Wall Street's outlook for 2024, plus central banks, rates after the "pivot," and 4th quarter earnings

The Sandbox Daily (1.8.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

Wall Street’s muted expectations for 2024

central banks at the finish line

rates fall after the “pivot”

analysts cut 4th quarter EPS estimates more than average

Tonight we are cheering on my alma mater, The University of Michigan, in the College Football National Championship game. Team 144 is seeking the first national championship for the Wolverines since 1997. Go Blue !!

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.11% | Russell 2000 +1.94% | S&P 500 +1.41% | Dow +0.58%

FIXED INCOME: Barclays Agg Bond +0.38% | High Yield +0.56% | 2yr UST 4.366% | 10yr UST 4.012%

COMMODITIES: Brent Crude -3.01% to $76.39/barrel. Gold -0.76% to $2,034.3/oz.

BITCOIN: +6.19% to $46,934

US DOLLAR INDEX: -0.16% to 102.247

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -2.02% to 13.08

Quote of the day

“Diversification means constantly feeling regret about something in your portfolio that’s underperforming. That’s a feature, not a bug.”

- Ben Carlson in Updating my favorite performance chart for 2023

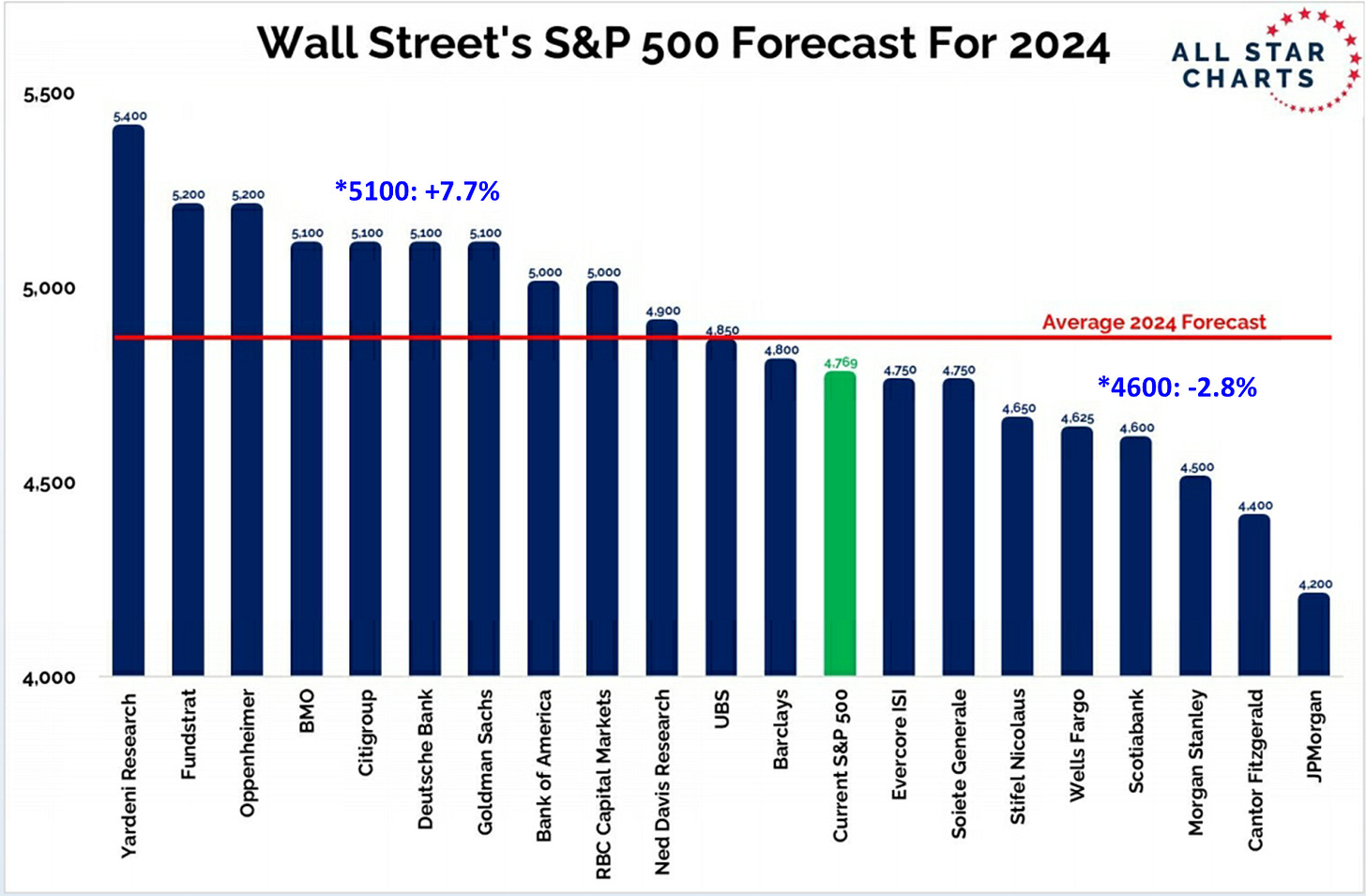

Wall Street’s muted expectations for 2024

Wall Street strategists whiffed on their 2023 forecasts in a big, big way.

The S&P 500 index finished 2023 at 4770, besting every major Wall Street firm’s price target by over 200 points, while the low-end targets from UBS and Morgan Stanley to Barclays and BNP Paribas missed the broad side of the barn.

After all, equity strategists were unusually negative on the market heading into 2023, fearing a recession, a labor market at risk of weakening, and broader economic softness in response to all those rate hikes from central banks around the world.

So, flipping the calendar forward, what’s the consensus view on 2024?

Canvassing the landscape, the 2024 year-end targets for the S&P 500 range from 5400 at the top end (Yardeni Research, +13% upside) to 4200 at the low end of the range (J.P. Morgan, -12% downside). The average forecast calls for ~4850, which represents just a 2% upside move from the current level of 4763.

Despite the strength and broadening out of the global stock market we witnessed in 2023, Wall Street continues its negative outlook for equities in 2024.

Be wary, though. The historical track record of wall street strategists correctly forecasting the market 12 months in advance is not great. In fact, they are often quite wrong, in particular the banks who generally hug the bogey 7-10% average return.

Sam Ro of TKer hit this right on the nose:

“I’d caution against putting too much weight into one-year targets. It’s extremely difficult to predict short-term moves in the market with any accuracy. Few on Wall Street have ever been able to do this successfully. I do however think the research, analysis, and commentary behind these forecasts can be informative.”

Strategists cite a number of potential market-changing narratives, from the health of the American consumer to the timing and size of interest rate cuts to corporate earnings reaccelerating to November’s presidential election.

Source: Charlie Bilello, All Star Charts, Sam Ro

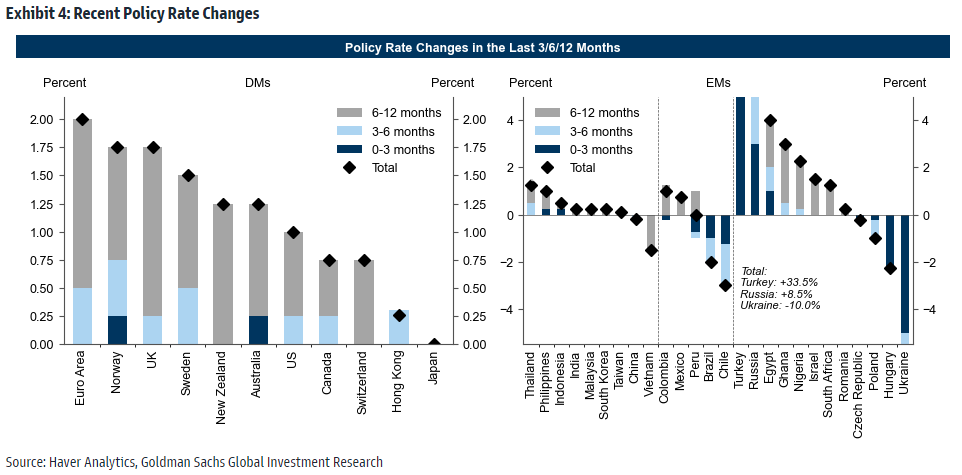

Central banks at the finish line

Only 2% of Developed Market central banks (on a GDP-weighted basis) raised policy rates over the last 3 months and most appear to have ended their hiking cycles, with major central banks – including the Federal Reserve, European Central Bank, and Bank of England – remaining on pause at their December meetings. Emerging Market central banks have also recently remained on hold, as only 5% lowered policy rates and 5% raised rates over the last 3 months.

Source: Goldman Sachs Global Investment Research

Rates fall after the “pivot”

Many investors will point to the last year’s FOMC meeting on December 13th when the Federal Reserve officially pivoted away from their rate hiking cycle campaign.

This is welcome news for yield-based investments like bonds, where interest rates have always fallen after the Fed “pivot.”

See the chart below when the Fed signaled an end to prior rate hiking campaigns, as measured by the peak in the 2-year U.S. Treasury yield:

A slightly different analysis from J.P. Morgan showed similar results.

When studying the final rate hike from the past 8 Fed tightening cycles, you can see bond yields were down each time by an average of 100 bps roughly 8 months following the final rate hike.

The last hike of this cycle was at the end of July, so we are roughly “6 months” past the final hike. With that in mind, the 10-year has dropped from its mid-October 2023 peak of ~5.0% to ~4.0% today.

Source: Piper Sandler, J.P Morgan Markets

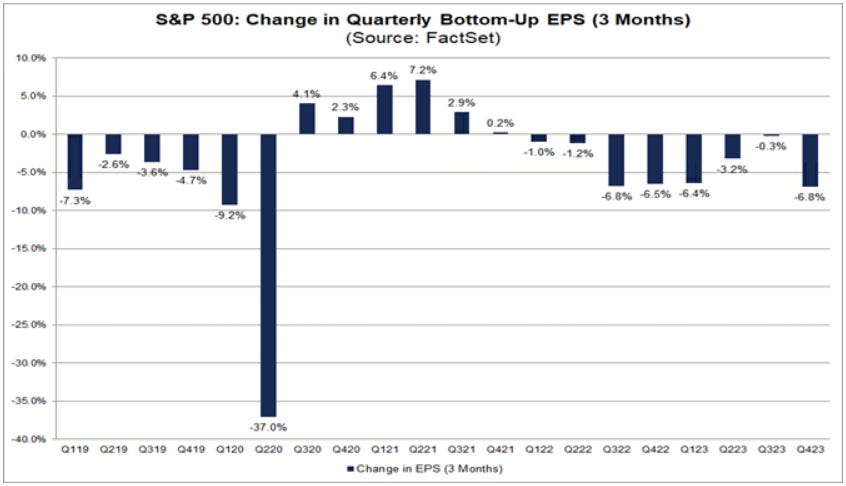

Analysts cut 4th quarter EPS estimates more than average

Analysts have lowered their 4th quarter 2023 earnings estimates by more than normal.

During the 4th quarter, analysts lowered their EPS estimates by -6.8%.

In a typical quarter, analysts reduce their earnings estimates, but the prior 5-yr average decrease is -3.5%, 10-yr decrease is -3.3%, and 20-yr average decrease is -3.8%.

A lower threshold makes it easier for corporate America to beat expectations.

At the sector level, 9 of the 11 sectors saw decreases in their bottom-up EPS estimates for Q4 from September 30 to December 31, led by Health Care (-21.3%) and Materials (-13.5%). Alternatively, Utilities (+1.9%) and Information Technology (+1.7%) were the only two sectors to record an increase in EPS estimates.

