U.S. 3rd quarter GDP advance print, plus the ECB hikes its key rate by 75 bps, big headlines from big corporations, and $SPX market breadth improves

The Sandbox Daily (10.27.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the U.S. 3rd quarter GDP advance report, the European Central Bank hikes its key policy rate by 0.75%, big headlines from big corporations, and a technical analysis update on S&P 500 breadth metrics.

Let’s dig in.

Markets in review

EQUITIES: Dow +0.61% | Russell 2000 +0.11% | S&P 500 -0.61% | Nasdaq 100 -1.88%

FIXED INCOME: Barclays Agg Bond +0.52% | High Yield +0.74% | 2yr UST 4.278% | 10yr UST 3.908%

COMMODITIES: Brent Crude +1.09% to $96.73/barrel. Gold -0.14% to $1,668.5/oz.

BITCOIN: -1.51% to $20,405

US DOLLAR INDEX: +0.77% to 110.548

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: +0.40% to 27.39

U.S. 3rd quarter GDP back in positive territory after two sequential negative quarterly prints

The U.S. economy grew more than expected in the 3rd quarter after two quarters of declines, boosted by strong consumer spending.

The Commerce Department’s advance report on Gross Domestic Product (GDP) showed a gain of +2.6%, better than economists’ forecasts of +2.3%. GDP had fallen -1.6% in the first quarter and -0.6% in the second. Personal consumption expenditures, which account for the biggest part of the economy, advanced +1.4%, more than expected although less than in the previous quarter.

Along with consumer spending, 3rd quarter GDP was lifted by exports, non-residential fixed investment (ie CapEx), and government spending. Consumers spent more on services, which helped offset fewer purchases of goods. Exports were boosted by increases in travel as COVID-19 restrictions eased, and other business services, mainly in the financial sector. Defense purchases and higher wages sent government spending higher.

GDP was negatively impacted by residential fixed investment, which was driven down by a decrease in new single-family home construction and brokers’ commissions, as well as a drop in private inventory investment. Imports, which subtract from GDP, declined.

Despite immense downside risks this year from the end of fiscal stimulus, aggressive Fed tightening, high inflation, and adverse geopolitical developments, the economy has averted recession so far. But amid evidence of underlying domestic demand weakness in today’s report, and as leading indicators continue to point to further slowdown in growth in the coming months and quarters, there remains an elevated risk of recession in 2023. Coupled with signs of inflation moderating, this opens the door for the Fed to step down to a less restrictive policy path going forward.

