Uncertain times require discipline, plus a brief recap of 🌴Future Proof 🌴

The Sandbox Daily (3.20.2025)

Welcome, Sandbox friends.

Quick recap of Future Proof before we begin today’s note, which includes key data for investors who remain nervous over the dizzying cross currents of today’s market environment.

It’s great to be back after a fourth appearance at the Future Proof wealth festival. Most financial conferences have been in decline for years for a reason: attendees don’t capture enough value from the whole experience. Future Proof has differentiated itself in that the underlying principles are grounded in content, social interaction, focused and carefully vetted “Breakthru” meetings (akin to speed dating), entertainment, and building relationships around the community. On that last point, building professional relationships has become quite a bit more challenging with the evolution of work-from-home, especially for someone like myself who primarily works out of my home office in a non-financial hub of Annapolis, MD. I’ve created lasting professional relationships, built new friendships, met personal heroes of mine, and discovered new products and services that directly benefit clients of Sandbox Financial Partners. Hell, I even shared a Jack and Coke with Dan Ives and Brian Belski while listening to The Fray and All-American Rejects - how cool is that!! When work is fun, I feel energized and motivated to bring my best, and that’s what Future Proof has done for me.

This trip was even more special this go-round, as my wife Jen joined along for some of the FP night experiences. Day 3 of the conference coincided with the one-year anniversary of my dad’s unexpected death last year, so her presence and strength was truly appreciated on the toughest of days.

Today’s Daily discusses:

uncertain times require discipline

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.03% | S&P 500 -0.22% | Nasdaq 100 -0.30% | Russell 2000 -0.65%

FIXED INCOME: Barclays Agg Bond +0.06% | High Yield -0.14% | 2yr UST 3.964% | 10yr UST 4.241%

COMMODITIES: Brent Crude +1.96% to $72.18/barrel. Gold +0.41% to $3,053.6/oz.

BITCOIN: -1.42% to $84,401

US DOLLAR INDEX: +0.36% to 103.805

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: -0.50% to 19.80

Quote of the day

“Your time is limited so don't waste it living someone else's life.”

- Steve Jobs

Uncertain times require discipline

In some circles, growth concerns have risen alongside the risk of recession.

The rhetoric during the recent earnings calls have focused on tariffs and the potential earnings impact. Economic policy uncertainty has caused a meaningful decline in confidence. Similarly, the Fed updated its statement yesterday which now includes its own economic growth warning: "uncertainty around the economic outlook has increased."

While much of the attention and market volatility has focused on the VIX jumping from around 15 one month ago to its recent peak of 29, it’s the small adjustment (thus far) in the widening of credit spreads that reflect the real perception of economic weakness ahead. While certainly not ringing any alarm bells just yet, it does start kicking the tires on a potential spillover into credit, which would be quite problematic.

Sentiment data from a variety of sources confirm the intensifying vortex of consternation.

Many cyclical stocks such as airlines, banks, and semis are down 20-30%. Tech and momentum, even worse. Concentrated bets, like the Mag 7 for example, are likely feeling the altitude sickness much worse than diversified portfolios.

The unwind over the last month has pushed the spread between bullish investors and bearish investors into deeply oversold territory.

Yet, in other circles, multiple technicians I follow have flagged some meaningful improvement across indicators that help establish a tradable low as markets are potentially bottoming out.

Internal oversold conditions, the advance/decline line surging off the lows, and some evidence of capitulation could prove important to thinking the worst of the waterfall selling pressure is behind us.

