What the "One Big Beautiful Bill Act" means for investors

The Sandbox Daily (7.7.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

One Big Beautiful Bill Act

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 -0.79% | S&P 500 -0.79% | Dow -0.94% | Russell 2000 -1.55%

FIXED INCOME: Barclays Agg Bond -0.36% | High Yield -0.34% | 2yr UST 3.897% | 10yr UST 4.387%

COMMODITIES: Brent Crude +0.75% to $69.63/barrel. Gold +0.14% to $3,347.7/oz.

BITCOIN: -0.61% to $108,056

US DOLLAR INDEX: +0.31% to 97.479

CBOE TOTAL PUT/CALL RATIO: 0.79

VIX: +1.77% to 17.79

Quote of the day

“Carry out a random act of kindness with no expectation of reward, safe in the knowledge that one day someone might do the same for you.”

- Princess Diana

What the "One Big Beautiful Bill" means for investors

After months of negotiations, a new tax and spending bill was approved by Congress and signed into law by President Trump on July 4th.

This fear-reaching bill matters because, while trade policy has been at the forefront over the past several months, tax and spending policy in Washington has been a growing source of uncertainty for many years.

Above all, it takes the possibility of a “tax cliff” off the table – a situation where tax policy could have changed dramatically if provisions expired at the end of this year. It cannot be overstated the importance of clearing this risk.

On an individual level, taxes directly affect many aspects of financial planning, and the specific provisions in this tax bill have immediate implications for household finances. From an economic perspective, many investors also worry about the level of government spending, the growing national debt, and other factors that have weighed on markets over the past two decades.

Thus, there are many angles from which to view the recently passed budget. Below we’ll review a few key items and what they mean for markets.

The Tax Cuts and Jobs Act rates are now permanent

The new tax bill, dubbed the “One Big Beautiful Bill Act” by the administration, extends and expands several key aspects from the 2017 Tax Cuts and Jobs Act (TCJA) that were set to expire. It also introduces new measures that provide other benefits to taxpayers, which are only partially offset by spending cuts in other areas.

Here are just some of the major provisions that may affect households; the New York Times provides a more extensive breakdown here:

Current TCJA tax rates and brackets are now permanent. They were originally set to expire at the end of 2025.

The standard deduction increases to $15,750 for single filers and $31,500 for joint filers in 2025.

There is an additional $6,000 deduction for qualifying seniors (sometimes referred to as a “senior bonus”) that phases out for gross incomes exceeding $75,000. The provision expires in 2028.

The alternative minimum tax exemption is now permanent.

The child tax credit rises from $2,000 to $2,200 per child, with future adjustments indexed to inflation to maintain purchasing power over time.

The state and local tax (SALT) deduction cap increases to $40,000 from a $10,000 limit with annual increases of 1% through 2029. It is then scheduled to revert back to $10,000 in 2030.

A deduction for tip income capped at $25,000 annually for workers earning less than $150,000, effective through 2028.

Some green energy tax credits are repealed, including for electric vehicles and residential energy efficiency credits.

The federal debt limit increases by $5 trillion. This will prevent Congress from having to debate and approve debt limit increases for some time, reducing political uncertainty.

These and many other changes maintain the relatively low tax environment that has characterized the past several decades.

As you see below, current tax rates remain at or near post-World War II levels.

Growing concerns over fiscal deficits

Tax policy and government deficits are two sides of the same coin. This is because tax cuts reduce government revenues which then need to be offset by either lower spending or increased borrowing.

Most government spending is for entitlement and defense programs which are politically difficult to change. According to the Department of the Treasury, 21% of government spending is for Social Security, 14% for Medicare, and 13% is for National Defense. Another 14% goes toward paying interest costs on the existing national debt.

It's no surprise then that government borrowing has increased persistently over the past century and will likely continue to do so.

The Congressional Budget Office, a non-partisan agency that supports Congress, estimates that this new tax and spending bill will add $3.4 trillion to the national debt over the next decade. This is against the backdrop of a federal debt that already exceeds 120% of GDP, or $36.2 trillion, which amounts to about $106,000 per American.

Unfortunately, there are no easy solutions to this fiscal deficit challenge, especially because this is a contentious political topic.

On the one hand, tax cuts can stimulate economic growth, which may help to offset revenue losses through increased economic activity. On the other hand, Washington has a poor track record of balancing budgets even when the economy is strong. The last balanced budgets occurred 25 years ago during the Clinton years, and 56 years before that during the Johnson administration.

Individual income taxes represent the primary source of federal revenue, which is why the issue garners so much attention. Social insurance taxes, also known as payroll taxes, are withheld from wages and help to pay for Social Security, Medicare, unemployment insurance, and other programs. Other sources of revenue are much smaller in proportion and include corporate taxes, which were also reduced by the TCJA, and excise taxes, such as tariffs.

