Wall Street's biggest bear throws in the towel and turns "bullish," plus corporate defaults, easing cycle broadens, and Dow 40k

The Sandbox Daily (5.20.2024)

Welcome, Sandbox friends.

A lot of new faces here – welcome aboard !! Appreciate the love more than you know, Sam Ro, CFA :)

Today’s Daily discusses:

last big bear on Wall Street turns bullish on U.S. stocks

monthly corporate defaults hit highest level since 2020

the G10 monetary easing cycle is broadening

what Dow 40k means for consumer net worth

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.69% | Russell 2000 +0.32% | S&P 500 +0.09% | Dow -0.49%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield +0.05% | 2yr UST 4.852% | 10yr UST 4.447%

COMMODITIES: Brent Crude -0.40% to $83.64/barrel. Gold +0.56% to $2,430.9/oz.

BITCOIN: +7.47% to $71,204

US DOLLAR INDEX: +0.16% to 104.613

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: +1.33% to 12.15

Quote of the day

“Don't cry because it's over. Smile because it happened.”

- Dr. Seuss

Last big bear on Wall Street turns bullish on U.S. stocks

Today’s big scoop was Morgan Stanley’s Chief U.S. Equity Strategist, Mike Wilson, throwing in the towel and turning “bullish” on stocks.

One of the most prominent bears on Wall Street boosted his price target for the S&P 500 from 4,500 to 5,400, a 20% hike Bloomberg reported and represents just under +2% upside from current levels. He now sees robust EPS growth plus modest earnings compression. “We prefer large caps over small caps and a barbell of quality growth and quality cyclicals,” he wrote.

A humbling capitulation.

~6 months ago, the average Wall Street 2024 year-end target for the S&P 500 was 4,861. See table below.

Today, as of May 20th, the S&P 500 is trading ~5,300.

Monthly corporate defaults hit highest level since 2020

Global corporate defaults have surged to a total of 55 so far in 2024, the highest number since the 2020 pandemic. This is on pace with the 2023 count and 25% above the 10-year average.

In April alone, global bankruptcies increased by 18, the largest monthly jump since October 2020. Yet, while the number of global defaults more than doubled from March to April, the volume of debt nearly halved from $16.3 billion to $8.6 billion.

Defaults have been largely concentrated in the US where 32 defaults have occurred year to date. The vast majority of defaults have been seen in Telecommunications and Technology with $20.9 billion of debt defaulting.

High interest rates, specifically leveraged loans tied to floating rates like SOFR, are taking their toll on corporations.

"Looming maturities, strained operations, and elevated refinancing costs were among the main reasons for the increase in bankruptcies," the report said.

Source: S&P Global, Wall Street Journal

The G10 monetary easing cycle is broadening

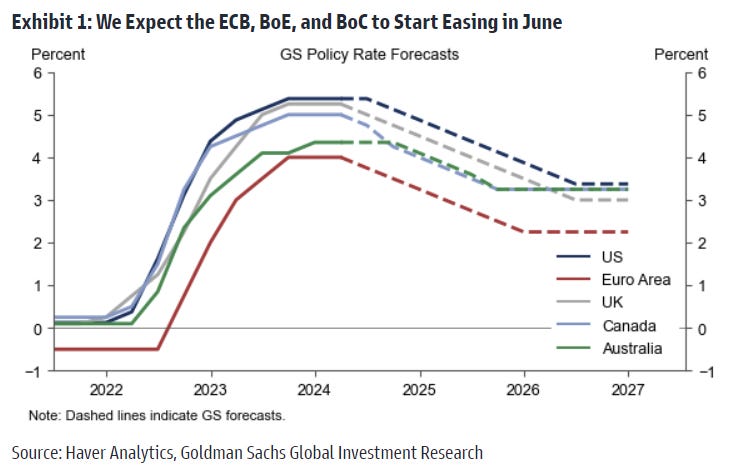

Following the recent moves by the Swiss National Bank and the Swedish Riksbank, Goldman Sachs expect the European Central Bank (ECB), Bank of England (BoE), and Bank of Canada (BoC) to start cutting rates in June.

