Unchartered Tariff-tory, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (4.4.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

unchartered tariff-tory

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 -4.37% | Dow -5.50% | S&P 500 -5.97% | Nasdaq 100 -6.07%

FIXED INCOME: Barclays Agg Bond +0.09% | High Yield -1.43% | 2yr UST 3.644% | 10yr UST 3.998%

COMMODITIES: Brent Crude -5.83% to $66.05/barrel. Gold -2.08% to $3,056.8/oz.

BITCOIN: +2.37% to $84,126

US DOLLAR INDEX: +0.91% to 102.998

CBOE TOTAL PUT/CALL RATIO: 1.37

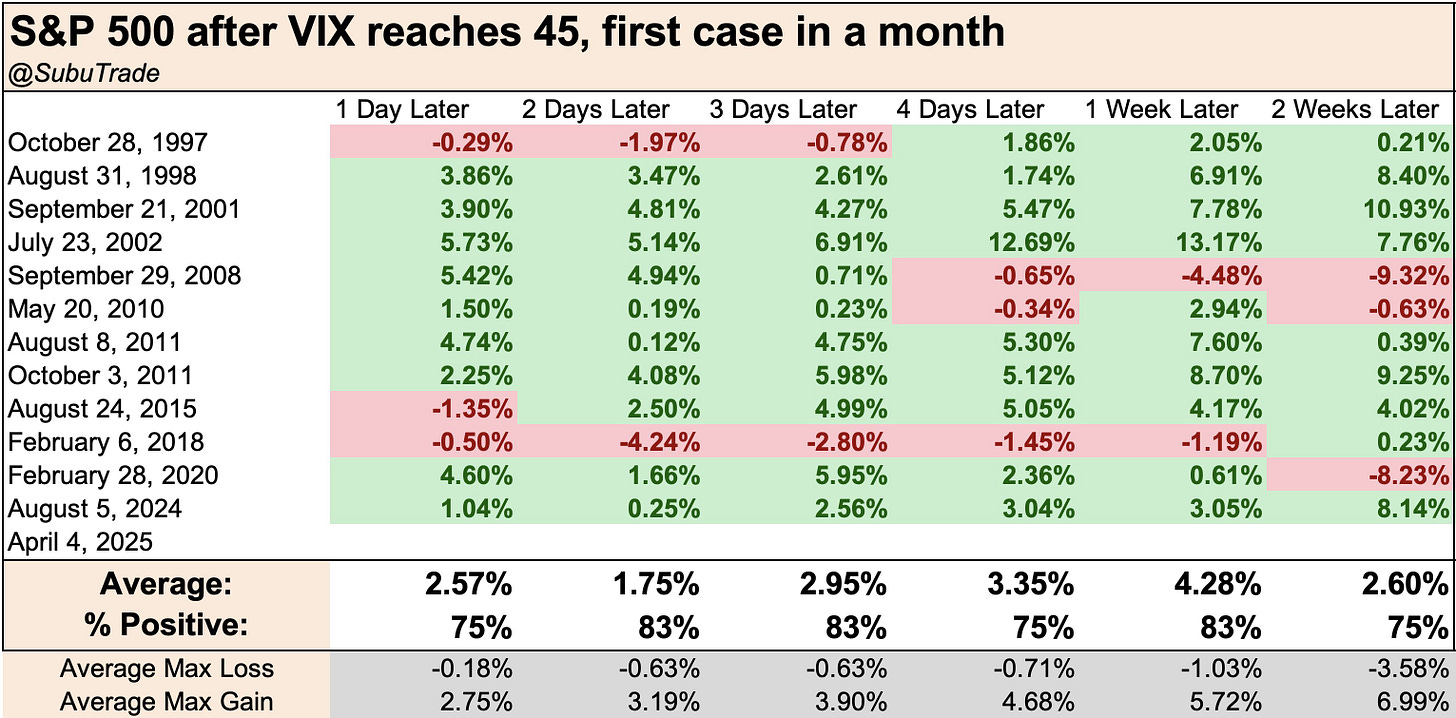

VIX: +50.93% to 45.31

Quote of the day

“The strength of a nation derives from the integrity of the home.”

- Confucius

Unchartered tariff-tory

Wow, a truly historic week for global trade and markets.

U.S. President Trump announced his “Liberation Day” plan for reciprocal tariffs on its trading partners.

The plan is twofold:

first, a 10% baseline tariff would apply to imports from all countries excluding Canada and Mexico (effective April 5) with some exclusions

second, most major trading partners – excluding Canada and Mexico – would face an additional tariff that equals half the ratio of the U.S. bilateral trade deficit with the country divided by U.S. imports from that country.

The jury deliberated and the verdict has been read:

Wharton’s Jeremy Siegel: “biggest policy mistake in 95 years”

Financial Times: “America’s astonishing act of self-harm”

Bloomberg’s Joe Weisenthal: “by basically any measure, Trump’s tariff announcement is a massive, stagflationary shock with almost no historical precedent”

Allianz’s Mohamed El-Erian: “risk of U.S. recession… uncomfortable high”

Ed Yardeni: “getting harder to be optimistic”

UBS’s Paul Donovan: “the uninhabited Heard and Macdonald Islands gets a 10% tariff (will the penguins retaliate?)”

JP Morgan: “There will be blood”

Why the visceral response?

Well, the Rose Garden trade policy announcement represented a materially harsher approach than consensus expected, myself included.

Estimates from rating agency Fitch project the average effective tariff rate on all U.S. imports will rise from 2.5% in 2024 to 22% in 2025.

This policy places the effective tariff rate above the ~20% level set by the 1930’s Smoot-Hawley Tariff Act, which has been cited by numerous economists and historians as a contributing factor to the Great Depression.

Should these tariff levels persist for an extended period of time, it is increasingly likely to lead the U.S. economy into recession with upside risks to inflation, which leaves the Federal Reserve in a precarious position.

Recission betting-odds from Kalshi have rocketed higher in the last few days:

The market response has been jarring to all.

The Chernobyl Reactor 4-like meltdown has seen the S&P 500 lose 10.5% over the last two days, its worst two-day decline since March 2020.

With roughly $6 trillion in market cap wiped out over the last two trading sessions, you’ll find the average large-cap U.S. stock is now down -30% from its most recent 52-week high.

The Trump administration has publicly stated their desire to see lower oil prices, borrowing costs lower, and a weaker U.S. dollar.

Let’s quickly review each one.

Brent Crude contracts trading at ~$64 are back to their lowest levels since 2021, which is helpful for the economy, bringing down inflation, and lowering prices at the gas pump.

Interest rates have fallen sharply, reflecting the realization that the global economy is at a growing risk of recession. The 10-year U.S. Treasury is below 4% and heading lower.

The U.S. dollar has been crashing for three months and it’s happening for all the wrong reasons, namely a big markdown in growth expectations.

This suggests the administration is accomplishing its market-based goals in real time.

Now we must ask ourselves: has the market repriced enough downside in growth expectations that we can stabilize and rebuild from here?

For weeks, investors have been looking for that traditional, short-term crescendo in selling pressure that often mark tradable bottoms – wipeout levels of indiscriminate, price-insensitive liquidation.

An intense unwind to flush out complacent positioning and exhaust the last of the sellers.

The various financial stress indicators we all follow that move along the same chain – a VIX spike, junk bond spreads widening out, expansion in the 20-day new lows list – have more or less all flared higher together.

Historically, this is short-term positive for market relief.

Missing for weeks was stress in the various market-based risk measures and any evidence of capitulatory selling. With those boxes now checked, this would suggest the end of the intense selling pressure is near.

This aligns with a Goldman Sachs proprietary indicator that has declined to a level which previously signals a tactical trading opportunity, confirming the rapid deterioration in both positioning and sentiment.

What’s next?

Over the weekend, investors will be closely watching how countries and specific companies respond to the tariffs and their willingness to negotiate deals with the Trump administration.

Sources: JPMorgan, Statista, Kalshi, Bespoke, SubuTrade, Goldman Sachs

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Morningstar – How to Avoid Outliving Your Retirement Savings? It’s All in the Sequence. (Jeffrey Ptak)

We’re Gonna Get Those Bastards – The Power of Negative Thinking (Jared Dillian)

Yield to Maturity – The Information Age and Markets (Cliff Cornell)

Wall Street Journal – Trump Just Shredded the Economic Playbook. Here Are Your Next Investing Moves. (Jason Zweig)

Discipline Funds – Finding Certainty in a Sea of Uncertainty (Cullen Roche)

Podcasts

RenMac Off-Script – Obliteration Day (YouTube, Spotify, Apple Podcasts)

Risk Reversal Podcast – Josh Brown on Trump, Tariffs, and Where Investors Go From Here (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The White Lotus – Greg Hunt, Belinda Lindsey (IMDB, YouTube)

Music

SYML – Carry No Thing (Spotify, Apple Music, YouTube)

Books

Vishal Khandelwal – Boundless (Safal Niveshak)

Fun

Metro Detroit Golfers – Stafford to DeChambeau (Instagram)

Tweet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: