Volatility reset: the latest tariff tantrum and the important lesson for investors

The Sandbox Daily (10.13.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

Trade war with China: the latest tariff tantrum

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +2.79% | Nasdaq 100 +2.18% | S&P 500 +1.56% | Dow +1.29%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.63% | 2yr UST 3.529% | 10yr UST 4.059%

COMMODITIES: Brent Crude +0.97% to $63.34/barrel. Gold +3.24% to $4,130.2/oz.

BITCOIN: +0.63% to $115,869

US DOLLAR INDEX: +0.29% to 99.267

CBOE TOTAL PUT/CALL RATIO: 0.98

VIX: -12.14% to 19.03

Quote of the day

“You are only given a little spark of madness. You must not lost it.”

- Robin Williams

Trade war with China: the latest tariff tantrum

Markets finally received the wake-up call they needed.

After a month of relatively no volatility, a 25.68% spike in the VIX to 21.66 on Friday put investors on notice, its biggest one-day move in more than six months.

Stocks paid the price as the S&P 500 index dropped 2.7%, with Friday’s red candle engulfing the prior twenty trading days in just one session. See the chart below.

Crypto joined the selloff, with approximately $20 billion wiped out following leveraged liquidations in the largest clearing event yet for the nascent asset class.

Driving the news?

Escalating tensions between the United States and China over rare earth metals and renewed tariff threats.

While the brief selloff rattled some investors, markets quickly repaired themselves today following softer language from the White House and President Trump.

So, what’s the important takeaway here after this latest Roger Clemens high-and-inside fastball?

It’s critically important to not let a single bad day, and all of the negative headlines that accompany it, sway our investment decisions.

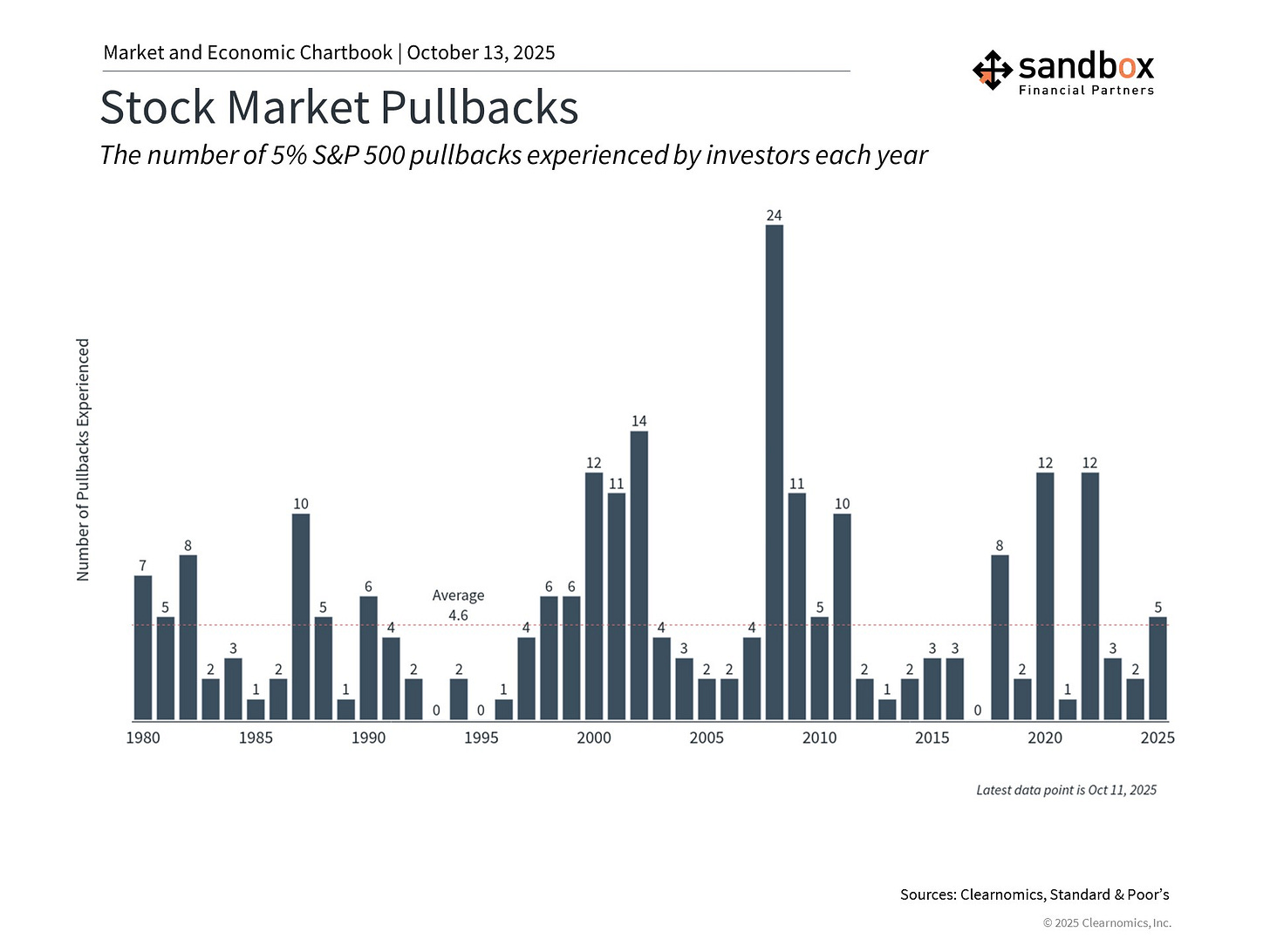

Instead, market swings can serve as a reminder that short-term volatility is a normal part of the investing process. Maintaining a long-term perspective remains the key to financial success.

