Understanding consumer debt in a two-speed economy, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (5.16.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

understanding consumer debt in a two-speed economy

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.89% | Dow +0.78% | S&P 500 +0.70% | Nasdaq 100 +0.43%

FIXED INCOME: Barclays Agg Bond +0.06% | High Yield +0.11% | 2yr UST 3.993% | 10yr UST 4.441%

COMMODITIES: Brent Crude +1.24% to $65.33/barrel. Gold -0.72% to $3,203.4/oz.

BITCOIN: +0.54% to $103,913

US DOLLAR INDEX: +0.21% to 101.089

CBOE TOTAL PUT/CALL RATIO: 0.68

VIX: -3.31% to 17.24

Quote of the day

“Service to others is the rent you pay for your room here on earth.”

- Muhammad Ali

Understanding consumer debt in a two-speed economy

The financial health of consumers is an important indicator of the broader economy. Consumer spending represents approximately 70% of all spending across the economy, and steady purchases are one reason economic growth has exceeded expectations over the past few years.

However, recent consumer weakness is often cited as a concern among investors worried about a possible recession.

Recent headlines paint a picture of rising debt levels and late payments amid worries of inflation and slowing growth. At the same time, other economic data shows strong consumer balance sheets, record-high household net worth, and manageable monthly payments. This apparent contradiction has left many investors wondering which narrative to believe, and whether cracks are forming beneath the surface.

The answer lies in understanding what economists sometimes call a “two-speed economy,” where financial situations vary across consumer segments based on income, wealth levels, credit scores, and more.

Consumer health indicators should be viewed as part of a more comprehensive picture that includes savings rates, debt service ratios, and overall net worth. This broader view helps explain why financial markets have remained relatively resilient despite these challenges.

Late payments are on the rise

One of the most closely watched indicators of consumer stress is the delinquency rate on various types of loans. Delinquencies occur when a consumer is late on their debt payments.

Over the past two years, credit card and auto loan delinquencies have increased significantly, as shown in the chart below.

Delinquencies are typically tracked in stages based on the number of days a payment is past due. A loan enters early-stage delinquency when payment is 30 days late, with severity increasing at 60 and 90+ days. The transition to new delinquencies is particularly important since it captures consumers who have recently begun struggling with payments. The fact that 90+ delinquencies for credit card loans have increased suggests that some consumers face ongoing financial difficulties.

Auto loan delinquencies are particularly telling because consumers tend to prioritize the repayment of these debts, even during periods of financial difficulty. This is because having a car is essential for commuting to work and maintaining daily activities.

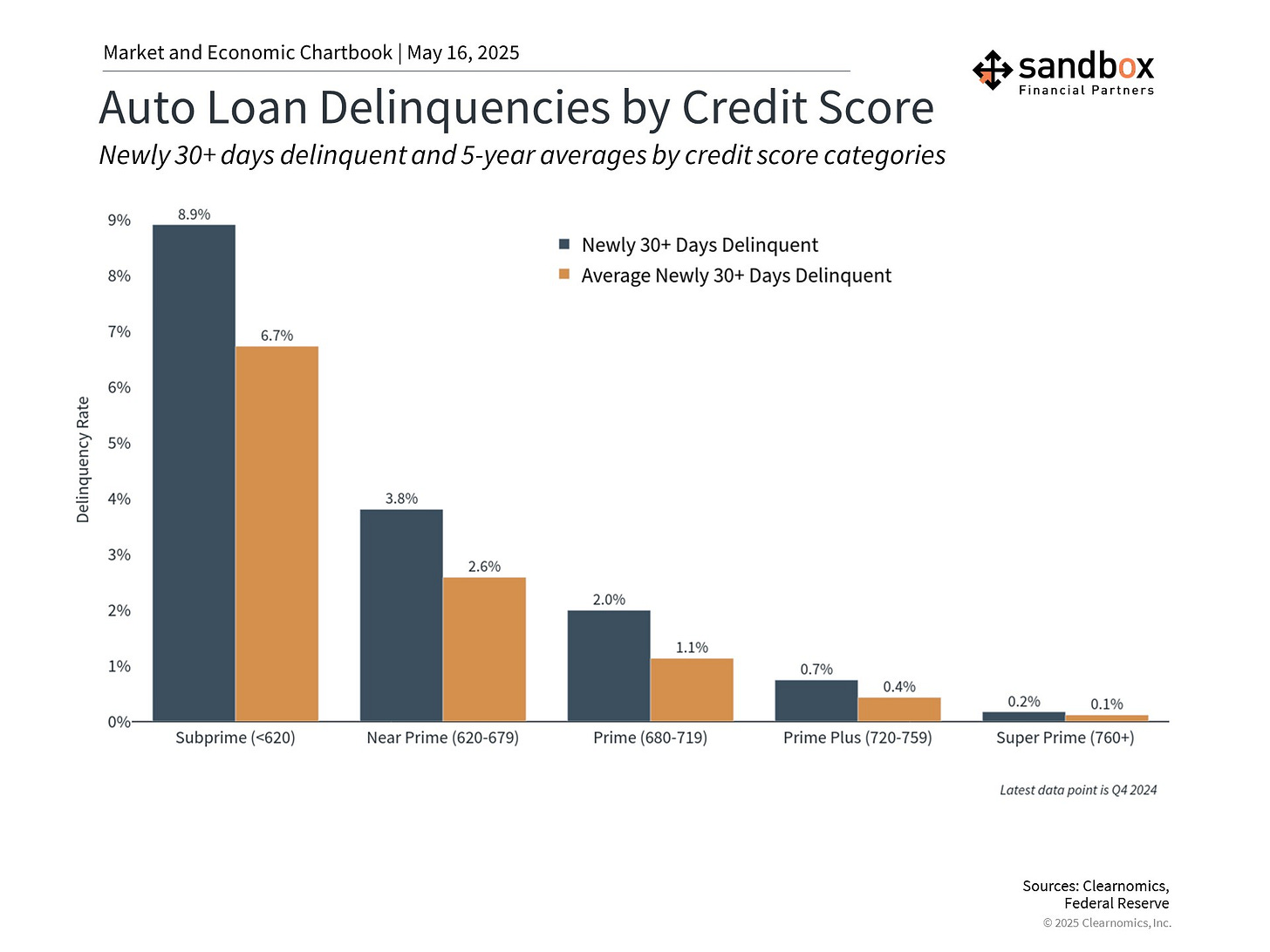

Delinquencies vary significantly by credit quality

What explains rising delinquencies and the divergence among types of loans?

Recent data shows that these factors are driven primarily by varying credit quality.

Credit quality is typically categorized along a spectrum, from subprime (borrowers with weaker credit histories) to prime (those with stronger credit profiles). Prime borrowers generally present lower default risk to lenders, while subprime loans often command higher interest rates due to a lower likelihood of being repaid in full.

Current figures suggest that the overall rise in auto loan delinquencies is concentrated heavily among borrowers with lower credit scores. In fact, the difference in delinquency rates between subprime and prime borrowers is significant both in absolute terms and relative to their historical averages. Other data suggest the same pattern can be found in credit card delinquency rates.

This pattern also explains why major banks have not signaled broader concerns about the financial health of consumers. During recent earnings calls, bank executives noted the continued resilience of their consumer portfolios. This is true despite tariff fears, poor consumer confidence, heightened inflation concerns, and a plethora of worries.

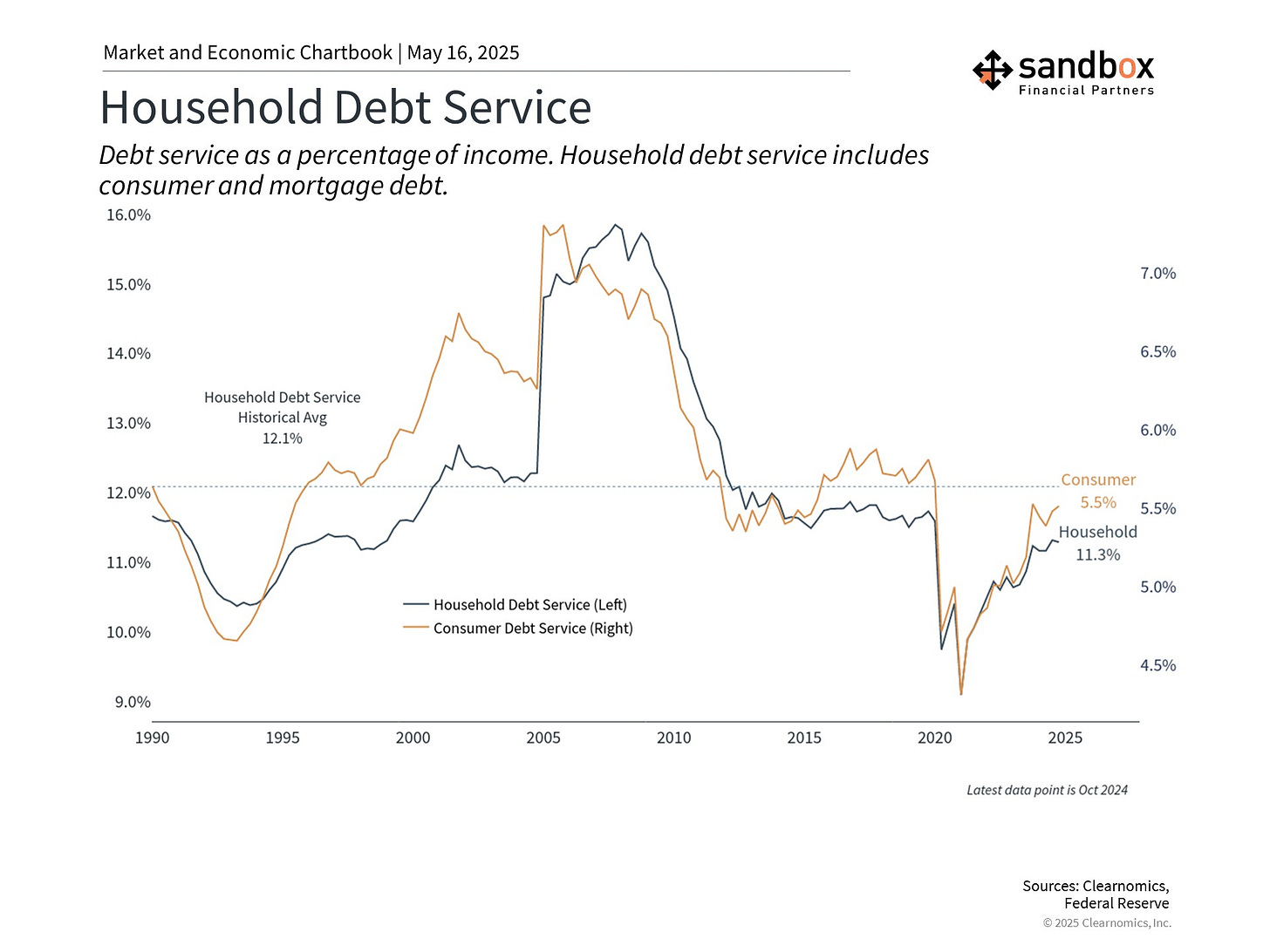

Overall debt service levels remain manageable

The reality is that debt levels tend to rise over time as the economy grows.

To properly assess consumer financial health, it's important to consider debt levels in relation to income and savings. For instance, the ratio of consumer debt payments to household income currently stands at 5.5%. While this figure is moving toward its long-term average, it remains low by historical standards. This suggests that the average consumer is still in a healthy position when it comes to managing their monthly payments.

Similarly, household savings rates have stabilized in recent months, with Americans now saving approximately 4.6% of their paychecks, although this remains below the historical average of 6.2%. Also, U.S. household net worth remains near record levels despite the market and economic uncertainty of the past few years. Together, these factors provide a strong foundation for the financial health of many consumers.

It's important to acknowledge that these aggregate statistics can mask significant variation across demographic and economic groups. The challenges faced by subprime borrowers in this “two-speed economy” are a real and concerning development. However, from a macroeconomic and market perspective, the broader indicators of consumer finances remain healthy.

Bottom line, overall consumer trends are still strong.

The two-speed economy explains why the overall consumer picture looks resilient despite pockets of financial stress.

Sources: New York Fed, Clearnomics

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Noahpinion – Globalization Did Not Hollow the American Middle Class (Noah Smith)

Can I Retire Yet – Is It Time to Take Your Medicine? (Chris Mamula)

The Verge – Grifters Thrive Under Trump’s Scam-Friendly Administration (Gaby Del Valle)

Carson Group – How to Identify a Recession and Why It Matters for Investors (Sonu Varghese)

Of Dollars and Data – Has the American Dream Become Unattainable? (Nick Maggiulli)

The Sandbox Pulse – April’s Roller Coaster: Why Volatility Was a Win For Your 401(k) (Brian Salcetti)

Podcasts

The Compound and Friends – The Soul of a Short-Seller with Carson Block of Muddy Waters (YouTube, Spotify, Apple Podcasts)

Music

The Fray – Known You Always (Spotify, Apple Music, YouTube)

Movies/TV Shows

The Four Seasons – Tina Fey, Steve Carell, Will Forte (Netflix, IMDB, YouTube)

Books

Sahil Bloom – The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life (Amazon)

Fun

Saturday Night Live – Washington’s Dream feat. Nate Bargatze (YouTube)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: