United States vs. Rest of World

The Sandbox Daily (5.14.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

United States vs. Rest of World

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.57% | S&P 500 +0.10% | Dow -0.21% | Russell 2000 -0.88%

FIXED INCOME: Barclays Agg Bond -0.29% | High Yield -0.36% | 2yr UST 4.057% | 10yr UST 4.542%

COMMODITIES: Brent Crude -1.19% to $65.84/barrel. Gold -1.90% to $3,186.1/oz.

BITCOIN: -1.12% to $103,526

US DOLLAR INDEX: +0.09% to 101.091

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: +2.20% to 18.62

Quote of the day

“Sometimes God has to lay you flat on your back to get you to look up.”

- Rick Warren

United States vs. Rest of World

This afternoon I had the pleasure to sit down with Neil Dutta of Renaissance Macro Research, head of economic research and frequent contributor to major financial media networks and podcasts. It’s not often to have a visitor of his gravitas visit the mid-Atlantic region.

For those unfamiliar with his work, Neil most recently earned his flowers as the economist who correctly called the “no landing” outcome in 2023 and 2024 when uniform consensus on the street warned of imminent recession, or a “hard landing” in Wall Street parlance.

Among our wide-ranging conversation, I couldn’t help but notice we regularly revisited the same general theme – one in which we both agreed was THE hot button topic with our respective clients in 2025.

Is the American exceptionalism trade over?

Is it time to look beyond the U.S. markets and find opportunity abroad?

The shift in U.S. trade policy marks a significant realignment of global economic relationships. While much remains uncertain, it is reasonable to question if this marks a longer-term inflection in regional equity performance.

The self-inflicted trade policy wounds from President Trump and cross border capital flows away from the United States, as well as the ongoing American underperformance relative to global ex-U.S. equities, raise concerns as to whether a more permanent restructuring is afoot.

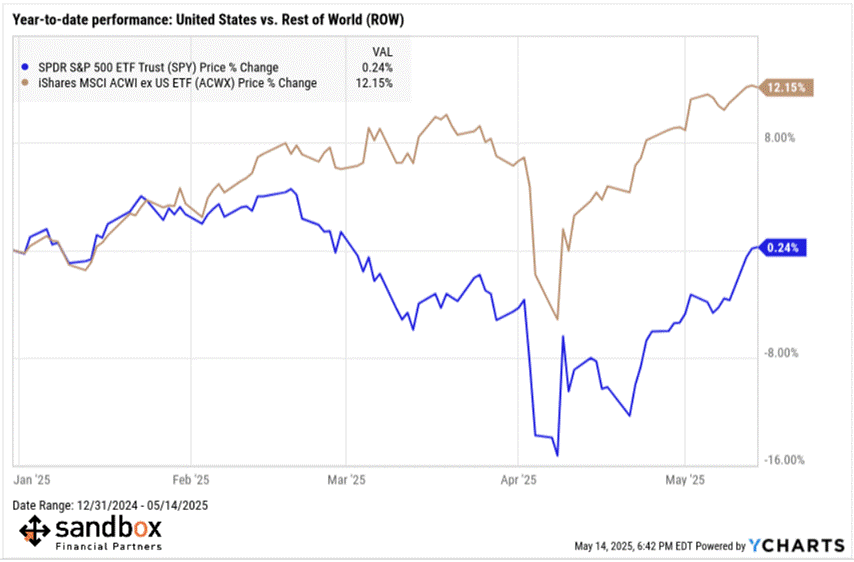

To date, the 2025 performance gap is one of the most notable on record, as U.S. stocks are roughly flat while international stocks are positive by double digits.

This is unfamiliar ground for many investors.

Among many manifestations within the data, let’s review three oft-cited drivers that suggest this unwind away from the United States has further room to run.

Valuation gap of international markets vs. U.S. equities is reversing

International equities currently trade near a 1.5 standard deviation P/E discount relative to U.S. equities, tightening from a 2 standard deviation discount at 2024 year-end.

And yet, the persistence of the U.S. premium exists because of stronger economic growth, higher returns on capital from profitability and efficiency gains, and Silicon Valley tech leadership.

Weakening U.S. dollar domination

The dollar index (“DXY”) strengthened over the last 15 years and this dollar strength has been a contributing factor to the outsized returns of U.S. assets. However, the U.S. dollar has come down from near-historic highs in 2022. Periods of a falling U.S. dollar have historically coincided with periods of international equity outperformance vs. the U.S. (examples: late 1980s, post 2000 TMT bubble).

The dollar might not trade like a safe haven as much as it has historically, especially if the real interest rate differential is narrowing globally and if the Fed’s credibility is called into question.

While it is true the dollar is softer by ~10% year-to-date (left chart below) – a notable move for any established currency but especially significant for the world’s reserve currency – the longer term chart shows that a more meaningful de-dollarization move lower is needed for this claim to gain real traction (right chart below).

Sentiment shifts supported by structural catalysts

European fiscal spending and Japanese corporate governance reform are durable, long-term tailwinds supporting internationally developed equity markets.

The proliferation of defense spending and development of new energy infrastructure have become top priorities.

Another source of support in recent weeks has been a greater sense of optimism over the potential of a ceasefire in the Russia-Ukraine conflict. Resolution over geopolitical risks should prove positive for cross-border trade.

The presence of positive catalysts and momentum abroad pose downside risks for U.S. assets, to be sure.

However, when we review the relationship between relative equity performance of the United States vs. Rest of World equities (ROW), betting on a regime shift after 15 years of U.S. market dominance is like calling the top.

Possible but historically rare and impossible to time.

Momentum, structural advantages, and investor inertia don’t unwind overnight.

While ex-U.S. equities have seen notable year-to-date (YTD) outperformance, the magnitude is small in the context of the long-term trend.

Sources: JPMorgan, Bespoke Investment Group, Eaton Vance, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: