U.S. economy rebounds in 2nd quarter and returns to growth mode

The Sandbox Daily (7.30.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. returns to growth mode in Q2

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.16% | S&P 500 -0.12% | Dow -0.38% | Russell 2000 -0.47%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -0.21% | 2yr UST 3.941% | 10yr UST 4.368%

COMMODITIES: Brent Crude +1.54% to $73.63/barrel. Gold -1.59% to $3,271.1/oz.

BITCOIN: -0.23% to $117,283

US DOLLAR INDEX: +0.93% to 99.803

CBOE TOTAL PUT/CALL RATIO: 0.94

VIX: -3.13% to 15.48

Quote of the day

“Every oak tree started out as a couple of nuts who stood their ground.”

- Henry David Thoreau

U.S. returns to growth mode in Q2

The world’s largest economy is growing again, fighting off trade uncertainties and fueled by American consumers who keep on spending.

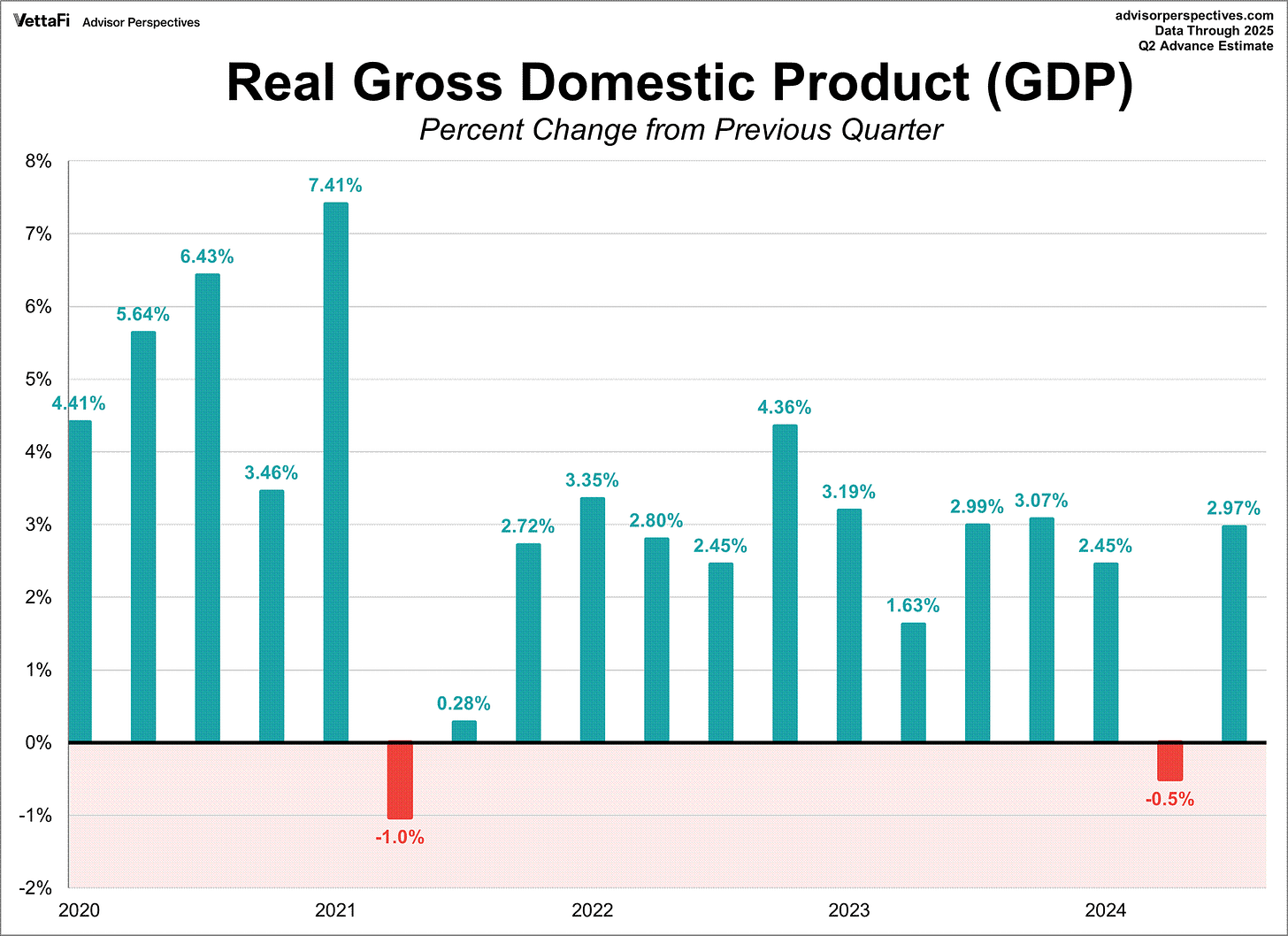

Economic growth in the United States, or “Real GDP,” rebounded at a solid +3.0% annualized rate in Q2, the most in nearly a year and well above the consensus estimate of 2.5%.

