U.S. dollar, plus Europe's energy crisis, investor sentiment, EV production, and U.S. support for Ukraine

The Sandbox Daily (12.22.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the U.S. dollar digging in at former resistance after significant downside pressure, the energy crisis in Europe, looking back at investor sentiment in 2022, U.S. electric vehicle production by brand, and how much aid and support the United States has provided Ukraine.

Tomorrow (Friday 12/23) is the last Sandbox Daily of 2022.

Let’s dig in.

Markets in review

EQUITIES: Dow -1.05% | Russell 2000 -1.29% | S&P 500 -1.45% | Nasdaq 100 -2.49%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield -0.62% | 2yr UST 4.283% | 10yr UST 3.684%

COMMODITIES: Brent Crude -0.68% to $81.69/barrel. Gold -1.30% to $1,800.1/oz.

BITCOIN: -0.16% to $16,797

US DOLLAR INDEX: +0.14% to 104.393

VIX: +9.47% to 21.97

CBOE EQUITY PUT/CALL RATIO: 2.03 (!! – see below on the parabolic move)

Dollar digs in

The U.S. Dollar Index (DXY) is finding its footing after experiencing significant downside pressure in recent weeks. Price is currently testing a critical level of former resistance marked by a shelf of former highs.

With so much price memory here, this area represents a logical level for demand to absorb supply. So far, that’s the case as former resistance has become support.

If DXY begins to mean revert in the coming days, we could expect risk assets to come under increased selling pressure.

On the other hand, a downside violation of this critical level would likely result in a tailwind for stocks and risk assets alike.

Source: All Star Charts

Energy crisis in Europe

The war in Ukraine added to European uncertainty, market volatility, and price pressures in 2022. Sharply higher natural gas prices contributed to the tighter financial conditions and depressed sentiment that likely pushed the euro area into recession in the 4th quarter.

We’re encouraged by Europe’s nimble adaptation to a sharp reduction in Russian gas imports. As the chart below shows, substitutions to supply in 2022 came from a combination of other fuels, renewables, supply from other sources, and existing storage. Even as those options soften the blow, the market is expecting that gas demand will have to contract by about 15% this winter relative to last year.

In the shorter term, high energy and food prices will continue to weigh on real household disposable incomes, while uncertainty about the war in Ukraine will impact consumer confidence. In the longer term, the extent of European gas shortages will be determined by the ability of countries to secure alternative energy supplies at a reasonable price.

Source: Vanguard 2023 Outlook

Year of the bears

The misery of 2022 has continued when it comes to investor sentiment. In the latest weekly sentiment poll from the American Association of Individual Investors (AAII) poll, bullish sentiment declined from 24.3% to 20.3%. That's the lowest reading since the end of September and less than five points above the YTD low of 15.8% from mid-April.

There hasn't been a single week this year where bullish sentiment has been above its historical average of 37.6%, and the only week where sentiment was even close to its historical average was at the start of the year.

With just one week left in the year, barring a historic one-week surge, 2022 will go down as the first year in the history of the AAII survey where there wasn't a single week that bullish sentiment was above average. Talk about malaise.

Source: American Association of Individual Investors

U.S. electric vehicle production by brand

While Tesla was the first mover to manufacture EV cars at scale and spends more on R&D per car than its competitors, legacy automakers are eager to overtake Tesla and are investing billions of dollars to catch up.

Toyota and Stellantis are the two biggest legacy automakers in the space behind Tesla, though it’s worth noting that they only produced plug-in hybrids. Volkswagen and Ford are the highest producers of true EV vehicles, and both have aggressive plans to achieve scale in the coming years; VW stated its plan to produce 22 million EVs by 2028, while Ford announced $22 billion in EV investment between 2021 and 2025 while also rushing to deliver the highly anticipated F-150 Lightning to market and is in receipt of over 200,000 reservations for the hugely popular pickup truck.

Source: Visual Capitalist

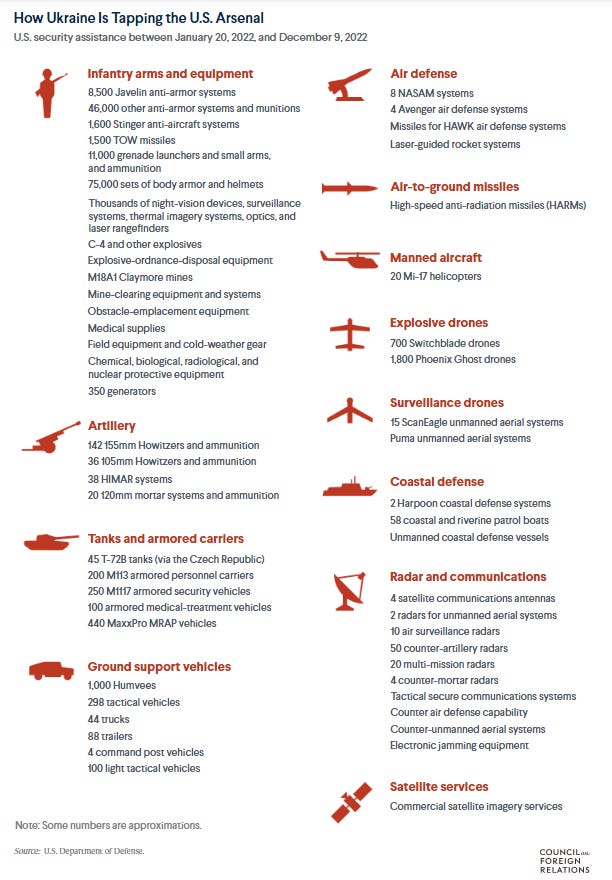

How much aid and support the United States has provided Ukraine

Ukrainian President Volodymyr Zelenskyy appeared before a joint session of the Congress yesterday, thanking the United States for its support while urging lawmakers to support his country for an extended conflict against Russia. It marked the Ukrainian president's first trip outside his country since Russia's invasion; watch the full speech here.

The speech followed warnings from Ukrainian officials that Russia is preparing a massive offensive sometime around February, possibly attempting once again to take the capital city of Kyiv. Analysts say about 150,000 Russian troops that have been called up during a partial mobilization will have completed training by early 2023.

The U.S. has provided roughly $48B in aid to Ukraine over the past year, with around $20B in direct support provided in the FY23 appropriations bill under consideration.

Much of the aid has gone toward providing weapons systems, training, and intelligence that Ukrainian commanders need to defend against Russia. Here is what the Biden administration has provided or agreed to provide Ukraine to enhance defense capabilities, including armored vehicles, anti-aircraft missiles, coastal defense ships, and advanced surveillance and radar systems.

Source: Council on Foreign Relations

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.