U.S. vs. Rest of World: regional differentials

The Sandbox Daily (6.16.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

U.S. vs. RoW: regional differentials

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.42% | Russell 2000 +1.12% | S&P 500 +0.94% | Dow +0.75%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield +0.20% | 2yr UST 3.973% | 10yr UST 4.451%

COMMODITIES: Brent Crude -1.89% to $72.83/barrel. Gold -1.40% to $3,404.3/oz.

BITCOIN: +3.74% to $108,484

US DOLLAR INDEX: -0.06% to 98.126

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: -8.21% to 19.11

Quote of the day

“A dream written down with a date becomes a goal. A goal broken down into steps becomes a plan. A plan backed by action makes your dreams come true.”

- Greg Reid

Regional differentials

International markets have performed well so far this year, relative to the United States.

2025 marks a stark departure from most investor’s experiences over the last roughly twenty years.

Since the end of the Global Financial Crisis in early 2009, the U.S. stock market has significantly outperformed international markets, as the S&P 500 has compounded at 14% while global equities ex-U.S. averaged 7%. Beyond the magnitude of performance differentials, this period of U.S. outperformance is also seen as one of the longest in history.

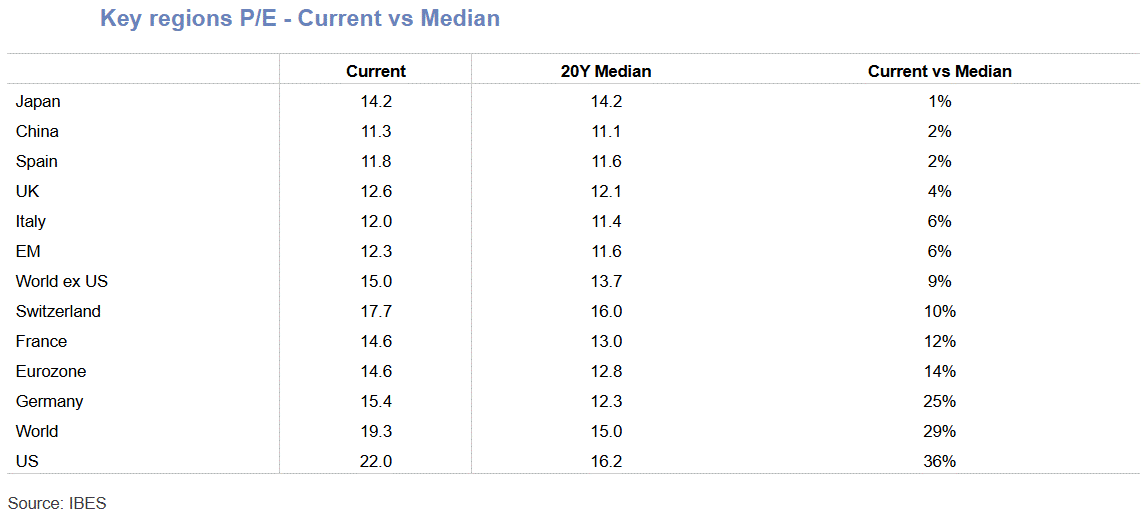

At face value, United States is trading at 22x forward earnings, versus the Rest of World at 15x, with the U.S. valuation premium over the years largely explained through superior earnings delivery.

Despite 2025’s shift in performance in favor of international assets, these global markets taken as a whole continue to trade at a historically steep valuation discount relative to the S&P 500 – currently -34%, which is roughly twice as cheap as the 20-year average.

The persistent downtrend channel of 15+ years suggests international equities remain structurally out of favor, but recent support favoring a reversal may hint at a potential bottoming pattern forming.

More time is needed for follow through on behalf of international markets to decisively declare we’re currently undergoing a structural regime shift.

What’s interesting is when reviewing the equity yield, the area of U.S. dominance – share buybacks – is narrowing, while the area where others are ahead – dividends – is widening.

With respect to Buybacks Yield, U.S. buybacks have outpaced European buybacks for most of the period since the Global Financial Crisis. Having said that, the wedge has been narrowing.

Compared to 2015 (ten years ago), U.S. buybacks have increased by 75%, while European buybacks have grown 160%. The U.S. is now at 1.8% vs Europe at 1.4%, a much smaller gap than has historically been the case.

Looking at Dividend Yields, Europe is at 3.1% while the United States is at 1.3%.

International markets always sported higher dividend yields, but if anything, the gap has widened of late.

Some are worried that the longer U.S. stocks continue to struggle in 2025, the greater the risk that international investors might pull their money and opt to park their capital in Europe or APAC or other markets – which could exacerbate the current setup and mark the beginning of a more lasting shift.

This is not to say that U.S. large caps will become less important or not return to its dominance in the near future. This is also not an argument for making significant changes to well-constructed portfolios.

Instead, maintaining a long-term investment strategy is all about considering various market outcomes and holding the right asset allocation across different types of investments.

While any single asset class may trend in and out of favor over various time frames, holding differentiated assets with unique characteristics and return patterns can provide valuable diversification benefits and benefit investors at different points throughout the cycle.

Sources: Bloomberg, YCharts, Goldman Sachs Global Investment Research, JP Morgan Markets

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)