Wall Street continues to shake off a barrage of uncertainty

The Sandbox Daily (1.12.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

12 landmines through January 12

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.44% | Dow +0.17% | S&P 500 +0.16% | Nasdaq 100 +0.08%

FIXED INCOME: Barclays Agg Bond -0.05% | High Yield +0.05% | 2yr UST 3.541% | 10yr UST 4.187%

COMMODITIES: Brent Crude +0.95% to $63.94/barrel. Gold +2.28% to $4,603.4/oz.

BITCOIN: +1.39% to $91,235

US DOLLAR INDEX: -0.24% to 98.891

CBOE TOTAL PUT/CALL RATIO: 0.75

VIX: +4.35% to 15.12

Quote of the day

“The height of the pinnacle is determined by the breadth of the base.”

- Ralph Waldo Emerson

Wall Street continues to shake off a barrage of uncertainty

The positive outlook for risk assets remains intact despite a field of landmines greeting investors early in 2026.

Investors started the year with (1) Operation Absolute Resolve and the (2) capture of Venezuelan President Nicolás Maduro in a middle-of-the-night military operation under the auspice of narco-terrorism and corruption charges.

Then it was a series of Truth Social posts early last week.

Trump said (3) he wanted to ban institutional investors from buying single-family homes, (4) bar defense companies from issuing dividends and doing stock buybacks while (5) later calling for a 50% increase in the nation’s defense budget, and (6) directed Fannie Mae and Freddie Mac to purchase mortgage bonds with the intent of driving mortgage rates lower.

Despite the noisy headlines and a mixed (7) November jobs report, the S&P 500 turned in a record high close last week while gaining 1.6%.

Over the recent weekend, the President (8) announced credit card interest rates must be capped at 10% and Americans will no longer be “ripped off” by exorbitant credit card fees. Then (9) the Department of Justice opened a criminal investigation into Federal Reserve Chair Jerome Powell over comments he made in a June 2025 congressional testimony related to a Federal Reserve renovation project.

Through it all, investors have largely shrugged their shoulders and moved on. Markets are always climbing the wall of worry and 2026 is no different.

