Volatility, plus Goldman's recession forecast (and why it doesn't matter), oil, and analysts (finally) raising estimates

The Sandbox Daily (9.5.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

volatility is normal, don’t let it derail your plan

why Goldman’s latest recession forecast does not matter

oil surges for 8th consecutive day, fundamentals remain solid

analysts raising estimates, finally

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.11% | S&P 500 -0.42% | Dow -0.56% | Russell 2000 -2.10%

FIXED INCOME: Barclays Agg Bond -0.54% | High Yield -0.65% | 2yr UST 4.962% | 10yr UST 4.266%

COMMODITIES: Brent Crude +1.17% to $90.04/barrel. Gold -0.81% to $1,951.2/oz.

BITCOIN: -0.09% to $25,776

US DOLLAR INDEX: +0.54% to 104.801

CBOE EQUITY PUT/CALL RATIO: 0.65

VIX: +1.37% to 14.01

Quote of the day

“We are in the business of making mistakes. The only difference between the winners and the losers is that the winners make small mistakes, while the losers make big mistakes.”

- Ned Davis, Co-Founder of Ned Davis Research

Volatility is normal, don’t let it derail your plan

Investors should expect pullbacks – both big ones like 2022’s market rout (which was the worst for U.S. stocks since the Global Financial Crisis) and small ones like we felt during March’s regional banking crisis or August’s summer swoon.

But despite these selloffs, stock markets have rewarded long-term investors. The S&P 500 has suffered an average intra-year pullback of -14% over the past four decades, with 16 of those 43 years seeing even steeper losses. Yet the full-year return was positive in 32 of 43 years (75% of the time).

So while the “risk” for stocks is volatility, the reward comes with the “return” of long-term capital appreciation.

Source: J.P. Morgan

Things we can control

In a note over the weekend, Goldman Sachs further reduced their 12-month U.S. recession probability to 15%, down a (whopping) 5% from their prior estimate and equal to the unconditional average recession probability of 15% calculated from the fact that a recession has occurred roughly once every seven years since World War II.

This change reflects continued encouraging inflation news, a favorable real income outlook, and rebalancing of the labor market.

Goldman has now adjusted their recession forecast 7 times over the last year and a half.

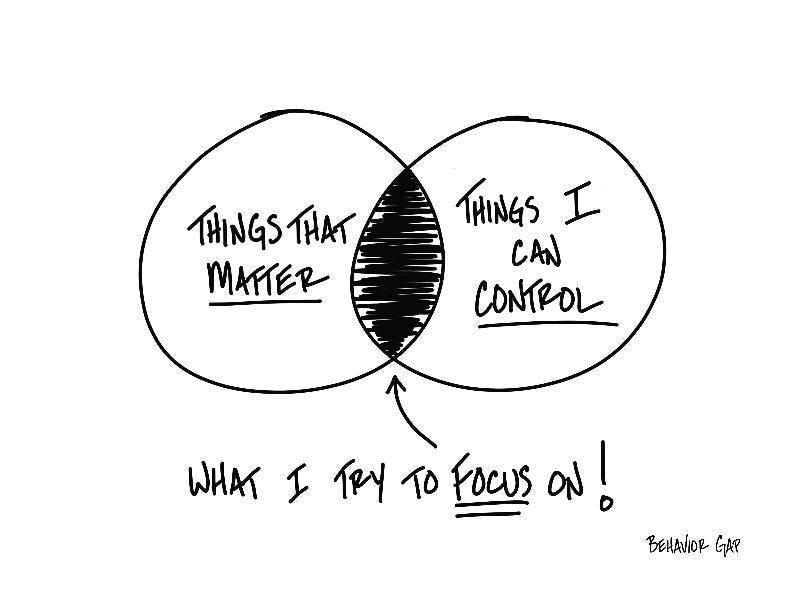

Are these forecasts and subsequent amendments things that matter? Are they within our sphere of control?

Of course the economy and stock market are totally unpredictable, which can either be exciting or frustrating or perhaps both at the same time. Despite that truism and despite its inherent difficulty, a plethora of banks, strategists, analysts, and economists – like Goldman Sachs above – still spend time and entire departments dedicated to forecasts, projections, and other forward looking statements.

But, what if we spent less time on these uncertainties and instead refocused our efforts more on the certainties within our control. These would include:

* your savings rate

* living expenses, including housing costs

* asset allocation and rebalancing methods

* the schedule on which you invest

* the types and amount of insurance coverage to carry

* education costs for your children

* personal relationships

Work on controlling the important things that are within your control, and use that to protect yourself from everything that is outside your control.

Source: Goldman Sachs Global Investment Research, The Behavior Gap

Oil surges for 8th consecutive day, fundamentals remain solid

Crude Oil prices surged higher for its 8th consecutive green day and closed at its highest price since November last year.

Despite disappointing July economic and credit data out of China – the world’s largest oil importer – which may weigh on global oil demand, the recent rally in oil should have more to run.

Global oil demand is reaching record highs and is set to expand further (see chart below), OPEC+ production cuts led by Saudi Arabia are set to keep oil supply tight, and declining crude stockpiles are all drivers that should support higher oil prices from here.

Source: The Kobeissi Letter, Topdown Charts, UBS

Analysts raising estimates, finally

For the first time since Q3 of 2021, analysts are increasing their earnings-per-shares (EPS) estimates for S&P 500 companies for the next quarter.

“The Q3 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q3 for all the companies in the index) increased by +0.4% (to $56.10 from $55.86) from June 30 to August 31.”

Typically, analysts lower their earnings estimates ahead of the coming reporting quarter over the first 2 concurrent months (July and August in this case for the July-September reporting quarter). In fact, over the last 20 years, the average decline in bottom-up EPS estimates is -2.9%.

After three consecutive quarters of negative earnings growth, does the pendulum swing the other way for the 3rd quarter earnings season?

Source: FactSet

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.