U.S. share buybacks signal confidence

The Sandbox Daily (10.6.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Share buybacks signal confidence

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.78% | Russell 2000 +0.41% | S&P 500 +0.36% | Dow -0.14%

FIXED INCOME: Barclays Agg Bond -0.22% | High Yield +0.02% | 2yr UST 3.592% | 10yr UST 4.158%

COMMODITIES: Brent Crude +1.58% to $65.55/barrel. Gold +1.87% to $3,981.9/oz.

BITCOIN: +2.09% to $125,263

US DOLLAR INDEX: +0.39% to 98.108

CBOE TOTAL PUT/CALL RATIO: 0.84

VIX: -1.68% to 16.37

Quote of the day

“The world is a narrow bridge and the important thing is not to be afraid.”

- Rabbi Nachman of Breslov (Daily Stoic)

Share buybacks signal confidence

Corporate America is flexing its financial prowess, again.

Stock buybacks, the process in which a company buys back its own shares in the open market, have been very strong in 2025 and remain on pace for another calendar year record – suggesting that beyond money managers and retail investors, corporate buying has provided significant support to equity markets.

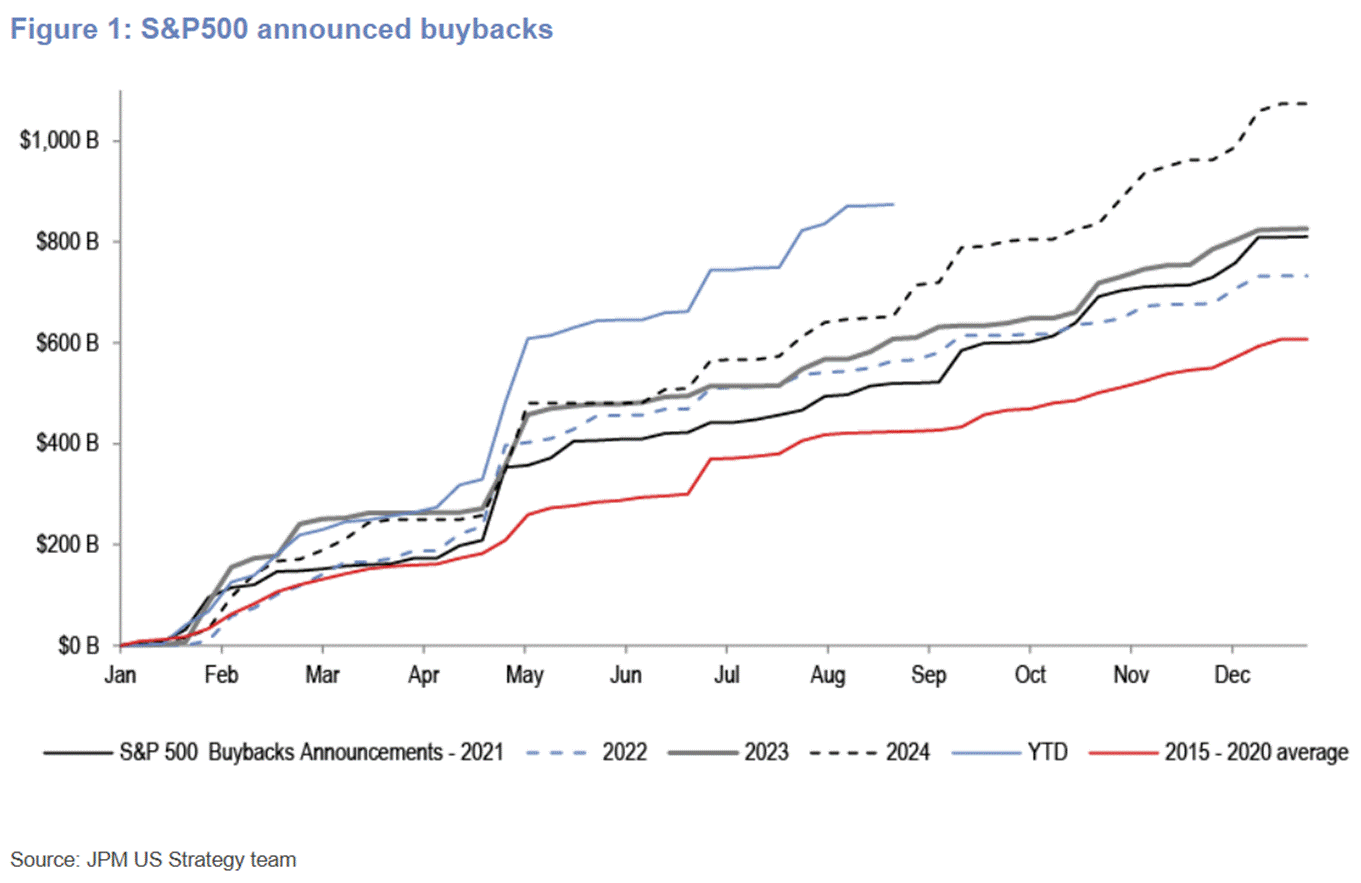

Year to date, S&P 500 companies have announced $960 billion in commitments which easily surpasses the three-year average of $644 billion.

