U.S. dollar: down but not out

The Sandbox Daily (8.4.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. dollar: down but not out

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.10% | Nasdaq 100 +1.87% | S&P 500 +1.47% | Dow +1.34%

FIXED INCOME: Barclays Agg Bond +0.08% | High Yield +0.34% | 2yr UST 3.679% | 10yr UST 4.194%

COMMODITIES: Brent Crude -1.48% to $68.64/barrel. Gold +0.88% to $3,429.8/oz.

BITCOIN: +0.37% to $114,857

US DOLLAR INDEX: -0.43% to 98.718

CBOE TOTAL PUT/CALL RATIO: 0.94

VIX: -14.03% to 17.52

Quote of the day

“I wish there was a way to know you’re in the good old days before you’ve actually left them.”

- Andy Bernard (Ed Helms), The Office

U.S. dollar: down but not out

One of the biggest themes in markets this year has been the unrelenting downward pressure on the U.S. dollar, which has had varied effects on other asset classes.

For decades, investors have flocked to American markets for safety and/or growth, which in turn benefitted the greenback.

Now, investors are rethinking the calculus of unwavering U.S. dollar strength.

A currency’s value is typically measured in terms of another, and given the dollar’s dominance in global trade, it is usually compared against a basket of other currencies, which can be weighted in different ways.

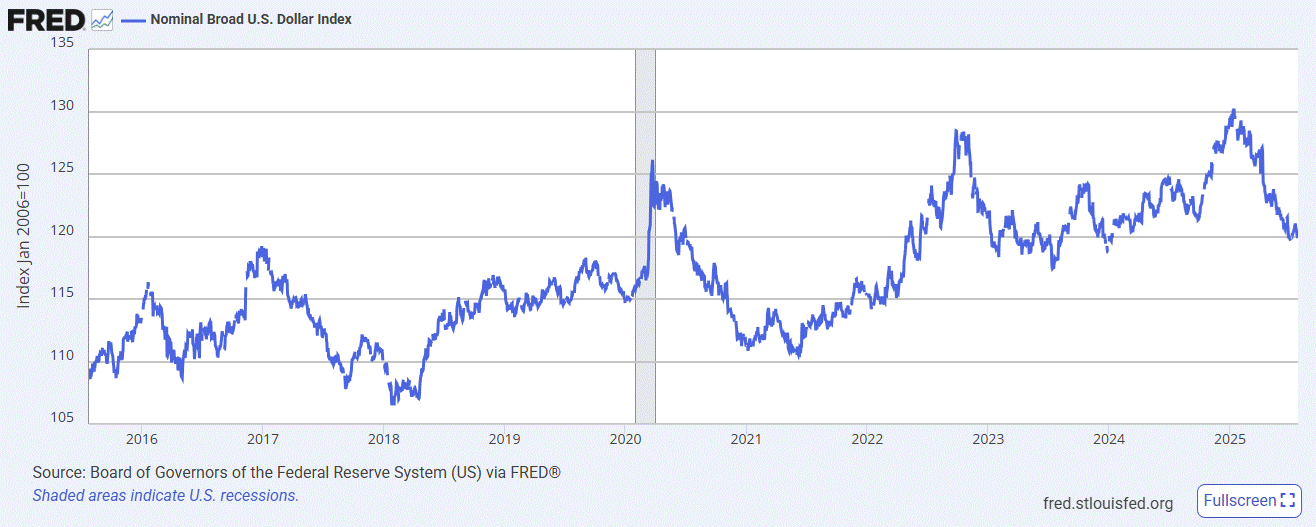

One method is to use the nominal broad U.S. dollar index – what used to be known as the trade-weighted U.S. dollar index. It provides a weighted average of the dollar against a broad group of major U.S. trading partners, with the top three weightings represented by China, Mexico, and Canada.

This year, the index has slumped roughly 10% from the highs in early January.

A weaker dollar typically boosts the overseas earnings of U.S. companies by making their exports more attractive in those markets.

During the current Q2 earnings season, several large multinational corporations have noted higher profits and an improved annual forecast due to the weaker dollar.

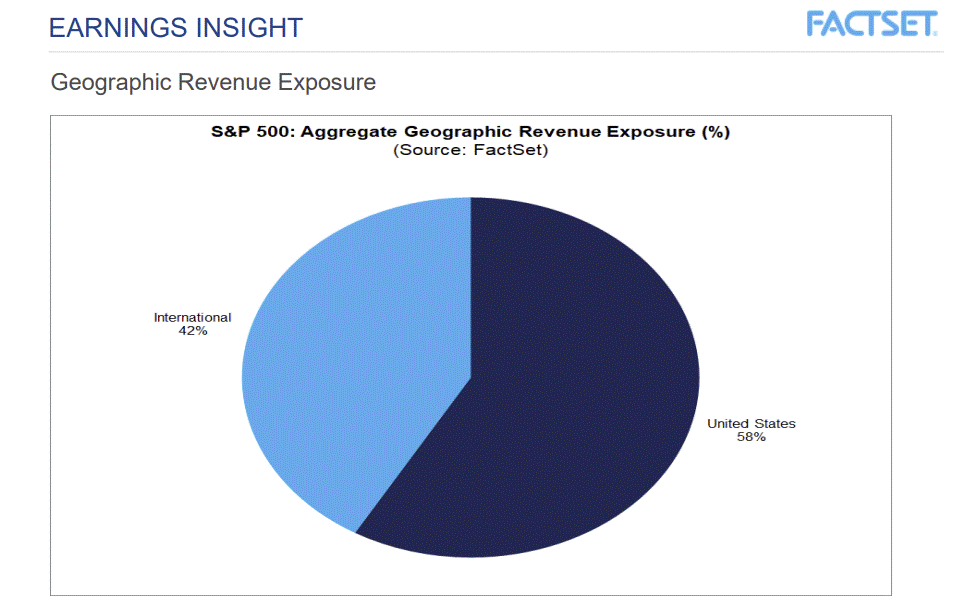

Per FactSet reporting, just over 40% of revenue from S&P 500 companies comes from non-U.S. markets, so the currency factor is a notable tailwind if the dollar continues to slide.

However, it remains to be seen whether this trend persists or just temporary in nature.

Investors may appreciate the currency-driven gains in the short-term, but organic growth in revenue and earnings tend to be the most important factors for equity returns over the long haul.

Furthermore, the dollar should stabilize once the world adjusts to shifting trade policies.

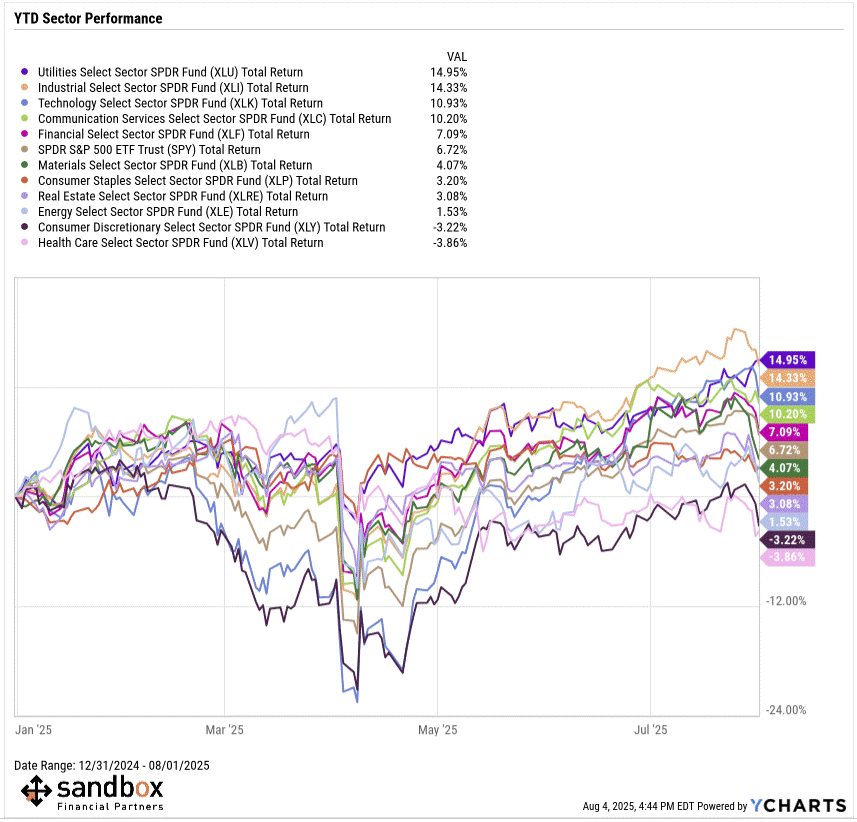

In the meantime, two sectors that typically have the most international exposure are Technology and Industrials, which are some of the best performers this year.

Sources: St. Louis Fed, FactSet, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)