It marks a significant turnaround from a -0.5% annualized decline in Q1, as growth in both quarters was distorted by tariffs to an unprecedented degree.

Real gross domestic product (GDP) measures how fast or slowly the economy is growing or contracting, and measures the inflation-adjusted value of all goods and services produced by the economy. It is considered the broadest measure of economic activity and the primary indicator of an economy's health.

Looking through the noise, real GDP growth averaged a 1.2% annualized rate in 1H 2025, which is about half the growth rate of 2.5% from 2024 and below the Fed’s estimate of longer-run potential.

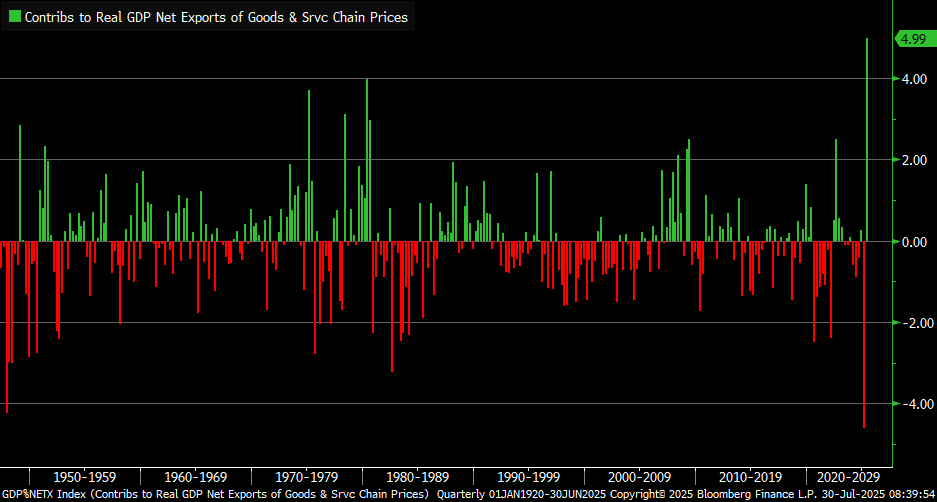

The obvious headline grabber in the report was the record down-then-up swing in Net Exports in the 1st half.

The anticipation of higher tariffs earlier this year led to a double-digit front-loading surge in Imports in Q1 (a drag on GDP growth) and a nearly commensurate decline in Imports in Q2 (an addition to GDP growth).

In contrast, Exports barely budged in both quarters.

As a result, Net Exports (Exports minus Imports) subtracted 4.61 percentage points from real GDP growth in Q1, which was more than made up by a 4.99 percentage points positive contribution to growth in Q2.

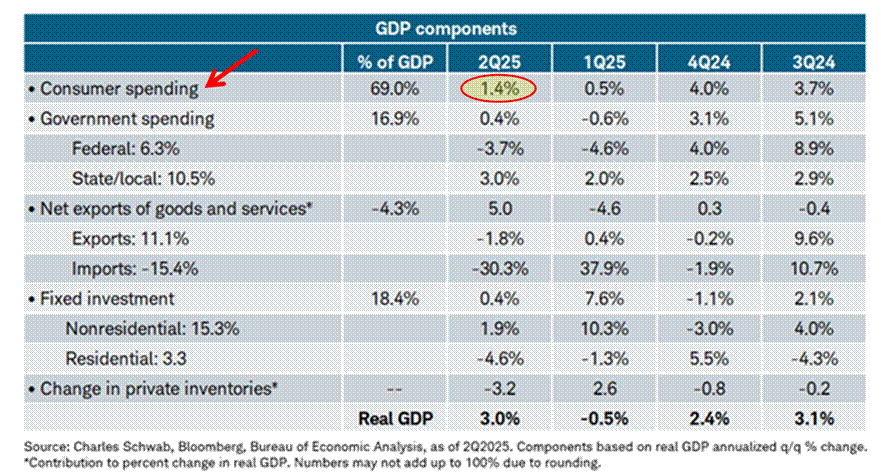

The other important bit in today’s report showed some stabilization in consumer spending, albeit at sluggish levels.

Consumer spending, the main engine of the U.S. economy, rose at a +1.4% annualized rate in Q2, following a +0.5% gain in the previous quarter.

Overall, average spending growth in the 1H25 was the weakest in this expansion and about a quarter of last year’s pace.

Some improvement in consumer confidence in early Q3 and ebbing in inflation expectations suggest that consumer spending may improve somewhat in the near-term, which bodes well for the outlook for continued economic growth, albeit at a slower pace than last year.

Over the past three months, President Trump has engaged our foreign trading partners in multiple sparring rounds of intense negotiations that nonetheless coincided with a subdued but solid pace of economic growth.

“The word of the summer for the economy is ‘resilient,’” said Heather Long, chief economist at Navy Federal Credit Union.

Today’s GDP reading came ahead of the Federal Reserve committee’s July meeting in which they voted to maintain their short-term interest-rate target steady in the range of 4.25%-4.50%, citing inflation that remains somewhat elevated and low unemployment.

Sources: Advisor Perspectives, Bloomberg, Charles Schwab

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)