VIX unlocking markets, plus stock returns after the final hike, U.S. economic growth, and credit

The Sandbox Daily (7.27.2023)

Publisher’s Note

The Sandbox Daily is taking a 1-day break on Friday 7/28 and will return to your inbox on Monday 7/31. It is family beach week and we’re making memories with the little rugrats! Enjoy your weekends !!!

Welcome, Sandbox friends.

Today’s Daily discusses:

VIX the key to unlocking markets?

S&P 500 performance following the end of Fed hiking cycles

U.S. economic growth re-accelerating

competing credit narratives

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.22% | S&P 500 -0.64% | Dow -0.67% | Russell 2000 -1.29%

FIXED INCOME: Barclays Agg Bond -0.86% | High Yield -0.79% | 2yr UST 4.926% | 10yr UST 4.002%

COMMODITIES: Brent Crude +1.13% to $83.86/barrel. Gold -1.19% to $1,985.6/oz.

BITCOIN: -1.39% to $29,179

US DOLLAR INDEX: +0.86% to 101.752

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: +9.25% to 14.31

Quote of the day

“I always say that while we can’t know where we’re going, we ought to know where we are (in cyclical terms). Understanding our environment can help us decide what tactics to employ, how aggressive to be, and which potential mistakes we should try hardest to avoid. Being conscious of cycles can be extremely helpful, even if we can’t see the future.”

- Howard Marks, It's All Good

VIX the key to unlocking markets?

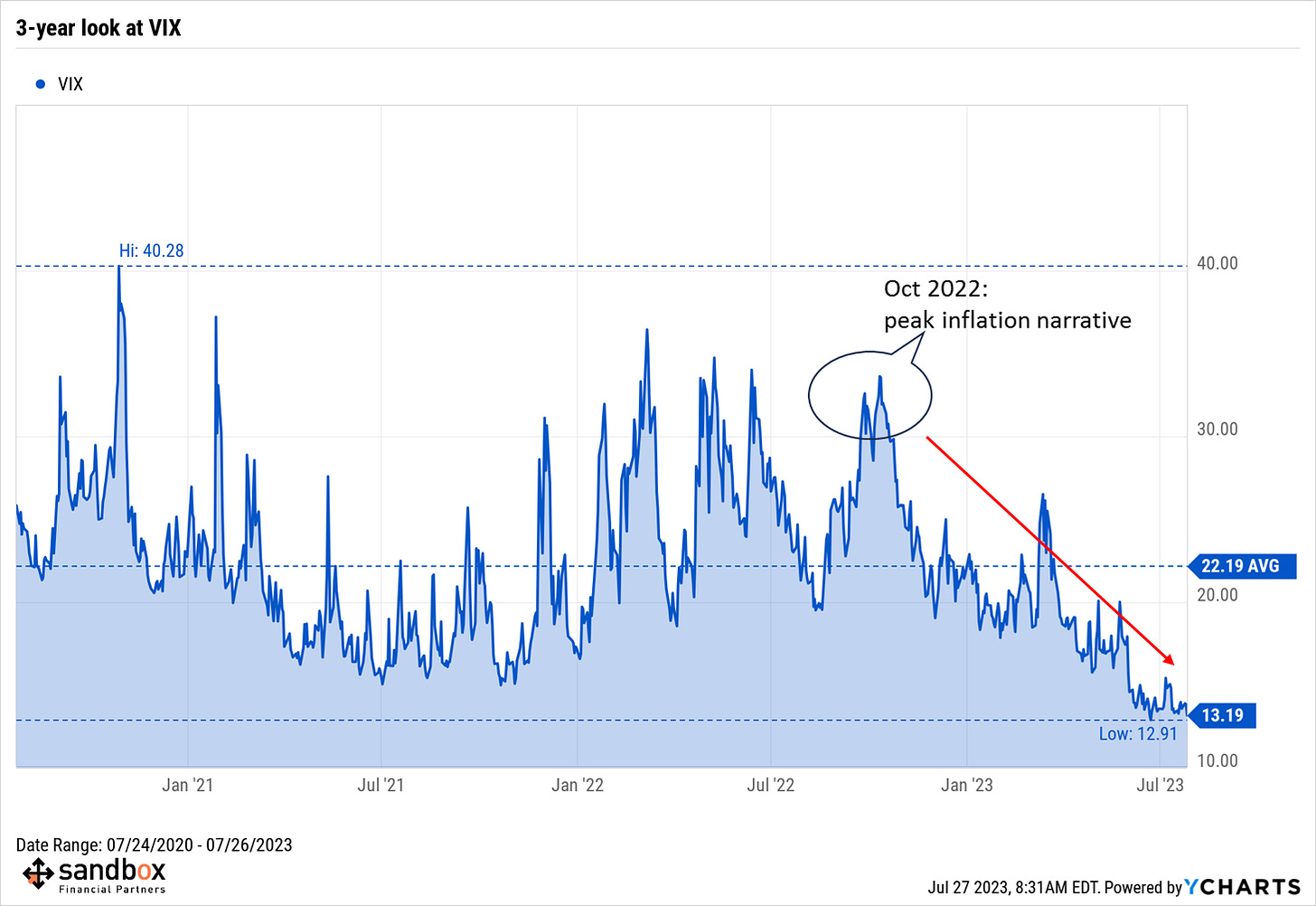

The CBOE Market Volatility Index, or VIX, has been volleying back and forth in a narrow range of 12 to 15 since June. Let’s unpack how we got to these levels.

The inflation narrative dominated headlines in 2022, peaking sometime around October. And when inflation “hit a wall” in October, so did equity volatility. This is around the same time when the U.S. dollar peaked and interest rates stopped backing up.

Refreshing our memory banks a little bit, October 13th is when we received another jumbo +0.6% MoM core inflation reading, causing the S&P 500 to gap down pre-market over -2% to only end the day positive (+2.6%, in fact) on the back of a fierce intra-day rally. This marked the stock bottom. Ever since, the collapse in VIX has been impressive, especially when weighed against the incredibly uncertain macro backdrop and tightening of financial conditions.

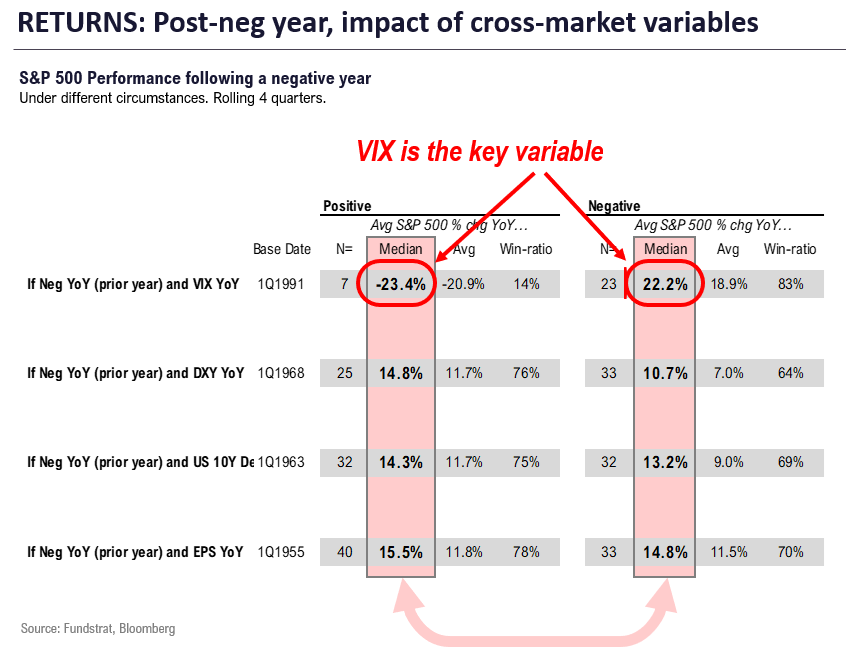

And falling volatility is generally a good thing for asset prices. In fact, after a negative return year (like 2022), the median equity gain the next year is +22% (win ratio 83%, n=23) when the VIX falls, versus equity losses with a median -23% return (win ratio 14%, n=7) when the VIX continues rising.