Given that actual buyback executions have kept pace with the record volume of announcements, U.S. share buybacks should exceed $1 trillion (~15% YoY growth) for the first time in 2025.

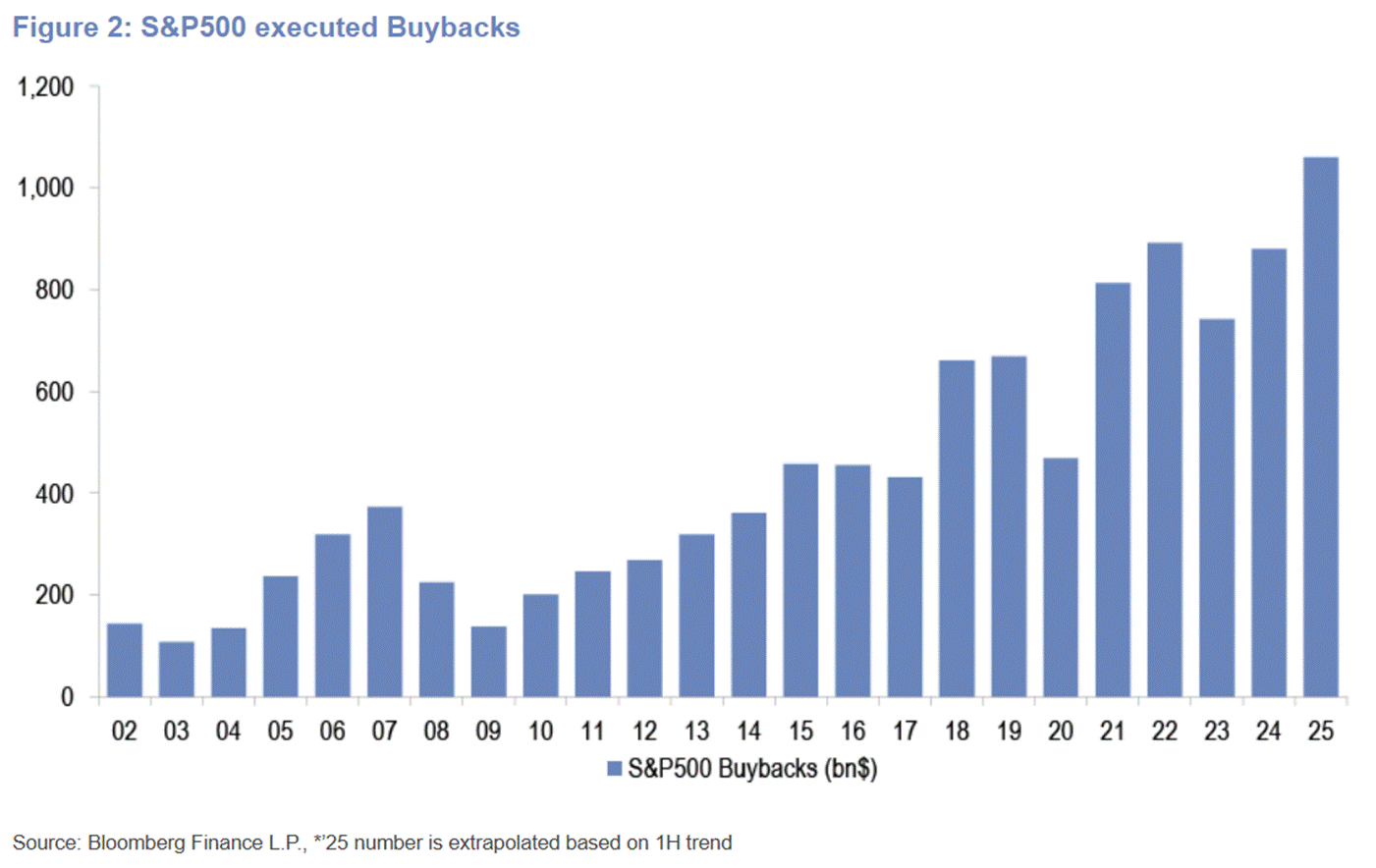

Stock buybacks have been on a bit of a roller coaster over the last couple years.

After crashing in 2020 during the pandemic, share repurchases exploded in growth in 2021 and the first half of 2022 before collapsing again in 2023 as C-Suites across America prepared for the recession that never came. They are back in a big way in 2024 and 2025.

Buybacks are buttressed by resilient earnings, good cash flow generation, looser financial conditions, and strong credit markets.

Taken together, this has companies feeling much more confident about the future after a tough first half that was marked by tremendous trade, political, and tax uncertainties.

On the other hand, cracks could emerge if labor markets wobble further or CapEx spending plans ramp up.

Sources: Bloomberg, J.P. Morgan Markets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)