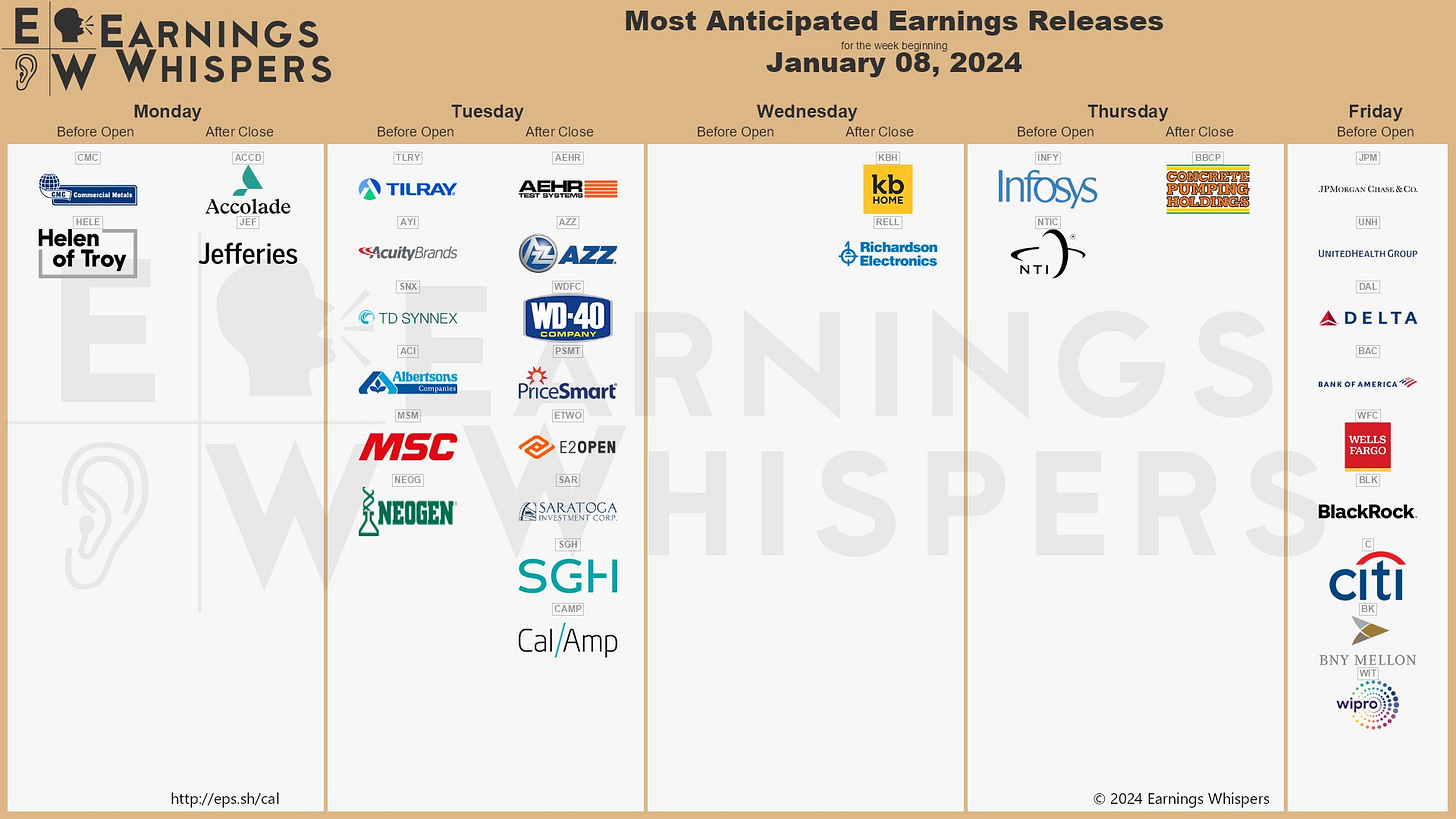

Earnings season starts in earnest on Friday this week when the banks begin reporting.

Source: FactSet, Earnings Whispers

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.