U.S. exceptionalism on ice (importance of staying invested), plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (3.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. exceptionalism on ice (staying invested)

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.74% | S&P 500 +0.55% | Dow +0.52% | Russell 2000 +0.43%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield +0.16% | 2yr UST 4.001% | 10yr UST 4.305%

COMMODITIES: Brent Crude +1.31% to $70.37/barrel. Gold -0.31% to $2,917.5/oz.

BITCOIN: -5.16% to $85,792

US DOLLAR INDEX: -0.15% to 103.905

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: -6.03% to 23.37

Quote of the day

“Words are free. It's how you use them that may cost you.”

-Rev J Martin

U.S. exceptionalism on ice, for now

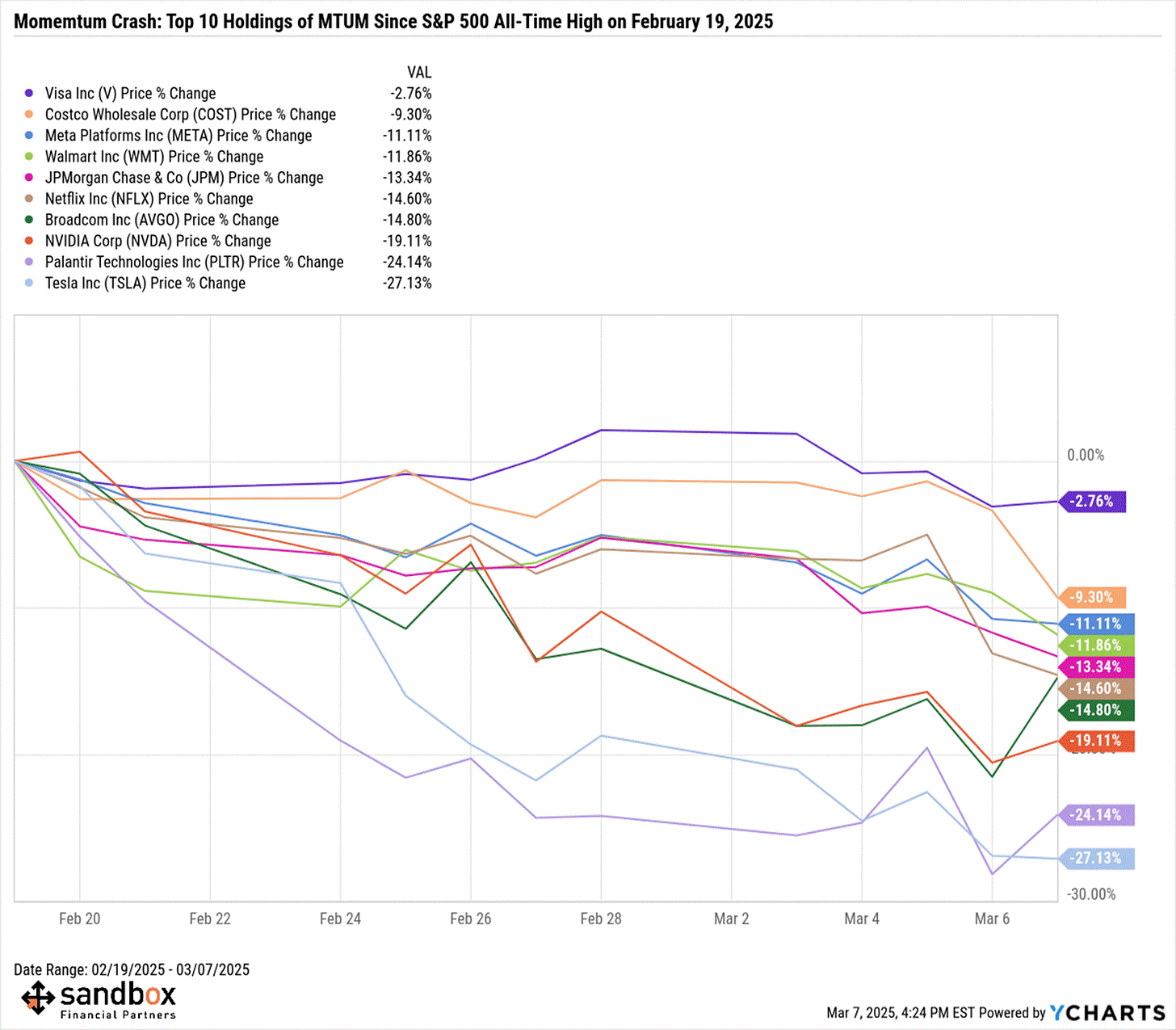

The U.S. exceptionalism trade has been experiencing major turbulence over the past two weeks as policy uncertainty (namely tariff announcements) rose sharply at the intersection of a budding economic growth scare and crowded investor positioning.

Tech and momentum have been at the center of the carnage, as investors rotate their exposures elsewhere.

The momentum factor was the big winner of 2024.

2025? Different story.

As the declines accelerate and weakness spreads across the zeitgeist, some investors get nervous about further losses and hit the panic sell button.

Others might be sitting on cash, hesitant to get back into the market because volatility is high and the chance of further downside remains.

Yet, it’s important to remember during these dislocations that investors should avoid timing the market.

Why?

The stock market makes most of its gains in 10 trading days in any single year.

This means most long-term investors are better off buying and holding (and plugging their nose) during these moments of opportunity, rather than trying to tactically time entry and exit points. Of course, your risk tolerance and time horizon are important considerations here as well.

For many, staying invested is the best way to weather market volatility over time.

History shows that maintaining a long-term approach remains one of the most effective strategies for navigating market volatility. While short-term market swings can be unsettling, investors who stay consistently invested through market cycles have historically captured the benefits of compound returns.

While pockets of the market have struggled, other sectors have performed well over the past several months. Other asset classes and regions have also performed well, reminding investors of the importance of a balanced portfolio. Bonds, for instance, have benefited as interest rates have fallen. As they often do in difficult market environments, positive bond returns have helped to offset stock market declines in diversified portfolios.

So, although there’ll be more scary headlines in the coming days and weeks, it’s important to remember that investing is not about a single day, week, or month.

Instead, building and holding a well-constructed portfolio is about achieving financial goals over years and decades.

Sources: JP Morgan, FundStart, Bloomberg

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

TKer – It’s Ok to Have Emotions – Just Don’t Let Them Near Your Stock Portfolio (Sam Ro)

Morningstar – 15 Stocks That Have Destroyed the Most Shareholder Value Over the Past Decade (Amy Arnott, CFA)

Oaktree – On Bubble Watch (Howard Marks)

Carson Group – Wait, Is GDP Growth Really Going To Be Negative in Q1? (Sonu Varghese)

iCapital – What Could Pause the Market Selloff and When? (Anastasia Amoroso)

Podcasts

Risk Reversal – Tom Lee is “Perma-Right” When It Comes to Markets (YouTube, Spotify, Apple Podcasts)

Preferred Shares Podcast – Texas Pacific Land Corporation: The Riches of Royalties (Preferred Shares, Spotify, Apple Podcasts)

The Tucker Carlson Show – Interview From Prison with Sam-Bankman Fried (X, YouTube, Spotify, Apple Podcasts)

The Compound and Friends – Tom Lee to the Rescue (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Zero Day – Robert DeNiro, Jesse Plemons (IMDB, YouTube)

Music

The Voidz – 7 Horses (Spotify, Apple Music, YouTube)

Books

Vishal Khandelwal – Boundless (Safal Niveshak)

Tweet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Blake---really good article today. You hit on some great points and some good additional sources to read/listen to. Enjoy your weekend. Jonathan