Two labor market dynamics that will matter in 2026

The Sandbox Daily (2.18.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

immigration and AI are reshaping the labor market

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.80% | S&P 500 +0.56% | Russell 2000 +0.45% | Dow +0.26%

FIXED INCOME: Barclays Agg Bond -0.14% | High Yield +0.12% | 2yr UST 3.468% | 10yr UST 4.087%

COMMODITIES: Brent Crude +4.16% to $70.57/barrel. Gold +1.98% to $5,003.5/oz.

BITCOIN: -2.21% to $66,143

US DOLLAR INDEX: +0.59% to 97.729

CBOE TOTAL PUT/CALL RATIO: 0.98

VIX: -3.30% to 19.62

Quote of the day

“Wherever you get to is better than where you started. To stay on the road is a massive achievement.”

- Anthony Joshua, British Professional Boxer

Immigration and AI are reshaping the labor market

Two labor market dynamics worth monitoring in the coming years center around whether the slowdown in job growth is due to cyclical factors, which would justify further Fed rate cuts, or structural changes, for which monetary policy may not be effective.

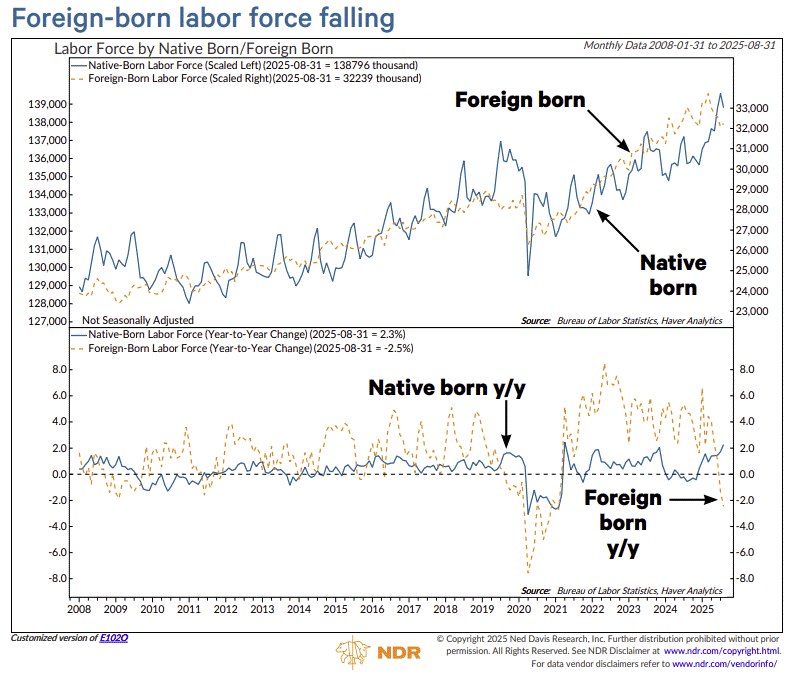

At the top of the structural list is immigration reform. The shutdown of the border and ongoing deportations have led to a collapse in the foreign-born U.S. labor force.

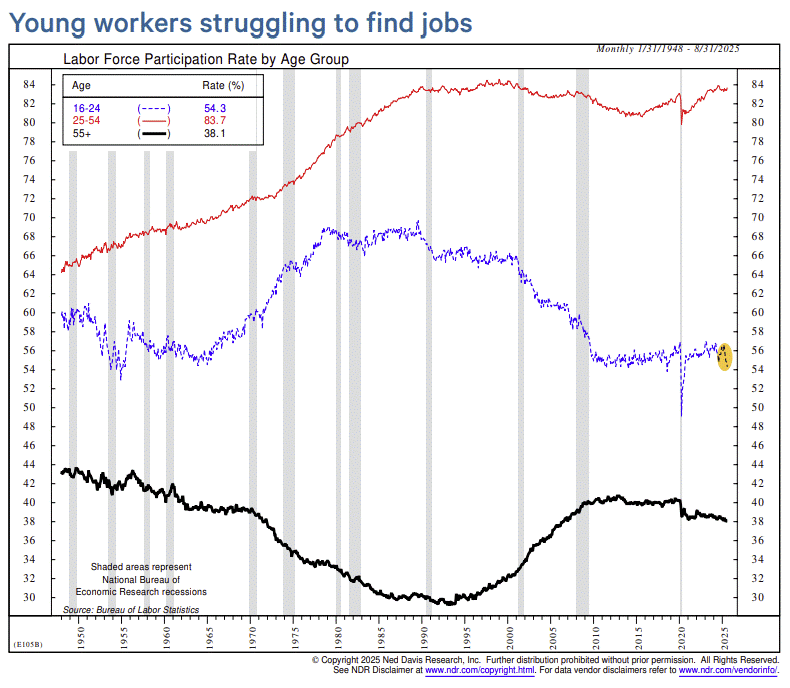

A second structural issue also happens to be the very driver of U.S. economic growth right now: artificial intelligence. Specifically, how A.I. is hampering younger workers.

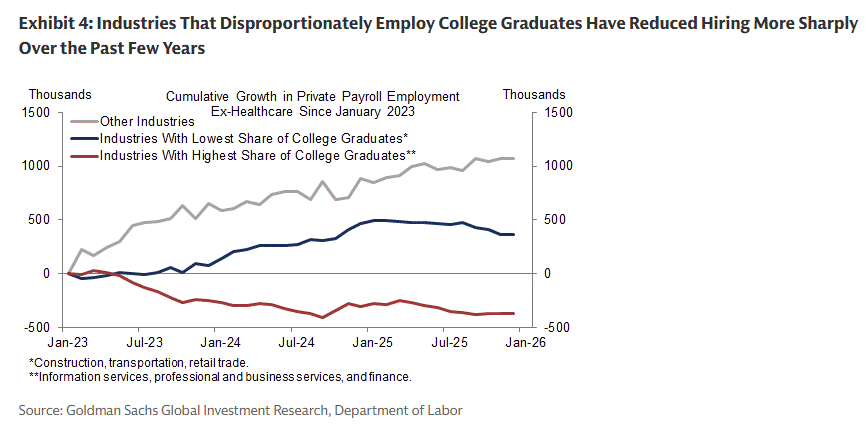

College graduates are disproportionately employed in occupations with greater shares of work tasks that can be automated following the full adoption of generative AI.

The labor force participation rate amongst the youngest-aged cohort (ages 16-24) has slumped over two points year-to-date.

Led by the tech sector, companies are replacing low-skilled younger workers with A.I. In addition, labor market turnover has declined sharply over the past few years, and the consequences fall disproportionately on young workers who are entering the labor force for the first time.

Meanwhile, some of the payroll growth slowdown is cyclical.

Companies appear to be protecting profit margins as tariffs push cost of goods (COGS) higher. One of the easiest ways for companies to manage/protect their margins is via the biggest line item of COGS: labor. Fed rate cuts could give companies the confidence that faster top-line growth will increase earnings instead.

According to the U.S. Bureau of Labor Statistics, labor costs can account for as much as 70% of total business costs. If executives are worried near-term about the White House or economic growth, work force attrition is one solution after years of labor hoarding post-pandemic.

The January employment report offered some evidence that the labor market is taking early steps toward the stabilization, but labor market data points over the last six months show a weaker trajectory – suggesting the case for stabilization is preliminary.

I continue to see the risks to the labor market forecast as tilted toward a worse outcome and see this as a key risk for the U.S. economy in 2026.

One reason is that labor demand is still concerning: job growth has been weak and narrow, job openings are still trending lower, and companies do not appear eager to hire.

More notably, in recent weeks, the risk of a faster and more disruptive deployment of artificial intelligence could be the primary disruptive factor.

Sources: Ned Davis Research, Goldman Sachs Global Investment Research, Paycor

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)