Voting with your wallet, plus time affluence, small-caps BTN, and a crazy Tech stat

The Sandbox Daily (2.7.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

It’s the economy, stupid!

time affluence

small-caps, by the numbers

tech: one simple chart

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.04% | S&P 500 +0.82% | Dow +0.40% | Russell 2000 -0.17%

FIXED INCOME: Barclays Agg Bond -0.20% | High Yield +0.17% | 2yr UST 4.433% | 10yr UST 4.117%

COMMODITIES: Brent Crude +0.98% to $79.36/barrel. Gold -0.07% to $2,050.2/oz.

BITCOIN: +2.81% to $44,361

US DOLLAR INDEX: -0.15% to 104.054

CBOE EQUITY PUT/CALL RATIO: 0.73

VIX: -1.76% to 12.83

Quote of the day

“In price, there's knowledge.”

- Alan Shaw

It’s the economy, stupid

The 2024 presidential election is sure to grab headlines and spark debates – healthy and productive ones, hopefully – across scores of issues that concern Americans all across this great nation.

The current setup has something for everyone: generational high inflation, multiple geopolitical conflicts, recent Supreme Court decisions including Affirmative Action and Roe v. Wade, foreign policy issues with China, immigration, soaring healthcare costs, homelessness, crime, etc etc etc. Don’t attack the messenger, here – I like to play the role of Switzerland.

But, like any election, voters generally vote with their wallets. As James Carville once quipped: “it’s the economy, stupid!”

To wit, here’s a recent AP poll that found Americans are more focused on the economy than any other issue – by a landslide. 76% of U.S. adults said they want the government to work on issues related to the economy in 2024, twice more a priority than anything else.

Just think about that for a minute.

With all the issues pressing this beautiful nation, it still comes down to jobs, paychecks, the price of goods and services, the value of your home and investment accounts, and quality of life.

That’s it. That’s what Americans care so deeply about.

One bit of advice ahead of the election? Don’t invest or adjust your portfolios based on headlines – we’ll get plenty of fireworks in 2024, to be sure. Remember your financial goals, stick to the plan, and carry on with your day.

Source: Associated Press

Time affluence

What does the word "affluence" mean to you?

For most people, this is a financial concept.

But academics have also developed an idea called "time affluence." So, what does that mean?

In short, it acknowledges that money isn't everything. In fact, for some people, it isn’t even the main thing. Free time, on the other hand, takes on significantly more value and becomes a key determinant to personal happiness.

"Time affluence" prioritizes meaningful experiences, values leisure over constant busyness, advances deeper human connection and personal relationships, and cultivates a more balanced life. It involves mindful use of time, reducing unnecessary commitments, and focusing on activities that bring fulfillment and well-being, ultimately leading to a more satisfying and enriched lifestyle.

According to Ashley Whillans, author of Time Smart: How to Reclaim Your Time and Live a Happier Life, 80% of working Americans feel time-starved.

To learn more, check out Professor Whillans' excellent TED Talk.

Source: Brown Brothers Harriman, Vox, New York Times

Small-caps, by the numbers

U.S. small-caps remain one of the few major market averages firmly off their all-time highs, as both the S&P 600 (-14%) and Russell 2000 (-20%) indexes still have lots of work remaining to retrace their losses from the 2022 bear market.

A large part for their underperformance is due in part because these companies are more sensitive to economic cycles and interest rates. After all, fundamentals still matter. Remember, these businesses were bracing themselves for Jamie Dimon’s “hurricane” – thankfully, that storm cell never came crashing down on the economy.

Take the composition of debt in the small cap universe, for example. Now that the Fed Funds Rate is trending above 5% following the most aggressive pace of interest rate hikes in history, it’s hard to imagine that such highly leveraged companies tied to floating rate loans will fare well in the current environment.

49% of the Russell 2000 universe is saddled with floating rate debt, versus just 9% for the S&P 500.

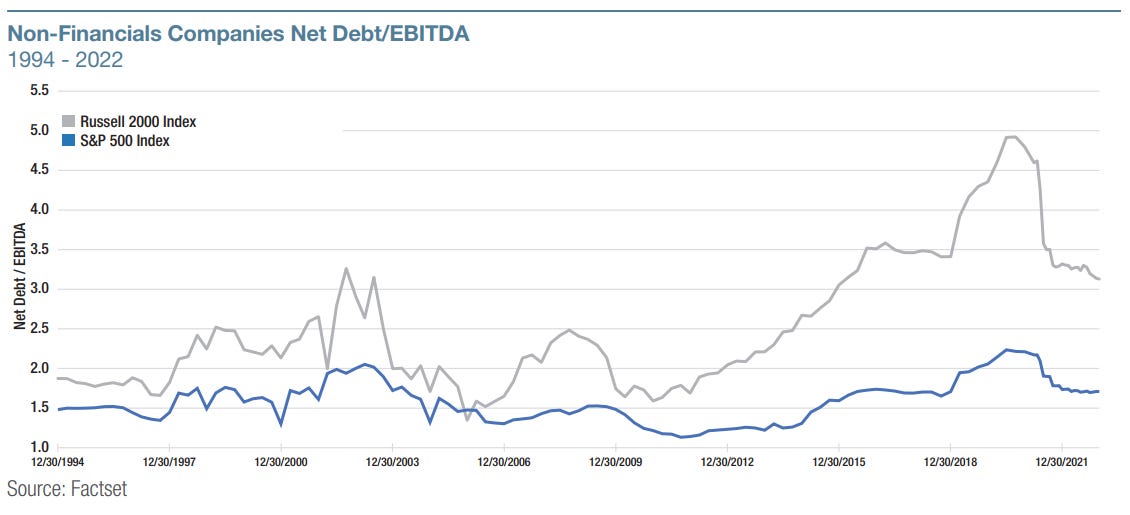

Leverage issues also hurt stock performance and warrant further caution for investors considering an allocation to small-caps. Here investors focus on the weighted average net-debt-to-EBITDA ratio – in simple terms, it’s a common debt ratio that shows how many years it would take for a company to pay back its debt if debt and earnings are held constant.

Small-cap companies have a Net Debt/EBITDA ratio of 2.5X, compared with an average of just 1.3X for the S&P 500. What’s more, the 2.5X Net Debt/EBITDA ratio for small-caps is roughly at the same level it was following the Global Financial Crisis, when interest rates were pushed down to almost zero as the result of the Fed’s QE program.

And many investors have noticed the maturity wall coming due in 2026-2028.

Unless interest rates decrease at a much faster pace, the burden of interest expenses is expected to persist, adding further strain to the earnings of small-cap companies.

One final area of concern for small-caps?

Earnings, or lack-there-of. Nearly half the small cap universe is unprofitable.

The convergence of these various factors fundamental metrics underscore the formidable challenges faced by small-cap stocks in the current environment.

Source: Pacer ETFs

Tech: one simple chart

This next one jumped right off the page for me.

Here’s Austin Harrison over at Grindstone Intelligence (emphasis mine):

Tech is unstoppable.

Just how unstoppable? Over the last 5 years, the Information Technology sector has risen more than 200%, 2x the return of the S&P 500 index.

It goes even further than that, though. Tech’s dominance has been so extreme that every other sector has lagged the benchmark. 10 out of the 11 sectors are below ‘average’.

Source: Grindstone Intelligence

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.