Sure, the inputs might vary from selloff to selloff. This time, investors have been worried about the market’s forward price-to-earnings ratio of 23x, the sustainability of the AI trade, and the government shutdown.

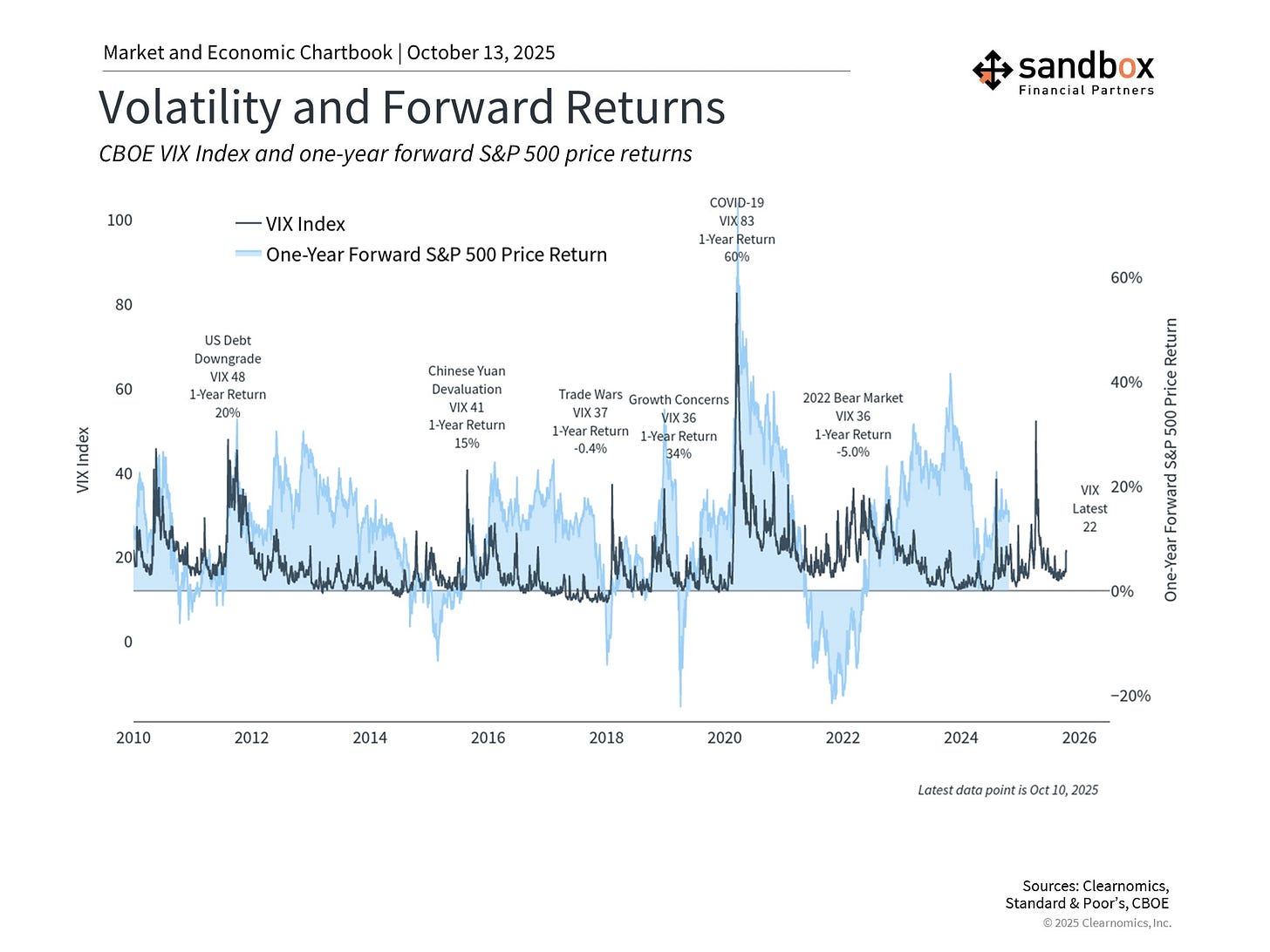

But, the end result remains the same. History shows that periods marked by heightened uncertainty, while uncomfortable, often present the greatest opportunities for patient investors.

Short-term washouts result in better entry points, which in turn support long-term growth. The fact that it’s challenging to invest during volatile periods is exactly why investors with the fortitude to do so are rewarded.

Friday serves as a necessary reminder that the market does not always go up in a straight line. Investors should always be ready for short-term turbulence.

Avoiding the tendency to overreact to every new development that could derail the market and your portfolio is one of the keys for long-term financial success.

Sources: TrendSpider, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Vol & forward returns is a nice reminder. Thanks Blake!