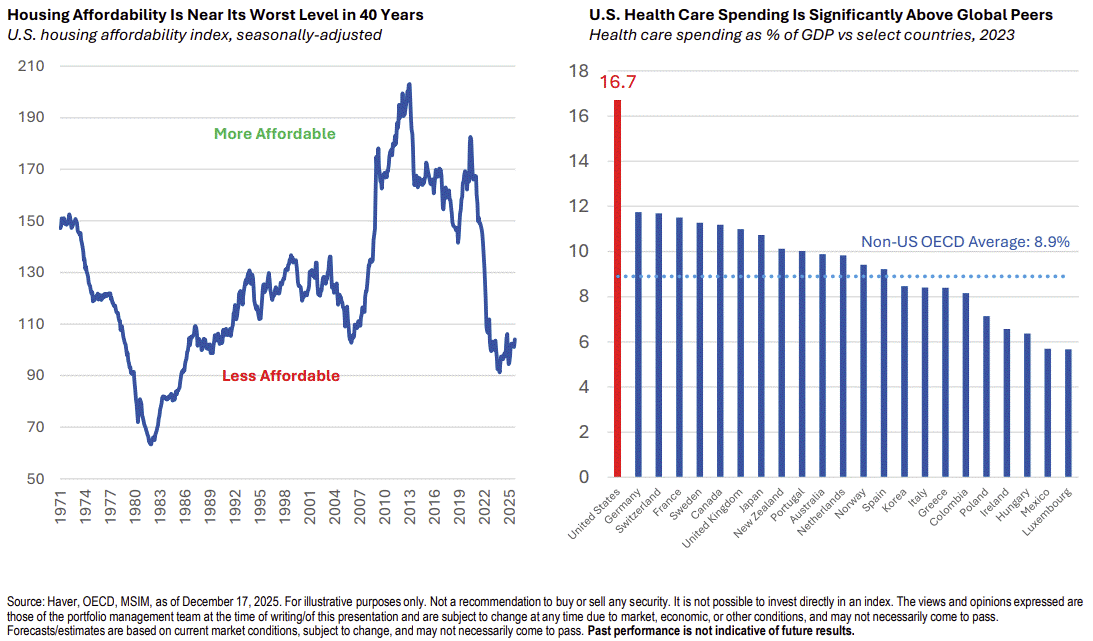

Housing affordability has quietly become one of the worst economic stress points for voters, sitting near its least affordable level in roughly 40 years. The toxic combination of elevated home prices, sharply higher mortgage rates, and a chronic shortage of supply has locked out first-time buyers and frozen existing homeowners in place.

Meanwhile, healthcare is the other slow-burn, with the U.S. spending roughly 16–17% of GDP on healthcare – nearly double the average of other developed economies. Despite this outsized spending, households continue to face rising premiums, deductibles, and out-of-pocket costs, making healthcare inflation a persistent political vulnerability. Throw in the administrative nightmares, limited transparency, and growing PE-based networks – and people take note.

Even as macro conditions remain largely robust, housing and healthcare are where the math still doesn’t work for many households.

When your biggest recurring monthly expenses become a millstone on your budget, voters don’t care much about the rest of the scoreboard – even if stock prices are up and gas prices are down.

Source: Morgan Stanley Investment Management

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)