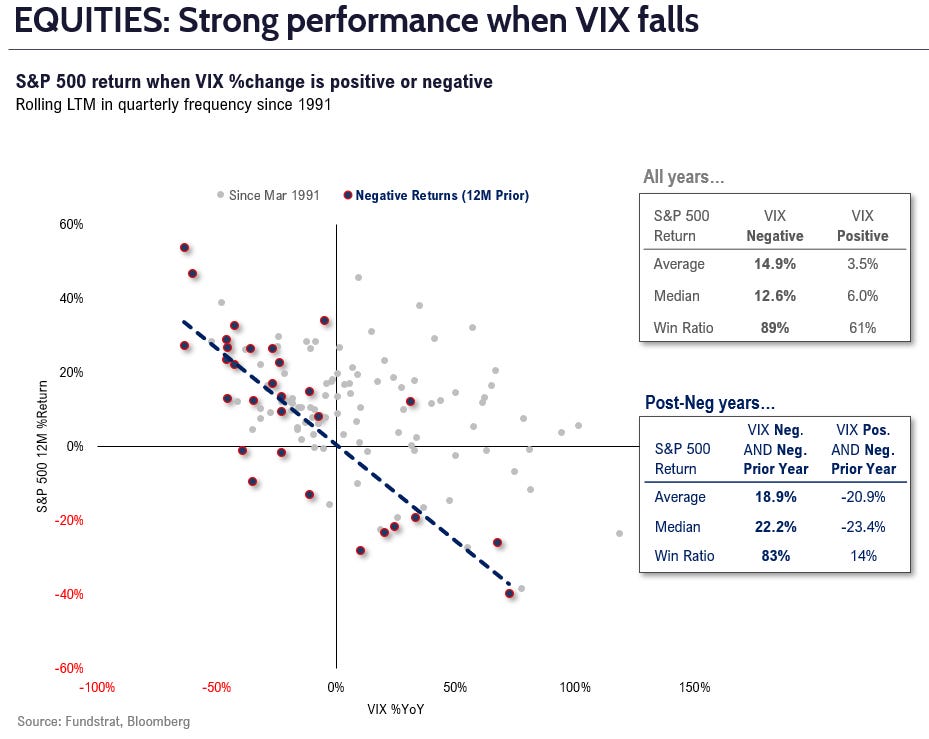

As the scatter plot below highlights, we can see the sizable influence of the VIX. Even in “All Years,” the bifurcation in outcomes shows VIX is a key differentiating input in realized returns.

So, is 2023 all just a volatility narrative?

Source: FS Insight

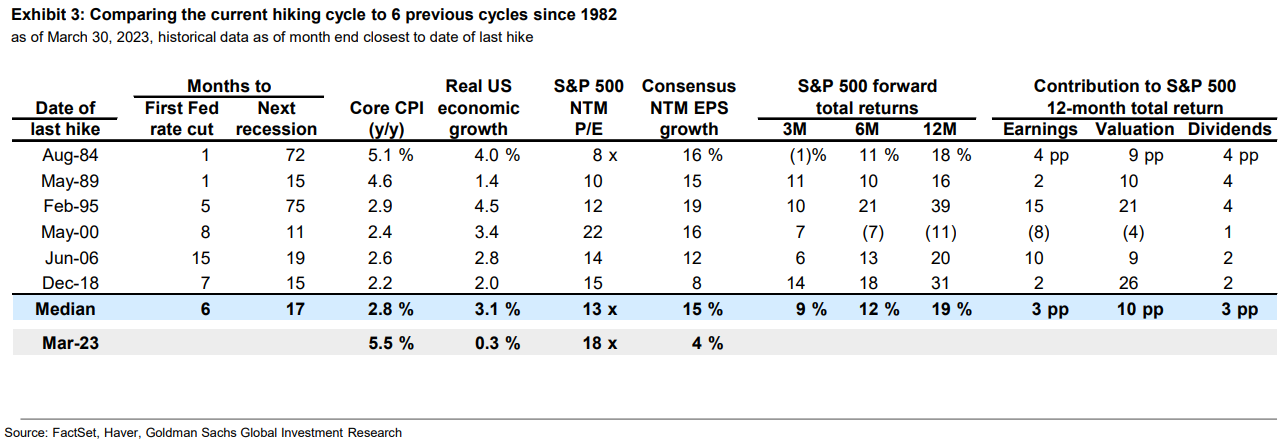

S&P 500 performance following the end of Fed hiking cycles

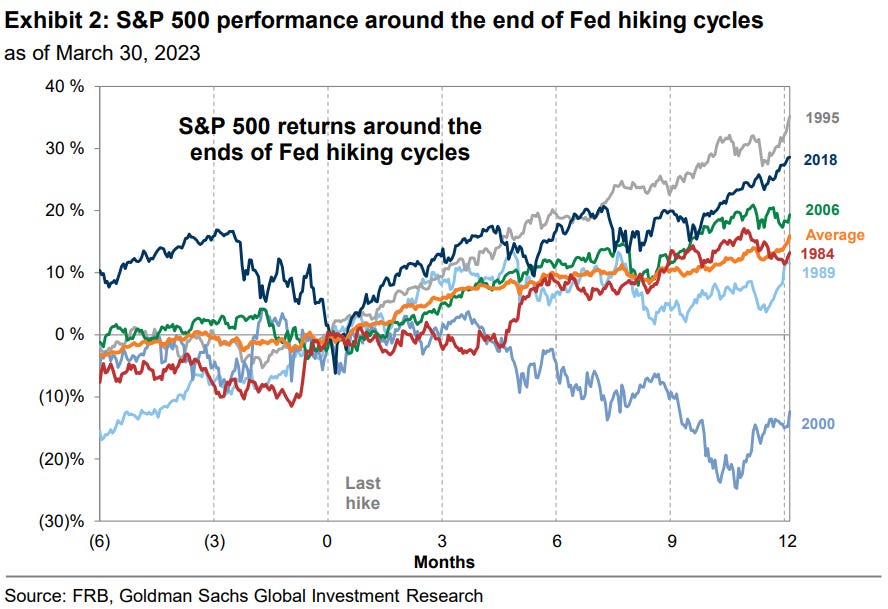

Yesterday, the Federal Open Markets Committee (FOMC) raised its target interest rate to 5.25-5.50%. Despite Fed Chair Jerome Powell stating the upcoming meetings will be “live” – meaning decisions will be made real time based on the incoming data – many believe the Federal Reserve is done hiking interest rates this cycle.

In recent market history, U.S. equities have generally rallied in the months following the end of past Fed tightening cycles.

In the 3-months following the peak Fed Funds Rate, the S&P 500 has returned an average of +8%, ranging from +14% to -1% and rising in 5 of 6 episodes. On a 12-month basis, the S&P 500 has returned an average of 19%, rising in 5 of 6 episodes and rallying by more than 10% in each of those.

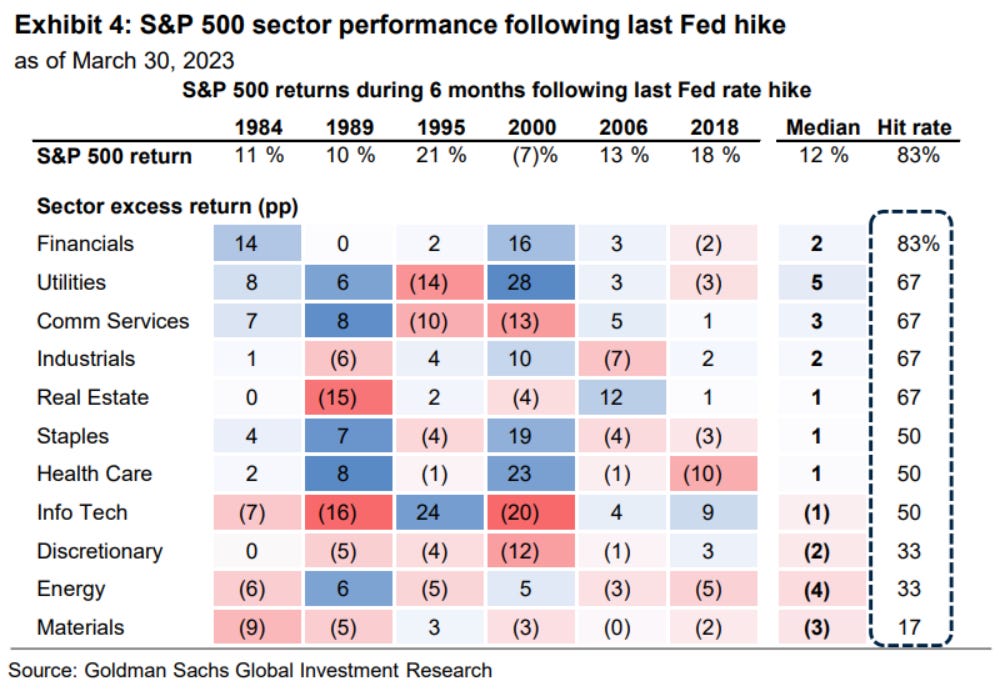

At the sector level, returns at the end of hiking cycles have been inconsistent. No sector out- or under-performed in every episode. Financials have outperformed the S&P 500 most consistently, leading the market in 5 of 6 cycles; Materials posted the worst hit rate (17%).

The big question is how much of the market has already priced this in.

Source: Goldman Sachs Global Investment Research

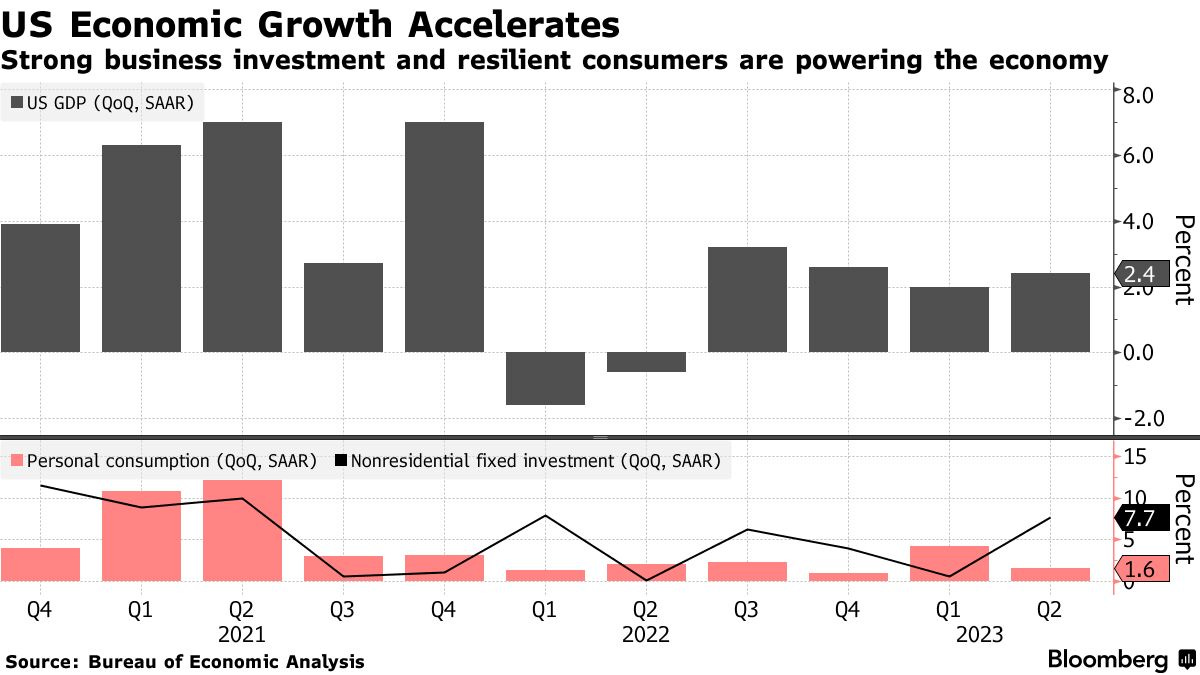

U.S. economic growth re-accelerating

The recession that everyone and their mother was expecting in 2023 must wait another day.

U.S. GDP growth accelerated to a 2.4% annualized rate in the 2nd quarter, above consensus expectations and the prior quarter’s growth of 2.0%. Economic activity seems to be striking the delicate balance policymakers want to see: strong, but moderating, activity.

Today’s report was led by private non-residential fixed investment, or “CapEx” – think spending on buildings, equipment, software, etc. It jumped at a 7.7% annualized rate, contributing 0.99 percentage points to the top-line number.

The re-acceleration of growth is a testament to the underlying strength and resilience of the U.S. economy since it comes on the heels of more than a year of Fed tightening which brought the Fed Funds Rate to its highest level since 2001.

Soft landing?

Source: Dwyer Strategy, Ned Davis Research, Bloomberg

Competing credit narratives

One story on credit says credit spreads (3.9%) on U.S. high-yield bonds are the lowest since April 2022 and well below the 10-year average of 4.5%.