Source: Ned Davis Research

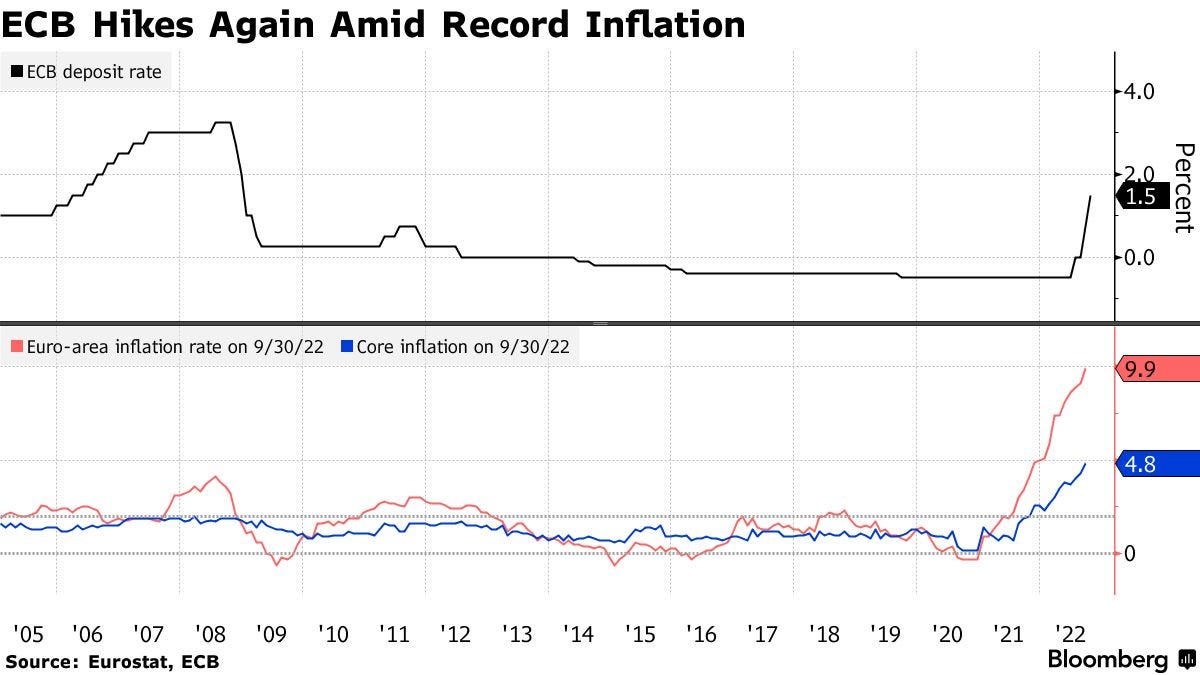

European Central Bank hikes policy rate by 0.75%

The European Central Bank (ECB) raised interest rates by 0.75% for the second time in a row Thursday to take the key policy rate to 1.50%, but signaled mounting concerns about economic growth, prompting investors to bet that the bank will soon reduce the scale of its rate hikes.

ECB President Christine Lagarde said the bank would likely raise rates further over the coming meetings. But she also sounded a cautious note on the deteriorating growth outlook for the eurozone economy, and emphasized that the ECB had already made substantial progress in phasing out easy money.

The ECB has moved less aggressively than the Fed to raise interest rates this year. That reflects the region’s weaker recovery from the Covid-19 pandemic, the hit to activity dealt by the Ukraine war and concerns about economic fragility in Southern European nations such as Italy.

Source: Bloomberg, Wall Street Journal

Big headlines from big corporations

As the corporate earnings cycle takes center stage, several mega-cap brands find themselves catching major headlines.

Adidas, the German sportswear giant, answered calls to drop Ye (the artist formerly known as Kanye West), joining the list of brands – Balenciaga, Vogue, Creative Artists Agency, Gap, JPMorgan Chase – that have distanced themselves from the rapper-turned-fashion-magnate after he made a number of anti-Semitic remarks on podcasts and social media. Adidas’s move was well received by the public and will come with a substantial financial cost. Some estimate that terminating the partnership will roughly halve the company’s profits for 2022 — a year that’s already seen the company plagued by slowing sales and a share price that’s fallen more than 60%.

It's been a tough week in big tech. Google’s parent company, Alphabet, reported its slowest growth since the pandemic, with users and brands skipping ads on YouTube. The video platform's ad revenue actually shrunk 2% year-on-year, spooking investors. Microsoft didn’t fare much better, as the company’s cloud division, Azure, missed expectations. And then Meta Platforms, the parent company of Facebook, Instagram, and Whatsapp, closed at its lowest level since February 2016 after wiping out some $700 billion in market cap in 2022 alone after announcing an ambitious and expensive pivot to the metaverse in which Meta expects its 2022 total expenses to be in the range of $85 billion to $87 billion and 2023 total expenses to be between $96 billion and $101 billion!

Meanwhile, Coca-Cola earnings were a rare bright spot in the busy earnings calendar earlier this week, with a refreshingly positive set of numbers. The drinks conglomerate, which owns Sprite, Fanta, and a number of other brands, raised prices to contend with commodity costs and shipping expenses and still saw their YoY revenue rise 10% last quarter.

Source: Chartr

Continued technical improvement

Breadth metrics for the S&P 500 improved on the week, but there is still a lot of work to be done before we can make the claim that breadth is healthy.

Advance/Decline Line: Below the 50-day moving average, but moving higher after making a cycle low on Friday, October 14th

S&P 500 % of issues above their 200-Day Moving Average: 29%, from 19% last week

S&P 500 % of issues above their 50-Day Moving Average: 49%, from 21% last week

S&P 500 % of issues above their 20-Day Moving Average: 83%, from 57% last week

Source: Potomac Fund Management

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.