The pace of easing is likely to be gradual because prices and wages are still growing faster than implied by central bank targets in every economy except Switzerland, and unemployment remains near pre-pandemic levels in every economy except Sweden (in fact, it stands at a multi-decade low in the Euro area). Nevertheless, G10 central banks increasingly think that a policy rate which looked necessary 6-12 months ago no longer looks appropriate now that the inflation throttle has passed.

Source: Goldman Sachs Global Investment Research

What Dow 40k means for consumer net worth

The Dow Jones Industrial Average reached 40,000 for the 1st time last week as markets continue to rebound from its spring malaise. While this has felt like a difficult year for many investors due to inflation, high interest rates, and growth concerns, the reality is that the broad market – as measured by the S&P 500 index – has achieved 23 new all-time highs. Other asset classes, including international stocks, commodities, and even gold, have surged alongside the U.S. stock market as interest rate expectations have fallen.

The health of the economy is perhaps the most important driver of this volatile but strong market performance, and this in turn boils down to robust consumer spending. Recent data show that the financial health of consumers is still remarkably strong despite higher prices for everyday goods and services, layoffs in certain sectors, and diminished savings rates. Since consumer spending makes up ~70% of GDP, the state of consumer balance sheets, wage gains, and sentiment are critical to both corporate revenues and overall economic growth. What does the financial health of consumers here in mid-2024 mean for the broader economy?

Household net worth has reached new record levels, exceeding the pre-pandemic high of around $150 trillion. Household net worth grows with the value of assets such as cash, stocks, bonds and real estate, and it declines with liabilities such as credit card debt and auto loans. The strong economy and bull market have led overall household net worth to more than double since 2007, despite the pandemic and the 2022 bear market.

Rising household net worth can drive consumer spending since the more money people have, the more they feel they can spend – a phenomenon known as the “wealth effect.” When people feel like they are in a good place financially, they tend to spend more which can then drive business profits, higher wages, and ultimately boost stock prices. The wealth effect can occur even when illiquid assets such as homes or retirement investment accounts increase in value.

While consumer balance sheets have grown in aggregate, consumer debt levels are also rising. For some consumers, there are also signs of distress due to the burden of monthly payments. According to the Federal Reserve Bank of New York’s latest Household Debt and Credit report, delinquency rates across all consumer debt levels increased in the 1st quarter of the year. While mortgage debt, student loan debt, and home equity loan delinquencies remain around their recent trends, credit card and auto loan delinquencies have jumped.

Specifically, 8.9% of credit card balances have become delinquent over the past year as some consumers have struggled with payments, much higher than the 10-year average of only 5.9%. Credit card balances declined slightly in the 1st quarter of the year but still total $1.1 trillion, 13.1% higher than just a year ago. Similarly, auto loan delinquencies have increased to 7.9% of balances with the total amount of auto loan debt growing 3.5% YoY to $1.6 trillion.

Higher interest rates can make servicing these debts difficult. In many ways, this is by design as the Fed attempts to tighten monetary policy and slow economic growth to fight inflation. New debt issuance has indeed slowed since the Fed began raising rates: excluding mortgage debt, the growth rate of debt balances has decelerated from 7.3% a year ago to 4.8% in the first quarter of 2024. While monthly payments will continue to be a challenge for many households, the fact that consumers are adding debt at a slower rate is positive.

Consumer sentiment has fluctuated because of market swings and the uncertain inflation environment. Sentiment tends to improve when inflation is decelerating and the job market is strong, as it was last year. Today, persistent inflation has negatively impacted how everyday consumers view the economy, even though unemployment remains near historic lows.

Fortunately, the trends are gradually moving in the right direction. The latest Consumer Price Index report, for instance, showed a deceleration of inflation with headline and core inflation of 3.4% and 3.6%, respectively, their lowest levels since 2021. These are still well above the Fed’s 2 to 2.5% target and follow several months of higher-than-expected inflation readings. Still, they have been enough for markets to once again expect two Fed rate cuts this year and are a reminder that the data can fluctuate on a monthly basis.

Bottom line, the average U.S. consumer continues to be financially healthy even though inflation, higher interest rates, and growing debt are burdens on many households. This is partly driven by rising asset prices as markets recover from their recent decline. The reverse is also true – the wealth effect drives consumer spending which helps corporate earnings, in turn supporting stock prices. In the long run, the health of consumers and the broader economy is a far more important driver of market performance than day-to-day headlines.

Source: Clearnomics

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.