U.S. debt ceiling, plus leading economic indicators, federal debt, and industrials

The Sandbox Daily (2.21.2023)

Welcome, Sandbox friends.

Today’s Daily discusses what is priced into the upcoming U.S. debt ceiling, leading economic indicators are flashing red (again), the federal debt maturity schedule and associated costs, and the strength in Industrials.

Let’s dig in.

Markets in review

EQUITIES: S&P 500 -2.00% | Dow -2.06% | Nasdaq 100 -2.41% | Russell 2000 -2.99%

FIXED INCOME: Barclays Agg Bond -0.94% | High Yield -1.54% | 2yr UST 4.729% | 10yr UST 3.954%

COMMODITIES: Brent Crude -1.44% to $82.86/barrel. Gold -0.35% to $1,843.8/oz.

BITCOIN: -2.37% to $24,208

US DOLLAR INDEX: +0.34% to 104.207

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: +7.72% to 22.87

The debt ceiling – what’s priced in?

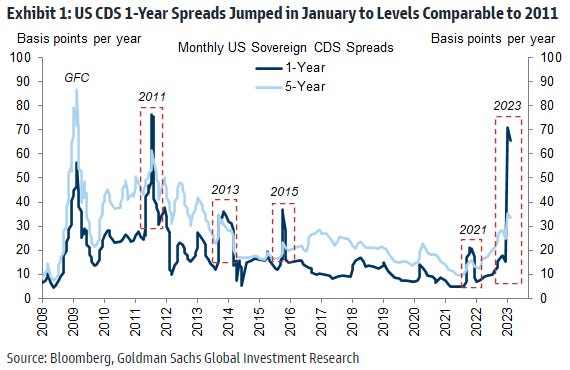

General consensus expects the debt limit deadline to hit sometime in August, and many strategists view the risk that Congress fails to raise the debt limit by the deadline as higher than any point since 2011.

Congress has always raised the debt limit before the Treasury has been forced to delay scheduled payments – and that remains the base case for this year’s deadline. Nonetheless, past debt limit uncertainty has been characterized by two main financial market reactions: heightened volatility and dislocation of Treasuries maturing closest to the stated deadline.

So far, however, debt limit-related effects on financial markets are very limited. The effects have been most pronounced in 1-year US sovereign CDS spreads, which have already reached their highest level since the 2011 debt limit episode. Five-year spreads have shown smaller but still meaningful widening.

Swap spreads suggest the Treasury maturing August 17 – a date around the estimated debt limit deadline – is trading “cheap” vs. swaps compared to surrounding points, implying it may be incorporating some risk. Overall, however, the current noise in the curve makes it hard to draw many definitive conclusions, which may be consistent with the substantial uncertainty surrounding the exact deadline.

Once the debt limit deadline becomes clearer, expect markets to price higher volatility around the deadline and impose a greater risk premium on Treasuries maturing near the date. As the main source of uncertainty is the level of April tax collections, the market should expect greater clarity on the deadline by late April or early May.

Source: Goldman Sachs Global Investment Research

Leading indicators still point to weakness ahead

The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major global economies. Today we’re looking at the Leading Economic Index (LEI), which made headlines again last week.

The Conference Board’s Leading Economic Index (LEI) fell -0.3% in January, down for the 10th consecutive month and down -5.9% on a YoY basis. The measure is in the midst of its longest streak of declines since 2009 as steep interest-rate hikes by the Federal Reserve to fight persistently elevated inflation began to spread across the economy.

Clearly the forward-looking indicators suggest enduring, widespread weakness across the economy. While no forecasting system is perfect, this one has a pretty good track record. The Index consists of 10 components that indicate the short-term future course of various sectors of the economy and are combined into a composite indicator of general economic performance.

“The Conference Board still expects high inflation, rising interest rates and contracting consumer spending to tip the US economy into recession in 2023,” Ataman Ozyildirim, senior director for economics at the Conference Board, said in a statement.

Source: The Conference Board, Ned Davis Research, The Daily Shot Editor

Expensive roll costs are coming

Prevailing interest rates will replace the low rates on outstanding debt as securities mature and are replaced by higher interest paper. This will happen sooner than one might think – roughly half the federal debt outstanding matures in the next 3 years.

The Interest Expense on U.S. Public Debt rose to $783 billion over the past year, a record high which is catching the attention of markets and U.S. citizens alike. With a balance sheet that has ballooned since COVID-19 and interest rates materially higher than just one year ago, the cost to finance America’s debt is becoming very expensive. In fact, if it continues to increase at the current pace, it will soon be the largest line item in the Federal budget, surpassing Social Security.

Source: Horizon Kinetics, Charlie Bilello

Strength in industrials

Despite last year’s sector losers (Consumer Discretionary, Communication Services, Technology) leading market performance in 2023, it’s Industrials that continue to show broad-based strength.

After trading in a sideways range on a relative basis for over two years, industrials are on the verge of reasserting their leadership role relative to the overall market.

Here’s a ratio chart showing the equal-weighted Industrials group versus the equal-weighted S&P 500 Index, removing the market cap factor and just looking at how the average Industrial stock is doing against the average stock in the market.

The sector bottomed relative to the rest of the market in early 2022, then things really got going in the fall when the sector broke out and ripped to multi-year relative highs.

We once again see a sector that's on the verge of breaking out of a multi-year consolidation. A failed move in December resulted in a mean reversion – but not a trend change. Will this attempt be the real deal?

Source: Grindstone Intelligence

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.