U.S. dollar’s reserve status at risk? I'll take the other side.

The Sandbox Daily (6.9.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. dollar’s reserve status at risk?

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.57% | Nasdaq 100 +0.17% | S&P 500 +0.09% | Dow 0.00%

FIXED INCOME: Barclays Agg Bond +0.12% | High Yield +0.05% | 2yr UST 4.005% | 10yr UST 4.478%

COMMODITIES: Brent Crude +0.93% to $67.09/barrel. Gold +0.05% to $3,348.1/oz.

BITCOIN: +3.72% to $110,278

US DOLLAR INDEX: -0.17% to 99.017

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: +2.33% to 17.16

Quote of the day

“Almost everything in life will work again if you unplug it for a few minutes, including you.”

- Anne Lamott, American novelist

Dollar’s reserve status at risk?

For many Americans, the status of the U.S. dollar reflects the country’s position in the world.

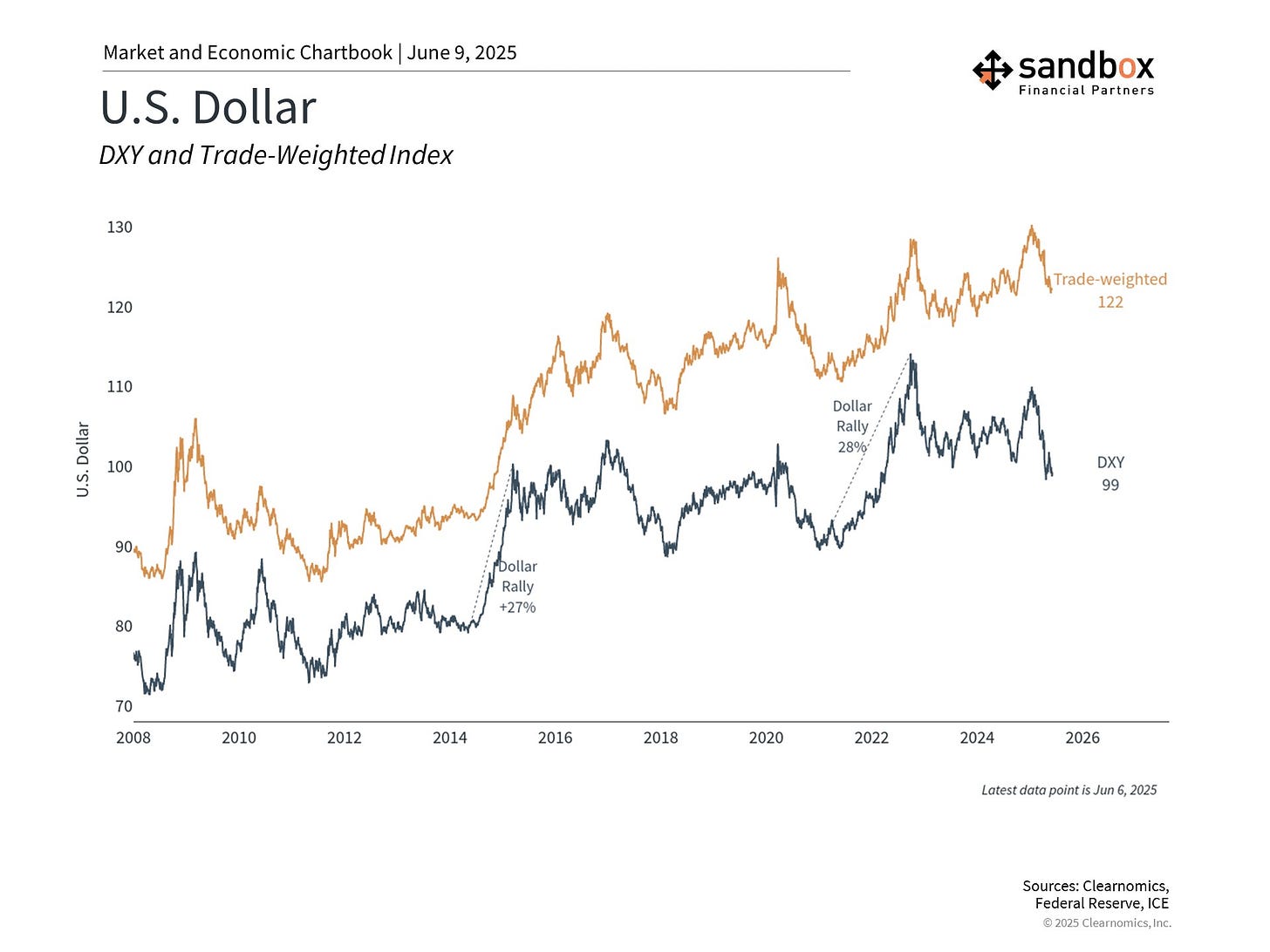

However, the dollar has weakened in recent months amid trade and economic uncertainty, declining against a basket of major currencies to its lowest level in three years. This has renewed calls that the dollar could lose its place as the global reserve currency.

And yet, any erosion in the confidence or valuation of the dollar should prove temporary and short-lived.

Understanding the dollar's role in global markets

The U.S. dollar has served as the world's primary reserve currency for the past century, since it overtook the British pound after World War I.

Some investors worry that geopolitics, fiscal challenges such as the national debt, trade policies, or emerging alternatives such as cryptocurrencies could threaten this status.

While these are real concerns, it’s important to understand that these worries are not new and tend to resurface during periods of economic uncertainty.

In the 1980s, Japan's economic boom led to speculation that the yen might challenge the dollar. The introduction of the euro in the 2000s, along with China's economic rise, sparked similar predictions. More recently, the emergence of cryptocurrencies has prompted questions about the future of traditional currencies like the dollar.

Despite these fears, the dollar has maintained its central role in global finance through many economic cycles. This resilience reflects the depth and liquidity of U.S. financial markets, the relative stability of American institutions, and the dollar's continued use in international trade and investment. In general, the dollar continues to be viewed as a safe-haven asset during times of global economic crisis.

When it comes to our daily lives, it’s natural to view a strong dollar as always being positive. For consumers, a strong dollar makes traveling abroad more affordable and lowers the cost of imported goods, potentially reducing consumer inflation. So, when it comes to buying foreign goods and services, having a strong currency helps.

However, there are negatives to a strong dollar as well, especially when it comes to selling our goods and services. A strong dollar can make U.S. businesses less competitive since their products become more expensive for overseas buyers, potentially hurting American manufacturers and farmers.

This is why many countries are often accused of keeping their currencies artificially low in order to boost their exports. It’s easy to see that the ideal currency level depends on a balance of factors and isn’t just about strength or weakness.

Many factors drive the value of the dollar

There are many ways countries can manage their currencies.

Some, like the United States and the United Kingdom, allow their currencies to float freely, with exchange rates determined primarily by market forces.

Others maintain fixed exchange rates by pegging their currency to another major currency, such as the U.S. dollar or euro, or keep the value within a range. This requires central bank intervention and is not always easy to maintain.

An important driver of currency values is international trade.

When foreign investors purchase U.S. goods and services, they must first exchange their currency for dollars. All things being equal, this demand creates upward pressure on the currency, raising its value. The opposite is true when Americans import more than we export: the dollar is sold for foreign currencies.

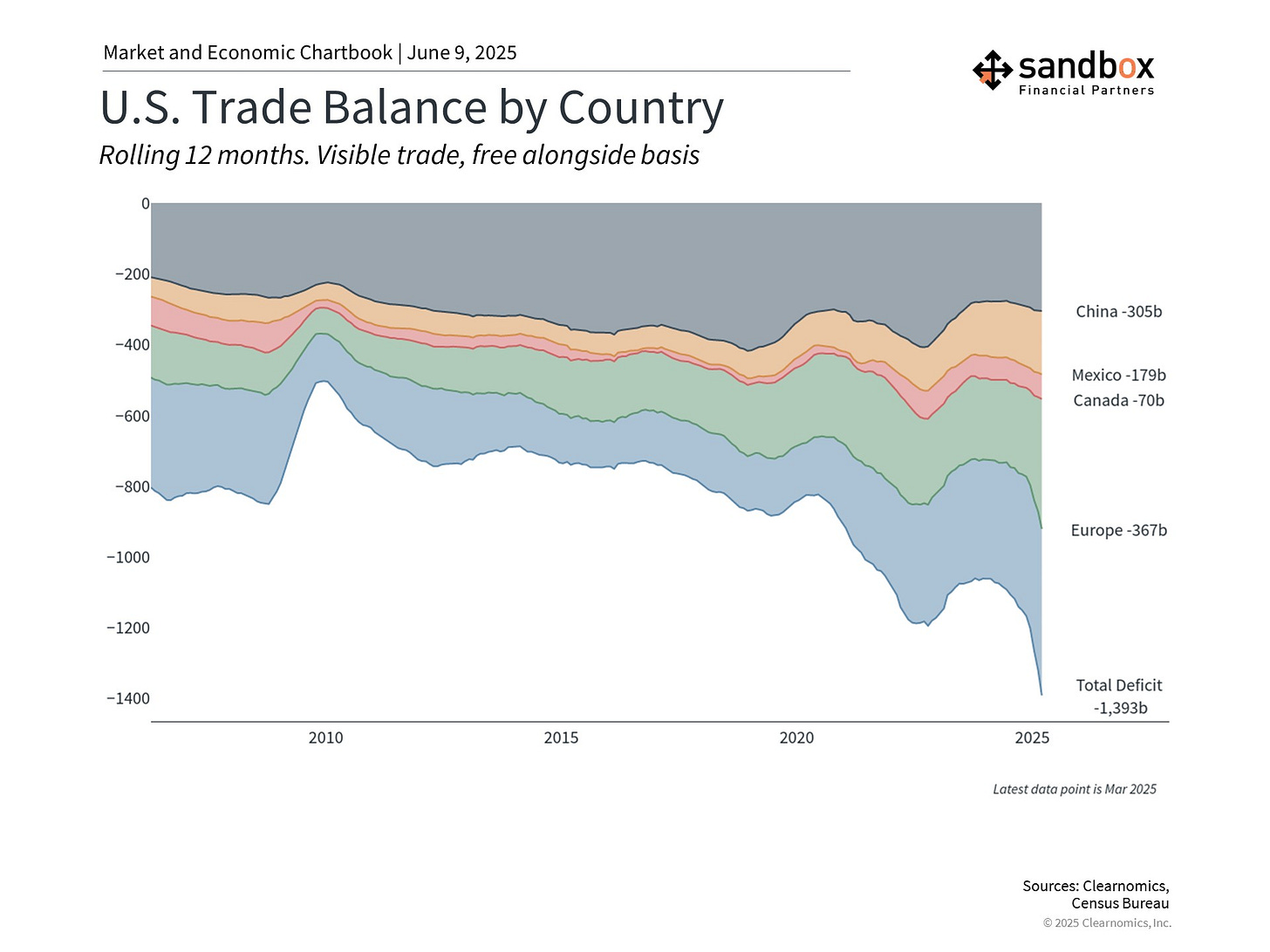

This is why a persistent trade deficit would normally lead to a weaker currency. Over the past twelve months, the U.S. imported $1 trillion more than it exported, as you can see in the chart below. This trade imbalance has persisted for many years, partly because there is significant demand for dollars by central banks and foreign businesses.

What’s interesting, recent tariffs have not resulted in a stronger dollar.

Economic theory would normally suggest that U.S. tariffs on foreign goods would reduce imports, thus putting upward pressure on the dollar. However, not only did many companies stockpile foreign goods ahead of these tariffs, but other factors such as capital flows and political uncertainty impact the currency as well.

Trade represents only one component of the broader currency equation.

Capital flows, interest rates, central bank policies, and international lending all contribute to global dollar demand. The complexity of these interactions explains why currency movements often seem disconnected from simple economic indicators.

For example, differences in interest rates are among the most important factors that influence currency values. When the Federal Reserve sets rates higher than other major central banks, it typically creates demand for dollars, since investors would shift their assets to higher-yielding Treasuries. In financial markets, this is known as a “carry trade.”

Additionally, concerns about fiscal policy may also be weighing on the dollar. With the national debt approaching 120% of GDP and persistent budget deficits, some investors worry about the long-term sustainability of U.S. fiscal policy. While these concerns have not reached crisis levels, they add another layer of complexity when valuing the U.S. dollar.

The dollar has maintained its global role

Given the many factors that influence its value, some perspective is needed when judging the current level of the dollar.

While the dollar has declined to its lowest level in three years, zooming out shows that these levels are still near their strongest over the past twenty years. As always, it’s important to maintain a broader perspective and not overreact to recent moves.

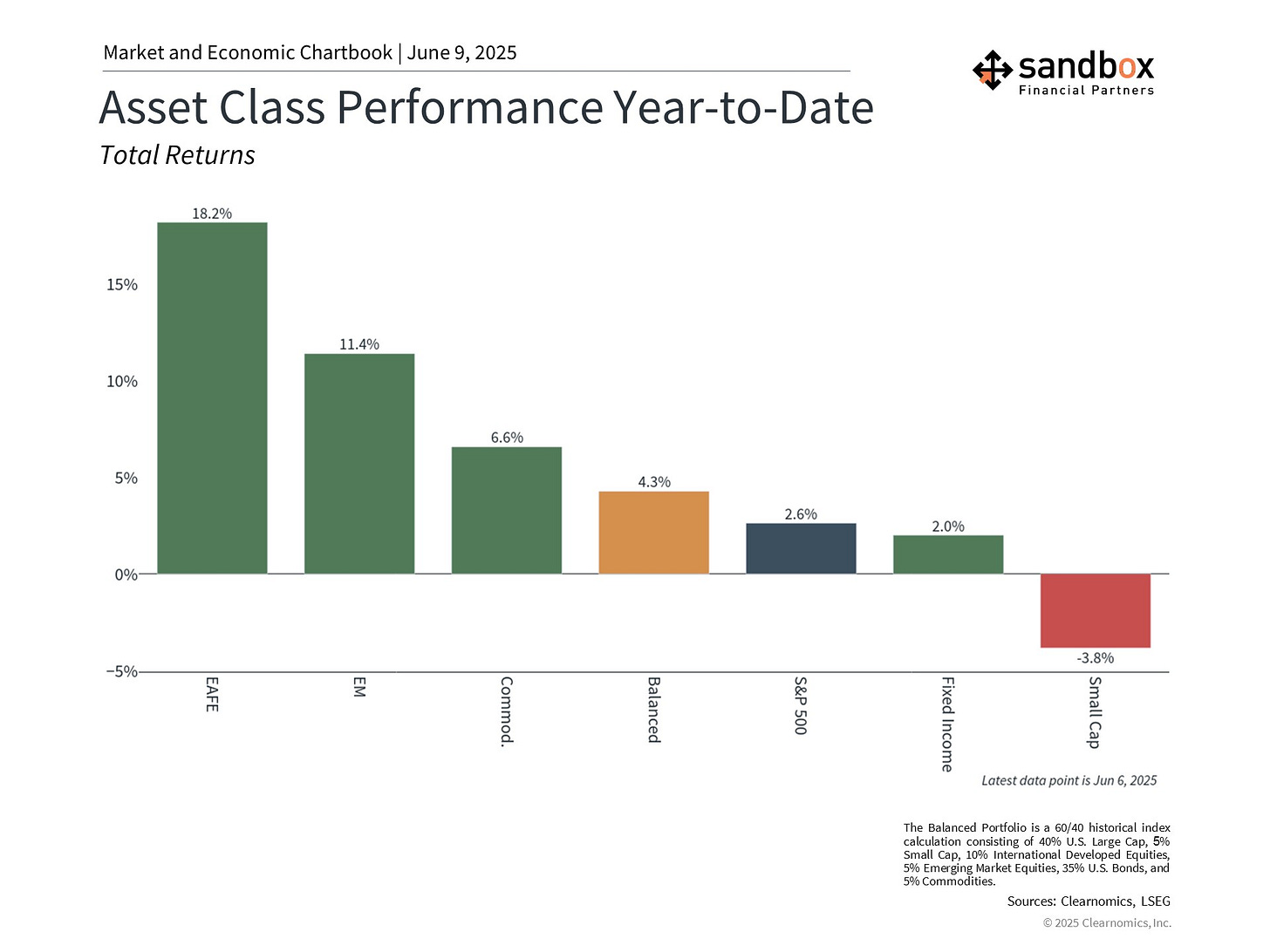

For investors, a somewhat weaker dollar has been positive this year for diversified portfolios.

A falling dollar means that international investments are worth even more when converted back from their local currencies, boosting returns.

Below you can see the MSCI EAFE index of Developed Market stocks and the MSCI EM index of Emerging Market stocks have outperformed the S&P 500 this year.

The bottom line?

Despite many legitimate concerns, the dollar continues to serve as the world’s reserve currency. Perhaps more importantly, it has helped to boost diversified portfolios this year.

For most investors, maintaining a long-term perspective on the dollar is most prudent.

Sources: Clearnomics, Bloomberg, Investopedia, Cato Institute

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)