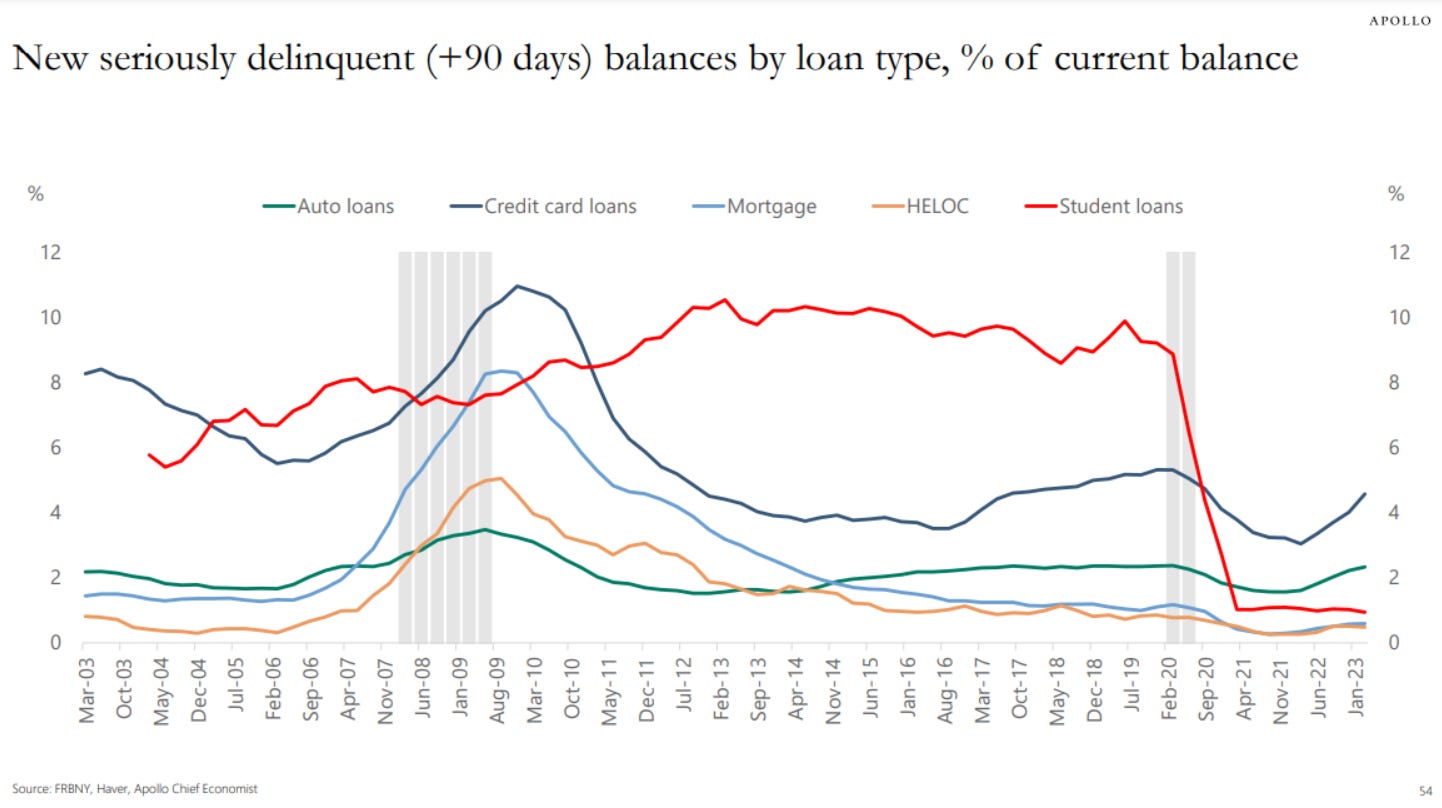

The other story, when looking at a broad range of indicators – rising delinquency rates for credit cards and auto loans (see chart below), rising default rates for HY and loans, rising corporate bankruptcies, slowing loan growth for banks), says the lagged effects of Fed hikes are finally creating fractures in credit.

With a higher cost of capital, this story is still in its first act. More to come…

Source: Apollo Global Management

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.

Thanks as always. I wonder if PCE comes in low likely followed by CPI, we'll get a big bump up.