U.S. fiscal strength in question, once again

The Sandbox Daily (3.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. fiscal strength in question, once again

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -0.33% | Dow -0.37% | Russell 2000 -0.39% | Nasdaq 100 -0.59%

FIXED INCOME: Barclays Agg Bond -0.05% | High Yield -0.19% | 2yr UST 3.996% | 10yr UST 4.361%

COMMODITIES: Brent Crude +0.37% to $74.06/barrel. Gold +1.54% to $3,069.1/oz.

BITCOIN: +0.39% to $87,419

US DOLLAR INDEX: -0.27% to 104.264

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: +1.96% to 18.69

Quote of the day

“Keep in mind that progress is not always linear. It takes constant course correcting and often a lot of zigzagging.”

- Buzz Aldrin

U.S. fiscal strength in question, once again

Moody's is back at it, ringing the alarm bell on United States fiscal strength, once again.

A new blistering report from the credit ratings agency comes after the organization already lowered its outlook on the U.S. government from “stable” to negative” back in November 2023, alongside a similar move by Fitch, following a divisive debt ceiling battle on Capitol Hill. S&P Global Ratings was the first to strip the U.S. government of its AAA sterling score in 2011.

Why is this happening again?

Large fiscal deficits, political polarization, and debt becoming less and less affordable. In other words, more of the same.

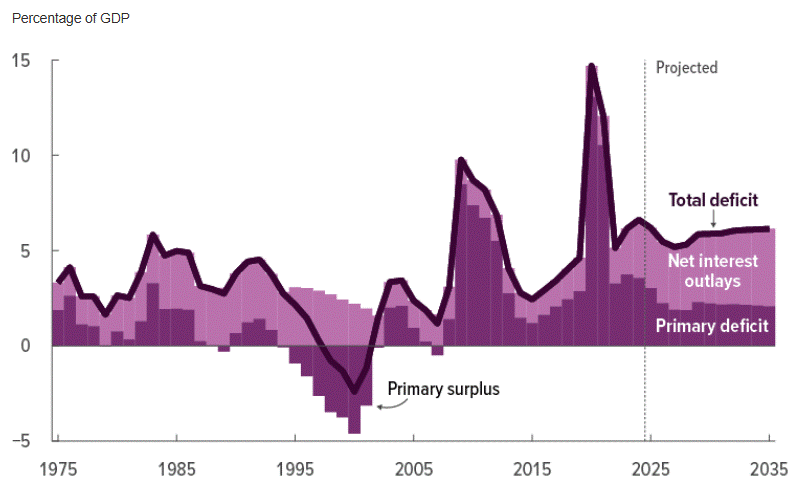

After the Federal Reserve hiked interest rates by 525 basis points between March 2022 and July 2023,the ramp higher in rates has substantially weakened debt affordability, with interest payments accounting for 30% of revenues by 2035 – up from 9% in 2021.

“The potential negative credit impact of sustained high tariffs, unfunded tax cuts, and significant tail risks to the economy have diminished prospects that these formidable strengths will continue to offset widening fiscal deficits and declining debt affordability.” the report said.

Credit ratings help investors gauge the risk profile of governments and corporations when accessing capital markets, as well as an entity’s capacity and willingness to repay its debt obligations on time and in full. A lower rating means higher risk, so those borrowers have to pay more in interest to attract investors.

Markets care about credit rating and outlook upgrades/downgrades because these ratings influence borrowing costs, bond prices, and overall confidence in the financial system.

Of course, there is plenty of criticism to go around over previous missteps from all the major rating agencies, like their pristine ratings of home mortgages and other-related instruments responsible for the Global Financial Crisis back in 2008 and 2009. The lack of transparency and oversight surrounding their actual methodologies and credit assessments doesn’t help instill confidence, either. Also, keep in mind the rating agencies are paid by the sellers of the securities they rate, so there are conflicts of interest to consider as well.

"The evolving U.S. government policy agenda on trade, immigration, taxes, federal spending and regulations could reshape parts of the U.S. and global economy with significant long-term consequences," Moody's declared. "Fiscal strength is on course for a continued multiyear decline" and there are "increasing risks that the deterioration in U.S. fiscal strength may no longer be fully offset by its extraordinary economic strength."

Markets are preparing for “pain” amidst this “detox period.” It appears at least one ratings agency (for now) is doing the same.

Sources: Moody’s, Congressional Budget Office, Reuters

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: