U.S. economic growth remains on solid footing, plus gold and housing affordability

The Sandbox Daily (7.25.2024)

Welcome, Sandbox friends.

OpenAI announces a new AI search engine called SearchGPT, Southwest Airlines will abandon its open seating policy and soon begin to assign seats on flights, and the U.S. military intercepted Russian and Chinese warplanes off the coast of Alaska.

Today’s Daily discusses:

U.S. economic growth in 2Q expands above forecasts

gold price rising

housing unaffordable for large swaths of Americans

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.26% | Dow +0.20% | S&P 500 -0.51% | Nasdaq 100 -1.06%

FIXED INCOME: Barclays Agg Bond +0.28% | High Yield +0.01% | 2yr UST 4.433% | 10yr UST 4.244%

COMMODITIES: Brent Crude +0.88% to $82.43/barrel. Gold +0.42% to $2,409.9/oz.

BITCOIN: +1.04% to $66,228

US DOLLAR INDEX: +0.01% to 104.395

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: +2.33% to 18.46

Quote of the day

“By failing to prepare, you are preparing to fail.”

- Benjamin Franklin

U.S. economic growth in 2Q expands above forecasts

U.S. Real GDP – i.e. economic growth adjusted for inflation – expanded at a 2.8% annualized rate in Q2, handily beating the consensus estimate of 2.0%. Growth accelerated from the 1.4% pace in the previous quarter, led by a faster consumer spending growth and inventory restocking. Capex and government spending also rose.

Real GDP growth averaged 2.1% in 1H 2024, which is much softer than the 4.1% average in the 2nd half of last year. At this pace, the economy is growing closer to trend.

The closely watched Personal Consumption Expenditures (PCE) price index, which is the Federal Reserve’s preferred inflation gauge, grew at a 2.6% annualized rate, the slowest pace since Q1 of 2021 and a marked slowdown from the 3.4% pace recorded in the prior quarter.

A robust economy is a good sign for the average consumer, and because it came in tandem with downward pressure on prices, it is in line with the soft landing of a healthy economy and cooling inflation that Federal Reserve officials are looking to achieve. Economists consider real GDP growth rates of between 2% and 3% to be healthy in developed economies.

Many economists expect momentum to ease in the back half of 2024, as consumer spending moderates amid slower payrolls growth, support wanes from excess pandemic savings, and the long and variable legs from restrictive monetary policy take hold.

The new data shouldn’t change the outlook for the Federal Reserve. Officials have signaled that they expect to hold interest rates steady at their meeting next week but should begin to cut at their subsequent meeting in September, if inflation continues to cool.

Source: Bloomberg, Wall Street Journal

Gold price rising

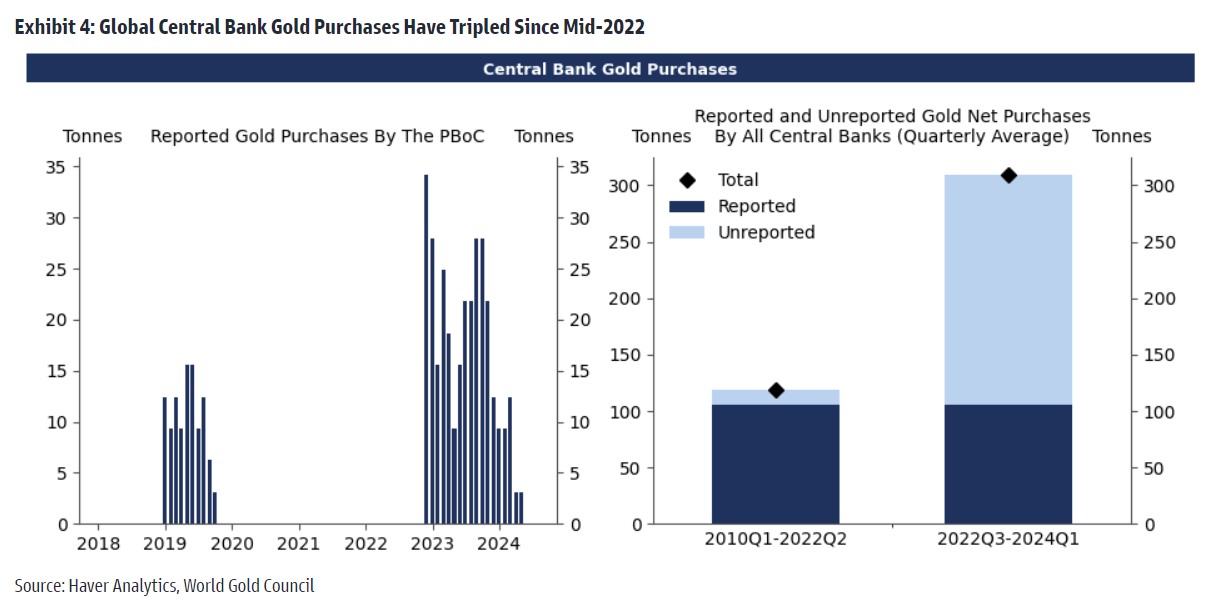

The price of gold has risen +20% over the last year on the back of geopolitical tensions, China stepping up purchases of gold, its long-time reputation as a store of value, and purchases by non-U.S. central banks as they seek to diversify away from dollar-based financial assets like Treasuries.

Source: Goldman Sachs Global Investment Research

Housing unaffordable for large swaths of Americans

The dream of homeownership is rapidly fading for millions of Americans.

A recent survey from the National True Cost of Living Coalition reported by Bloomberg expressed that sentiment, with one-quarter of respondents saying they were middle class (earning at least $60k annually) felt extreme stress with respect to housing.

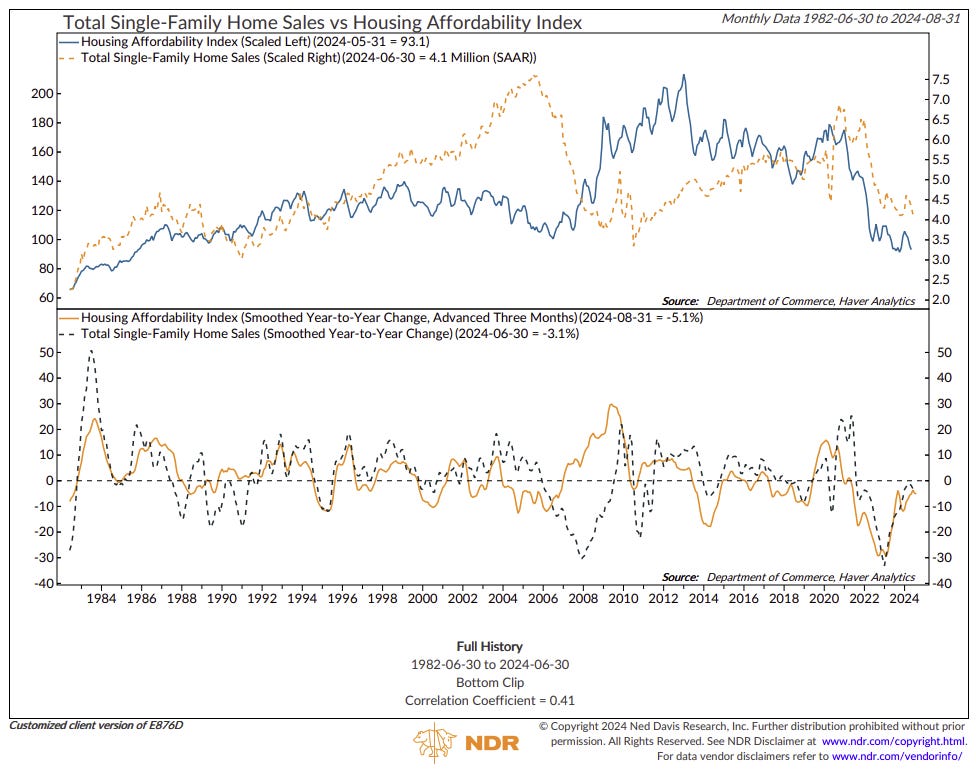

Years of rising house prices, modest income growth, and (more recently) high mortgage rates have made housing unaffordable for large swaths of Americans. The NAHB/ Wells Fargo Cost of Housing Index (CHI), a housing affordability index, confirms such sentiment.

The CHI shows how much of the pre-tax median family income is needed to make a mortgage payment on a median-priced home. In Q1, with median income of $97,800 and a median new home priced at $420,800, the CHI was 38%. For the median existing home priced at $389,400, the CHI was 36%.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.