What is r-star and why does it matter for investors

The Sandbox Daily (8.21.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

r-star, the Fed’s compass

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.32% | Nasdaq 100 +0.53% | S&P 500 +0.42% | Dow +0.14%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield +0.23% | 2yr UST 3.933% | 10yr UST 3.799%

COMMODITIES: Brent Crude -1.42% to $76.10/barrel. Gold -0.04% to $2,549.5/oz.

BITCOIN: +2.89% to $61,232

US DOLLAR INDEX: -0.24% to 101.198

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: +2.46% to 16.27

Quote of the day

“People overestimate what they can get done in a year and underestimate what they can get done in five years.”

- Bill Gates

R-star, the Fed’s compass

There is a lot of talk these days among economists, bond investors, and the media about what the current level of r-star is.

What is r-star you ask ??!?

R-star, or r*, is the real long-run neutral policy rate when the economy is at full employment and stable inflation. It is the monetary policy setting rate that neither contributes to, nor detracts from, these goals. It guides the Federal Reserve on how much of a headwind or tailwind their interest rate policy impacts the economy. For the Federal Reserve, r-star is the captain’s compass that guides the ship.

And yet, r-star is a squishy concept since it is not directly observable. Nevertheless, it is a useful theoretical concept for policymakers and bond investors alike. Frequently the longer-run policy rate is expressed in nominal terms by adding the inflation target or long-term inflation expectations to r-star.

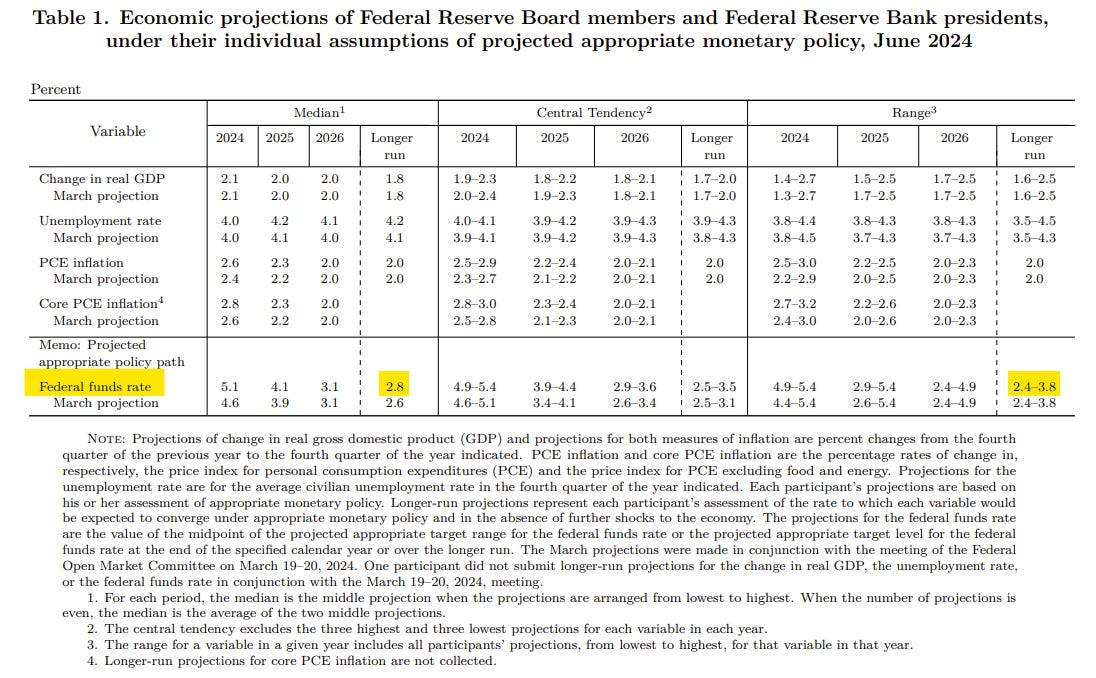

Using the latest Summary of Economic Projections (SEP) from June, the Fed’s median longer run policy rate was 2.8%, up from the 2.5% it’s been more or less since mid-2019 (except for a brief dip to 2.4% in March 2022). More importantly, 2.8% is well below the current stance of 5.25% to 5.50%. Since the FOMC is committed to its 2.0% inflation target, the Fed’s median estimate of r-star is 0.8%.