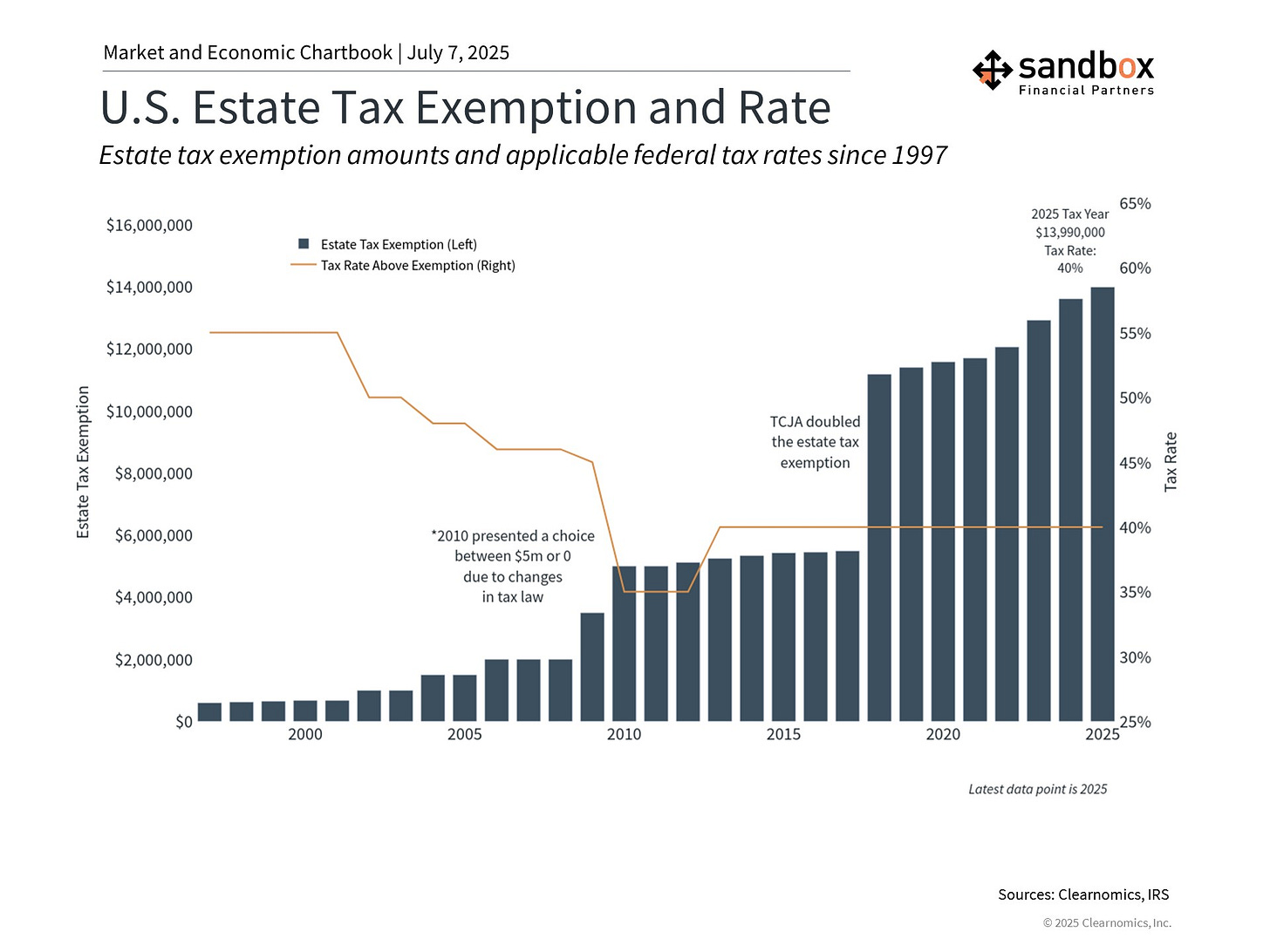

The bill continues the higher estate tax exemption limit

One set of provisions that would’ve been at the center of a tax cliff is the estate tax exemption.

The TCJA doubled these limits which were scheduled to revert to previous levels this year. However, the passage of the new bill makes these higher exemptions permanent, further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

While it may seem like estate taxes only apply to higher net worth households, the reality is that all families should consider how assets are passed to future generations.

This requires a holistic approach that integrates all the fun stuff of financial planning: estate planning, tax efficiency, philanthropy, and long-term family wealth preservation goals. It’s important to keep in mind that individual states can impose estate taxes with exemption thresholds that are less favorable than the federal level.

Bottom line of the OBBBA?

The new spending and tax bill extends and expands the current low-tax environment which will provide an economic tailwind for the years to come, but Americans will pay for those tax initiatives with steep cuts to certain items like Medicaid, green energy, and food benefits, as well as borrowing more money.

Sources: Clearnomics, Congressional Budget Office, Committee for a Responsible Federal Budget, New York Times

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)