What it's like to prepare for a tv hit

also: my prep notes for Making Money with Charles Payne

Welcome, Sandbox friends.

Every August 3rd, we celebrate Jim Cramer’s 2007 “they know nothing” meltdown rant. Bear Stearns ($BSC) was trading at $109 that day; seven months later, the esteemed investment bank sank under the enormous weight of its toxic mortgage-backed securities portfolio and was sold to J.P. Morgan for $10 per share.

30-second YouTube clip below:

Today’s Daily discusses:

what it’s like to prepare for a tv hit

Let’s dig in.

Markets in review

EQUITIES: Dow -1.51% | S&P 500 -1.84% | Nasdaq 100 -2.38% | Russell 2000 -3.52%

FIXED INCOME: Barclays Agg Bond +1.12% | High Yield -0.33% | 2yr UST 3.882% | 10yr UST 3.799%

COMMODITIES: Brent Crude -2.82% to $77.28/barrel. Gold -0.10% to $2,478.4/oz.

BITCOIN: -0.91% to $62,957

US DOLLAR INDEX: -1.17% to 103.203

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: +25.82% to 23.39

Quote of the day

“A moment’s insight is sometimes worth a life’s experience.”

- Oliver Wendell Holmes, Sr.

What it’s like to prepare for tv

Today, the great folks over at Fox Business and Making Money with Charles Payne invited me as a guest to share my perspectives on “surviving a bear attack.”

Doing television hits is something new for me. Going live is exciting, terrifying, and gratifying all at the same time.

Without any formal media training, I’ve found best practices when priming for television includes proper preparation:

Know your message. Be clear about the key points you want to convey and speak with confidence. AND… speak quickly. TV moves in 30-second sound bites, not 5-minute long-form podcasts dialogue.

Research the interviewer and format. Understand who will be interviewing you and their style. Familiarize yourself with the show's format, typical questions, and the audience it caters to. This will help you tailor your responses and anticipate the direction of the conversation.

Do your homework. Do the work and do it thoroughly. While you may not have an answer for every question that comes your way, you do need to familiarize yourself across a variety of subjects and arguments for/against so you’re not caught flat footed. There is no such thing as overpreparing. Also, talk with others who have done it and ask for pointers; I found this blog post from my friend Ryan Detrick of Carson Group so helpful in preparing for my first tv hits.

Practice, practice, practice. Then practice some more. Work on your speaking style, tone, pace, and body language. Ensure you maintain good posture, may eye contact, and use gestures naturally. Practice in front of a mirror. Practice with a spouse or friend to get feedback on how you come across. And, perhaps most uncomfortable, practice on tape and watch yourself. Over time, like developing your muscles and flexibility at the gym, this whole exercise becomes easier – almost like second nature – so less practice will be required.

Dress appropriately. My former boss at UBS was a top advisor in the firm out of the Washington D.C. office and nothing slipped by him. A loose hem? Get some scissors. Yellow inside collar from sweat? Toss. Shirt isn’t pressed? Head home. Dress for success. Your appearance is your first visual impression to the viewers so it matters. There are so many factors outside our control but this is low-hanging fruit that we can control – so take the easy win. Research has also shown that people tend to feel more confident in themselves when dressed appropriately.

Moving along.

One of the trickiest elements of going live is building a dialogue that seems as much natural as it is informative for the audience. The production team, the host, and the network all have ideas on what they want to talk about. Meanwhile, there are always two or three points that I want to get across. Sometimes these overlap, but often they don’t.

The typical day-of process involves the interviewee sending a list of topics, talking points, data, and charts to the show’s producer. Some short time before the show begins, the network team will submit their list of topics back to the interviewee. More likely than not, their list is not your list. Surprise! So, back to the drawing table where the guest will chicken scratch some quick notes and ideas to prepare for the live interview.

Going live is when the adrenaline kicks in.

If the tv hit is live in person, there’s a process of check-in, makeup, the green room backstage, getting mic’d up, and ushering into the studio 30-90 seconds before going live. It sure is fun!

If the tv hit is at home, the stress level is much lower from the comfort of your own office. A few minutes before the hit starts, the broadcasting station sends you a live VCC link (virtual contact center, or video call center) and boom – you’re live through your home computer and A/V equipment. Doing tv from your office or home does require the proper A/V equipment, lightening, positioning, and internet connection. The best part is the dress code: business formal up top, jeans/shorts on bottom.

Given the amount of time and thought that goes into preparing the talking points – which can be recycled, massaged, and modified over the course of a week or several weeks – I thought I’d share my prep notes and analysis for today’s show below. This is a peek behind the curtain.

Enjoy!

Talking points for Making Money with Charles Payne

Fox Business, Making Money with Charles Payne

Time: 2:15pm

Date: August 2, 2024

TOPIC #1: Are you worried about this economy?

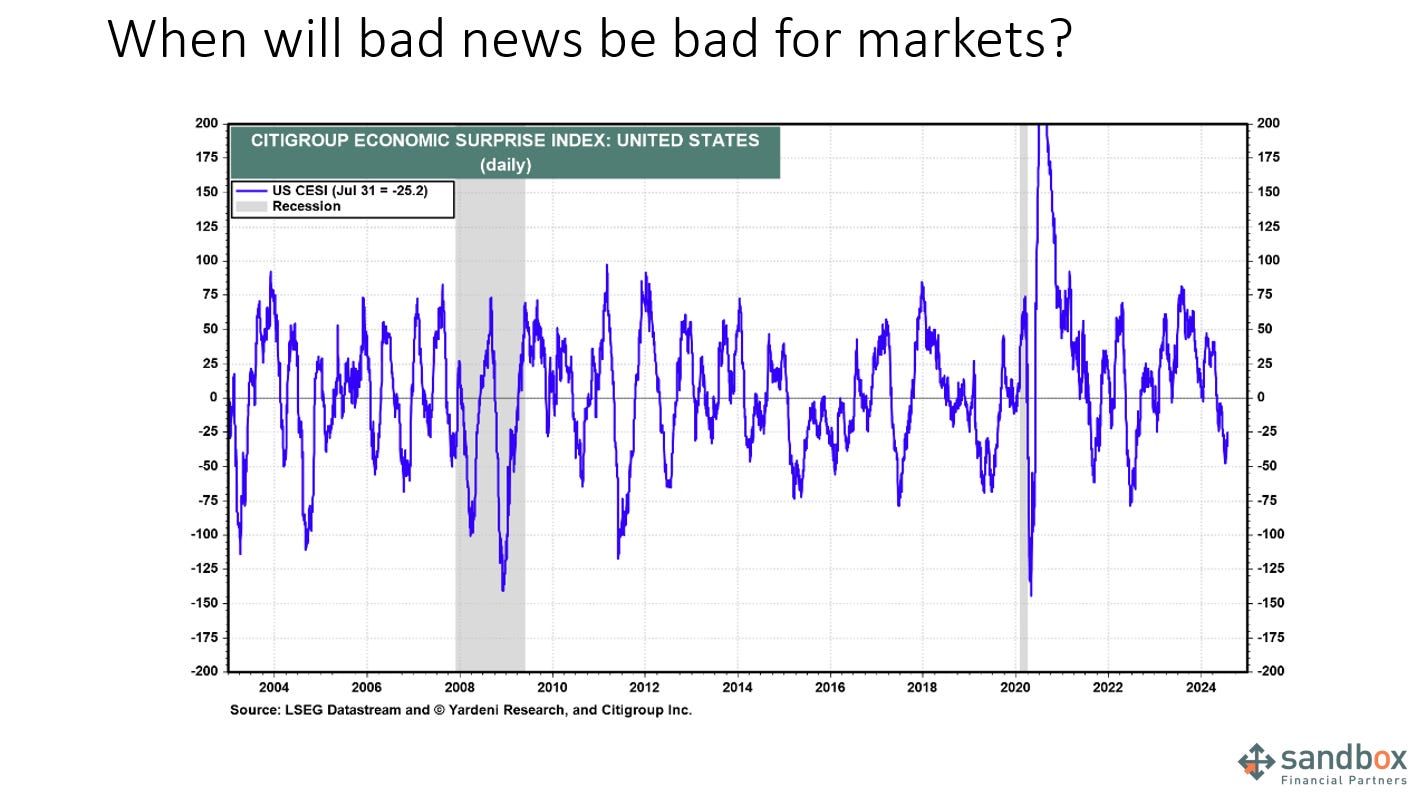

* Broadly speaking, no. This smells more like a mid-cycle growth scare and a strong shake of confidence.

* Make no mistake, the market is responding in real time to yesterday and today’s softer labor readings: rising initial claims, the unemployment rate ticking higher to 4.3% (which has risen 6 consecutive months and now sits at the highest level since October 2021) and triggered the Sahm Rule recession indicator.

* If you don’t like the color red, I’d advise our viewers to divert their eyes from the screen:

The VIX nearly hit 30 today reflecting panic

credit spreads over Treasuries are rising to reflect perceived economic weakness ahead

the Nasdaq officially hit a 10% correction today

Gold is spiking

* Citi and JPMorgan now expect the Fed to cut rates by 50 basis points in September and another 50 bps in November

* So it seems the market is recalibrating where the economy will be in 6-9 months and it’s an unwind of the market narrative this year

* It’s important to remember this: when a correction happens – which is what I think we’re perhaps in – it always feels like its something MUCH worse.

* Our take: this is an knee-jerk over-reaction:

The economy is still growing. Last week’s 2.8% GDP print showed that.

2nd quarter corporate profits are higher, reporting a 12% YoY blended earnings growth rate.

Softer economic data still supports the “soft landing” camp and gives the Federal Reserve some leash for interest rate cuts.

*** TOPIC #1: FEATURED CHART ***

TOPIC #2: The better part of valor, “be too early or late,” is being tested. Is this like the Taper Tantrum of 2013 – the market pushing the Fed. What will the Fed do?

Emergency Cut

Articulate message that hints at 50 bps in September

Stay calm and cool

* Interest rates influence our financial decisions in profound ways, and the expectation of lower rates could influence so much around us.

* With the Fed bypassing a possible cut earlier this week, it does raise the probability of the Fed falling behind the curve.

* We can see the bond market has moved meaningfully in the last two days and now it expects the Fed to lower rates by 50 bps in September. That probability rose from 8% Wednesday to over 70% today.

* BUT, this is just a fraction of the amount they’ve increased rates over the past 2 years.

* And yet, the significance of the 1st cut goes far beyond its size. That’s why Wall Street won’t shut up about it.

* At its core, it ends the 2.5 yr tightening cycle.

* But the tip of the spear is a change in sentiment and outlook:

Mortgage rates can come down from 7-8% and unthaw the residential housing market

Businesses and C-Suites can make better strategic decisions and unlock new CapEx plans knowing money is easier and cheaper to raise

Banks can lend again

* Does the Fed cut 25 bps in September? Does it go for 50?

* Whatever they decide, they have one-and-a-half months to signal that to the market because setting expectations is one of the most important tools the Fed has at its disposal.

*** TOPIC #2: FEATURED CHART ***

TOPIC #3: Does overall investing change in an economy that’s moving closer to recession?

* To be clear, we don’t expect the economy to slide into recession in the coming 6 months.

* The economy is still growing, corporate profits are inflecting higher, and the labor market still remains quite strong and resilient (today’s data notwithstanding).

* As the National Bureau of Economic Research (NBER) defines it, we are not seeing a “significant decline in economic activity that’s spread across the economy”

* However, if we do slide into recession, investors can plan ahead to position their investment portfolio for the economic downturn by adopting a more conversative playbook:

Cash is always king, especially when CDs/money markets can pay investors ~5%

Hold defensive stocks like Consumer Staples or Healthcare or Utilities that tend to be insulated from the larger downside moves

Use dollar-cost averaging as an investment strategy to buy back into the market at lower levels

Look for higher quality assets that have lower market beta, lower leverage ratios, and higher return on equity

Historically, bonds have tended to do well during recessions

* Even if a recession is on the horizon, no one can know how long it will last or to what degree it will affect the stock market

* Often, the best way to invest during a recession is just continue doing what you’ve already been doing. It’s always best to stick with your long-term investment strategy and focus on saving and investing.

*** TOPIC #3: FEATURED CHART ***

TOPIC #4: The market wants bond yields lower, but the pace smacks of sheer panic - thoughts on the flight to safety? WOULD YOU buy the tech dip?

* The flight to safety is a tale as old as time.

* During periods of heightened volatility and perceived weakness, capital will always rotate in traditional safe haven assets like the U.S. dollar, U.S Treasuries, or Gold

* BUT, when you look are technicals and market scans of breadth and relative strength, I’m not convinced this market is rolling over. Here’s why":

More stocks are going up in price, not fewer.

You buy stocks in bull markets.

Most trends are moving higher.

Consolidations and rangebound markets have resolved higher.

New leadership groups like mid- and small-caps have emerged.

Big bottoms have completed and are resolving higher.

* If you’re buying Tech here, you’re trying to catch a falling knife.

* You must be patient and adopt a longer-time frame for new capital.

*** TOPIC #4: FEATURED CHART ***

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Brilliant. Well done.