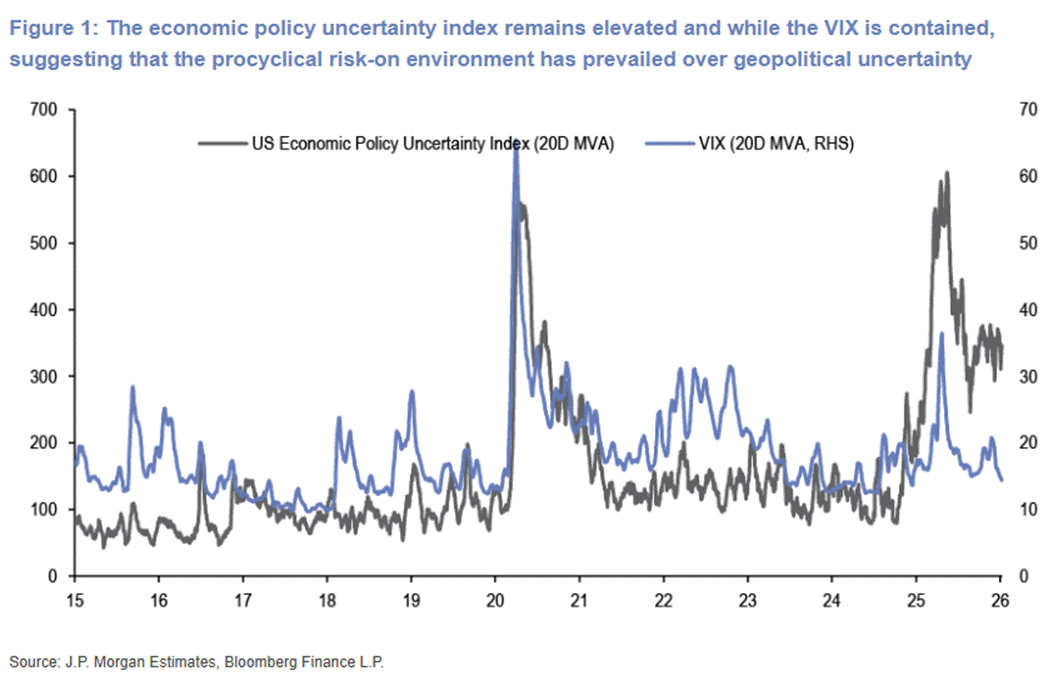

Market sentiment remains robust with many risk appetite indicators accelerating and moving into the high end of ranges.

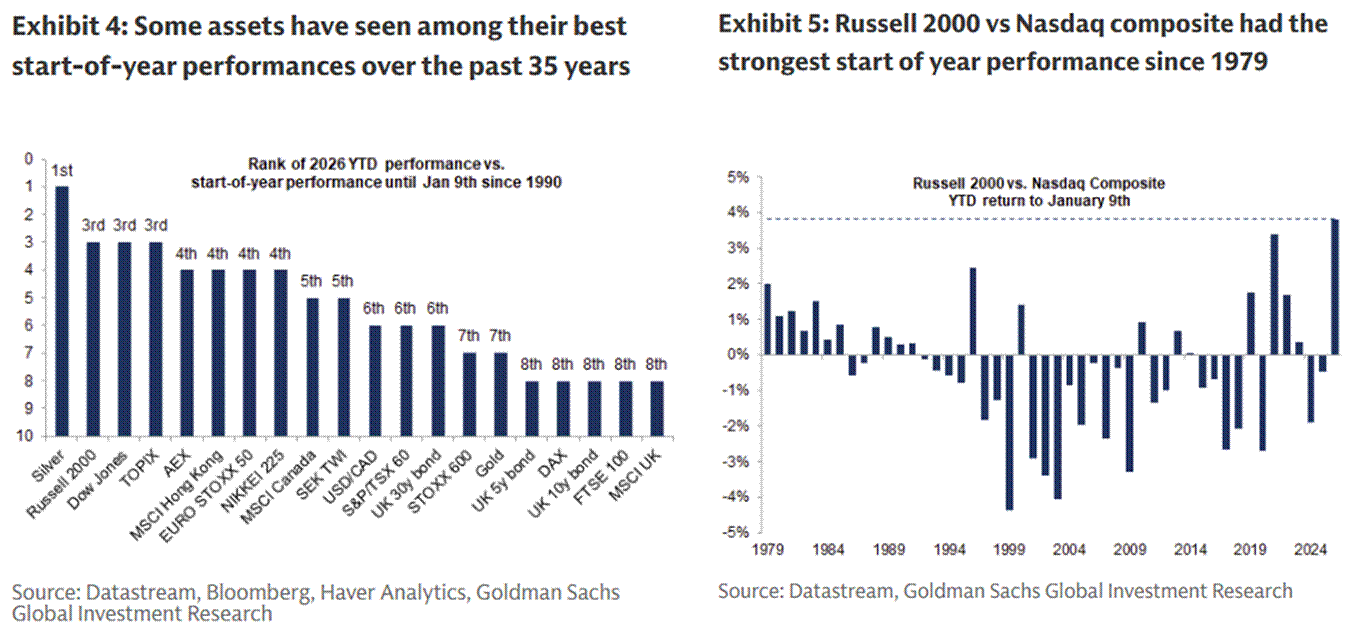

Some assets are experiencing the best start of year rallies in their history.

Silver had the strongest start of a year since at least 1968, while U.S. small-caps are enjoying their largest year-to-date outperformance over the Nasdaq in history.

What landmines lie around the corner?

(10) Tuesday’s CPI inflation print, (11) the U.S. Supreme Court decision over the legality of President Trump’s sweeping global tariffs, and (12) Q4 earnings season starting with the banks later this week.

Head on a swivel as they say !

Sources: J.P. Morgan Markets, Goldman Sachs Global Investment Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)