Voting-implied volatility, plus powering the AI revolution, Industrials, and earnings

The Sandbox Daily (11.5.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

voting-implied volatility

powering the AI/data center revolution

could rate cuts fuel another leg higher for Industrials?

downward earnings revisions aren’t what they seem

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.88% | Nasdaq 100 +1.32% | S&P 500 +1.23% | Dow +1.02%

FIXED INCOME: Barclays Agg Bond +0.23% | High Yield +0.28% | 2yr UST 4.187% | 10yr UST 4.281%

COMMODITIES: Brent Crude +0.61% to $75.54/barrel. Gold +0.27% to $2,753.5/oz.

BITCOIN: +2.74% to $69,783

US DOLLAR INDEX: -0.43% to 103.436

VIX: -6.78% to 20.49

Quote of the day

“Sometimes the smallest step in the right direction ends up being the biggest step in your life.”

- Naeem Callaway

Voting-implied volatility

The U.S. Presidential Election is finally here.

Based on polls and betting markets, it is an exceptionally close race that brings about market uncertainty regarding its outcome. And markets do NOT trade well on uncertainty.

Markets expect policies relatively similar to the status quo under a Kamala Harris presidency and favors big Tech, while a second Donald Trump presidency brings about potential tariffs and corporate tax reductions that would likely result in higher inflation, interest rates, and a stronger Dollar.

Investors are pricing quite a large equity move both on Wednesday and the following days.

Downside protection is in vogue, with put-buying coming in greater than 2x call-buying on Friday of last week.

As Jason Goepfert writes: “That’s one of the highest turnovers in 15 years. It has typically spiked at times of extreme anxiety.”

Meanwhile, bond traders expect significant volatility in the future of bond yields.

The BofAML MOVE Index, which tracks Treasury volatility sort of like a VIX for the bond market, has surged to its highest levels of the year. The MOVE Index has increased from 90.14 on September 26 to 136.26 as of November 4 and is currently double its longer-term average.

No matter the election result, the fork in the road ends here. A major market clearing event shifts to the rear view mirror.

After Tuesday, Americans will have selected their future government and the rest of us will continue on with life as we know it, just like any other week.

Source: Goldman Sachs Global Investment Research, Jason Goepfert, Google Finance

The business of America is business

Microsoft, Google, Salesforce, and countless other Big Tech companies are embarking on ambitious plans to expand their data center capacity to meet surging demand for foundational and generative AI models. And those data centers require lots of electricity to run information technology equipment and cooling systems.

Among the constraints facing these hyperscalers, none looms as large as power adequacy.

How much electricity is AI likely to consume? That’s one of those questions where no answer, however hyperbolic, seems too ridiculous to countenance.

The International Energy Agency expects data centers to consume more electricity by the end of 2026 than the entire economy of Japan. At current fixed investment rates, data centers’ share of U.S. electricity generation increases at the rate of nearly 1% per month.

Source: International Energy Agency

Could rate cuts fuel another leg higher for Industrials?

If lower interest rates lead to more capital investment, Industrials should be one of the biggest beneficiaries.

Over the coming months and quarters, sector leadership could provide clues to whether investors believe the Fed is on track to accomplish its policy normalization goals. A non-recession easing cycle has the potential to aid some of the most economically sensitive sectors that have lagged the index this year. Among cyclical Value sectors, only Financials has outperformed, with Industrials, Materials, and Energy all trailing the S&P 500 year-to-date.

Generally speaking, the economic impact of easing often takes longer compared to the impact of financial markets. However, the lag effect has tended to be shorter when the economy has not fallen into a recession.

In fact, when the economy dodges recession, CapEx spend has historically risen heading into the easing cycle, with the ascent continuing after the first cut (red line below). Meanwhile, capital expenditures have flat-lined during recessionary cycles as companies shelve R&D projects and protect capital.

If lower interest rates and a resilient economy result in rising CEO confidence and CapEx spending, Industrials should benefit into year-end and 2025.

Source: Ned Davis Research

Downward earnings revisions aren’t what they seem

Over the last week or two, several strategists on the major financial networks have made the claim the market is due for a pull back based on the premise that earnings estimates for Q4 are dropping while the market is fully valued at 21.3x forward earnings.

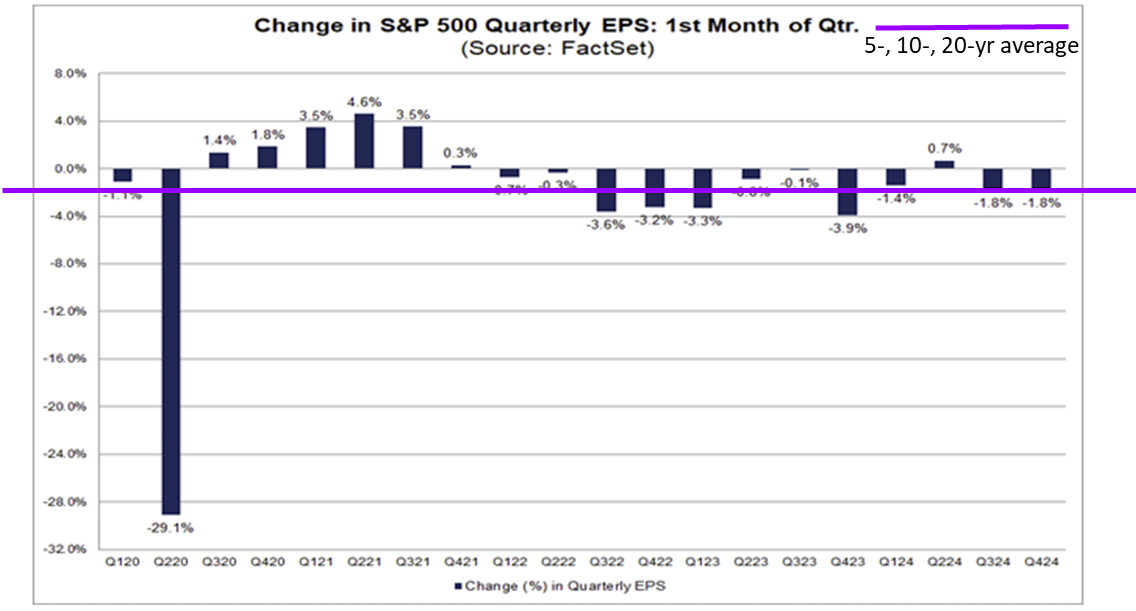

Setting aside the market multiple and instead focusing on the adjustment to forward earnings, FactSet is reporting that sell-side analysts have taken down their Q4 bottom-up EPS estimate by -1.8% throughout the month of October (Sept 30-Oct 31).

Well, maybe those strategists were correct after all. Earnings estimates are dropping, which on the surface is not a great thing.

Except, context is everything.

Over the past five-, ten-, and twenty-years, the average decline for the next quarter’s EPS estimates (here: Q4) during the first month of the prior reporting quarter (here: Q3) is a decline of -1.8%, -1.8%, and -1.8%.

In other words, analysts always take down collective earnings estimates by roughly 2% ahead of the next quarter which is right in line with historical patterns.

This bit of trickery from Wall Street allows a lower hurdle for companies to beat expectations and receive favorable marks on their next quarterly report card.

Source: J.P. Morgan Guide to the Markets, FactSet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: