U.S. national debt, homebuilder confidence, and economists ring the alarm bells

The Sandbox Daily (10.18.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the numbers behind the U.S. national debt, U.S. homebuilder confidence continues its slide amidst soaring mortgage rates, and the latest survey of economists from the Wall Street Journal show many are predicting a recession due to the Fed's rate hiking cycle.

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.16% | S&P 500 +1.14% | Dow +1.12% | Nasdaq 100 +0.77%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield +0.70% | 2yr UST 4.433% | 10yr UST 4.007%

COMMODITIES: Brent Crude -1.23% to $90.49/barrel. Gold -0.42% to $1,657.1/oz.

BITCOIN: -0.58% to $19,421

US DOLLAR INDEX: -0.04% to 111.996

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: -2.77% to 30.50

The U.S. national debt, by numbers

The U.S. national debt recently crossed above the $31 trillion mark for the first time, with the increase in debt over the last 3 years totaling an astounding $8 trillion, or +35% increase.

When the existing debt matures, new debt must be issued at much higher interest rates. As the approximately $24 trillion of U.S. Treasury marketable debt held by the public is replaced by higher coupon paper, Federal interest expense will more than double from current levels (assuming debt levels remain constant and current prevailing rates are applied). At current levels, the weighted average coupon payment is ~1.9% which translates into ~$450 billion in interest expense per year. With the significant rise in interest rates in 2022, the expected adjustment to the interest expense on Public Debt will soon approach $1 trillion on an annual basis and become a significant line item in the budget.

Comparing our country’s debt to its gross domestic product (GDP) reveals the country’s ability to pay down its debt. This ratio is considered a better indicator of a country’s fiscal situation than just the national debt number itself because it shows the burden of debt relative to the country’s total economic output and therefore its ability to repay it. The U.S. debt-to-GDP ratio surpassed 100% in 2013 when both debt and GDP were approximately $16.7 trillion. As of 2021, the Debt-to-GDP ratio is at 125%, just shy of the record set in 2020 at 128%.

Source: Charlie Bilello, Horizon Kinetics, Treasury.gov

U.S. homebuilder confidence keeps sliding as rates soar

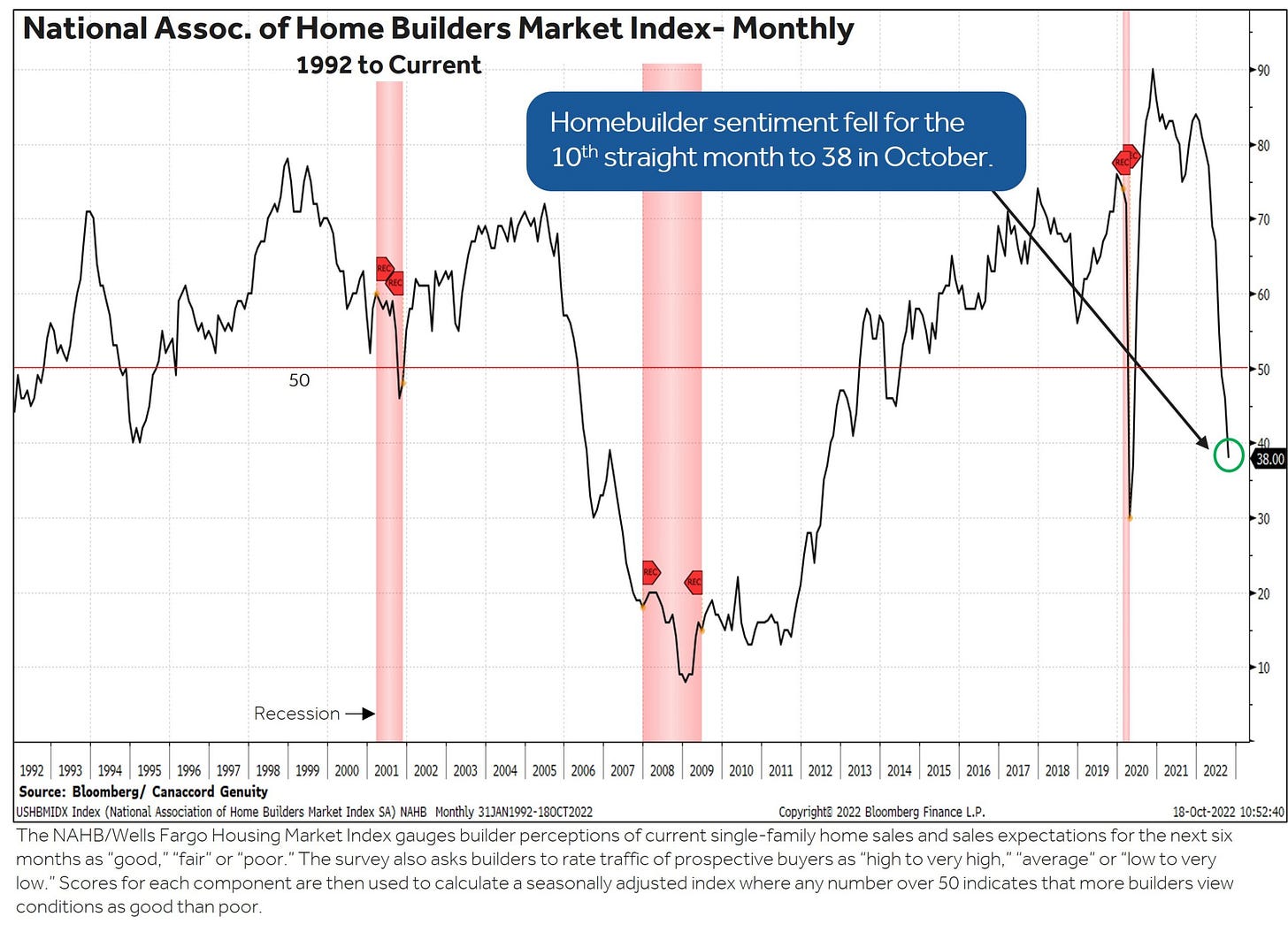

The NAHB/Wells Fargo Housing Market Index (HMI), a measure of U.S. homebuilder sentiment, dropped for a 10th straight month in October, hitting the lowest level since the early days of the pandemic (May 2020) and illustrating a housing market battered by soaring mortgage rates. The gauge was weaker than the most pessimistic forecast in a Bloomberg survey of economists.

The housing market has been the clearest sign yet of the Federal Reserve’s policies working their way through the economy, sending mortgage rates to a 20-year high. Excluding the pandemic, this was the lowest level in builder confidence since August 2012. It implies more weakness to come in housing starts, a forward looking measure on the state and health of the housing market.

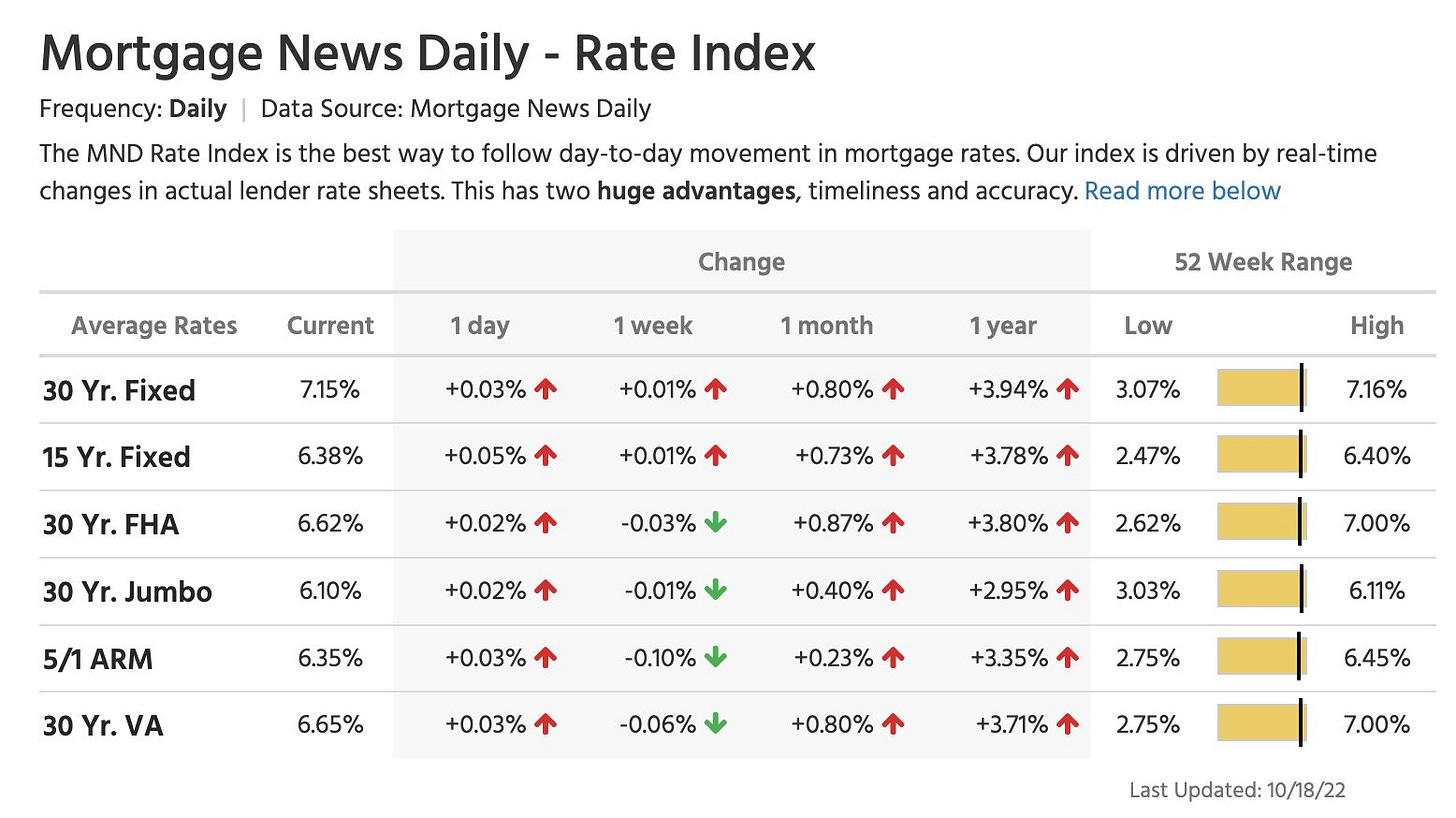

A main driver of this weakness? Mortgage rates. The average 30-year fixed rate mortgage is currently at 7.15%, up from 3.07% one year ago.

“While some analysts have suggested that the housing market is now more ‘balanced,’ the truth is that the homeownership rate will decline in the quarters ahead as higher interest rates and ongoing elevated construction costs continue to price out a large number of prospective buyers,” NAHB Chief Economist Robert Dietz said in a statement.

Source: Tony Dwyer, Ned Davis Research, Bloomberg, Mortgage New Daily

A majority of top economists are predicting U.S. recession due to Fed's rate hikes

The U.S. is forecast to enter a recession in the coming 12 months as the Federal Reserve battles to bring down persistently high inflation, the economy contracts and employers cut jobs in response, according to The Wall Street Journal’s latest survey of economists. On average, economists put the probability of a recession in the next 12 months at 63%, up from 49% in July’s survey. It is the first time the survey pegged the probability above 50% since July 2020, in the wake of the last short but sharp recession.

Forecasters have ratcheted up their expectations for a recession because they increasingly doubt the Fed can keep raising rates to cool inflation without inducing higher unemployment and an economic downturn. Some 58.9% of economists said they think the Fed will raise interest rates too much and cause unnecessary economic weakness, up from 45.6% in July.

Source: Wall Street Journal

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.