U.S. military operation captures President Maduro, Trump plans to “run” Venezuela

The Sandbox Daily (1.5.2026)

Welcome, Sandbox friends.

Happy New Year and wishing everyone a healthy and happy 2026! After a two-week hiatus, it’s time to dig back into the charts.

Today’s Daily discusses:

Operation Absolute Resolve: the U.S. military operation in Venezuela

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.58% | Dow +1.23% | Nasdaq 100 +0.77% | S&P 500 +0.64%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.26% | 2yr UST 3.453% | 10yr UST 4.157%

COMMODITIES: Brent Crude +1.76% to $61.82/barrel. Gold +2.91% to $4,455.4/oz.

BITCOIN: +4.42% to $94,132

US DOLLAR INDEX: -0.12% to 98.311

CBOE TOTAL PUT/CALL RATIO: 0.83

VIX: +2.69% to 14.90

Quote of the day

“If you’re going to try, go all the way. Otherwise, don’t even start.”

- Charles Bukowski, German-American poet and novelist

U.S. military operation captures President Maduro, Trump plans to “run” Venezuela

The arrest of Venezuelan President Nicolás Maduro by U.S. forces represents an unexpected and significant shift in the geopolitical landscape.

As widely reported, the U.S. military conducted a military operation that detained Maduro on charges related to drug trafficking and corruption. President Trump stated in a press conference that the United States will “run” Venezuela and work to expand its oil production.

While the humanitarian and regional implications are paramount, investors may naturally ask what this means for markets. The move raises questions around the role of the U.S. in the region, the prospects for democratic elections in Venezuela, potential changes to oil production, and how Iran and China respond.

History provides important context: geopolitical events often create short-term market volatility, but their long-term market impact tends to be limited. This is because these events don’t typically change the direction of broad economic and market drivers, even if oil production is affected.

Historical perspective

U.S. involvement in Latin America is not new.

The Monroe Doctrine, first drafted by President James Monroe in 1823, established opposition to European interference in the Western Hemisphere – a concept President Trump has recently referenced in outlining his foreign policy views as the “Don-roe Doctrine.”

This isn’t even the first time the U.S. has intervened in a Latin American country using military force. In 1990, the U.S. captured Manuel Noriega in Panama based on drug trafficking charges. Maduro himself has been under indictment since 2020 by the U.S. Department of Justice on charges of narco-terrorism and drug trafficking.

For investors, the takeaway is straightforward: geopolitical risk is a recurring feature of markets. While these events often feel more unsettling than routine economic news, history shows markets usually recover within weeks or months, if they react meaningfully at all.

Oil links geopolitics financial markets

The most important market transmission here is oil. To this day, oil remains one of the most strategically important resources in the global economy.

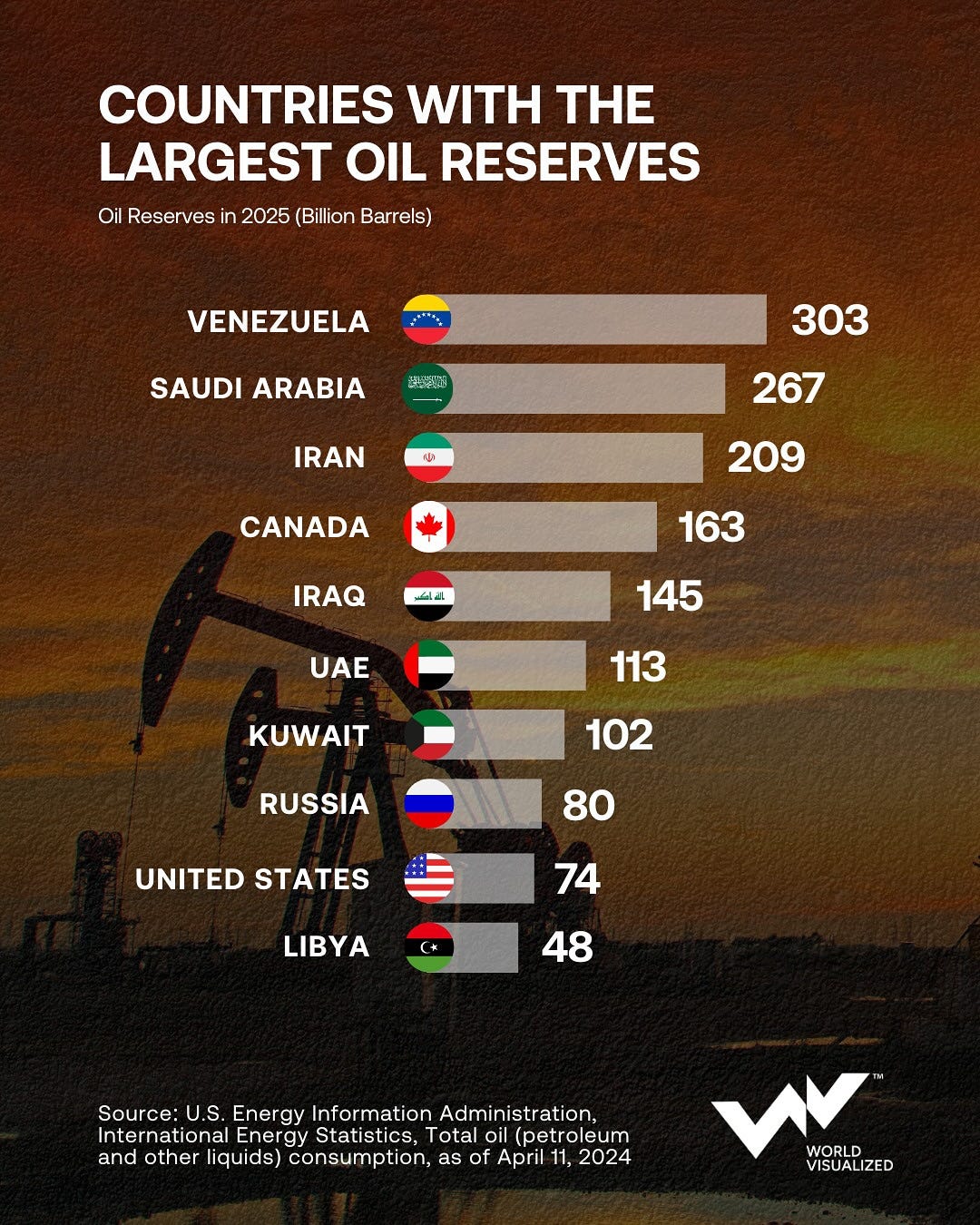

Venezuela holds the world’s largest proven oil reserves, estimated at roughly 303 billion barrels. For context, this exceeds Saudi Arabia’s 267 billion barrels.

Despite these vast reserves, Venezuela produces far less oil than other countries. Mismanagement, lack of infrastructure investment, and sanctions have all contributed to production falling below 1 million barrels per day, compared to the U.S. of nearly 14 million.

Even if Venezuelan output increases, doing so would require significant time and capital, limiting the near-term impact on global supply and prices. Over time, expanded production could put modest downward pressure on oil prices, which would benefit consumers but potentially offset gains for energy producers.

That said, energy prices are notoriously difficult to predict. Past episodes remind us that global supply, demand, and policy responses can shift faster (and in different ways) than expected.

Venezuela plays a minimal role in global markets

Venezuela itself plays a largely insignificant role in global financial markets.

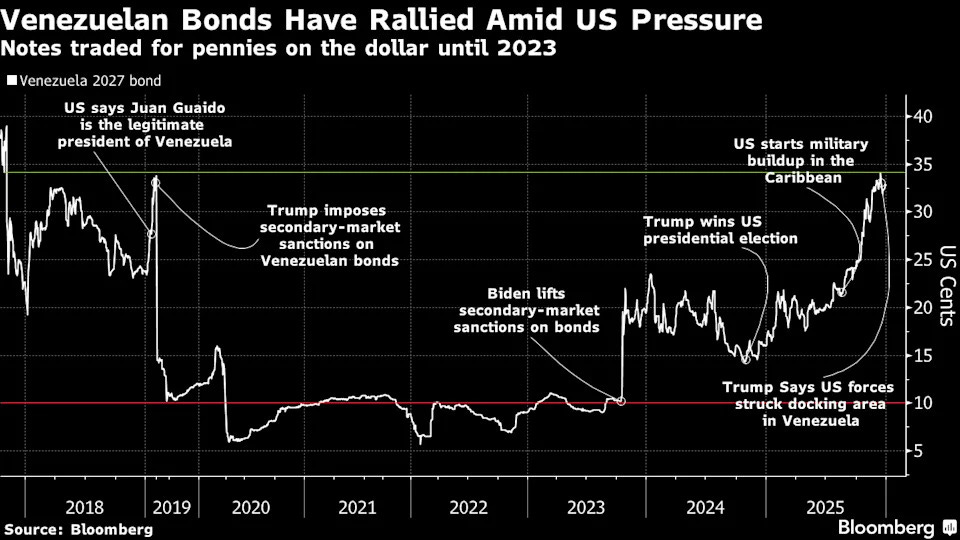

Its stock market, the Bolsa de Valores de Caracas, is small and illiquid, and it’s excluded from major Emerging Market indices, leaving most global investors with little direct exposure. The country has been in sovereign default since 2017, and its bonds trade at distressed levels. In recent days, however, the prospect of a U.S. takeover has greenlit Venezuelan asset prices, sending them on a rocket higher.

As events unfold, indirect effects – particularly through oil prices and sovereign negotiations – are likely to matter far more than Venezuela’s financial markets themselves.

Bottom line?

The arrest of Venezuela’s president represents a significant geopolitical development, yet history shows that disciplined, long-term investment strategies can navigate geopolitical uncertainty.

Sources: International Energy Agency, Bloomberg, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)