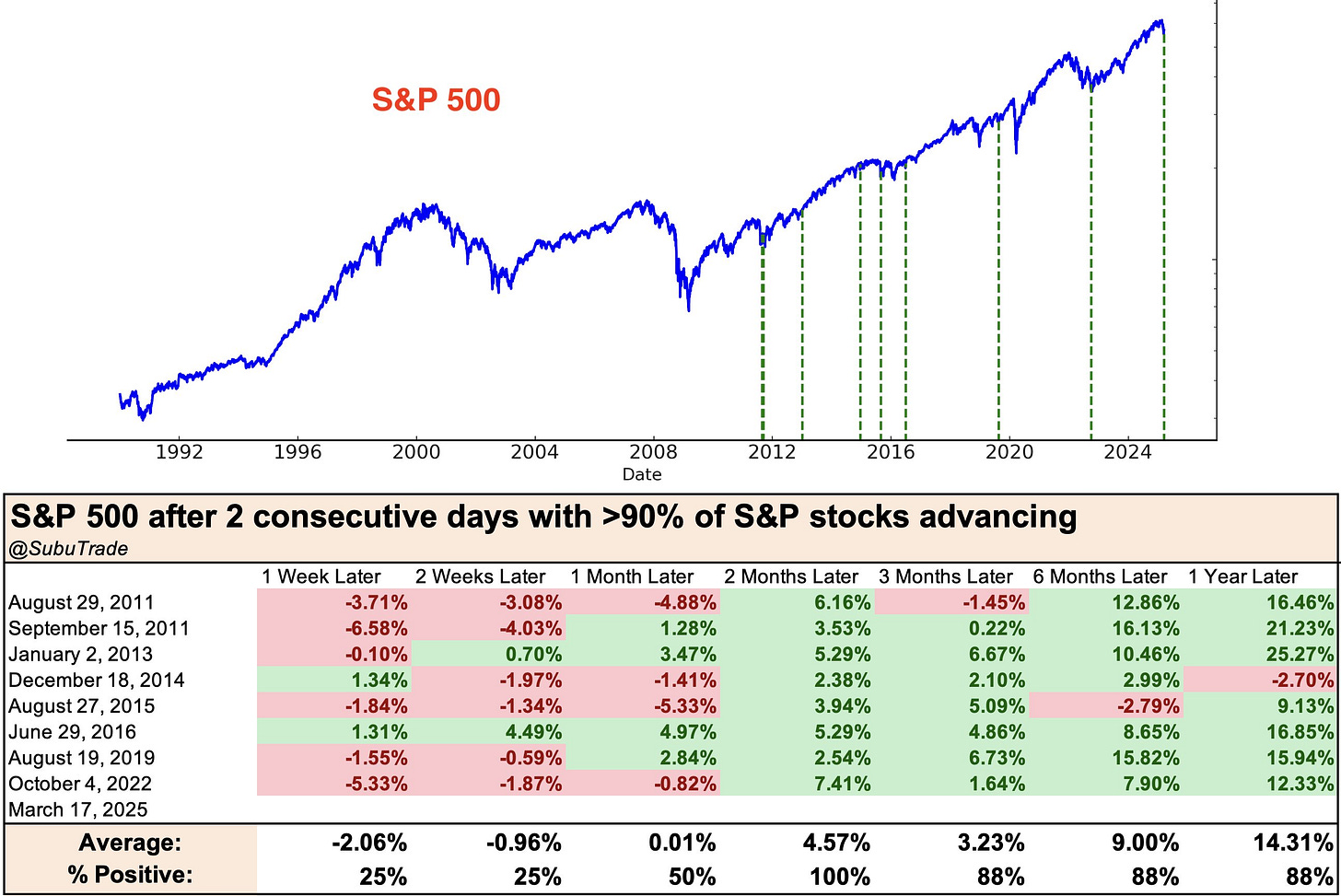

In fact, the combination of Friday and Monday’s two-day knockout punch that saw 90% of stocks advancing twice is a positive development for stocks that should not be quickly dismissed.

Forward returns are quite compelling on a 3-month, 6-month, and 12-month basis during these recent signals.

And this is what makes a market.

Two camps, bulls and bears, battling in the trenches like Michigan and Ohio State every November – fighting over inches.

Most importantly, we must collectively remind ourselves that uncertain times require discipline, not emotional over-reactions. Given the increased negative banter and many macro forecasts being revised to the downside, it’s easy to fall victim to the pervasive fear.

So, here’s one final point to lift your spirits.

Most corrections do not turn into bear markets. 14 of the 44 post-WWII corrections morphed into bear markets, while over the past three decades that ratio dropped to 4 out of 16.

More importantly, much of a market recovery happens quickly. For instance, the S&P 500 returns an average of 8.1% in the month following a non-bear market correction low, which equates to a roughly 50% retracement of the average correction loss (down 13-14%). See the chart below on the left.

This means that most of the rebound is front-loaded following the end of a correction – in other words, markets have historically shown to snap back like rubber bands. See the chart below on the right.

Sources: Ned Davis Research, JP Morgan, RenMac, SubuTrade, BMO

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: