U.S. economic growth defies recession calls, plus small business boom and shell companies

The Sandbox Daily (1.25.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. economy shines in Q4, caps unexpectedly strong year

3-year U.S. small business boom is unprecedented

understanding shell company behavior

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.71% | Dow +0.64% | S&P 500 +0.53% | Nasdaq 100 +0.10%

FIXED INCOME: Barclays Agg Bond +0.45% | High Yield +0.77% | 2yr UST 4.299% | 10yr UST 4.121%

COMMODITIES: Brent Crude +2.86% to $82.33/barrel. Gold +0.18% to $2,038.9/oz.

BITCOIN: +0.41% to $39,865

US DOLLAR INDEX: +0.27% to 103.513

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: +2.36% to 13.45

Quote of the day

“Chance favors the prepared mind.”

- Louis Pasteur

U.S. economy shines in Q4, caps unexpectedly strong year

The U.S. economy ended the year on a high note, dismissing any fears of a near-term recession.

Real Gross Domestic Product (GDP) – which measures the monetary value of all goods and services produced in a country in a given period of time – increased at a 3.3% annualized rate, far above the consensus of 2.0% and the GDPNow tracking estimate of 2.4%.

On an annual basis, real GDP increased 2.5% in 2023, up from 1.9% in 2022.

The economy’s main growth engine – personal spending – rose at a 2.8% rate. With the labor market still strong and consumer sentiment rising in early January to its highest level since July 2021, we expect the momentum in consumer spending to carry into 2024.

All other major GDP components also made positive contributions.

Within the broader report, a closely watched measure of underlying inflation – the Core PCE deflator – rose at just a 2% annualized rate, the 2nd quarter in a row and in line with the Fed’s inflation target of 2%.

The Federal Reserve receives another report card indicating the soft landing is in place. This cycle is truly remarkable!

Source: Ned Davis Research, Piper Sandler, Bloomberg, Statista

3-year small business boom is unprecedented

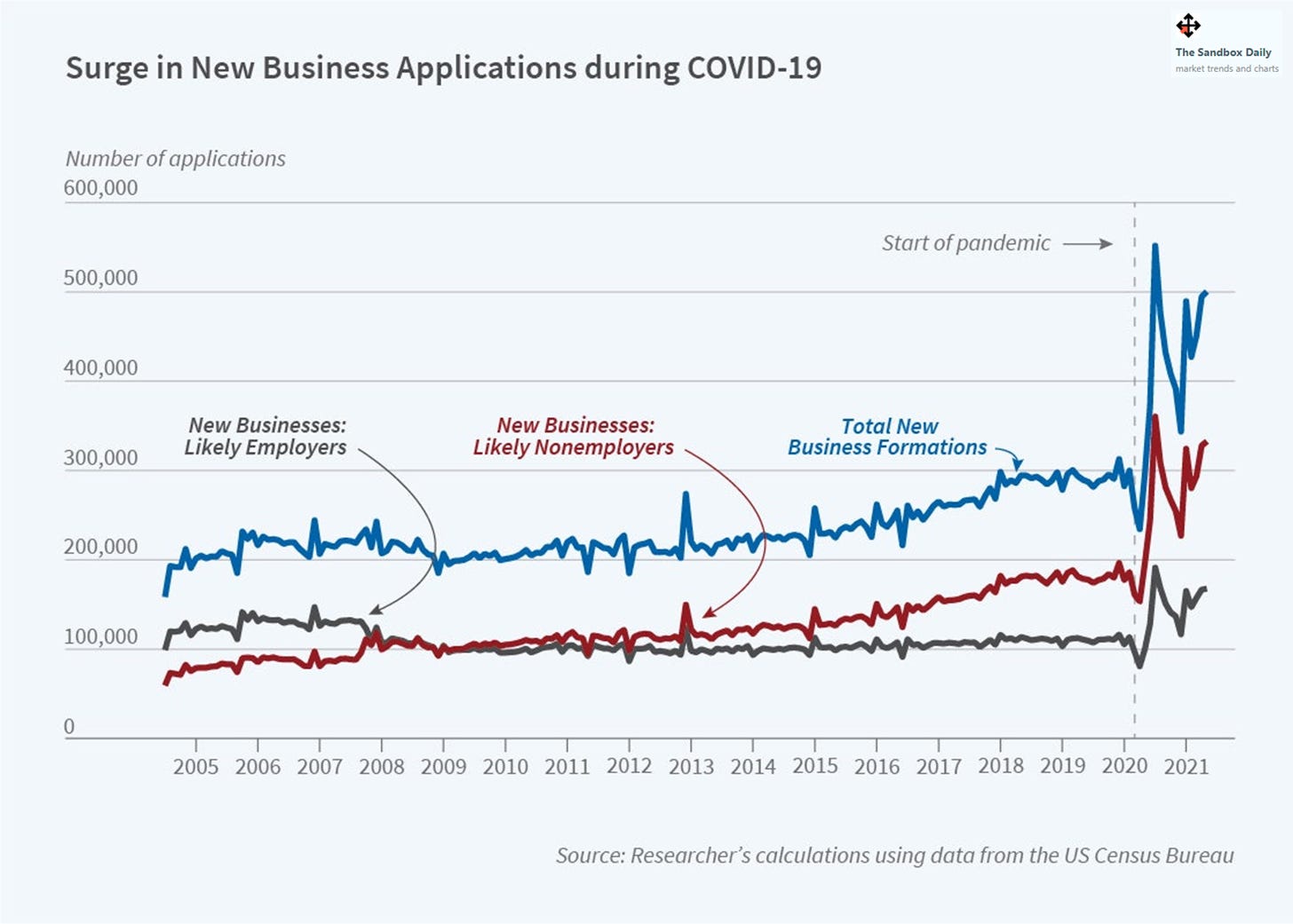

New businesses play a key role in fostering job creation and productivity growth in the U.S. economy. In the United States, small business is booming.

Business applications – a leading indicator of business formation that is reported through the Census Bureau’s Business Formation Statistics – have risen substantially during the past 3 years relative to any previous period since 2004, when the series began.

Americans filed 5.5 million applications to start new businesses in 2023, an all-time high marking the 3rd consecutive year of record-breaking growth.

In fact, the 440,000 average monthly filing rate from 2021 through 2023 represents an 85% increase in the average flow of monthly applications relative to the period from 2004 to January 2021 !

Within the surge in business formations, the most common industry was retail trade, followed by professional services amidst the work-from-home revolution, and construction firms that boomed amidst rapid housing price growth.

Source: U.S. Census Bureau, National Bureau of Economic Research, Apricitas Economics, Forbes

Understanding shell company behavior

Moody’s Analytics has found 21 million “red flags” associated with shell companies that could be used to enable financial crimes, from ancient directors to dubious addresses.

The Moody’s report highlights include a 942-year-old director, ~22,000 businesses supposedly working out of the pyramids in Egypt, and one individual who held 5,751 roles at 2,883 different entities. The country with the highest number of shell company risks was the United Kingdom.

Though new regulations across the world are looking to improve transparency at shell companies, there is still some way to go, with $1.6 trillion laundered annually.

While shell companies might have legitimate purposes, their opaqueness is often used to hide criminal financial activity. Moody’s identified the following 7 key behaviors used to obfuscate appearance:

The study looked at some 472 million companies in November.

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.