What the “Sell America” narrative gets wrong

The Sandbox Daily (2.10.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

“sell America” – fact or fiction?

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.10% | S&P 500 -0.33% | Russell 2000 -0.34% | Nasdaq 100 -0.56%

FIXED INCOME: Barclays Agg Bond +0.29% | High Yield -0.10% | 2yr UST 3.452% | 10yr UST 4.141%

COMMODITIES: Brent Crude +1.41% to $69.01/barrel. Gold -0.62% to $5,047.9/oz.

BITCOIN: -2.84% to $68,654

US DOLLAR INDEX: +0.03% to 96.847

CBOE TOTAL PUT/CALL RATIO: 0.88

VIX: +2.48% to 17.79

Quote of the day

“Sell America” – fact or fiction?

There’s been a lot of talk recently about the “Sell America” trade. Is it real or just a fun narrative circulated by the media?

As always, the best place to start is the data.

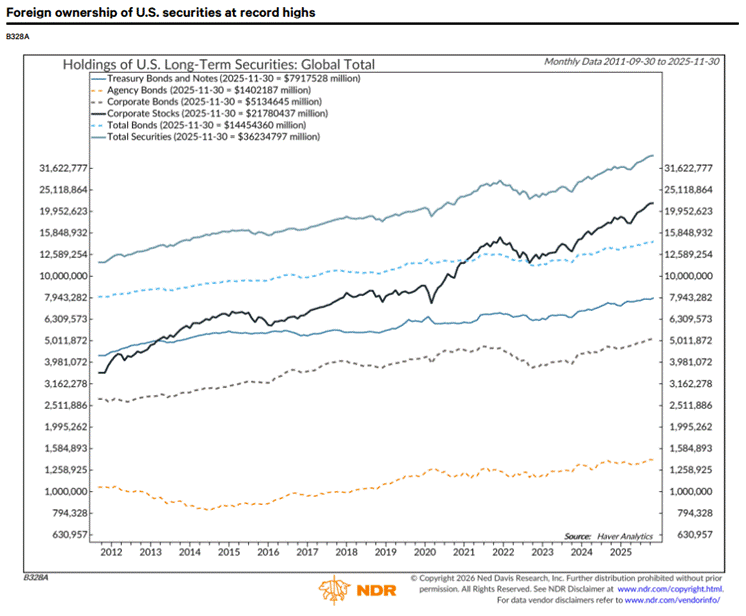

As of November, foreign holdings of Treasurys, agency MBS, corporate bonds, equities, and total securities had reached record highs.

Of course, these amounts are in nominal terms. Meaning, assets tend to increase in value over time, especially during bull markets.

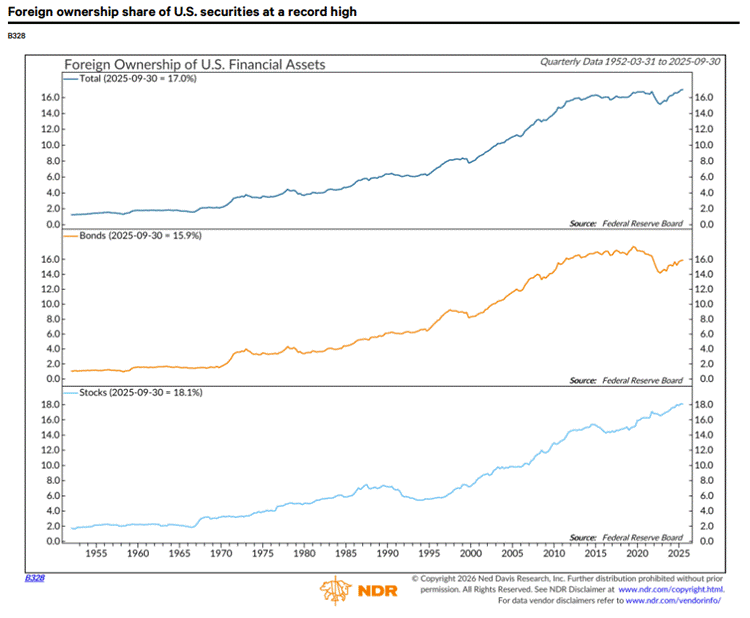

What about ownership share?

Here too, the foreign ownership share of U.S. assets hit a record high in Q3, led by equities. Meanwhile, fixed income is still a little below its pandemic peak.

And this is exactly what makes the “Sell America” narrative so interesting: it’s not showing up in the broad ownership data.

If anything, foreigners are holding more U.S. financial assets than ever, and their ownership share is still climbing.

The disconnect exists because “Sell America” isn’t really about U.S. risk assets as a whole – it’s about one very specific corner of the market.

And that corner matters, because it sits at the center of global funding, f(x) reserves, and the plumbing of the financial system.

U.S. Treasuries.

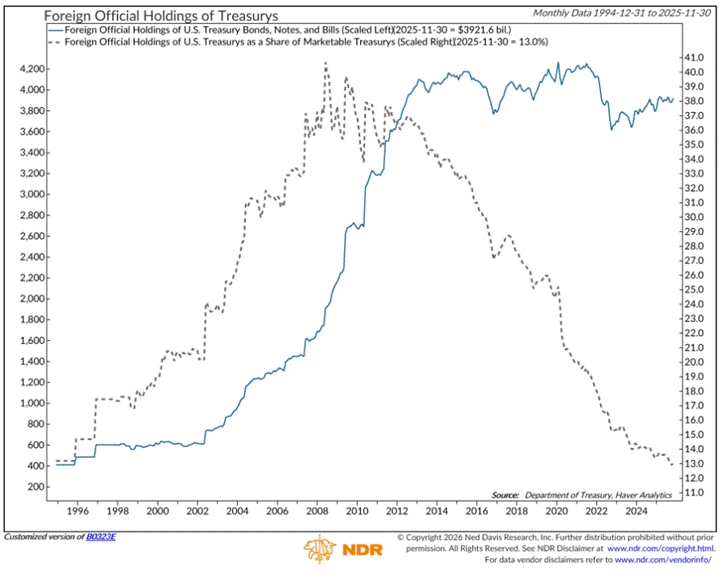

China has been the steady culprit reducing its Treasury holdings. From a peak of $1.3 trillion in 2013, China has slashed its holdings by nearly half to $683 billion. But it’s not just China.

India has reduced its Treasury holdings by 25% since September 2024 to $186.5 billion, with most of that occurring since Liberation Day – perhaps in protest of its tariffs.

Brazil has been steadily reducing its holdings of Treasurys for more than seven years. It now owns almost half of what it had in August 2018 to $168 billion.

Japan, same story. $1.4 trillion at the peak in 2021, down to $1.2 trillion.

And on and on…

In aggregate, foreign official holdings of U.S. Treasurys have slid gradually lower from a peak of ~$4.2 trillion in 2021 to $3.9 trillion today.

And due to the massive issuance of Treasurys since the GFC, the foreign official share has collapsed from 41% to 13%.

So, America isn’t being “sold.”

It’s being financed differently, with the marginal buyer increasingly shifting from foreign central banks to U.S. investors and institutions.

And if that private bid can’t keep pace with the flood of issuance, the adjustment mechanism will be higher yields, a weaker dollar, or both.

Sources: Ned Davis Research, St. Louis Fed

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)