But the dispersion of estimates is quite wide, with nominal rates ranging from 2.4% to 3.8%, or an r-star of 0.4% to 1.8%.

In the original Taylor rule formulation, r-star was assumed to be 2.0%.

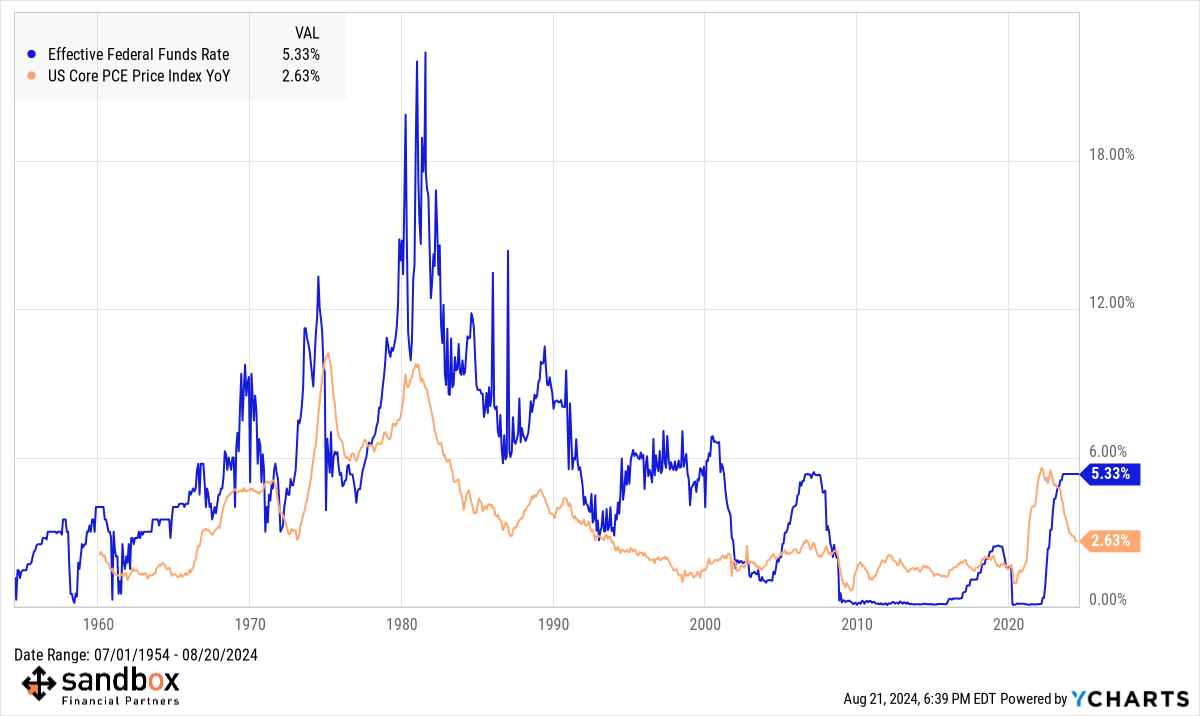

With such a wide array of estimates, the debate today is over how restrictive policy is.

Today, r-star is roughly 2.7%. That’s a touch higher than the Fed’s median estimate 0.8%.

Now let’s step away from Econ 101 and the theoreticals.

Against a backdrop of easing inflation pressures and above-trend growth, the real Fed Funds Rate is decidedly more restrictive than before prior easing cycles and it is notable that Fed speakers from across the spectrum have recently highlighted the need to moderate this stance.

Thus, with the disinflationary process resuming and labor markets significantly looser than they were a year ago, this makes the case for substantial Fed easing in the coming months quite easy.

We know the Fed is cutting rates in September. They have to.

The only questions remaining today are how much and how quickly do they downshift policy in 2024 and 2025.

Source: Federal Reserve, J.P. Morgan Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.